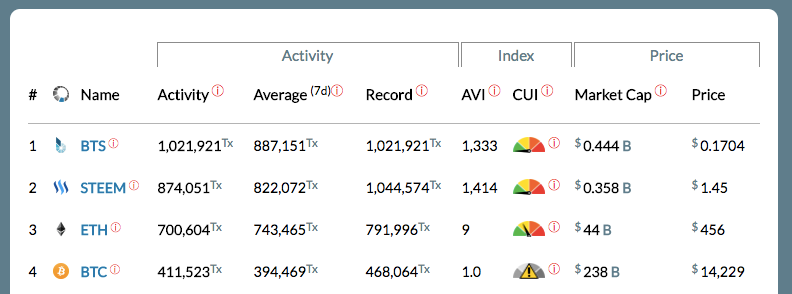

http://blocktivity.info/ has the answer:

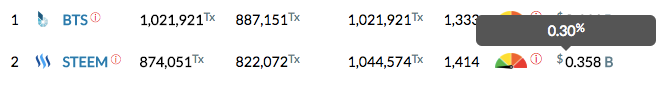

STEEM is not even using a single percent of its current network capacity:

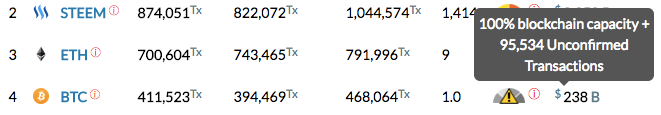

Where as Bitcoin... well:

It's getting hammered.

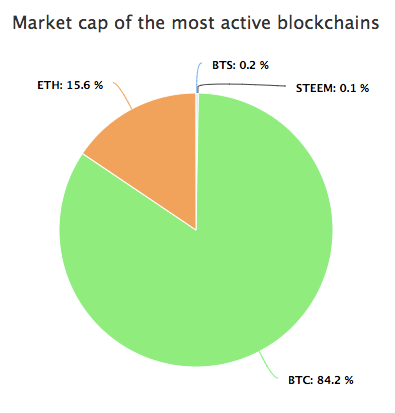

IMO, BitShares and STEEM are not getting the love they deserve:

This needs to be repeated over and over again until more people get it.

STEEM is an amazing cryptocurrency.

Zero fees.

3 second block confirmation times.

Energy efficient with DPOS (Delegated Proof of Stake) block production which is collaborative instead of competitive (unlike POW: Proof of Work).

Once more people realize this, we could see much high prices. On top of that (almost as an afterthought) the STEEM blockchain also supports amazing social media sites like steemit which currently has a global Alexa ranking of 2,085.

Bitcoin vs. Bitcoin Cash: Irrelevant?

There's been a lot of debate about Bitcoin Segwit vs. Bitcoin Cash and so far I haven't really weighed in on the discussion much. I really enjoyed this article by SFOX Is Bigger Better? How to Evaluate Bitcoin Cash Based on Block Size which made me realize why I haven't been so interested in the debate. It's not just about bigger blocks. In many ways, it's about how POW simply can't meet the demands we're putting on blockchains today. When digital kitties can make the Ethereum network unusable, clearly we have a problem.

This @steemitblog post did an excellent job explaining how this wouldn't be an issue for STEEM at all: Digital Kitties on Steem? How would the Steem blockchain handle 700,000 transactions per day?

Yes, I may think Bitcoin Cash is technically closer to the original Satoshi vision where block sizes are increased to keep the mempool unfilled to facilitate the "Electronic Cash System" outlined in the original paper. I see the conflict between the miners and the users where the miners are incentivized to increase the transaction fees at the expense of the users. That said, it's no longer strictly "peer-to-peer" (in terms of IP-based) like it once was either. Additionally, comparing a current version of a technology in a fast-moving space to its original might be like comparing a Tesla to a Model T Ford. You might argue a Tesla isn't true to the original vision of a car because it lacks an internal combustion engine, but I'd still prefer having a Tesla. :)

Bitcoin may do alright with 2nd layer solutions like lightning networks, but I still don't think it can do what a DPOS chain can do. Whatever scaling solution they can come up with (sharding, etc), we could probably also implement to even further increase our performance lead.

So yeah. Call me a fanboy if you want, but I'm excited to be invested in STEEM, BitShares, and EOS. I think these DPOS coins represent a future which can truly scale to solve enterprise-level problems.

I'm glad you're with me on this journey here on the STEEM blockchain. As always, this isn't investment advice (blah, blah, blah), but it's just me sharing my passion.

Side note, I left this rediculously long comment to my friend @uberbrady defending DPOS. If you care about this geeky stuff, maybe give it a read. Thinking about all this is what got me fired up enough to write this post. DPOS is an amazing thing.

Luke Stokes is a father, husband, business owner, programmer, STEEM witness, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com