Bitcoin is dead, it will never scale. Transaction fees are sky high, it takes days for things to go through. Ethereum can’t handle one single viral kitty cat app for one day. The whole cryptocurrency sector is a cesspool of scams, liars, pump-and-dump schemes and baseless speculation. Everyone and their mother has an ICO and a whitepaper and 99% of them don’t work. It’s a bubble, cash out now, don’t walk, run someplace safe. The crash is coming, and it's gonna be big.

Stop. Breathe. Let’s have a touch of perspective.

Imagine it’s January 1996. You’re pretty sure this new world wide web thing is gonna be big. You try to tell your friend: “Seriously, you won’t ever use your TV to watch broadcast television anymore, you won’t ever have to go to the library anymore, you’ll never buy a paper map again, you’ll never use a phone book again, you’ll stop buying CDs because you can listen to any recorded music at any time, ever. You’ll probably never need to write a check again because you can pay all your bills via your computer. Oh, and you’ll be able to buy anything you want without leaving your home.”

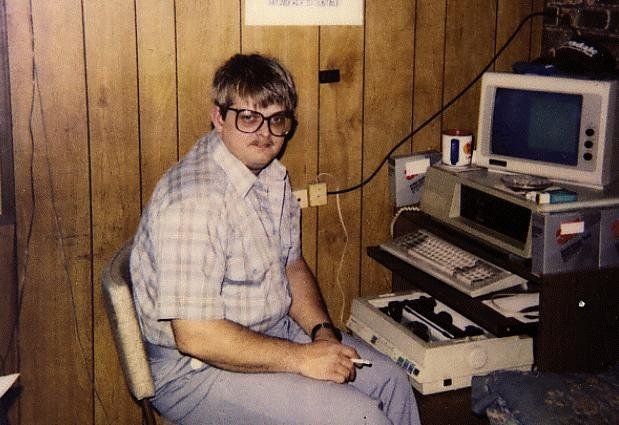

Your friend says, “OK sure, show me this internet thing.” You boot up your Pentium 166 MHz PC with 8 MB of RAM, sit down in front of your 13” CRT monitor, connect via 28.8 kbps dialup (you have to kick someone else off the phone first) and show him the Amazon Homepage on the copy of Netscape Navigator that you bought for $50. It takes 40 seconds for the page to load. You can buy books there, but it takes a week for them to arrive at your home, and you have to pay extra for shipping. He looks at you like you’ve lost your mind:

“This is so slow! You’ll never be able to do any of those things on here! Why wouldn’t I just go to the bookstore and buy a book today?”

Pictured: The actual Internet in the mid-90s

If your friend is more technical, you might get arguments about how unreliable the network connections are, the high cost of hosting and serving web pages, the lack of any kind of best practices for development, the security concerns involved with e-commerce, and so forth.

Your friend isn’t really wrong. In 1996, Javascript had only existed for a few months. Google wouldn’t exist in any form for 2 more years. Streaming audio used RealPlayer, which introduced everyone to the term “buffering...” Generally speaking, home internet maxed out at about 28 kilobits per second, although if you were willing to pay hundreds of dollars a month, you could get an ISDN line that might go up to 128 kbps. Social media wasn’t really a thing, at all. The idea of the “web as a platform” was very, very far away indeed.

This is where blockchain is now; 2017 was our 1995. Technologies that will be commonplace and taken for granted in the future haven’t even been invented yet. Whole industries built on the underlying technology have yet to be imagined. And yet, despite the nascent state of the technology, there are people who have unironically said exactly the things I wrote in my first paragraph.

With this in mind, we can begin to imagine what the next year will look like for blockchain. Applications and layer-2 solutions that we have been promised will begin to roll out. Some will succeed, but others will fail. It’s really impossible to know which ones at this point. However, I firmly believe that regardless of who comes out on top, 2018 is the year when potential will begin to be realized. We will also move faster than the web. What took years to emerge for the web will take months for blockchain.

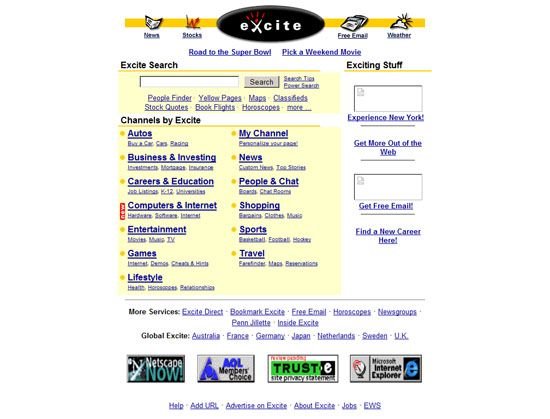

Your friend in 1996 wasn’t wrong, but neither were you. If you invested in Amazon at the time, you would be very wealthy today. On the other hand, if you invested in Excite instead you’d be considerably less so. Getting involved financially in an internet venture in 1996 was a very risky proposal, and determination of winners and losers seemed more or less random. But still, the web as a whole clearly had a ton of untapped potential.

A promising multi-million dollar web property.

But what if you had had the opportunity to invest directly in the underlying technology stack in 1996: TCP/IP, DNS, HTTP, and HTML? Web sites and even whole internet industries came and went, but all those technologies (more or less the same basic ones that existed in 1996) are still used to power all the things we get over the web. Your investment would have grown 100x, if not more in the intervening years.

This is the unique opportunity that cryptocurrency provides: the chance to financially invest in the underlying technology directly, regardless of what application it may eventually be used for.

In 2018 we're going to get the chance to see which technologies are truly useful and which are not. And we have the unique opportunity to invest and benefit directly from those technology stacks that are most useful and most used, which makes this cycle fundamentally different from something like say the dot-com boom of the late 90s. Personally, I can't wait to see what happens.