For the last few days, I've been shovelling out Factom Factoids into the lending market at Poloniex. For what it's worth, I bought a lot of 'em around 0.0025 - but I bought a lot more of 'em at or above 0.004. I have a modest profit on my >5,000 Factoids, but my gains certainly would have been more if I had bought smarter.

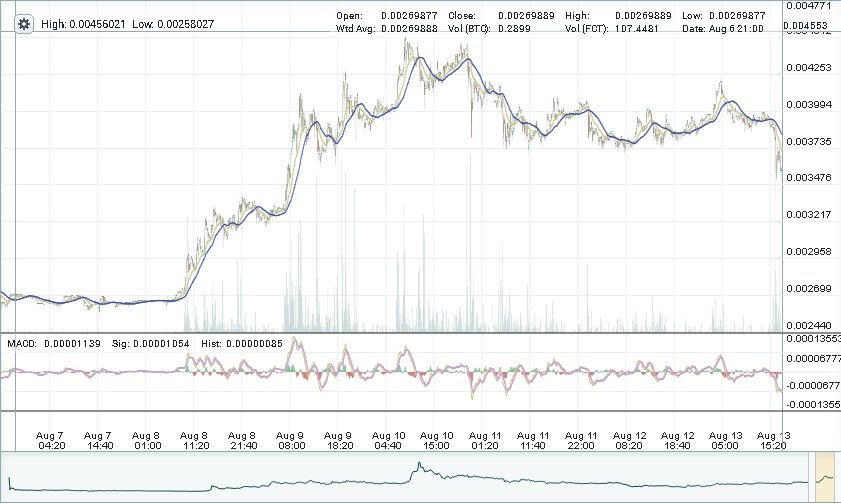

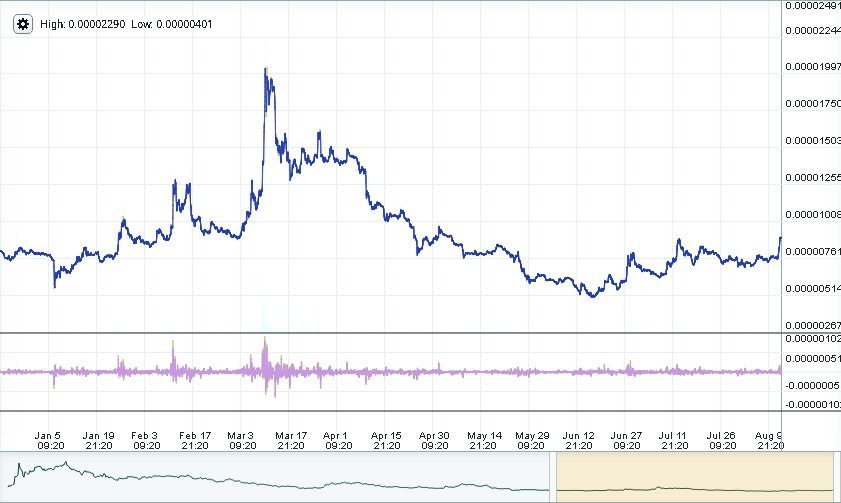

What follows are the lessons I've learned from putting my Factoids out to loan to short sellers on Poloniex's Lending market. Yes, for the past few days I was one of those folks who fed the sometime-ravenous maw of short sellers hoping that Factoids would go a-plummeting. As this one-week chart shows:

...many of them recently got their wish.

After the bittersweet lessons, which experienced punters will nod at, I'll discuss their applicability to Bitshares. If you've been keeping up, you saw BTS jump up to ~900 satoshis today. Even though the state of the Bitshares Lending market is profoundly different from Factom's, it's still revealing. You'll find out why near the end.

Poloniex's Lending Market Normally Isn't Great For Lenders

When Poloniex added margin trading and short-selling functionality, it also added a peer-to-peer Lending market that allows holders to lend out one of twelve cryptocurrencies: they being Bitcoin and eleven high-volume alts. Bitcoin is unique in that its borrowers are Margin longs hoping for extra punting profits on their leveraged buys. Borrowers for all eleven others - Factom, Ethereum, Ripple, Monero, Stellar, Maidsafe, Litecoin, Dash, Dogecoin, Clamcoin and Bitshares - are short sellers hoping to make a profit from the alt declining.

In one way, Lending is an odd thing to do because you're effectively supplying ammo for your opponents. But in another way, it seems like a dream - particularly if you're holding for the long-term. You can earn interest on your holdings while waiting for your crypto dreams to come true!

The trouble is, lots of folks have the same dream. As a result, the low-ask rates are usually not that good. Poloniex makes you offer a daily interest rate, which is compounded every twenty-five seconds. As I write, the low offer for Ethereum is 0.0183% per day. The APR for this rate is less than 7%.

To make things more disheartening, that 7% APR is in no way guaranteed because the Lending market is callable on the borrower's side. In addition to offering a daily rate, you also have to specify a term in days. The minimum is 2 and the maximum is 60. As a Lender, you're bound to the length of the term; the borrower can repay you at will.

That's why, in normal circumstances, the occasional eye-popping rates ("More Than 1% Daily!!") simply don't last. Once the borrower liquidates his or her shorts, the coumpounding is finito. You have to re-offer your crypto at a more normal rate - which, as Murphy's luck would have it, is usually below 0.02% daily.

Lending Tips And Tricks

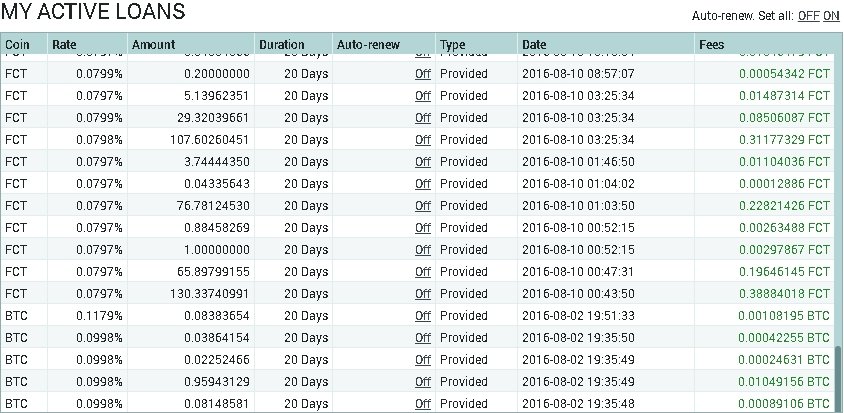

For the last several days, Factom has been an exception to that disheartening rule. Just below is a screenshot from my oldest extent loans:

These aren't my most lucrative; they're my oldest still outstanding. My newest ones are compounding at similar rates, with some much higher. So, these tips are battle-tested.

- Offer a longer term when the rate is especially high. Assuming you're a long-term holder, you shouldn't care about your crypto being locked up in a Lending contract. The longer your term, the longer you can theoretically earn at a great rate.

- Ignore The Loan Demands Side Of The Book. From my experience, even very active Lending markets have no demand offers. Short-sellers, being hasty folks, typically snap up the low Offers when they're ready to pounce.

- Do Not Lend Into Even A Juicy Demand Offer; Always Offer At The Low Ask. The Loan you'll contract is the same as any other: redeemable at will. There's no point in counting on a Demand offer lasting longer than any other contract; from what I've experienced, it doesn't. Whenever I've seen a tantalizing Demand rate, the low ask has a much higher rate. As I pointed out in #2, the bulk of Loan offers are snapped up at the low ask.

- Turn Off Auto-Renew. Auto-Renew doesn't do you any good. It doesn't extend the term of a closed Loan; it just puts out an offer with the same rate, term and quantity. If the low-ask has fallen, your offer is stuck way up in the book. If the low ask has risen, your offer will be snapped up by a short-seller who likely would have borrowed at the prevailing ask rate had the Auto-Renew not presented him with an instant bargain. It's sure disheartening to see your loan at 0.07% repaid when the prevailing rate is 0.2% - and a new borrower snaps up your auto-offer that could have gone for 0.2% had you reissued it manually.

- Ladle Your Crypto Out At The Low Ask, And Keep An Eye On The Book This way, you'll have some crypto in reserve when the shorters pile in and drive the rate up even higher. True, some do mind their costs and redeem a high-interest loan when the low ask has plummeted - but some don't. You don't have to hover over the Lending tab, but you should check in regularly to see if the rate has jumped.

- When Building A Offering Ladder, Use Small Amounts At Rates Just Below Huge-Quantity Levels. In my experience, a lot of the big-quantity orders are placed manually; they're not placed by bots. So there's little risk is placing a small order whose rate is a smidgen below a big quantity. As mentioned previously, short-sellers are often hasty; a flood of borrow-now demand can push up the rate by quite a bit.

- Never Forget That You're Supplying Speculators Which Market Wisdom Pegs As The Smart Money. In market lore, the ordinary punter (a long) is the dumb money. Short sellers, on the other hand, are generally considered smarter. If you're in your crypto for the long haul, this point won't matter - so long as you're comfy with rising a loss. But it does matter if you have your eye on a cash-out capital gain - and it matters a lot if you're buying more in order to lend into a huge rate. As you're about to find out, I learned this one the hard way.

Three Days In The Lending Trenches

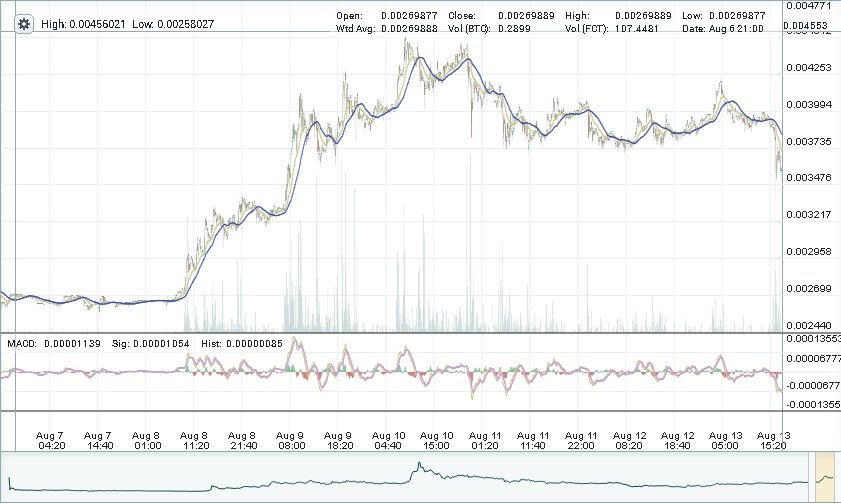

Over this last week, I saw something really unusual. As Factom climbed up, as seen in this same chart as above,

the low-offer Loan rates stayed persistently high. Normally, high rates call forth a flood of supply and the good times don't last long. But with Factom, they persisted.

So, starting last Wednesday, I hovered over the Lending book and doled out the Factom I had to offer. Surprisingly, the high rates mostly continued; there were times in which they got very high. As I write, I still have an outstanding loan contracted at 0.699% daily (!) on August 10th at about 2:30 PM GMT. In accordance with the above rules, I offered the maximum term of 60 days. It's the one survivor of several; as I write, it hasn't been repaid.

As Murphy's luck would have it, that loan went through when Factom was above 0.004; so did the loans that haven't been repaid. Remember, short sellers tend to be the smart money: at a minimum, they're tactically smart. During my days of hovering and lending, I noticed that demand and the low offer both picked up when Factom took off. Often, the jump was followed by a pullback that was induced by those shorters.

That did make for a frustrating - sometimes unnerving - time when I watched Factoms settle into a sometimes-eerie range after peaking at 0.0045. I did make the dumb mistake of buying more Factom to loan into the book: ~3,500 out of my ~5,000. When the sad denouement came this morning, all of those buys are well in the red. Had I not cushioned them with the ~1,500 I had bought at much lower prices, I'd be sitting on a substantial loss.

I did buy for the long-term. But my dumb timing (in retrospect) reinforced a very important lesson about trading:

If you're trading, it's best to move suddenly once you see a trend worth catching and become skeptical as your trade works. This learned-the-hard-way rule shows why trading is difficult. Normally, as my dumb buy-timing indicates, we humans need reinforcement: we start off cautious but get bolder as we see our moves working. This normalcy gets you hammered when you're trading: you buy high when the trend seem "proven" only to see it fall apart. The smart way requires not only discipline but practice because it's so contrary to our natures.

Also essential to smart trading is liquidating if you see you've misread the trend. This habit also takes practice, and it's the habit that'll have you eating a lot of crow before your hand becomes sure. There's nothing more frustrating to see you liquidate your long only to realize that you've been faked out and you missed a nice gain. But this habit is one that a smart trader must master, even if part of the "tuition" is restraining the desire to hit your head against the nearest wall after you've been faked out again. Had I not been trader-dumb, I would have sold some of my Factom when it boogied up to 0.0042 and waited to see if the uptrend fell apart (as it did.)

Relevance To Bitshares

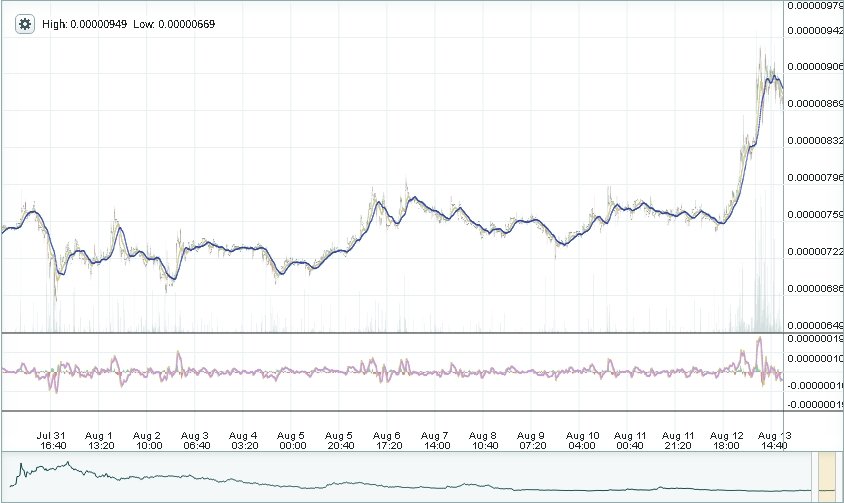

If you've been following Bitshares, you know that it's shot up to almost 900 satoshis after spending a couple of weeks in the 700s doldrums:

As you BTS vets know, this jump looks like another fake-out :(

But what's intriguing abut it is the fact that the Bitshares Lending market is all-but dead. As I write, the low ask on the Loans is the absolute minimum: 0.0001%, for a compounded annual rate of less than 0.04%. As of now, more than one million Bitshares are offered at that 0.0001%.

Given my time in the trenches, there are two interpretations:

- The short sellers, being smart money, don't want to take the risk of betting Bitshares will go down. To the extent that this reason is right, Bitshares looks like a buy.

- Short-sellers just aren't interested in shorting BTS, even though its ear-to-date chart...

...(ouch)...

...indicates that it's a plausible candidate for shorting. Based upon my occasional watching of it, reason 2 looks more true than reason 1. If I'm right, then there's a chance to make some money by (cautiously!) shorting BTS.

But if I'm wrong, this is a good time to accumulate. As the above chart shows, it's been sneaking up - albeit slowly - all summer. If you're a long-term Bitshares bull and think reason 1 makes more sense, you've got a reasonably decent buying point.

So long as you're prepared to hold for the long term!