A few days ago, the ICO for the BANCOR token broke all records.

They might have had the biggest ICO to date with over $156 Million raised in just 3 hours!

The demand was so high that a lot of buyers' transactions didn't even go through, and the network experienced heavy malicious attacks (but all funds remained secure).

In total, the incredible amount of 396,720 ETH was raised in the 3 hour timespan.

What is BANCOR ?

Bancor Protocol is a standard for a new generation of cryptocurrencies called Smart Tokens.

The BANCOR protocol is a solution for different currencies to trade with each other, enabling a token to hold one or more tokens in reserve.

That way, there is a relationship between different tokens established, where conversions can be done directly with a smart contract.

This means that you don't have to rely on any exchange or 3rd party - you can instantly purchase or liquidate any currency directly through the smart contract.

And this works for any token, whether that's a fiat currency, cryptocurrency, or even physical assets like gold.

The Bancor protocol enables built-in price discovery and a liquidity mechanism for tokens on smart contract blockchains. These “smart tokens” hold one or more other tokens in reserve and enable any party to instantly purchase or liquidate the smart token in exchange for any of its reserve tokens, directly through the smart token’s contract, at a continuously calculated price, according to a formula which balances buy and sell volumes.

Use Cases

The different Use Cases for smart tokens include:

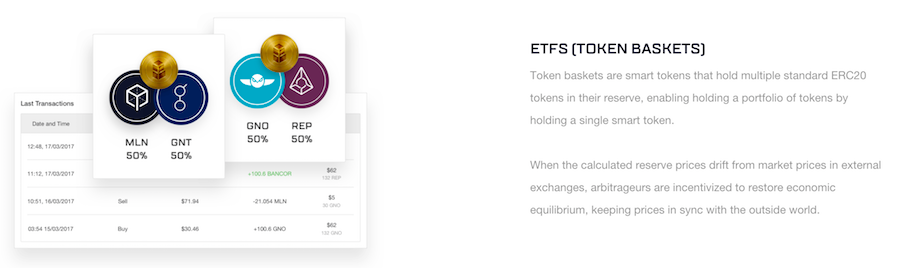

- Token Changers: smart tokens which are being used to exchange between different other tokens which are previously held in their reserve.

- ETFS Token Baskets: Similar to token changers, but in this case a smart token can hold multiple ERC20 tokens in their reserve, which in turn enables holding a portfolio of tokens just by holding a single smart token.

- Project and Protocol tokens: smart tokens can be used for crypto-crowdfunding projects. Tokens will be liquid and market-priced right away.

- Token creation for everyone: BANCOR allows anyone to launch their own smart token as well as multiple types of crowdsales without too much technical knowledge. This can be done by using chat bots within facebook messenger, telegram or wechat.

BANCOR Team and Investors

The team behind BANCOR consists of different cryptocurrency- and blockchain specialists.

Yehuda Levi (CTO), Eyal Hertzog (chief of product) and Ilana Pinchas (VP engineering) have formerly launched a Bitcoin marketplace platform called AppCoin. Two of the founders, Galia and Guy Benartzi have each founded and exited a startup.

Other advisors include Yoni Assia, the CEO of trading platform eToro, and Meni Rosenfeld, an award-winning mathematician well-versed in Blockchain technology.

Since the BANCOR protocol is a totally new mechanism on the Ethereum Blockchain which has never been executed before, the team is especially eager to ensure complete security of the funds.

That's why BANCOR has teamed up with some of the most well-known Ethereum security advisors, including Nick Johnson and Martin Holst Swende from the Ethereum Foundation.

Investors

The record-breaking ICO of BANCOR completed with 10,885 buyers, and 15.000 transactions for purchase in total.

What's interesting is that one (anonymous) buyer spent over $28 million for roughly 6.8m BNT, purchasing almost half of the tokens for sale!

Among other notable investors is Tim Draper of VC fund Draper Fisher Jurvetson who also joined the board of BANCOR, as well as Token-as-a-Service (TaaS), the first-ever tokenized closed-end fund dedicated to Blockchain assets (who are said to have invested over $1 million).

Blockchain Capital, an investment company that focuses on startups in the blockchain field, has also invested heavily in BANCOR:

“We are thrilled to invest in such an innovative and thoughtful project as Bancor. What attracted us was first and foremost the team. With two decades of experience in end-user applications, a strong network of supporters and advisers, the Bancor team has exactly the kind of DNA we want to see more of in the Blockchain space to help bring the value revolution to mass market.”-Blockchain Capital

What's Next?

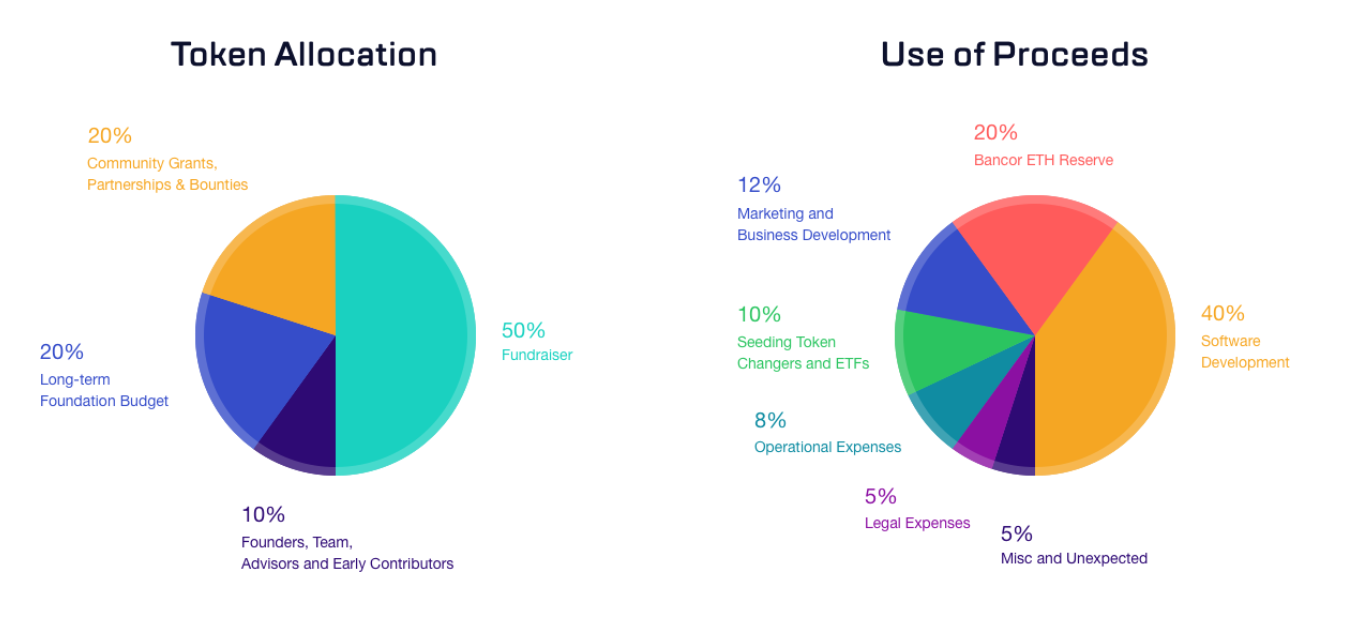

The token distribution will be executed as follows:

- 50% of BNT tokens issued to contributors of the fundraiser

- 20% long-term operating budget of the foundation

- 20% allocated to partnerships, community grants and public bounties

- 10% to founders, team members, early contributors and advisors

Roadmap

According to BANCOR's Roadmap, there are several ambitious goals for the future.

Within the next 6 months, they want to make purchases with other currencies available, for example BTC, XRP and LTC, they also want to make the purchase of tokens possible via credit card, create a peer-to-peer online marketplace and more.

Their goals for the next 2 years include native iOS and Android Apps, communities without tokens, and open-sourcing the software.

Images: 1, 2, 3, 4, Sources: 1, 2, 3, 4, 5, 6, 7

© Sirwinchester