What's the biggest reason why cryptocurrencies haven't gone mainstream by now?

It's the usability! It is simply not convenient enough to use your crypto assets as real-life payment methods.

Not many retailers accept it yet, and even if they do, it can be quite the hassle to scan a QR code, wait until the transaction has been confirmed etc.

If cryptocurrency really wants to achieve mainstream adaption, we need to make it EASY and quick for people to use it.

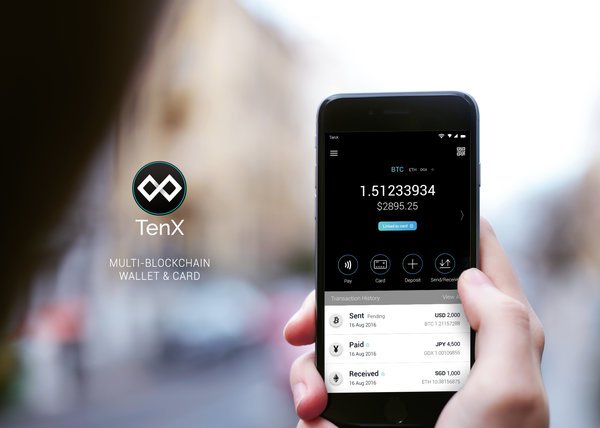

Introducing TenX: Making "any cryptocurrency as usable as a dollar bill in your pocket" with Visa Cards!

What is TenX ?

TenX graduated from PayPal's startup incubation program earlier this year and is a singapore-based company featuring a mostly Austrian team.

It aims to solve the liquidity problem by creating cryptocurrency visa cards that make it very easy and convenient to spend your crypto-assets in real life.

These visa cards would be accepted almost anywhere in the world (over 36 million points of acceptance), and TenX offers no processing fees for any online or offline payments.

Apart from the visa card, TenX also offers its users a cryptocurrency wallet where the tokens are stored until the customer actually wants to spend them - then, the funds get exchanged to fiat for the best possible rate.

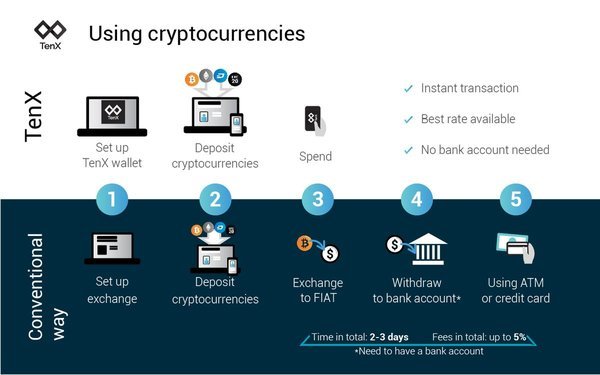

How does it work?

So how exactly can you spend your cryptocurrencies in real life now?

First, users need to download the free TenX app. Then they setup a wallet for the tokens they'd like to use, and transfer some funds over to the wallet so that they're ready to spend it.

Next, users need to order a virtual or physical visa card - and with that, they can start spending their crypto assets at over 36 million points of acceptance in the world.

Anywhere where visa is accepted, you can use TenX to pay via cryptocurrency!

Take a look at how the TenX team buys a coffee at Starbucks in Singapore, using the TenX card and Ethereum funds:

Cryptocurrency Details

The native cryptocurrency of TenX is the PAY Token, which is built as an ERC20 token on the Ethereum Blockchain..

Users can exchange funds in their wallet for Bitcoin, Litecoin, Dash, Ethereum, and all ERC20 tokens like BAT, EOS, GNO, ANT and many more.

Rewards

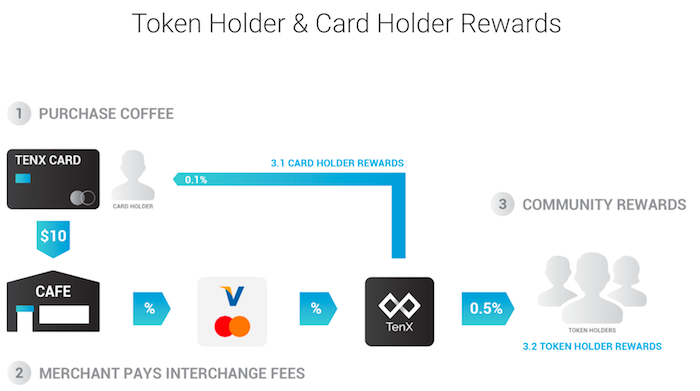

TenX offers revolutionary rewards for its users - everytime they buy something with the TenX app or card, they will benefit from it!

For token holders, TenX enables 0.5% rewards (ETH) for every transaction and for TenX card holders, there 0.1% rewards (PAY) for every transaction.

This offers an incentive for both card holders and token holders and is a game-changer in the niche market for cryptocurrency debit/credit cards.

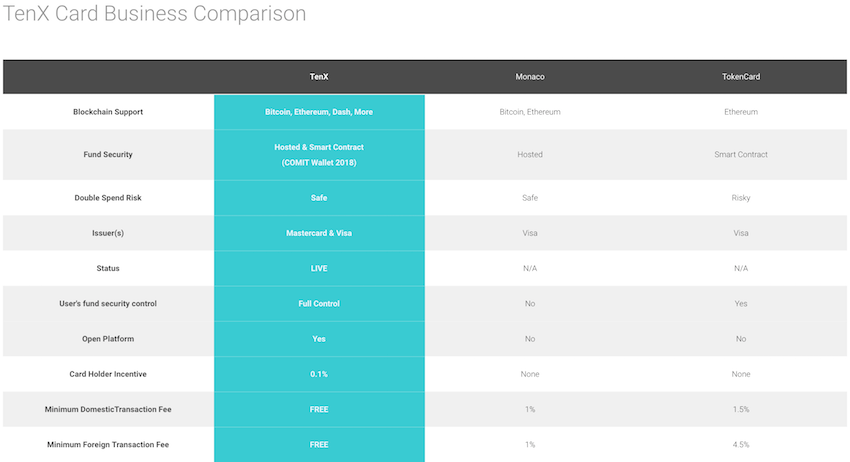

TenX Card compared to other cryptocurrency cards

TenX is not the first company to come up with the idea of cryptocurrency debit/credit cards - but it offers its users some unique benefits.

When compared to the popular alternatives Monaco Card or TokenCard, you will immediately notice the difference:

TenX is the only one that offers a wide variety of different currencies, NO domestic or foreign transaction fees, and also the only one who offers any user incentives.

Conclusion

TenX is a promising fintech startup that aims to make it much more convenient to spend cryptocurrency in real life.

They have created the first debit card that offers multiple cryptocurrencies, no transaction fees, and user incentives all in one.

There is also a TenX wallet app where you can exchange your tokens.

The TenX ICO concluded in June this year. Currently, it is trading on spot #4 on the asset market cap ranking and the TenX cards will be released in 2018.

© Sirwinchester