The experiment:

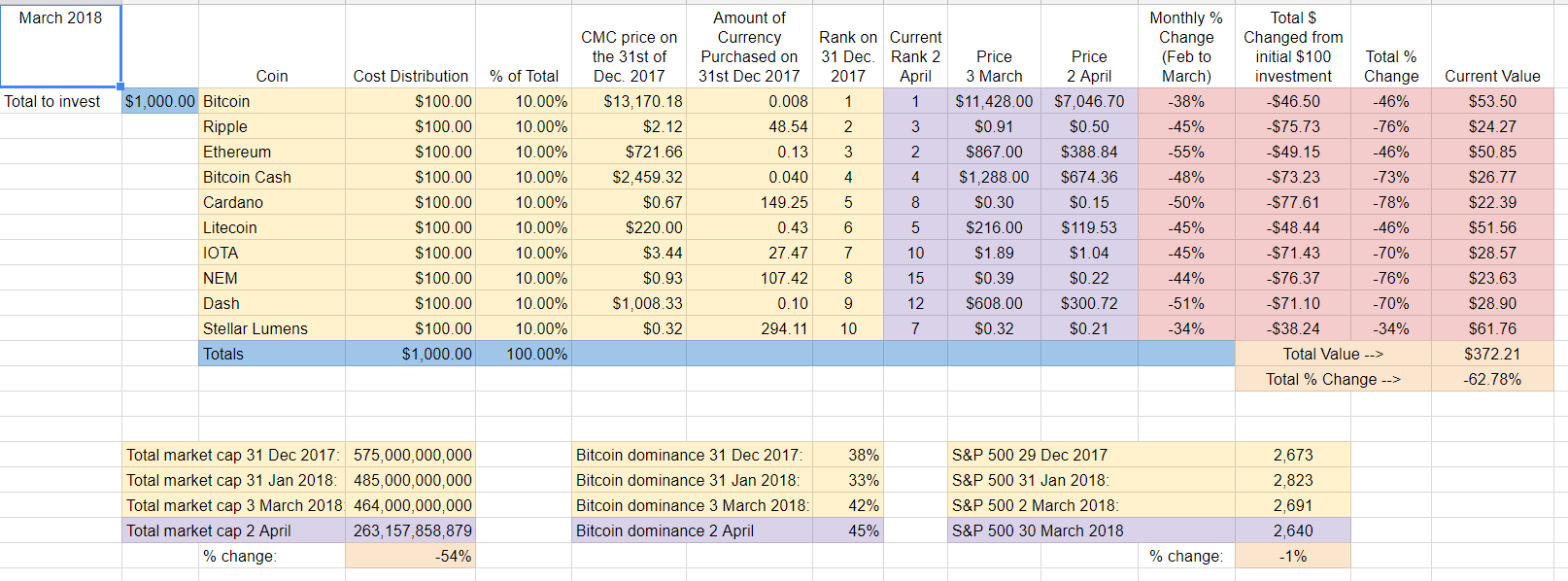

Instead of hypothetically tracking cryptos throughout the year, I made an actual $1000 investment, $100 in each of the Top 10 cryptocurrencies by market cap as of the 1st of January 2018. I'm trying to keep it simple and accessible for beginners, a type of homemade Index Fund* for those looking to get into cryptos but maybe not quite ready to jump in yet.(*without weighting and rebalancing it's not a true Index Fund - but hopefully still helpful as a sort of a proxy for the entire market).

The Rules:

Buy $100 of each the Top 10 cryptocurrencies as of January 1st, 2018. Run the experiment 365 days. Hold only. No selling. No trading. Report monthly.Month three (March) update:

Nothing but red.

March Winners - None. The top two performers in March lost "only" close to 1/3 of their value. Stellar has dropped the least (-34%) followed by Bitcoin (-38%). Stellar managed to climb up a position in the rankings going from #8 to #7 and IOTA went from #11 to #10. All others either maintained their position or dropped in ranking.

March Losers - Everyone. Ethereum wins first loser down more than half at -55% followed by Dash and Cardano, both down about -50% for the month.

Overall update/Q1 update - Stellar down the least, Cardano, Ripple, and NEM getting crushed

Since the beginning of the year not one of the Top Ten cryptocurrencies is in the green. Stellar, which has easily performed the best, is still down -34%. Interestingly, three of the most established cryptos (BTC, ETH, and LTC) come next - and all are down the same amount for the year (-46%).

Losers? Cardano (-78%) is leading the race to the bottom followed closely by Ripple and NEM both down about -76%. Dash and NEM have both lost their places in the Top Ten.

Bitcoin dominance:

Bitcoin dominance continues to climb to new highs for 2018. It now stands at about 45.5%.

Total Market Cap for the entire cryptocurrency sector:

The overall crypto market shed about 200B in March (that's a loss of about -43% for the month) and is down over fifty percent (-54% to be exact) from January 1st.

Overall return on investment from January 1st, 2018:

My $1000 initial investment is now worth about $372, down about -63%.

Implications:

Stellar's recent run places it squarely in the lead so far in 2018, but being down -34% is a bit of a hollow victory. After Stellar, the Big Three (Bitcoin, Ethereum, Litecoin) continue to perform second "best" - all are down nearly 50% since the beginning of the year.

Money continues to flee the crypto space. The total market cap shrunk from 464B to 263B in March alone (-43%) and is down -54% from January 1st, 2018.

Focusing solely on holding the Top Ten continues to be a losing strategy. While the overall market is down -54% from January, the Top Ten are down -63% over the same period of time.

As I've explained in previous posts, I'm also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. So far the S&P 500 is down -1.2% for the year.

Conclusion:

To say crypto had a rough first quarter of 2018 would be a massive understatement. While I (and many others) were hoping we reached bottom in February, that clearly has not been the case as another 200B was lost in March. While the stock market is down this year, a -1.2% loss (as measured by the S&P 500) is obviously much more palatable than being down -63% as I am so far in this experiment. Like last month, with perfect hindsight, the initial $1,000 would have been better placed in a high-yield savings account making 1.5% or so in interest.

Thanks for reading and the support for the experiment. A bleak picture so far but there are three more quarters to go - a lot can (and will) happen. I continue to be committed to seeing this process through and reporting along the way. I've been traveling a lot recently, so hope to find time to make my monthly update video sometime this week as well.

Stay tuned for progress reports and wishing you all the best in your crypto adventures!