Exchanging Column `The Writing On The Wall' – Strategies for 2018; Hodl or Diversify?

This is a week after week exchanging tips arrangement called 'Composing On The Wall', in which our diversion hypothesis control, Eric Wall, tries to disentangle showcase signals. This week, methodologies for 2018;

Also Read : Cardano Surges by 145% of every 1 Day, Charlie Lee Questions Value

Also Read : Cardano Surges by 145% of every 1 Day, Charlie Lee Questions Value

2017 has been a totally crazy year for crypto. For merchants, it's been stuffed with a perpetual horde of chances and brief period to appropriately assess even a small amount of them. Attributable to the extraordinary positively trending market, for all intents and purposes each medium-to long haul methodology executed with some assurance has been ludicrously effective, in any case in the event that it included holding just bitcoin, betting everything on bitcoin money, putting resources into a substantial assortment of altcoins or wagering huge on each well known ICO under the sun.

The Writing On The Wall

As the Christmas occasion approaches, now is a great time for merchants to make a stride back, re-assess current portfolio appropriations and position oneself for the year to come. In this post, we'll assess the current crypto scene and check whether we can make some informed conjectures as to where the cash will stream.

It's possible that 2018 will be recognized as the year after open enthusiasm for bitcoin blasted, however the year prior to the picked way of scaling approaches (Segwit, Schnorr, MAST, Lightning Network) truly became effective. This sets the scene for yet one more year of tainted clash, which, for the merchant, just means all the more exchanging open doors are coming soon.

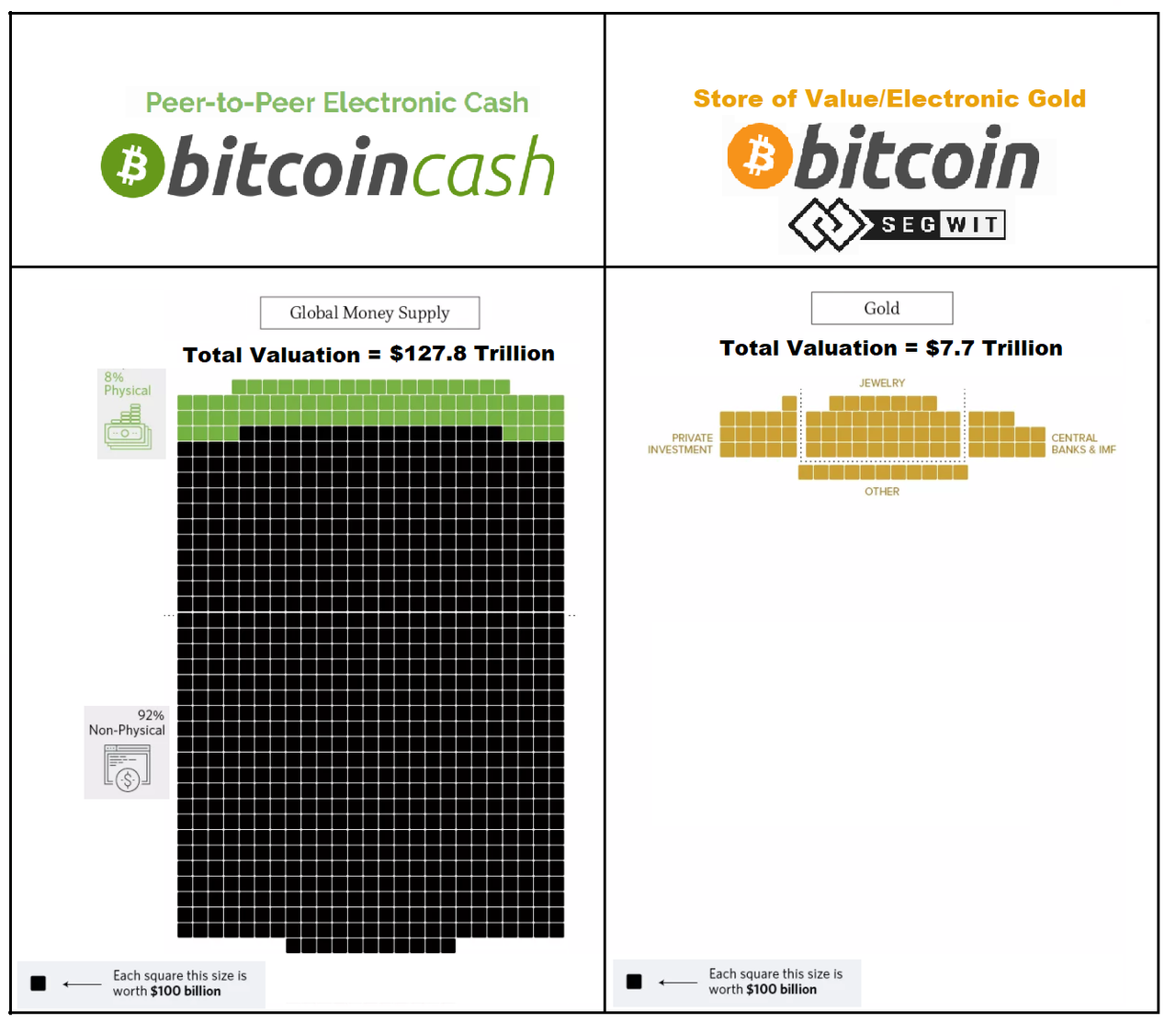

While a few sections of the group are unquestionably happy with bitcoin as a type of computerized gold, the partition between the SoV (store-of-significant worth) and MoE (medium-of-trade) advocates is probably going to increment further as weighty charges turn into a certain piece of the truth of bitcoin. While the disappointment of Segwit2x may have been viewed as a demonstration of the versatility of bitcoin by numerous, the specialized grounds on which it was rejected shows that no hard-fork piece measure increment without replay assurance is probably going to be fruitful. The political grounds on which Segwit2x was dismissed additionally implies that it will be exceptionally troublesome for a gathering of organizations to concede to naming a hard-forked rendition of "bitcoin" on in advance. Essentially, it is impossible that a square size increment hard-fork can be propelled as something besides an altcoin. Thusly, it is totally conceivable that the bitcoin group leaves stroll over of the MoE offer of the digital currency showcase amid 2018 to some altcoin, while it concentrates on breathing life into second-layer arrangements.

Here are a couple of cases of potential 2018 MoE contenders.

Case: While Bitcoin Cash absolutely has the piece estimate properties to deal with the MoE advertise, its genuine quality sits with the solid on-chain scaling feelings of its group. Groups are the foundations to the achievement of any digital money; they contain the market request that reason administrations to help them, and are the ones that offer some incentive and security to a coin. The quality of the group, joined with the acquired codebase and coin conveyance from bitcoin (BTC), makes bitcoin money a solid contender for catching the MoE advertise amid 2018.

Proposal: Hold the same number of bitcoin money as BTC.

Litecoin, square size: Effectively 4-8 MB (contingent upon SegWit appropriation)

Case: Litecoin (LTC) is essentially bitcoin with 4 times the square rate and 4 times the supply. While it doesn't share coin dispersion with bitcoin, it has a long reputation, a famous primary figure, and it easily sits outside the contaminated clashes encompassing bitcoin. The execution of SegWit enables it to profit by the Lightning Network when prepared, which implies that Litecoin can oversee comparable high on-anchor throughput amid 2018 to Bitcoin Cash, while at the same time profiting by the propelled scaling methodologies of bitcoin later on.

Proposal: Hold 4 fold the number of LTC as BTC.

Ethereum, square size: None

Case: While Ethereum doesn't have a square size point of confinement, it has a piece gas restrain which is set progressively by excavators for each piece. Right now, the Ethereum arrange is preparing north of 800,000 exchanges for each day, with a middle exchange expense of only 60 pennies. Conversely, bitcoin forms approximately 350,000 exchanges for every day where $10+ is as of now expected to get into a piece in a convenient manner.

In the meantime, this doesn't imply that Ethereum (or Litecoin or Bitcoin Cash so far as that is concerned) scales superior to bitcoin. Actually, it scales more awful than bitcoin, with the exception of that the cost of handling exchanges is consumed by the hubs rather than the clients. The Ethereum people group knows this, and realize that they should likewise grow new methods so as to scale for MoE, which they're right now seeking after through sharding and Raiden. Until the point that such conventions are set up, Ethereum is probably not going to seek the MoE showcase.

Proposal: No reallocation for MoE fundamental.

Bitcoin, square size: 1-2 MB (contingent upon SegWit appropriation)

Case: While it's as of now not looking extremely encouraging for bitcoin to have the capacity to help the MoE market of 2018, there are a couple of things which could change in support for bitcoin amid 2018. Allows first recall that lone fourteen days back, 25 penny charge exchanges cleared from the mempool. The present high charges are likely an impact of a standard rage and hypothesis in bitcoin which won't really be as exceptional all through all of 2018. Charges could go down without anyone else. Generally there's likewise the likelihood that some extensive organizations, for example, blockchain.info and Coinbase, embrace Segwit and that Coinbase begins grouping exchanges, which would decrease mempool stack fundamentally.

On the off chance that none of that were to happen, there's as yet a thin plausibility that the group in bitcoin achieves agreement on another delicate or-hard fork piece estimate increment proposition.

Suggestion: Don't offer all your bitcoins.

What do you believe is in store for 2018? Tell us in the remarks segment underneath.

Upvote For More Details >>> @wahabali

.gif)