Fintech has been showing fascinating development for the past few years, thus bringing brand new terms into our lives, primarily ‘’blockchain’’ and ‘’cryptocurrency’’. These terms are often mixed up or even considered to be one and the same thing, which is wrong.

Blockchain is a technology based on tokenisation — the system, while cryptocurrency is a form of digital (tokenised) money — an entity distributed through the system. Like any money, cryptocurrency can be traded or exchanged. Sounds simple so far, but if you’re a newcomer in the cryptoworld, questions will start to pile up eventually.

Let’s suppose you have some amount of cryptocurrency you want to exchange for conventional money, for example, USD, but you don’t know how to do it. You’ll need to go to a crypto exchange. In order to choose one wisely, you have to consider a number of factors.

Technological Factors

Crypto exchanges are platforms that let you trade and exchange cryptoassets for other cryptoassets (cryptocurrency or any tokenised commodity) or against conventional money (USD, EUR, etc.). Types of cryptoexchanges include the following.

Trading platforms

These are like traditional stock exchanges, with a mediator in buyer-seller relations. The exchange process is linked to current market prices. The platform charges a fee for each transaction.

Direct trading

Based on peer-to-peer (P2P) principles, direct trading excludes the middle-man from the buyer-seller chain. Sellers set their own exchange rate, whilst buyers search for sellers via the platform and perform an Over the Counter (OTC) Exchange or denote most appealing rates, so the platform matches buyers and sellers.

Brokers

Brokers are somewhat similar to foreign exchange dealers. You can buy and sell cryptocurrencies at a price set by the broker (usually market price plus a premium for the broker).

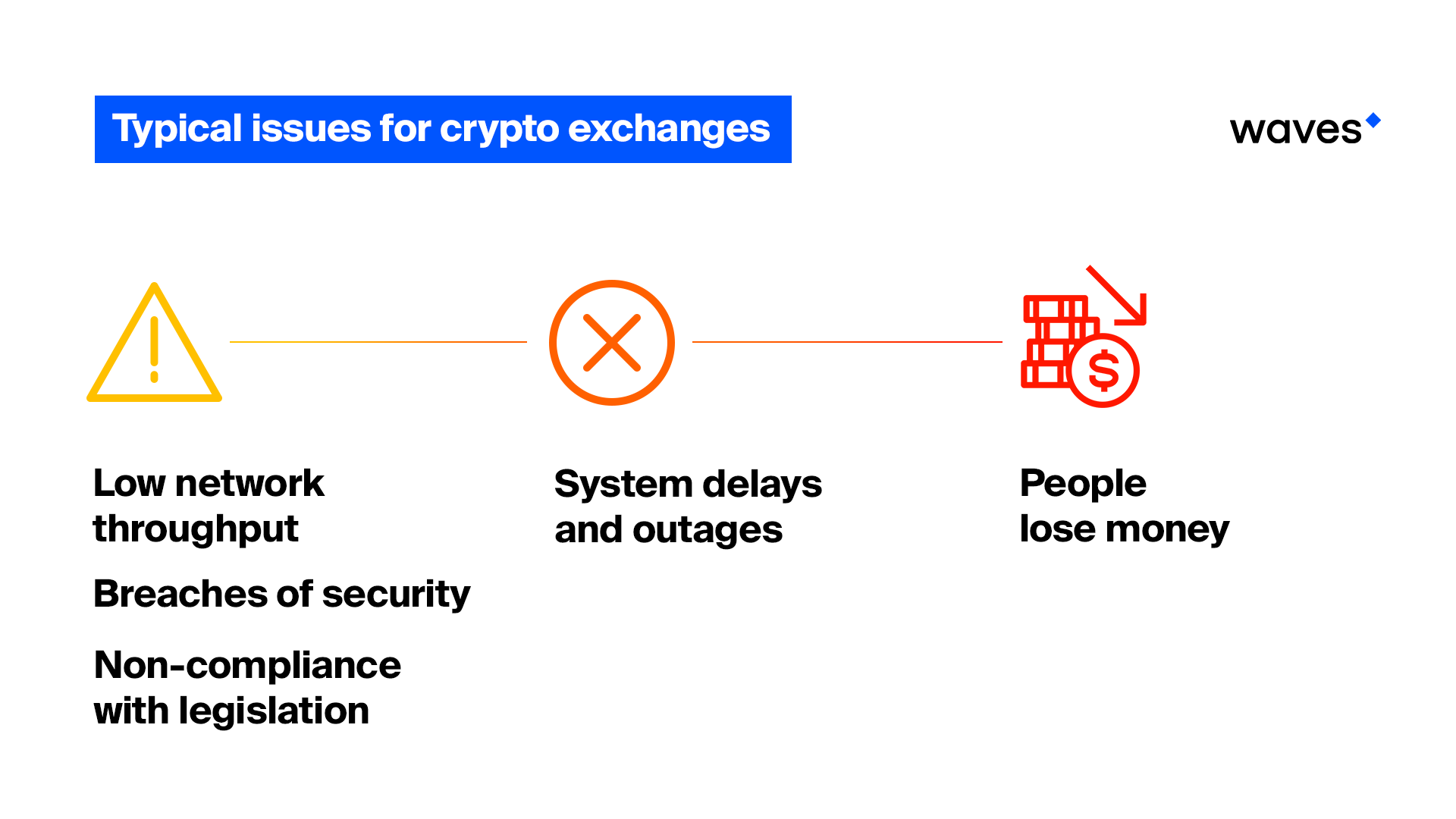

Also you have to remember that crypto exchanges are linked to the current state of blockchain technology. By far, the main technological issues are:

- the throughput limit of transactions — a cause for delays and malfunctions in the system;

- breaches of security.

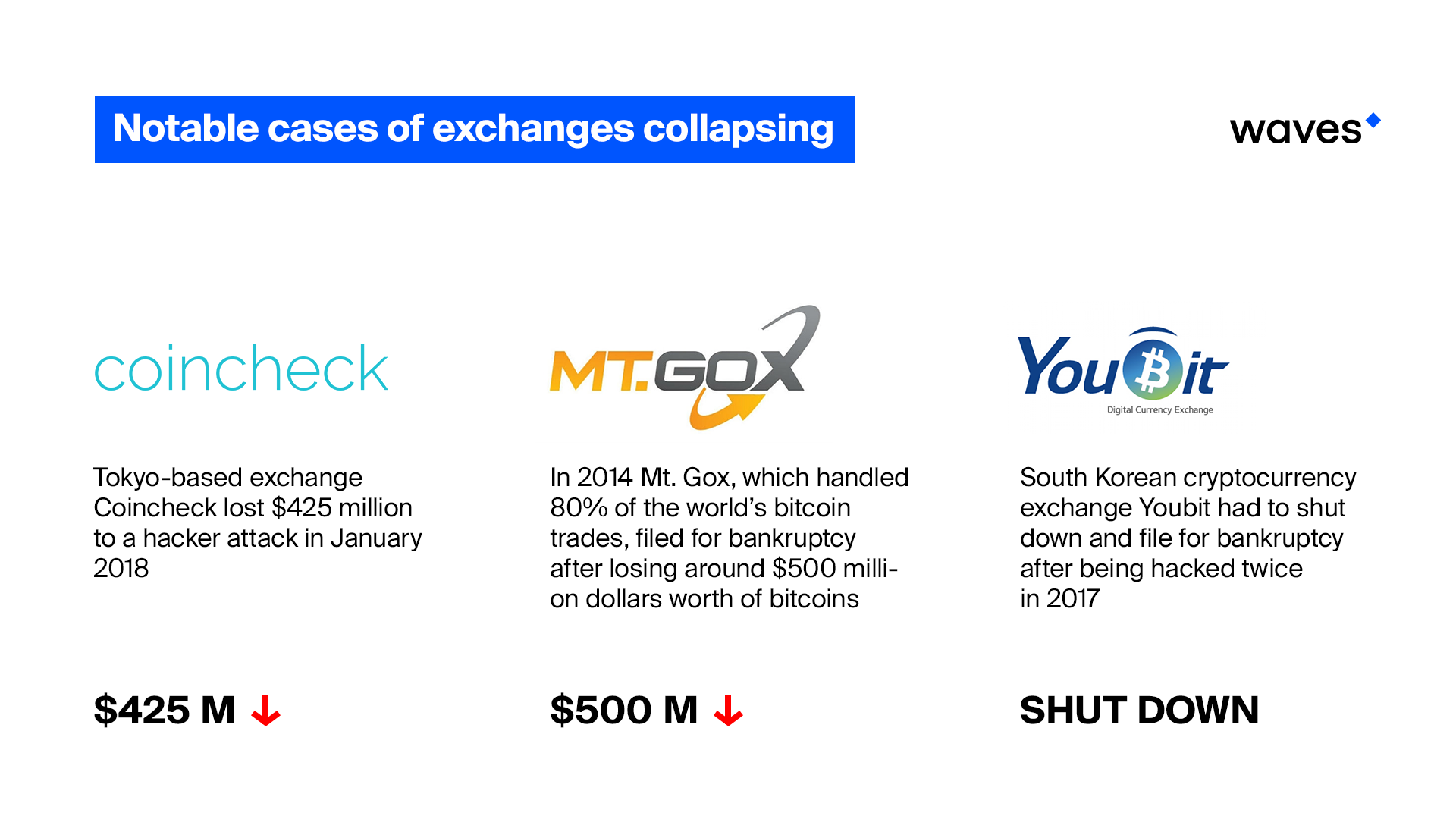

Alone and combined these issues have already caused some exchanges to halt operations or even file for bankruptcy, forcing people to lose money without compensation. Mt. GOX, Coincheck and Youbit are among most notable examples.

Legal Factors

Blockchain technology is subject to relevant legislation, which is currently evolving both internationally and regionally. Besides taxation, there are other considerable legal factors, including the legal status of exchanges.

Even if the country where the exchange is located has resolved a number of legal issues, you should always keep up with the latest news, because there isn’t a single state with completely settled legal rules for cryptocurrencies yet. The regulations debate is still going on and new issues are introduced literally every month, so what is convenient today might become a problem tomorrow and vice versa.

Usability Factors

Last but not least is the usability of the exchange:

- Level of liquidity

- Transaction fee structure

- Exchange rate

- Transparency of coins, prices and volumes data

- Payment options

- Geographical restrictions

Waves DEX is fully compliant with all the factors mentioned above.

The Technology

Benefits of centralized and decentralized technology paired with unprecedented security and speed

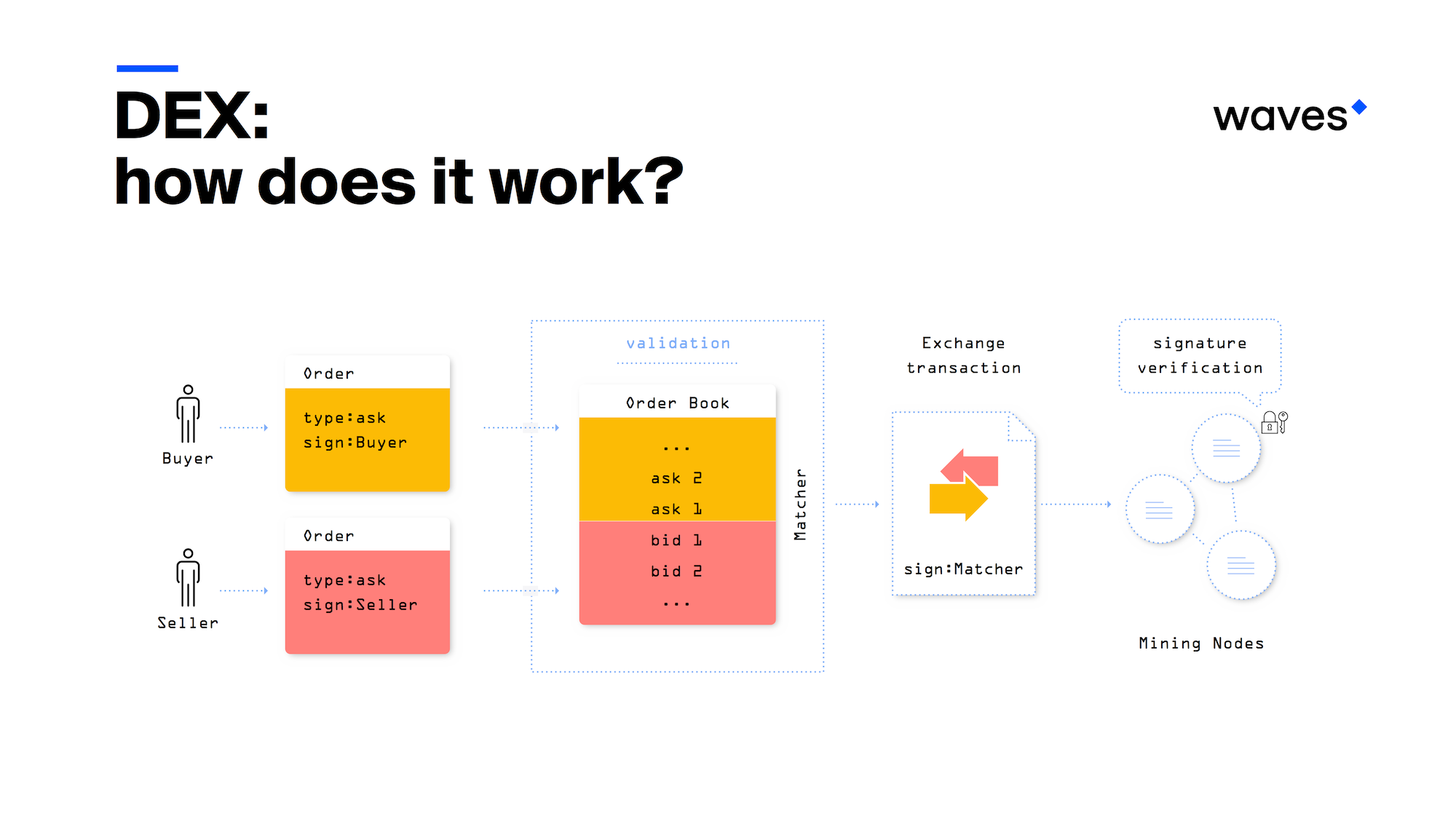

All transactions happen on the blockchain, and only the order list is held on the centralised matcher. This allows us to take full advantage of both centralised and decentralised technologies.

Your orders are transferred to the matcher over an encrypted channel and are not visible to other participants until the moment of execution. This excludes the possibility of unscrupulous traders manipulating information about an upcoming trade. Funds are kept in your wallet, not on the exchange.

Moreover, our platform is powered by Waves-NG, the fastest protocol in blockchain’s history.

Legislation

Waves approaches the legal aspects of blockchain’s development seriously. Not only is our platform the most technologically advanced, it is constantly kept relevant with the latest updates in crypto legislation.

In 2017 we partnered with Deloitte to launch the development of a legal framework for wider adoption of blockchain technologies, thus keeping our products, including DEX, updated with evolving legislation.

The Usability: Liquidity, Fees, Interface

Waves’ DEX allows you to trade any token pairs that are on the blockchain. In addition, there are no restrictions on the withdrawal of funds from the DEX. As soon as your transaction is complete, the cryptocurrency will appear in your wallet.

There is a very low and fixed fee on DEX, which doesn’t depend on the size of the trade. The commission per order is 0.003 WAVES. If an order isn’t executed in full, an incomplete and proportional commission is calculated for you. By canceling the order, you lose nothing.

DEX provides a wide range of indicators and trading tools, and is suitable for use by professional traders and newcomers alike. You can use major national currencies (EUR, USD and TRY) and cryptocurrencies (WAVES, BTC, ETH, ZCASH, LTC) or even profit from running your own matcher.

Join Waves Community

Read Waves News channel

Follow Waves Twitter

Subscribe to Waves Facebook