Last month I wrote about the Fear of Missing Out (FOMO) surrounding the EOS ICO.

I was wrong.

Well, at least I was wrong about my initial short term predictions. I figured, with a year long ICO, the price of EOS would surely drop below the initial 5-day ICO price. As eosscan.io clearly shows, the price went up almost 7 times higher by day 2. It has come down since then and is currently hovering just below $2, but still higher than I expected.

I thought the price would be much lower. I figured it would continue to decline as the months go by and people lose interest and move on to the next hot ICO. Maybe they will, and I won't be completely wrong. I've only bought a handful so far by placing some low buy orders on Bitfinex where I thought support might be.

I want to buy more. Part of me thinks I'm being penny wise and dollar foolish to wait. I do think this may be one of the best blockchain technologies we've yet seen. Dan has a proven track record for building high performance, useable technologies which meet very real needs (a distributed exchange and a decentralized, uncensorable social media platform). If EOS has a chance to be the Amazon Web Services of decentralized blockchain applications, any holders of EOS could become very well off indeed.

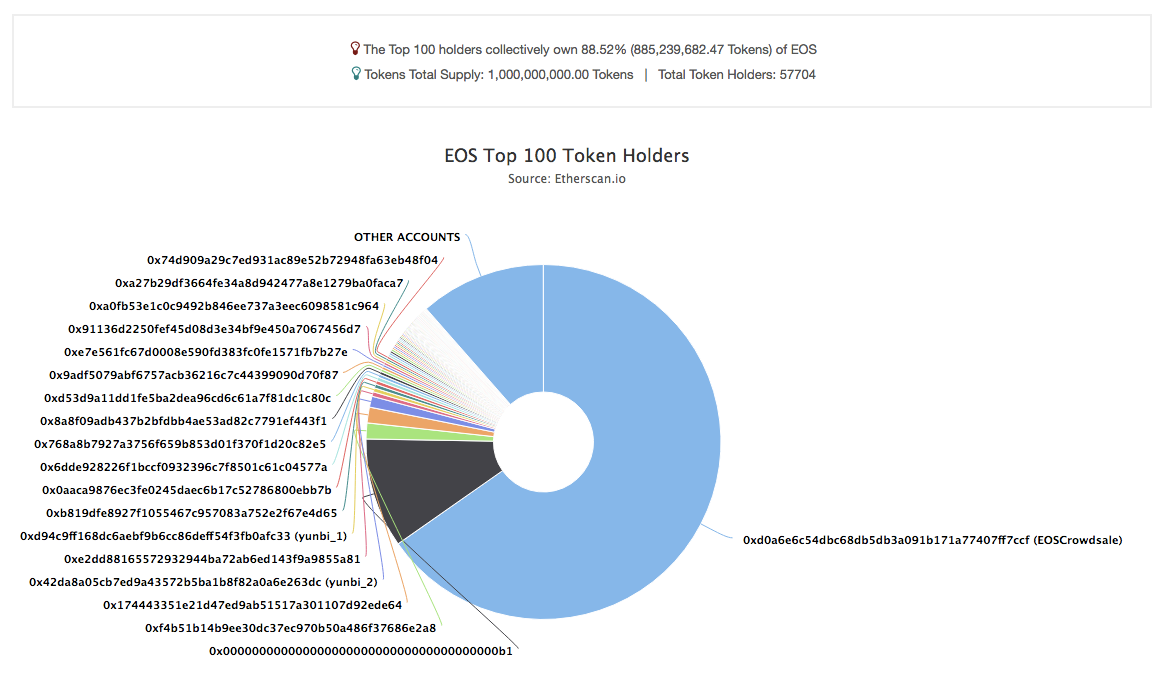

As I was thinking about things today, I was curious about how the distribution is going so far. I was really impressed to see this:

10% is locked up for later use by block.one.

65% is still to be distributed by the year-long ICO.

The two next largest wallets have only 1.45% and 1.42% and for all I know they could be exchanges. There are currently over 57,704 EOS holders and there are still 320 days left in the ICO period. If you haven't yet read this post, give it a read:

Logically Consistent Principles for Token Distributions

From my perspective, they were right. So far, the 6 principles they laid out are being met:

- Nobody should get something for nothing

- Everyone should receive a market determined price

- Everyone should have an equal opportunity to participate

- Developer incentives should be aligned

- Economic disincentives for buying more than 50 percent of a distribution

- Minimize transaction costs (mining, fees, etc.)

So far, the price has been surprisingly stable after the initial correction:

So we have a new token that (so far) is being widely distributed. Sure the whales will keep buying up a large share, but we haven't seen one wallet owning a huge amount like with many other ICOs. That, to me, is fantastic.

So am I buying? Well... not yet. I'll keep putting in lower orders for the price to bounce off of, but I also want to be patient and rational. For example, the last ICO window closed at $1.1886 but the market price is at $1.94. That's not very rational.

So what am I doing in the mean time? Well, I'm compiling EOS. :)

I'm using @clayop's docker guide and Google Compute Engine. I've never used Google Computer Engine before, and it's pretty neat. I've got a $300 credit good for 12 months, so I can play around with this for free (for now). I also joined the EOS Developers Telegram to start listening and learning.

In addition, I'm reading through EOS Development Sneak Peek for Very Early Developers by @dan. My hope is to get familiar with things early on and help the EOS community however I can. I'll be posting more in the future if I get it up and running and start playing with some of the example contracts. I intend to go through some tutorials on C++ as well. Though I've programmed in many languages, that's one I haven't messed with professionally.

Exciting times!

Created with ChainBB to help support that project.

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com