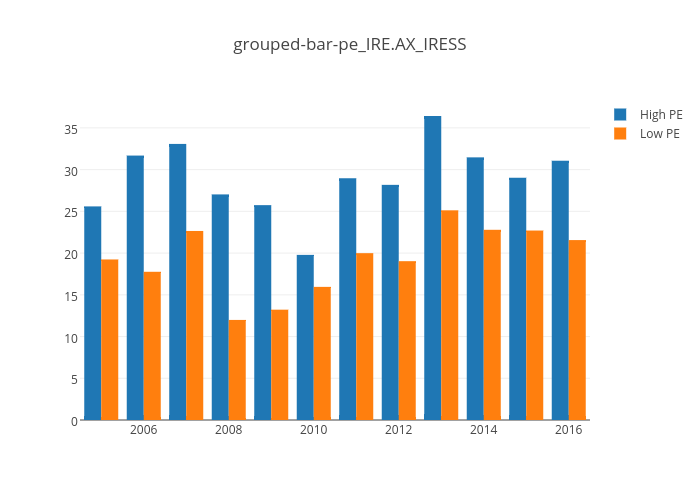

Each day, stock prices fluctuate around their value. Finance market has some criteria to evaluate share price level, such PE, PB, dividend and price ratio. If a historic chart could indicate the yearly maximum and minimum PE, dividend and price ratio, that could give investors a baseline to compare, thus have an idea of where the current prices levels are. This would be mostly useful for some companies with stable revenue and profit development.

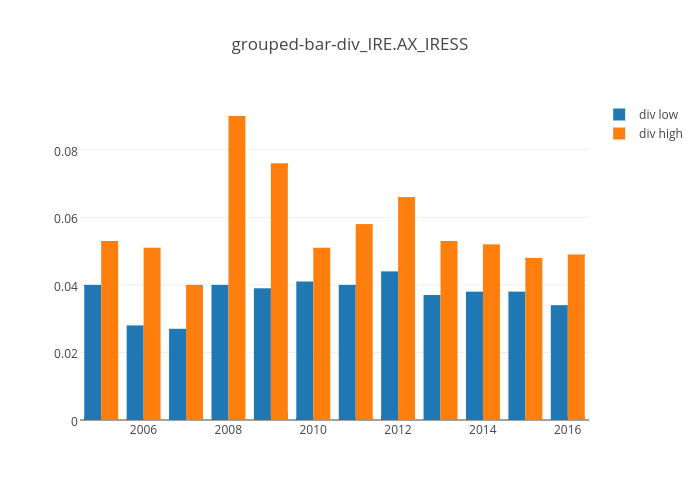

Here is an example:

Most people cannot understand how useful these histogram charts are for investors!

e.g.

With knowledge of the historic highest and lowest dividends, investors can make decisions on the buy or sell based on these censuses.

I set the high dividend ratio to 0.05, low dividend to 0.037, which means if the market price divided by dividend exceeds 0.05, I will buy, if it is less than 0.037, I will sell; I will hold in other circumstances. We can do a back test on how much we can earn over 2015 and 2016:

2015-01-16 00:00:00 strategy [INFO] BUY 5060 IRE.AX at $8.78/share

2015-02-16 00:00:00 strategy [INFO] SELL 5060 IRE.AX at $9.96/share

2015-03-03 00:00:00 strategy [INFO] BUY 5721 IRE.AX at $8.85/share

2015-05-18 00:00:00 strategy [INFO] SELL 5721 IRE.AX at $10.04/share

2015-08-21 00:00:00 strategy [INFO] BUY 6355 IRE.AX at $8.87/share

2016-03-09 00:00:00 strategy [INFO] SELL 6355 IRE.AX at $10.76/share

2016-06-29 00:00:00 strategy [INFO] BUY 6598 IRE.AX at $10.37/share

2016-07-14 00:00:00 strategy [INFO] SELL 6598 IRE.AX at $11.18/share

Name of the company IRESS

Initial portfolio value: $50000.00

Final portfolio value: $80072.78

net profit percentage:$60.15%

我比较过美国和澳洲蓝筹股的估值,对比中国而言,中国蓝筹被大大低估了,大批人民币已经无处可去,除了中国蓝筹,一波估值修复的牛市正在进行中!

BTW, blue chips in Australia, U.S. are too expensive compared with China! In China, it looks money will go nowhere else except blue chips in the share market. I can confidently announce a bull market is just starting in Chinese stock market!