Today I am starting an easy-to-follow series on Forex to teach you what Forex is and how to use it to make money.

How to Forex - A Beginners Guide to Forex Trading

Table of Contents

In this five part series you will learn:

An Introduction to Forex - What is Forex, the brief history of Forex, the benefits and risks of Forex

How to use Forex Platforms - Trading Applications, Brokerages, Opening live and demo accounts

Forex Trading Strategies - Trend trading, Scalping, Range trading, Breakouts, Signal trading, and Risk Management

Market Analysis - Fundamental and Technical analysis

Start trading Forex - Summary of all lessons, how to create your own strategy, the psychology of trading, and remembering the risks

1. An Introduction to Forex

What is Forex

The Foreign Exchange (FOREX) is the over-the-counter (OTC) market in which the foreign currencies of the world are traded.

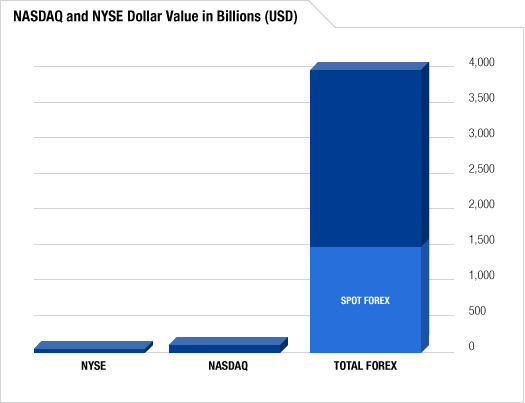

It is considered the largest and most liquid market in the world.

There is no centralized market place for trading Forex.

Forex exists wherever two currencies are being traded, also known as trading currency pairs.

It is open 24 hours a day, five days a week.

The primary trading centers are in London, Paris, New York, Tokyo, Zurich, Frankfurt, Sydney, and Singapore.

All levels of traders, from central banks to speculators, use Forex to trade currencies.

Forex exists as an intermediary market between buyers and sellers to ease trading and investments and creates an affluent marketplace for traders.

A Brief History of Forex Trading

Before Forex there was the Bretton Woods System.

The Bretton Woods System was created at the end of World War 2 to help European economies recover after the financial burdens of war.

The Bretton Woods System pegged most other nations currencies against the price of Gold.

U.S President Richard Nixon and his administration abolished the Bretton Woods System in 1971 and introduced the Smithsonian Agreement.

The Smithsonian agreement adjusted fixed exchange rates so that the U.S dollar was no longer backed by gold.

This created a free-floating currency - known as fiat currency - within a decade later all nations done the same.

Forex is the over-the-counter exchanges of international fiat currencies through banks, exchanges, and market makers.

The benefits of Forex Trading

- Market Liquidity and Volatility

Forex trades over $4 trillion liquid assets a day.

Volatility in the Forex market enables trader's to take advantage of exchange rate fluctuations.

- Market Hours

Forex trading operates 24 hours a day, five days a week. The greatest liquidity occurs when operational hours in multiple time zones overlap.

- Low Cost Trading

The cost of trading on Forex is the spread - The difference between the bid and ask price - this is their commission fee for using their services. Spreads on Forex tend to be much smaller than other securities such as stocks.

- Margin-Based

OTC Forex brokers offer margin-based trading, meaning you can leverage your position in order to trade more than you would technically be able to.

- Buy / Sell Regardless of Market Direction

Regardless of the direction the market is moving you can profit either way. If the price is falling you can sell a currency pair to net a profit - this is called a short sale or short - and if the price is rising you can buy the currency pair - this is called a long sale or long.

The Risks of Forex Trading

- Never risk more than you can afford to lose

Only trade using your risk capital - an amount that you're willing to lose - as Forex trading is not without risk and if you're not smart you could lose more than your initial deposit.

- Greater volatility also means greater risk

Forex prices fluctuate constantly. If you do not have a sound risk management plan in place - i.e stop losses - a currencies price could breakout in the opposite direction to your long and/or short positions, and you may end up losing more than you initially planned for.

- Leveraged trading carries a high level of risk

Understand how much you're leveraging and what your margin is. Your broker could shut you out - this is called a Margin Close Out - if your margin falls below a certain percentage of your equity. They do this to ensure that you do not lose more than what is already in your account. Always use a stop loss to prevent this from happening.

- Trading more than one market at a time is risky

You can trade more than one currency pair at a time - this can be risky - if all of your open positions start to fall your open margin will also fall very quickly and you could find yourself closed out or even worse, in debt.

- You may lose more than your initial deposit

It is possible to end up with negative equity when trading Forex - a debt owed to your broker - your broker will try to liquidate your positions before this happens but it may still happen due to the high volatility or potential tech problems incurred when day trading. I recommend always using a stop loss to prevent this from happening.

Now you know what Forex is

In the next part of this How to Forex series you will learn how to use Forex Trading Platforms

- What a trading platform is

- What a Brokerage is

- How to open a Demo account

- How to open a Live account

I will try add each part of this series within 24 hours of one another

Thank you for reading this article

This article is exclusive to Steemit

It has been provided to you by @senseiteekay - An aspiring Anarcho-Capitalist

All learning resources and references for each part of this series will be linked below

If you would like to donate towards my work you can do so using the button below

Disclaimer:

The contents herein these articles are not investment advice. Follow this guide of your own accord. If you do choose to follow these guides do so at your own risk. I am not a qualified professional. I am self taught and provide these guides as a guide only and not as a step-by-step rule to make money.

The Forex market carries many risks and anyone who decides to trade on Forex should know these risks before opening an account. I advise you to fully read each part of my series and to also do further research if there's anything you do not understand herein these guides.

Please be safe when trading.

Learning Resources & References:

http://www.investinganswers.com/financial-dictionary/forex/foreign-exchange-forex-699

https://www.oanda.com/forex-trading/learn/intro-to-currency-trading/benefits/trading

https://en.wikipedia.org/wiki/Foreign_exchange_market

https://www.oanda.com/forex-trading/learn/intro-to-currency-trading/currency-market/

https://www.oanda.com/forex-trading/learn/intro-to-currency-trading/currency-market/evolution