What's the opportunity cost of buying kids toys instead of investing for their future?

Let me start by saying my nephew is a smart and mature 10 years old. Last year i sat him down after giving him his first ounce of silver and attempted to explain the value of precious metals. surprisingly he took to this train of thought very well and was very open to it.

I started out by giving him some silver; with a puzzled look on his face he turned to me and asked 'what does it do?', it holds value i said with a cheeky smile on my face. i likened his newly obtained metal to valuable pirates treasure and started asking him questions about the last couple of presents that i had got for him for Christmas and for his birthday. He struggled to name the last couple of presents and once i reminded him of them and asked where they are now and how often he uses them he; he conceded that they are in the back room and are not being used.

I reminded him of earlier presents which are also not in use anymore and explained the value of these toys is limited and that it might be fun for a few weeks but by the time the next year rolls around he has moved on to other things of interest.

I continued to explain that his silver will not do anything but look pretty and retain some value.. when he is older they will have 'X' value; and he can use this to buy something meaningful. His eyes shot opened and excitedly he asked 'A Car?'.. yes i said; you can definitely put it towards a car, a house, a boat what ever you like.. the thing is, this is like money but you won't accidentally spend it on lollies and it may get a lot more valuable over time.

Sold!. in his mind he was getting a car...; i felt bad, so i reminded him that he will need a lot of these silver coins to buy a car and that if he likes i would buy him silver and gold for his birthday and Christmas instead of toys; i reminded him that on his birthday and Christmas he has many toys from all his other family and that 1 less toy would not be a big loss.

From that point on i have been buying him Silver, not sure if he considers me the boring uncle; but one day i think he will fully appreciate what i have done for him and in the mean time the cost of 1 less present is not a deal breaker.

Also with the economy in the state it is i think holding a little bit of gold and silver is a good idea.

His Birthday present this year

This time i opt'd to get him some pirate themed coins which i think he will enjoy for their rustic appearance. There are 2 coins and each is 2 ounce of .999 fine Silver. The face of 1 is the Kraken and the other is a pioneer/pirate the back of each coin is a skull and cross bones with the text 'No Prey, No Pay'.

What if someone bought me Gold or Silver when i was growing up?

Interested in what might have been if my uncle has invested my presents in gold for my life looked back at historic gold and silver charts to derive the price of metals and through inflation adjusted figures i estimated what value i might have amassed over a 34 year time-span. my uncle does not buy me presents any more but i was on a roll so i just collected all figures and i will display them in a table below.

How i came to these numbers

i used a Conservative value of $50 for a present in 2016 which adjusting for CPI inflation worked out to about $20 in 1982; i then derived an average value based on the time-span and these number as the extremes. The resulting value was multiplied by 2 to represent birthday and Christmas for the given year.

I calculated the price of metals for each year in June/July and used that figure to derive the amount of ounces of precious metals for that year.

Results

| Year | Currency Spent | Price of Gold | Ounces of Gold | Gold Sum | Sum Gold Worth | Price of Silver | Oz Silver | Silver Sum | Sum Silver Worth |

|---|---|---|---|---|---|---|---|---|---|

| 1982 | $40.00 | $296.00 | 0.14 | 0.14 | $40.00 | $6.08 | 6.58 | 6.58 | $40.00 |

| 1983 | $41.82 | $403.00 | 0.10 | 0.24 | $96.28 | $11.64 | 3.59 | 10.17 | $118.40 |

| 1984 | $43.64 | $350.00 | 0.12 | 0.36 | $127.25 | $8.07 | 5.41 | 15.58 | $125.72 |

| 1985 | $45.45 | $310.00 | 0.15 | 0.51 | $158.16 | $6.04 | 7.53 | 23.10 | $139.55 |

| 1986 | $47.27 | $339.00 | 0.14 | 0.65 | $220.23 | $5.06 | 9.34 | 32.45 | $164.18 |

| 1987 | $49.09 | $452.00 | 0.11 | 0.76 | $342.73 | $7.63 | 6.43 | 38.88 | $296.66 |

| 1988 | $50.91 | $443.00 | 0.11 | 0.87 | $386.82 | $6.71 | 7.59 | 46.47 | $311.80 |

| 1989 | $52.73 | $374.00 | 0.14 | 1.01 | $379.30 | $5.23 | 10.08 | 56.55 | $295.75 |

| 1990 | $54.55 | $360.00 | 0.15 | 1.17 | $419.64 | $4.83 | 11.29 | 67.84 | $327.68 |

| 1991 | $56.36 | $367.00 | 0.15 | 1.32 | $484.17 | $4.34 | 12.99 | 80.83 | $350.80 |

| 1992 | $58.18 | $339.00 | 0.17 | 1.49 | $505.41 | $3.95 | 14.73 | 95.56 | $377.46 |

| 1993 | $60.00 | $379.00 | 0.16 | 1.65 | $625.05 | $4.55 | 13.19 | 108.75 | $494.79 |

| 1994 | $61.82 | $383.00 | 0.16 | 1.81 | $693.46 | $5.32 | 11.62 | 120.37 | $640.35 |

| 1995 | $63.64 | $389.00 | 0.16 | 1.97 | $767.96 | $5.12 | 12.43 | 132.79 | $679.91 |

| 1996 | $65.45 | $385.00 | 0.17 | 2.14 | $825.52 | $5.11 | 12.81 | 145.60 | $744.04 |

| 1997 | $67.27 | $344.00 | 0.20 | 2.34 | $804.88 | $4.73 | 14.22 | 159.83 | $755.98 |

| 1998 | $69.09 | $293.00 | 0.24 | 2.58 | $754.64 | $5.36 | 12.89 | 172.72 | $925.76 |

| 1999 | $70.91 | $258.00 | 0.27 | 2.85 | $735.41 | $5.02 | 14.13 | 186.84 | $937.95 |

| 2000 | $72.73 | $282.00 | 0.26 | 3.11 | $876.54 | $4.98 | 14.60 | 201.45 | $1,003.20 |

| 2001 | $74.55 | $272.00 | 0.27 | 3.38 | $920.01 | $4.38 | 17.02 | 218.47 | $956.88 |

| 2002 | $76.36 | $326.00 | 0.23 | 3.62 | $1,179.02 | $5.10 | 14.97 | 233.44 | $1,190.54 |

| 2003 | $78.18 | $347.00 | 0.23 | 3.84 | $1,333.15 | $4.50 | 17.37 | 250.81 | $1,128.66 |

| 2004 | $80.00 | $391.00 | 0.20 | 4.05 | $1,582.19 | $5.82 | 13.75 | 264.56 | $1,539.73 |

| 2005 | $81.82 | $419.00 | 0.20 | 4.24 | $1,777.31 | $7.33 | 11.16 | 275.72 | $2,021.03 |

| 2006 | $83.64 | $583.00 | 0.14 | 4.39 | $2,556.60 | $12.26 | 6.82 | 282.54 | $3,463.97 |

| 2007 | $85.45 | $655.00 | 0.13 | 4.52 | $2,957.80 | $13.11 | 6.52 | 289.06 | $3,789.58 |

| 2008 | $87.27 | $891.00 | 0.10 | 4.61 | $4,110.78 | $18.09 | 4.82 | 293.88 | $5,316.37 |

| 2009 | $89.09 | $961.00 | 0.09 | 4.71 | $4,522.83 | $15.94 | 5.59 | 299.47 | $4,773.61 |

| 2010 | $90.91 | $1,242.00 | 0.07 | 4.78 | $5,936.23 | $18.59 | 4.89 | 304.36 | $5,658.13 |

| 2011 | $92.73 | $1,542.00 | 0.06 | 4.84 | $7,462.83 | $37.42 | 2.48 | 306.84 | $11,482.03 |

| 2012 | $94.55 | $1,621.00 | 0.06 | 4.90 | $7,939.71 | $28.24 | 3.35 | 310.19 | $8,759.77 |

| 2013 | $96.36 | $1,411.00 | 0.07 | 4.97 | $7,007.49 | $22.72 | 4.24 | 314.43 | $7,143.88 |

| 2014 | $98.18 | $1,314.00 | 0.07 | 5.04 | $6,623.93 | $20.65 | 4.75 | 319.19 | $6,591.19 |

| 2015 | $100.00 | $1,172.00 | 0.09 | 5.13 | $6,008.11 | $15.73 | 6.36 | 325.54 | $5,120.79 |

| 2016 | $102.00 | $1,244.00 | 0.08 | 5.21 | $6,479.20 | $16.43 | 6.21 | 331.75 | $5,450.67 |

| Total Fiat: | $2,482.00 | Total Ounces Gold: | 5.21 | Total Gold Worth : | $6,479.20 | Total Ounces Silver: | 331.75 | Total Silver Worth: | $5,450.67 |

Conclusion

Interestingly if i cut the calculations off in the year 1999 at age 17 the fiat amount is actually higher than both gold and silver; with Fiat coming out on top and gold in last place. Although in saying that gold and silver are inherently harder to spend than fiat so the likelihood of their value actual standing the test of time would be a lot higher than fiat handed over in a card.

Figures from 1982 - 1999 based on inflation adjusted $100 (2016) per year

| Total Fiat | Total Gold | Total Gold Worth | Total Silver | Total Silver Worth |

|---|---|---|---|---|

| $998.18 | 2.85 | $735.41 | 186.84 | $937.95 |

Figures from 1982 - 2016 based on inflation adjusted $100 (2016) per year

| Total Fiat | Total Gold | Total Gold Worth | Total Silver | Total Silver Worth |

|---|---|---|---|---|

| $2,482.00 | 5.21 | $6,479.20 | 331.75 | $5,450.67 |

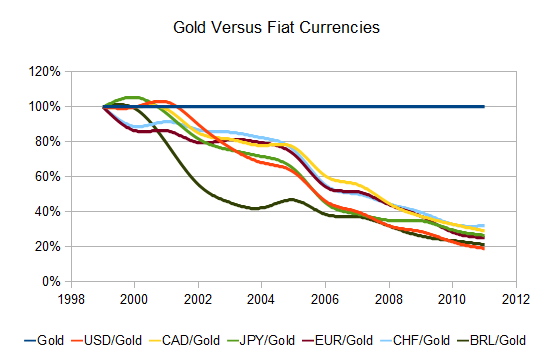

The figures above shows that the state of the economy makes a large difference in profitability of your investment with the last 16 years showing massive growth in both the gold and silver price based on uncertainty in financial institutions and markets. with Both Gold and Silver values being worth more than twice as much as the value of the fiat currency used to purchase it.

Although what ever the case may be i stand by my decision to purchase precious metals for him instead of toys as at least it will be useful for him in the future no matter the retained value in comparison to the value expended to purchase the precious metals initially. one thing is for sure the resale value of the metals he is collecting will far out weight the value of 10 more years of toys.

I also plan to introduce him to bitcoin and other digital currencies in a few more years and his collection of precious metals will be building a solid foundation for him to see the value of digital gold.