1. Project Introduction

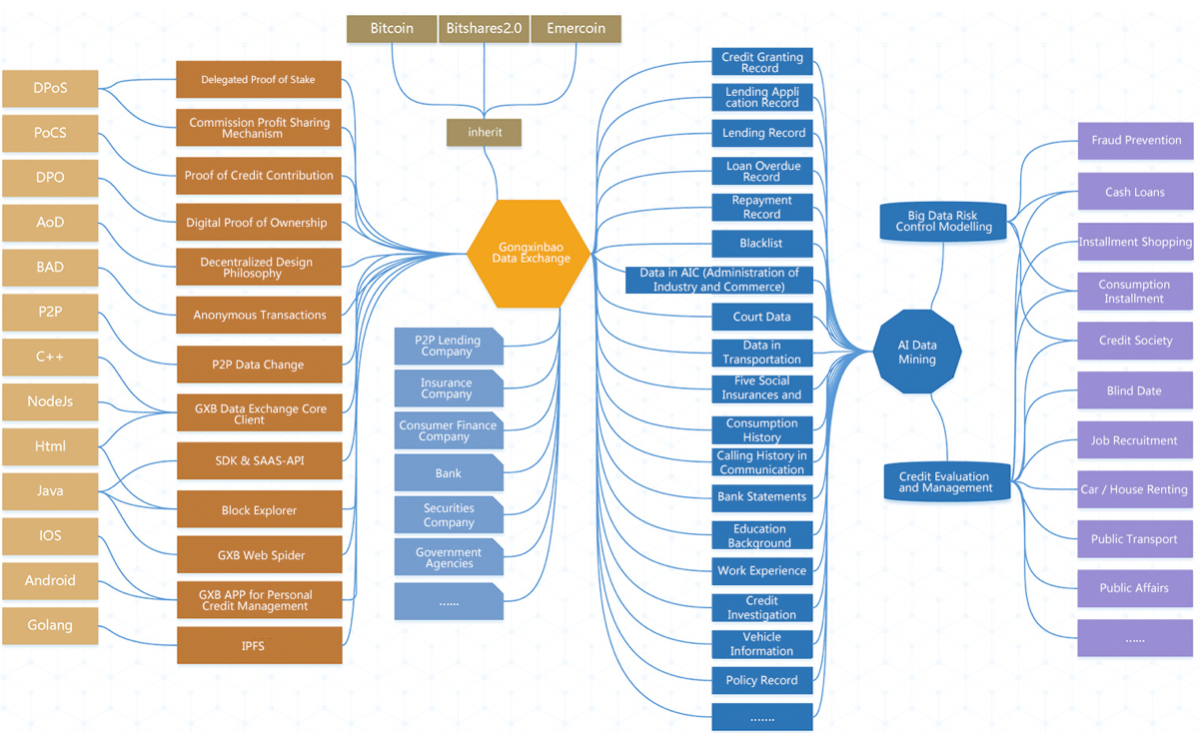

Gongxinbao (GXB) is a blockchain-based decentralized data exchange designed to set up a bridge between data sources released on different platforms and realize peer-to-peer data trading and sharing between all kinds of organizations or agencies.

An ideal data exchange shall enable both parties to a transaction store, transfer and exchange data with minimum risks and costs. We have redefined a new product named GXB, which is built upon the idea of decentralization and blockchain technology, to bring about the ideal data exchange. In the first place, GXB Data Exchange breaks the deadlock to get rid of data precipitation existing in traditional data exchanges. No any third party other than the transacting parties is able to access the data. In the meantime, in order to safeguard the identity privacy, both parties are kept anonymous by GXB. In addition, GXB enables the equal exchange between enterprises with a wide gap in their data volume, facilitates authentication of digital assets ownership and effectively curbs data fabrication in data exchange.

GXB Data Exchange, a universal data exchange platform and an alliance chain based on the blockchain (public chain) technology, is applicable to data exchange in all walks of life. Its typical customers range from internet financial enterprises to government organizations, banks and insurance companies with data exchange demands (“Merchants”). In order to better demonstrate its applications and more promptly access to the market, we first opt to set P2P lending, automobile finance, consumer finance and banks as the target group and the data generated by these organizations and agencies on performance of financial agreements as the prime assets for data exchange.

2. Industry Background

2.1 Flourishing Development of Internet Finance

Economically speaking, investment, consumption and export are often compared to three carriages spurring the GDP growth. While in contrast to the current decline in investment growth rate and insufficient exporting impetus, consumption grows rapidly, leading to a new round of economic development.

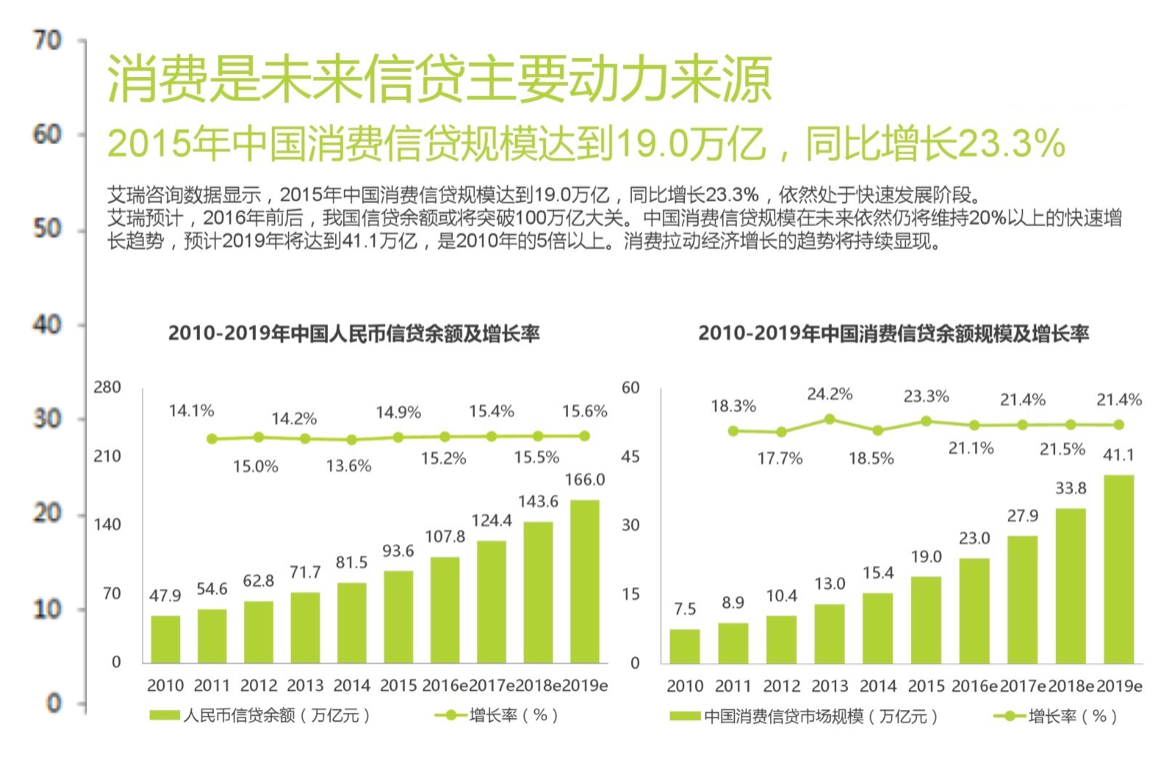

As indicated by relevant data released by iResearch, China’s consumer credit scale reached RMB 13 trillion in 2013, RMB 15.4 trillion in 2014, RMB 19 trillion in 2015, and is estimated to climb up to RMB 41 trillion in 2019. In future, the importance of consumption will be further enhanced, and its growth rate is expected to remain robust in the next few years.

The continuous growth of consumption’s contribution to economic growth means that, following the rapid industrial development, the economic growth are more reflected in resident welfare and achievement sharing. It also indicates that consumption will hold greater significance in the future. The blue ocean has formed.

In Q1 2016, the People's Bank of China and China Banking Regulatory Commission jointly issued the Guiding Opinions on Enhancing Financial Support to New Consumption Sectors, which put forward detailed financial support policies and measures for new consumption sectors to enhance financial support to the key fields. Meanwhile, ban on the access to the consumer finance market was to be lifted as determined at the executive meeting of the State Council on June 10, 2016. The pilot programs carried out in the designated consumer finance companies from the original 16 cities were to be expanded to the whole country so as to boost the impetus of consumption on economic growth, propel the development of consumer finance, release the consumption potential and facilitate the consumption upgrade. The frequent policy guidance and highlight on the development of consumer finance established the foundation for the status of consumer finance.

With 8 non-government credit investigation agencies getting qualified pursuant to the Notice on Ascertaining Preparation for Personal Credit Investigation, China’s credit investigation system has officially set sail. With the support of state policies and gradual perfection of the credit investigation system, the ban on consumer finance has been lifted and consumer finance has expanded to the whole country. It is expected to motivate the self-transformation of the banking industry and the emergence of internet finance. The consumer finance market has ushered in a huge development opportunity.

2.2 Development Potential of Personal Credit Investigation Industry

As credit investigation is a latecomer in China, some sectors still remain uncovered under the credit system of the People's Bank of China. In China, the total number of people trackable with transaction records and covered by credit investigation system is around 300 million, mainly those with mature and stable financial capacity. While the other 500 million people covered by the credit investigation system of the People's Bank of China only have basic information. This is a blank market for credit investigation. Plus the groups not covered by the People's Bank of China, there is great development potential in China’s credit investigation market in future.

(Source Data from the People's Bank of China)

(Source Data from the People's Bank of China)

The core of the finance industry is risk pricing. As urged by the internet finance, the credit investigation industry, just getting on track since 2013, is put in the teeth of the storm and has become the target of parties wrestling with each other for profits. Some credit investigation and data companies would directly buy data from the black market, or even hire hackers to steal data. One such company was evaluated as billions of RMB. Some companies are eager to cash their data. They hire agents to promote their credit investigation reports from place to place, and their annual turnovers are up to hundreds of millions. “Middle man” for such kind of registered transaction have emerged, who are publicly selling the registered credit investigation reports made by the credit investigation companies. Currently, there are up to tens of thousands of middle men selling data, and the price of the data resold each time is up to tens of thousands or even to millions. “The underground black market has already grown into a trillion-worth market.”, said an insider.

The sensitive and core industry is experiencing a savage age.

3. Introduction to GXB’s Operator

GXB is developed, maintained and operated by Hangzhou Credit Data Technology Co., Ltd. (杭州存信数据科技有限公司)

The Company was established in July 2016; its core members are like-minded practitioners in software development, internet finance and blockchain, who come from home and abroad and have been working together closely for many years.

Hangzhou Credit Data Technology Co., Ltd. has accumulated years of experience in blockchain development. The Company boasts a profound background of internet finance and a top web crawler technical team in China. It is dedicated to development of the leading-edge Fin-Tech, blockchain, big data, IPFS and other technologies, with an aim to offer top-quality integrated solutions for clients by combining with the current mainstream business models.

4. The Origin of GXB Project

The rapid development of internet finance, personal credit investigation and personal information leakage became the center of public concerns in 2016. As the nature of finance is risk pricing, and there is no unified sharing and trading of data on performance of financial agreements in the internet finance industry, risk control of the entire industry remains at a very low level and the issue of multi-end loan becomes prominent. On the other hand, due to data “caching and precipitation” in traditional data exchanges, enterprises cannot afford to share and trade essential data on performance of financial agreements. All the above has made us aware that various problems troubling today’s industry can only be solved by virtue of the blockchain technology. It is under such a background that the GXB project has gradually taken its shape on the basis of repeated adjustments in technical and market aspects as well as the development strategy.

GXB decentralized Data Exchange Project has been included into the Project Library of the Ministry of Science and Technology of the People's Republic of China.

5. The Operational Status of GXB

The blockchain-based GXB Decentralized Data Exchange and its components are as follows:

- • Core product: decentralized data exchange

- • Data exchange component 1: authorized data crawler product

- • Data exchange component 2: KYC ( Know Your Customer) system

5.1.1 Data Exchange Component 1: Authorized Data Crawler Product

Data crawler is a Fin-Tech product developed to capture user’s data with user’s authorization. It covers multidimensional data on greater finance, greater e-commerce, greater social networking and individual identities, and provides quality service to supply basic credit data for banks, consumer finance, P2P lending, automobile finance and other companies. In future, data obtained through crawlers will be fed into GXB Data Exchange as its own data source.

The data crawler product was launched in October 2016. So far, we have 37 contracted internet finance enterprises and 89 contracted petty-loan companies. Over millions of data entries on loan borrowers are captured every day. These business customers have become the first customers of “GXB Data Exchange”, which are entitled to grab a share in proceeds arising from data transaction.

5.1.2 Data Exchange Component 2: KYC System:

GXB’s KYC system is designed to recognize and validate user’s identity by comparing the mug shot taken by a camera with the data held by the First Research Institute of the Ministry of Public Security of PRC (no need to upload ID card pictures) , and thus to realize truly effective identity verification. It is best applied to anti-money laundering and anti-fraud, geared to customers engaged in internet finance, banking, Bitcoin Exchange and insurance, who are highly dependent on the KYC system.

The KYC system was launched in February 2017. Now, we are working on its integration with the customers’ systems.

6. Partial List of Our Client

7. Team Introduction

8. Why Choose GXB to Build the Data Exchange?

8.1 Must Have Experience in Big Data Directory System Modeling

GXB deals with data exchange, so it needs to establish multiple data structure standards and directory systems, which is quite demanding on practitioner’s experience in the field of data directory system modeling. As GXB’s founding team has participated in the construction of many directory systems and data exchange systems for government as well as modeling and computation of internet big data risk control system, we have accumulated abundant hands-on experience in this field.

8.2 Must Have Experience in Internet Finance Industry

Many of us in the GXB team have been working on this since the first year of internet finance; we have a deep understanding and rich practical experience in the application and development of big data risk control, anti-fraud, credit rating in the internet finance industry, and we also know well the core issues leading to a low level of risk control in internet finance industry.

8.3 Have Good Relationship with Bitcoin Exchange

Our team has established a good relationship with domestic and overseas Bitcoin Exchanges and Altcoin Exchanges, which has laid a solid foundation for the debut and trading of “GX share” in the future.

8.4 GXB Is an Impartial Third Party

As internet finance enterprises are dedicated to such business as P2P lending and installment consumption, they were born to hold a position. They will not win the trust of other internet finance enterprises (competitors) if they branch out to shared data exchange. As a result, the entire data exchange market will not get anywhere due to the lack of vitality.

9. Product Architecture of GXB Data Exchange

10. GXB Project Introduction Video

优酷:http://player.youku.com/player.php/sid/XMjUzNDc4MDExMg==/v.swf

11. Product White Paper

Please refer to GXB Decentralized Data Exchange White Paper.

Download link: https://ico.gxb.io/download/GXB_Blockchain_White_Paper_v1.2_EN.pdf

12. Screenshot of Product DEMO

Note: The above screenshots are captured from product demo, and the specific style (fonts, color, icons and layout) is subject to changes before its official release.

13. GXB Development Plan (Roadmap of GXB Data Exchange)

13.1 Phase I: Build the Authorized Data Crawler Product (Completed)

The mission of phase I is to build a network crawler product to attract more clients from the internet finance enterprises in a free and fast way and incorporate those business clients into the list of “GXB Data Exchange Alliance Members” to share the profits made from data exchange. Development of crawler was completed on October 8, 2016. Now, the GXB’s crawler team is working on more crawler dimensions and new crawlers are brought online every day.

13.2 Phase II A: Build the Blockchain-based Decentralized Data Exchange (In Progress)

GXB blockchain development team was founded in November 2016 and now it has set about for code development. The first version is expected to complete in June 2017 and the stable version be released before September.

13.3 Phase II B: Activate Exchange Operation and Incorporated with Internet Finance Data

Over more than half a year since the development of GXB Data Exchange, more internet finance clients are solicited through the free and precise crawler product. They will be automatically added to the list of data exchange alliance. By the end of 2017, we plan to develop 500 business clients, covering 200 million individual users in the P2P lending and consumer finance sectors.

13.4 Phase III A: R&D of GXB APP for Individuals (December 2017 – February 2018)

GXB APP for Individuals: is a powerful tool designed for the public to manage their own credit data. The credit management function is enabled by completing the four elements and face recognition and authentication. Sensitive data on individual privacy involved in GXB Data Exchange are subject to personal authorization through the APP before exchanging takes place(alternatively by SMS for non app users), and the confirmation messages are logged into the blockchain.

13.5 Phase III B: Build Alliance and Cooperation with the Internet Finance Associations (September 2017 – Long Term)

Continue to expand the business client base in the internet finance industry and cooperate with the internet finance associations. GXB will build independent data exchange alliance for the internet finance associations from across the country to enable the sharing of data on performance of financial agreements between the members within the associations. At present, there are over 30,000 P2P lending, consumer deposit and offline petty-loan companies and more than 100 internet finance associations and alliances.

13.6 Phase IV A: Attract Other Related Governmental Departments, Enterprises (December 2017 – Long Term)

GXB Data Exchange is applicable not only to data exchange and trading between lending and consumer finance enterprises, but also to data exchange between the enterprises of all industries and governments. In the beginning of November 2016, GXB was acknowledged by leaders of Zhejiang Province Big Data Center, who expressed their wish for GXB to accelerate data exchange R&D and to put data exchange modules of relevant government organs in GXB’s shared data exchange, or to jointly operate a private alliance chain specifically managed for government.

13.7 Phase IV B: Expand the Base of Individual Users (February 2018 – Long Term)

GXB APP for individuals will be applicable to a wide range of scenarios and we will advance the expansion of C side clients at all strength.

13.8 Phase V: Expand Overseas Market for GXB Data Exchange (November 2018 – Long Term)

The GXB Data Exchange model is featured with strong radiation and shall be applicable to the same scenarios in foreign countries. According to the reports of the renowned consulting company IDC and Open Evidence, by 2020, the volume of the data exchange market of the entire Europe will be up to €111 billion (download link of the report: https://drive.google.com/file/d/0B5Co3wBffnzhUTBQUklCS0VoRTg/view). Only a model like GXB’s decentralized data exchange will be accepted by foreign clients, as they share the same concerns over data exchange as domestic clients.

14. Objectives of ICO

14.1 Development of the Data Exchange

GXB Data Exchange is a brand new blockchain developed from the underlying layer on the basis of analysis on the advantages and merits of the existing blockchain. It is designed to solve problems existing in data exchange in the real world, e.g. data fabrication, data interception by exchange brokers, credit data island, non-exchange of data between enterprises with a wide gap in data volume, poor data updatedness, unprotected user privacy, etc.

14.2 Operation of the Data Exchange

The developer of GXB project – Hangzhou Credit Data Technology Co., Ltd. —is the first company in China to combine the study of blockchain and personal credit investigation. As a reputable company in the industry, we are frequently invited to well-known industry forums, summits and presentations home and abroad, and declare and review the achievements of relevant teams. The team invests its best human resources, material resources and financial resources in operating the knockout product – shared data exchange, in order to gain the maximum social effects, market effects and economic effects in the shortest period of time.

14.3 Legal Affairs and Emergency Response

To handle relevant legal affairs and emergencies.

14.4 Community Participation

Being the first precise business client + touchdown commercial application + community pattern ICO blockchain project in China, the Company needs to seek financial support not only from the investors, but also from the entire community. The reason why GXB Data Exchange’s ICO is open to the whole world, in addition to the convenience to attract global capital, more importantly lies in its strong radiation to fit into all data exchange scenarios in the world. Therefore, the importance of community participation is much more highlighted.

15. ICO Rules

15.1 Glossary

GXCoin(公信币): refers to the system token used at GXB Decentralized Data Exchange for settling transactions and calculating commissions. It permanently anchors with the RMB at 1:1, and the operator of GXB (Hangzhou Cunxin Data Technology Co., Ltd.) serves as the acceptor.

GXShares(公信股): issued by GXB Decentralized Data Exchange as the object of ICO.

15.2 Commission Dividend Distribution Rules

The proposed GXShares to be issued is 100 million (100,000,000), carrying the right to enjoy 10% of the commissions generated by GXB Data Exchange (please be kindly noted, it is sharing of commission instead of profit. Commissions will be shared on the basis of transactions, regardless of the profitability of the Company). Our plan is to distribute dividends derived from commissions once every 6 months in the first year since the launch of GXB Data Exchange, once every 3 months in the second year and once every month in the third year. The dividends (GXCoins) shall be distributed directly into the respective account as per the shareholding ratio registered within the system of the exchange; GXCoins can be cashed via GXB’s gateways.

15.3 ICO Plan

Total volume of GXShares (公信股): 100,000,000 Shares

Total volume of private equity: 10% (10,000,000 shares) – issued to the first private equity investors (private placement was completed on December 12, 2016, which raised 500 BTCs from 250 investors in total, each limited to maximum 2 BTCS.)

Total volume for ICO: (39%) 39,000,000 shares

Shares held by GXB Foundation: 51% (51,000,000 shares) is held by the foundation as restricted shares and shall be circulated by year; maximally 6% in the first year and shall be used for marketing programs (consultant appointment, talent recruiting, community construction, ICO referee incentive and ICO propaganda and promotions etc.); maximally 5% for every year after that. The dividends (GXCoins) generated during such period shall be owned by the foundation. The GXCoins account held by the foundation shall be made known to the public and the plans and purposes for the use of funds shall be announced on its official website and open to social supervision.

15.4 ICO Fund-raising Procedure

15.4.1 Date and Time of ICO

As scheduled, GXB’s ICO will be officially commenced at 8:00 pm March 15, 2017 (Beijing time) and ended at 8:00 pm April 14, 2017, lasting for one month, or it will be ended immediately when the targeted amount of BTC had successfully raised through the ICO claim process.

We proudly announce today, as of this announcement, GXB had been successfully raised the minimum 1000BTC as required through ICO. GXB team believes that the team should put more efforts to other prior works with the preliminary success in ICO, which including the closed development to be initiated immediately, disposal of more important partner relationships, as well as, including but not limited to, establishment of new subsidiary, invest in state-owned enterprises and so on, in order to rapidly expand the business of the data exchange. Therefore, we decided to end the ICO process in an early stage, scheduled on 20:00 March 28, 2017.

15.4.2 ICO Claim Rules

As considering the following two aspects, GXB’s team had decided to adjust the original claim rules which were aimed to raise 3,900 BTCs due to the sharp rise in BTC’s price in RMB recently:

At the very beginning when planning GXB’s ICO, BTC’s price in RMB is far below RMB8,800. The targeted 3,900 BTCs was calculated by GXB’s team according to expected scale of the business development of the company based on BTC’s price in RMB during that time. However, due to the sharp rise in BTC’s price in RMB recently, the ICO users shall shoulder more if BTC’s price in RMB remains around RMB9,000; meanwhile, what is in the first place is always the expansion and development of our own business, from the perspective of GXB’s operation mode.

However, as uncertain risk exists in BTC’s price, especially in the sensitive period recently. In addition, GXB shall implement the ICO+ policy of Yunbi that the 30-40% of the BTC raised shall be managed by Yunbi for 1 year, then, it will be up to the holder of GXShares to pay for the residual, BTC’s price in 1 year remains much less predictable. We have taken into account of many factors before making the decision on a “flexible price exchange” which could guarantee the benefits of ICO users while reducing the risks facing GXB:

The time node of the “flexible price exchange”: the closing price of BTC on Yunbi at 18:00 March 15, 20:00 March 28, 2017 (Beijing time).

Exchange ratio:

A: If the closing price of BTC by that time is below RMB 8,000, the upper limit of BTC to be raised through ICO process shall be 3,900, then, the ICO exchange ratio shall be 1BTC=10,000 GXShares;

B: If the closing price of BTC by that time is over RMB 8,000 (including RMB 8,000), the upper limit of BTC to be raised through ICO process shall be 3,455, then, the ICO exchange ratio shall be 1BTC=10,000 GXShares if we failed to raise 3,455 BTCs, while the ICO exchange ratio shall be 1BTC=11,000 GXShares if we successfully raised 3,455 BTCs.

The minimum BTC to be raised through ICO process shall be 1,000. We will announce the failure of ICO if we the BTC we raised through ICO is less than 1000. Then, the raised BTC through ICO shall be returned to the investors from the original route.

15.5 ICO Incentive Program

15.5.1 In-kind Incentive

One first prize winner, being the TOP1 in ICO investment, rewarded with one set of MAC PRO laptop worth of RMB13,888 (latest version of 2016, with Multi-Touch Bar and Touch ID);

One second prize winner, being the TOP2 in ICO investment, rewarded with one set of iPhone7S/iPhone 8 worth of RMB8,000 (specific model and price is subject to Apple’s spring release 2017);

One third prize winner, being the TOP3 in ICO investment, awarded with one set of Huawei Mate 9 worth of RMB3,399;

Seven outstanding prize winners, being the TOP4~TOP10 in ICO investment, rewarded with a JD shopping card worth of RMB 1,000;

Ten lucky prize winners, randomly drawn from all ICO participants, rewarded with a JD shopping card worthy of RMB500.

All ICO participants with 1 or more BTCs (including 1 BTC) shall receive a book compiled by Dr. Han Feng – Blockchain ~ Quantum Wealth Outlook (worth of RMB49, to be published in April 2017); overseas participants are required to provide a mailing address in China.

Note: The prize for overseas participants may be replaced with Amazon shopping card of equivalent value.

15.4.2 Referee Incentive

GXB’s ICO will be launched on the Yunbi platform. All registered users of yunbi.com will be assigned a dedicated link for GXB ICO reference. Referees will receive an incentive of GXShares equivalent to 1% of the total GXShares subscribed by the ICO investor referred through the link.

15.6 ICO Platform

GXB has established a relationship with Beijing Yunbi Technology Co., Ltd. (hereinafter referred to as “YUNBI” https://yunbi.com) and entrusts Yunbi with GXB’s ICO program, funds custody, GXShares online trading in future and other matters.

YUNBI, formerly known as Peatio Exchange, is a wholly-owned project under BitFundPE and co-funded by Li Xiaolai and Qiu Liang. YUNBI was initiated on July 1, 2013, launched on April 1, 2014 and officially renamed to YUNBI on October 8, 2014. It is built on the independently-developed Peatio Open Source Project. In addition, YUNBI is the first in the industry to provide full disclosure of its reserves, and the quantity of all digital coins and legal tenders are open and transparent.

15.7 Fund Custody

In order to safeguard the security of investors’ funds, we, as a responsible operator of GXB, decide to place BTCs raised during GXB ICO (excluding those raised by private placement) under YUNBI’s trusteeship. The custody ratio will be calculated according to the total volume of BTCs raised during ICO:

If the total volume of the BTCs raised during ICO (excluding those raised by private placement) is 1,000~2,000 (including 2,000), then, 30% of the total will be deposited at YUNBI;

If the total volume of the BTCs raised during ICO (excluding those raised by private placement) exceeds2,000, then, 40% of the total shall be deposited at YUNBI;

Withdrawal of deposited funds will be determined through voting by GXShare holders 1 year after the end of ICO. Funds shall not be withdrawn if 51% of the holders vote no, and the residual BTCs shall be returned to the users in proportion to their shareholding. Meanwhile, GXShares will be removed from YUNBI exchange and shall not be traded again.

15.8 Fund Demand and Purpose

The total basic fund demand for the development, construction, operation and promotion of GXB Decentralized Data Exchange is estimated to be around RMB10 million, largely spent on the following aspects:

Server purchase: CNY 500,000;

Development of network spider and data service: CNY 1.5 million;

Blockchain development: CNY 4.5 million;

SDK and APP development: CNY 1 million;

Distribution channel development: CNY 1million;

Propaganda and promotion: CNY 500,000;

Daily operation and initial working capital of the company: CNY 1 million.

The total above is CNY 10 million. Our maximum ICO goal is set at 3,900 BTCs to guarantee the rapid progress, grab a large market share and beef up the technical inputs and market inputs, so as to establish a trade barrier and technical barrier before competitors join in the game.

16. Expected Return

The development of consumer finance in China is still in its initial stage, however, the consumer finance industry develops rapidly with a great potential. The current economic, social and policy environments in China have created favorable conditions for the development of consumer finance industry. Its industry chain is improving. A complete consumer finance industry chain shall consist of the upstream consumption demanders, core consumer finance communities (consumer finance service platforms and regulators) as well as the downstream consumption suppliers. The basis of the core consumer finance community is the regulators (regulators, credit investigators and bad loan caretakers). However, as the regulation regime (especially the independent third-party credit investigation and rating) is missing at the current stage, the cost of risk control incurred by consumer finance service providers is high. Risk control is crucial to the development of the consumer finance service providers,because all types of consumer finance service providers must select appropriate risk control measures according to the features of their own services. The blockchain-based decentralized data exchange developed by GXB is promising in improving the risk control capability of the entire consumer finance industry.

In two years, according to the estimate that the scale of consumer credit in China will rise up to RMB 41 trillion by 2019 and considering the current one-trillion data transaction volume of the black market each year as well as GXB’s integration capacity with major institutions, banks, business side (B) merchants and client side (C) users, we expect GXB Data Exchange’s annual turnover to be beyond RMB100 billion. The commission profits, service fees of the exchange shall exceed RMB10 billion, including the 10% of the commission (i.e. RMB1 billion) to be distributed to the holders of GXShares. If calculated by a total of 100 million GXShares, the dividend per GXShare shall be RMB10 each year. Along with the enhancement of GXB’s integration capacity, the annual transaction volume of the data exchange shall pick up rapidly, thus the investors holding GXShares shall enjoy more dividend return each year.

In the near future, we hope to see that, a landlord can quickly obtain data on the potential tenant’s criminal record, drug abuse history, credit rating and other information by scanning the tenant’s GXB APP on his mobile with the tenant’s authorization and paying RMB 2 to GXB Data Exchange, and accordingly makes the rental decision. Along with the development of the society, the future must be a world where all is built on the basis of credit. This is a world only for people with good credit.

17. Commitment and Guarantee

- 1. GXB will disclose the progress made by each project team once a quarter;

- 2. GXB will disclose the operation condition each month after the GXB Data Exchange is brought online;

- 3. Following the commencement of its official operation, GXB Data Exchange will calculate and distribute dividends to the GXShare holders as per the ICO rules;

- 4. The public key address of GXB Foundation will be announced and subject to the supervision of the entire community.

18. Release Rules

- 1. Restricted shares held by GXB Foundation shall be released by year, maximally 5% in each year;

- 2. During the period when GXShares are held by the Foundation, the dividends generated from the restricted shares (GXShares) shall be owned by the Foundation.

19. Expert Remarks on Gongxinbao (GXB)

Ni Liya, Doctor in Law, bureau-level researcher at the Policy Research Office of CPC Central Committee

GXB Data Exchange organically combines the innovation of internet information technology with that of the financial integrity construction. It breaks a new ground to realize secure and efficient circulation of data and its market development prospect is bright. I wish your team success in making continuous innovation and meeting your goals step by step.

Chai Lin, Director / Procurement Specialist of the Ministry of Finance of PRC, Information Center of Communication Department of Zhejiang Province, E-Government Affairs Unit, Zhejiang provincial government

Under the current background of e-government, the construction of informationization is developed under independent systems. As a result, all the existing information systems are scattered, heterogeneous and closed, and information cannot be shared by each other. The issue of information island must be solved if we want to give play to the effectiveness of e-government. GXB’s blockchain technology and model are able to address this issue in a better way.

Han Feng, Doctor, i-Center Tutor at Tsinghua University, Secretary-General of DACA Blockchain Association

The transformation of big data into assets that could be circulated through ownership authentication is a new world of human wealth.

Li Xiaolai, the Richest Man with Bitcoins in China

Bitcoin is an irreversible invention, and the same of blockchain technology, they are quietly making a better world!

20. Q & A

- 1. Will the Data Exchange challenge the state administrative rules on credit investigation? Is it legal?

The uttermost concern of the industry over the processing of credit investigation data lies in its attribute to challenge the administrative rules on personal credit investigation, which may be vigorously repelled by the regulating authorities and lead to legal issues. Instead of caching and processing data, or providing data assessment report, GXB Data Exchange facilitates data exchange only when it’s authorized by the user himself. Therefore, it does not break the administrative rules on personal credit investigation. The blockchain-based data exchange via P2P technology puts an end to the chaos of offline black market transactions. It brings about rational and rule-keeping data sharing between alliance members and builds an equal and impartial trading and exchange platform.

- 2. What is the relationship between ICO GXShares and GXCoins or GXB?

GXShares are shares used by GXB Data Exchange for ICO, carrying the right to share 10% of the commissions generated at the Exchange. While GXCoin is the token of GXB Data Exchange, permanently anchoring with RMB at 1:1, used for transaction settlement and dividend distribution within GXB Data Exchange. For instance, when Company A (e.g. a P2P lending company) needs to inquire or purchase data, it first has to buy GXCoins with cash via the GXB interfaces, and then it’s able to buy data within the Exchange with GXCoins; while Company B as the data seller will receive GXCoins from the buyer, and then it may purchase the required data with GXCoins or cash GXCoins via the GXB interfaces. Dividends received may also be cashed in the same way by the shareholders.

- 3. Where does the profits of GXB Data Exchange come from?

Being the first blockchain-based decentralized data exchange with the authentic application scenario and real business clients, the profits of GXB Data Exchange come from the commissions of each data exchange transaction. Based on the growth of our client base, the initial estimated volume of transacted data each day following the launch shall be up to millions and the figure will increase exponentially along with the continuous growth of alliance members.

- 4. How to cash the dividends of GXShare into RMB?

GXB Data Exchange integrates the interface developed by GXB’s operator (Hangzhou Credit Data Technology Co., Ltd.), so the users may directly cash their shares into RMB or BTC via the wallet client . The Company will transfer hard cash into your account via Alipay, online banking transfer or remittance.

- 5. Is there a limit on the number of investors? What is the limit?

There is no limit on the number of investors, but the total volume for ICO is 3,900 BTCs. The ICO channel will automatically close when it has successfully raised 3,900 BTCs during the ICO.

- 6. How much could GXShare be valuated?

We cannot accurately estimate the value of GXShare; however, judging by the commercial capability of the Company and the demand of the entire market, a very good performance is expectable once the Exchange is brought online. Certainly, this requires the support of you investors and the unremitting efforts of the GXB team!

- 7. How is GXShare issued?

When GXShares are brought online at GXB Data Exchange, they will be issued to the same public key address as the investors send the BTCs in proportion to the shareholding at the time of ICO. Besides, the digital currency exchange will also offer assistance to the investors on how to receive GXShares.

- 8. Is the GXShare client for individuals the same as GXB Data Exchange client?

Yes, it is. GXB blockchain employs GXCoins as the token with constant price used for transaction settlement and dividend distribution. Its exchange rate to RMB is set at 1:1. In future, the GXCoins received by the Exchange shareholders as dividends are on the very same blockchain as those spent by alliance members. That is to say, the client for the alliance members is consistent with the individual client. Statistics of everyday transaction can be viewed on the UI interface of individual client, which guarantees the transparency of the revenue generated by GXB Data Exchange. For the alliance members, the GXB Data Exchange client is connected to its local data servers through the interface. It retrieves data from local data server to process transactions, and completes the follow-up settlement only when the transaction is being retrieved and traded. Therefore, the UI presented at the clients is consistent with the UI of the individual client.

- 9. Can individual GXShare holders make data query at the Exchange? Or can they participate in data exchange?

No, they can’t. GXB Data Exchange is an alliance chain, only the alliance members can participate in data exchange, and what the data exchange consumes is GXCoins instead of GXShares. We adopt the “whitelist” mechanism to incorporate alliance members and classify them by group. For instance, internet finance companies are only eligible for specific classified data transactions such as on individual credit history and performance of financial agreements, while their governmental counterparts are only allowed to transact within predefined groups, so as to guarantee the purity of parties to data transactions.

21. Partners and Media

Contact:

Twitter: https://twitter.com/gongxinbao

Weibo: http://weibo.com/gongxinbao

Facebook: https://www.facebook.com/gongxinbao/

Youtube: https://www.youtube.com/channel/UCioTZwhEMJK4jz7_zCVHpsA

BTT ANN: https://bitcointalk.org/index.php?topic=1813679.0

WeChat: gxbdata

ICO Website: https://ico.gxb.io/en/