For this first week of this new season, I wish to continue with the study of topics that were left pending in the last season as well as to deepen even more what I have learned.

For this reason, I have decided to start this week with an even deeper study regarding strong and weak levels, and other types of liquidity levels.

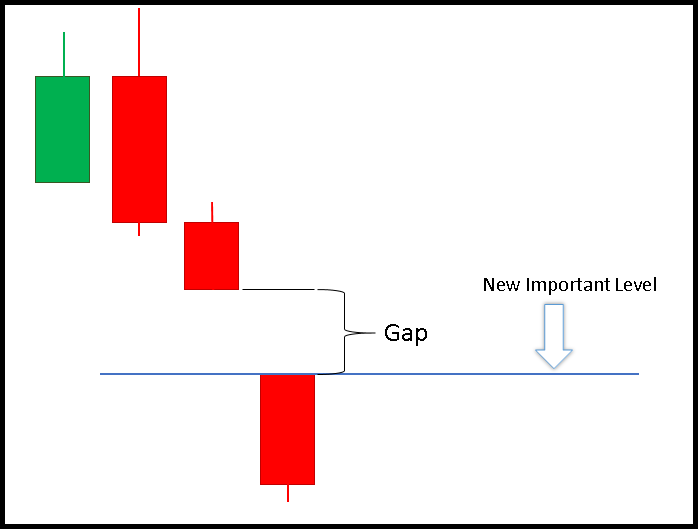

Image edited by me in Powerpoint

Strong supports and resistances.

When a level repels the price several times, we are in the presence of a strong level.

From a graphical point of view, a strong level is an imaginary horizontal line with which the price constantly interacts. In fact, the way to recognize a strong level is to observe which resistance or support makes the price bounce several times. In addition, a strong resistance can later become support or a strong support resistance.

Strong Levels Source

From the market's point of view, these levels are actually popular price zones where large amounts of pending buy or sell orders accumulate, which provide liquidity to the market.

Once the price reaches these levels, the pending orders are activated, triggering a reaction where large amounts of money move, and consequently modifying the price trend.

Weak supports and resistances.

On the other hand, a weak level refers to a type of support or resistance line that is not very reliable.

Graphically it can be visualized as a level that bounces the price on one or two maximum occasions, but then is easily broken by the price.

Weak & Strong Levels Source

From the market point of view, these levels correspond to areas where there are also pending buy or sell orders, but this time in smaller quantities and much lower volume.

For this reason, when the price touches these levels, the liquidity makes the price react in the opposite direction, however, they are quickly exhausted... For this reason, when the price passes through the same level again, as there are no more pending orders, the support and resistance are simply broken.

Supports are influenced by pending buy orders. Resistance is influenced by pending sell orders. The level of strength of these resistances and supports will depend on the amount of buy or sell orders and the volume in the market.

What is a Gap?

Image edited by me in Powerpoint

Types of Gap, and its functions.

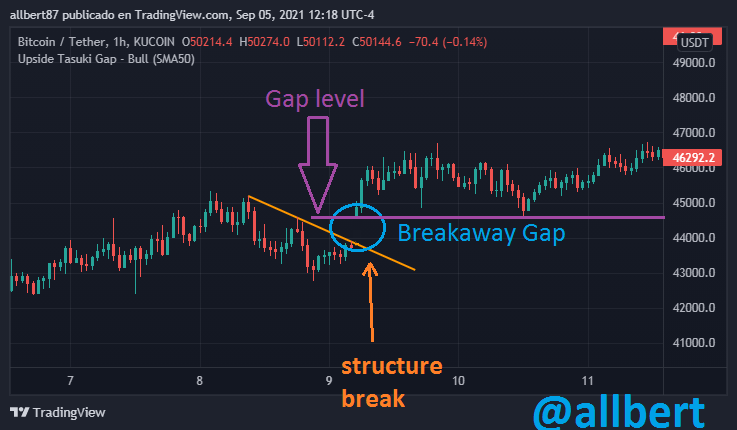

Breakaway Gap

For now, it will be the most functional for us. It is the type of gap that occurs as a breakout of a lateral movement structure or previous trend.

Image taken from Tradingview Source

It indicates the beginning of a new trend and represents a strong resistance or support level.

Runaway Gap

These are gaps that occur when the trend is still young and represent a trend continuation indicator.

Image taken from Tradingview Source

However, they are not very practical as they are difficult to identify, mainly because they are often confused with the following ones.

On the other hand, if they are correctly identified, because they are in the middle of a trending market, their level can also be considered an important resistance or support.

Exhaustion Gap

It occurs near the end of a trend indicating the last impulse. It is very difficult to identify as it is often confused with the Runaway Gap and can only be identified once the movement has passed.

Image taken from Tradingview Source

In this type of gap, the level is not very important, since the price will generally seek to fill the gap. For this reason, this gap is traded in the opposite direction, as the price is expected to return and reclaim the levels omitted in the gap.

Due to these characteristics, and for this class, we will trade with the support and resistance levels generated in the Breakaway Gap, which are the easiest to identify.

How to trade with Gap and Strong levels.

Both types of levels (Strong and Gap Levels) can be traded using a simple strategy such as the BRB, where we first look for a breakout of the support or resistance line.

Then a pullback and a restest or bounce at the claimed level is expected.

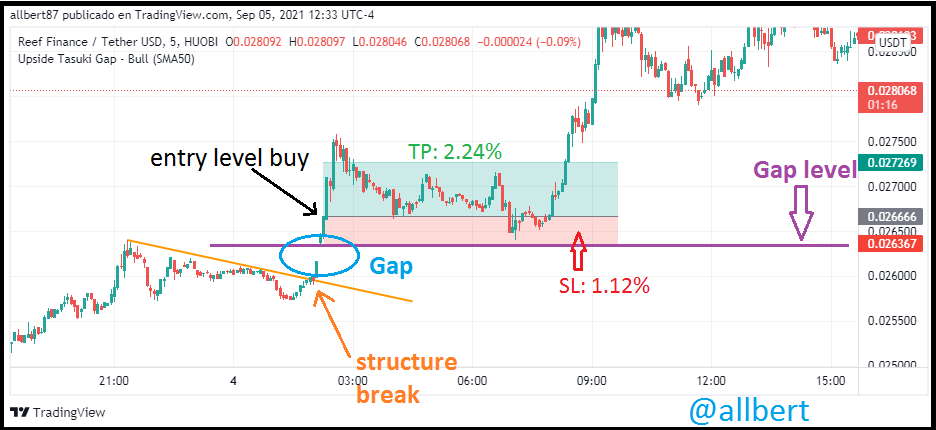

Image taken from Tradingview Source

Image taken from Tradingview Source

In the case of a breakout of a strong level, the entry (buy/sell) is established at the swing point, and a stop loss is set just at the expired support or resistance.

The take profit is set following a Risk/reward ratio = 1/1 or 1/2.

In the case of the Gap level, you can choose to make the entry at the end of the next long candle in the direction of the new trend, setting the stop loss at the gap level. This strategy can be used in case you consider yourself a risky trader.

Image taken from Tradingview Source

If you rather consider yourself cautious, you can choose to use also the BRB strategy and wait for the price to make a pullback and retest the level of the Gap. In which case the stop loss would also be placed at the Gap level and the take profit is set following the Risk/reward ratio = 1/1 or 1/2.

CONCLUSION

Although we are in the presence of a very simple strategy, if it can be mastered, very good results can be obtained in a short time. Due to the simplicity of identifying support and resistance the success rate for novice traders is high. In fact, many experienced traders still use these simple methods in their trading.

The heart and soul of this strategy are knowing how to correctly identify strong and important supports within the price chart. In this step lies most of the success rate, because if they are misidentified, it will naturally be impossible to forecast price movements accurately.

Finally, although this method works well on its own, it never hurts to accompany it with other indicators such as the MACD, RSI, or ADX which can help confirm trends.

Homework Task (Season 4/Week-1)

1- Graphically, explain the difference between Weak and Strong Levels. (Screenshots required) Explain what happens in the market for these differences to occur.

2-Explain what a Gap is. (Required Screenshots) What happens in the market to cause It.3- Explain the types of Gap (Screenshots required, it is not allowed to use the same images of the class).

4- Through a Demo account, perform the (buy/sell) through Strong Supports and resistances. Explain the procedure (Required Screenshots).

5- Through a Demo account, perform the (buy/sell) through Gaps levels. Explain the procedure (Required Screenshots).

Guidelines

- Make sure you post in the Steemit Crypto Academy community.

- Be Original!!! Refrain from copy any else posts and ideas. Be creative. The content is certainly the same, but the way of presenting it is unique.

- Your article should be at least 400 words.

- Refrain from spam/plagiarism. Plagiarism of any kind won't be tolerated.

- This task requires screenshot(s) of your own experience, add a watermark on it with your username. Also, use images from copyright-free sources and showcase the source, if any.

- This homework task will run from 00:00 September 6th to 23:59 September 11st, Time UTC. (7:59 pm hora Venezuela)

- Users having a reputation of 60 or above, and having a minimum SP of 400 (excluding any delegated-in SP) are eligible to partake in this Task. (Must not be powering it down)

- Add tag #allbert-s4week1 #cryptoacademy among the first five tags in this order. You can also use other relevant tags like your country tag. Also, tag me as @allbert in any part of your post.

- Please don’t leave your homework link on the comment section unless your post hasn’t been graded within 48 hours.

- If you have any doubts about Homework Task, feel free to join the comment section