Background :

The debt-ownership ratio calculation model helps the company to know the amount of debt and ownership used to finance its assets, in order to determine whether the financing of the company's assets tends to be debt or ownership. The debt-to-ownership ratio also reflects the shareholders' ability to cover all outstanding debts in the event of any decline in the company's commercial activity.

And this is the case for our Steemit ecosystem which always tries to reduce this Debt-Ownership ratio from becoming too high, by minimizing the amount of STEEM allocated via SBD conversions if the level of debt were to exceed 10%.

According to the payment rules of the Steemit blockchain and if the user chooses the parameter "50% SBD / 50% SP", the payment will be made in SDB and SP by default but this will only be applicable when the debt ratio- ownership will be less than 9%.

What is Debt-Ownership Ratio ?

Blockchain Steemit designed the SBD token as a factor or means to reward content creators, giving it the STEEM equivalence based on the market price.

With the exception of authors and Steem DAO (another group aiming to fund proposals) who are rewarded in SBD, other representatives like (curators, SP holders and witnesses) are rewarded in SP.

Debt ownership ratio varies with market condition, i.e. if the market is bullish, it is usually low since the value of STEEM is usually high, so the STEEM/SBD ratio is also high , which means less STEEM tokens are needed to support 1 SBD.

Conversely, if the market is bearish, the price of STEEM is also falling and the STEEM/SBD ratio decreases, which means more STEEM tokens are needed to support 1 SBD.

The Steemit blockchain system constantly prints SBDs to reward content authors. However, it has been programmed to stop printing new SBD tokens if the debt holding percentage exceeds 10% (the cap), in which case the payout is in STEEM.

Blockchain prints 100% SBD for debt ownership ratio up to 9%, from 9% to 10% the print rate starts decreasing linearly and stops completely at 10%.

The SBD print rate, in this case, would correspond to this formula: SBD print rate = 100% * (10 -debt ratio).

To better understand the above chart, we will take the example where the debt ratio is 9.5%, then SBD print rate = 100% * (10-9.5) = 50%

That is, 50% of the cash reward will be paid in SBD, the remaining 50% of the cash reward will be paid in STEEM, and the fortified reward will be in SP as usual.

Suppose debt ratio is 9.7%, then SBD impression ratio = 100% * (10-9.7) = 70%

So 30% of the cash reward will be paid in SBD, the remaining 70% of the cash reward will be paid in STEEM, and the fortified reward will be in SP as usual.

Once the debt ratio reaches 10%, there will be no SBD bonus.

The debt-to-ownership ratio is defined as the ratio of SBD market capitalization to STEEM market capitalization.

Debt-to-ownership ratio = SBD market capitalization/STEEM market capitalization.

The STEEM market capitalization takes into account the entire virtual supply, including those necessary to support SBD.

STEEM Market cap= Virtual STEEM supply * STEEM current value

Also, SBD market capitalization takes into account the total supply of SBD as well.

SBD Market cap= Total SBD supply * SBD price

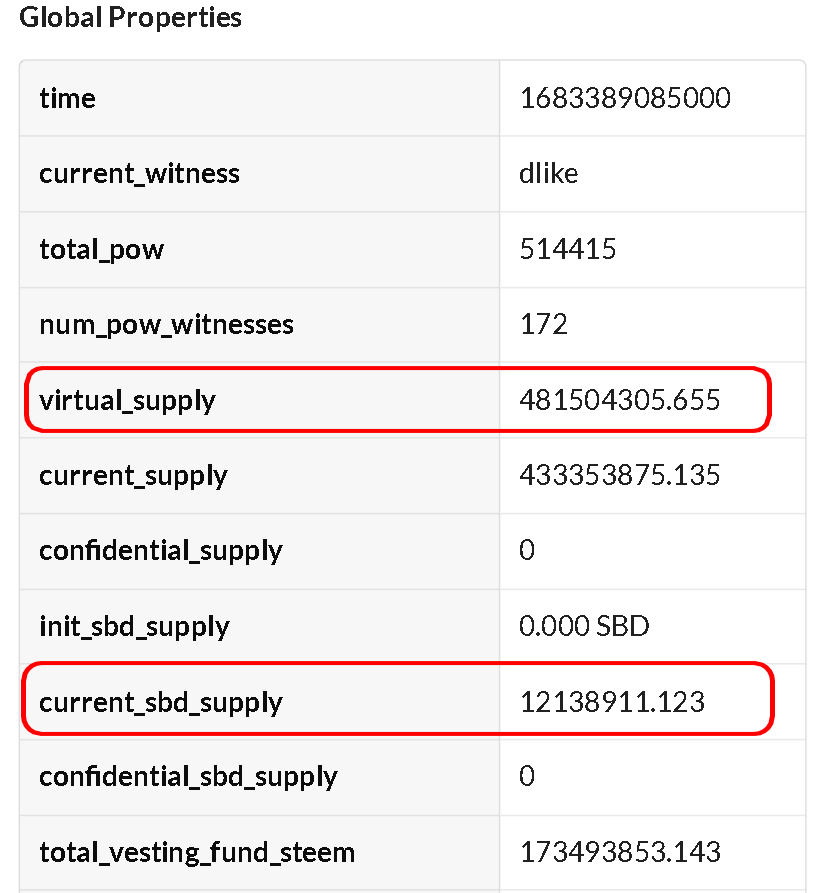

Total SBD supply and Virtual STEEM supply can be obtained from Steemdb.io.

STEEM Market cap= 481504305.655 * 0.2094 $ = 100827001.60

SBD Market cap= 12138911.123 * 2.54 $ = 30832834.25

Current Debt-to-ownership ratio = 30832834.25 / 100827001.60 =0.30

According to this calculation, the debt-to-equity ratio is now 30%, which means that the printing rate for SBD is 0%.

Thus, now 0% of the cash reward is paid in SBD and 100% is paid in STEEM. That's why you can now see author payments in a combination of STEEM + SP.

Notes :

It is seen that the debt-to-equity ratio decreases if the market cap of STEEM increases, and if it reaches the 9% threshold, Blockchain Steemit will start printing 100% SBD and the author will be paid in SBD + SP.

If the authors of the Steem Blockchain set the yield to “Power Up 100%”, it will also help to some extent, as the daily money supply will remain under control, which will affect the supply/demand ratio in favor of STEEM and STEEM. Better performance in the market. If the price of STEEM goes up, the market value will also increase and the debt ratio will go down.

Conclusion :

Since the debt ratio is over 10%, "Power Up 100%" should be encouraged even more in PoB, at least until we have a debt ratio in the comfortable zone (preferably below 9%).

I wish that this fifth post in this series helped many users to understand about debt-ownership ratio in steem blockchain in the hope that the series will continue in a future episodes.

Best Regards,

@kouba01

Cc- @steemcurator01