Hi guys

Welcome to my fifth trading post for the week. Am still with the Team-Frontline trading team which is under the leadership of professor @abdu.navi03 and @shemul21. This week, I want analyse a pair of WAVES/USDT. Let's get started.

Welcome to my fifth trading post for the week. Am still with the Team-Frontline trading team which is under the leadership of professor @abdu.navi03 and @shemul21. This week, I want analyse a pair of WAVES/USDT. Let's get started.

The name and introduction of the project token, and which exchange can be traded on, project/technical/team background, etc

The waves platform can be seen as a multi purpose blockchain platform that has multiple usecase among which include the support of smart contract and the development of DAPPs. The waves blockchain platform was developed in the year 2016 with the major aim of increasing the speed of transaction and also making the interface of the platform user friendly enough to be use by any user. The native tolen of the waves platform is known as WAVES token. It is use to carry out transaction on the platform.

Waves platform was founded by a scientist that goes with the name Alexander Ivanov he is from Ukrain. Since the development, Ivanov has put in effort to promote the token as well as the platform via a lot of interview. Presently, over 180 employees are working with the platform.

The algorithm use by the waves platform is known as the proof of stake consensus algorithm. Presently, the block reward for waves platform is 6 WAVES I.e for every successful 110,000 blocks. The image below shows the founder of the waves platform.

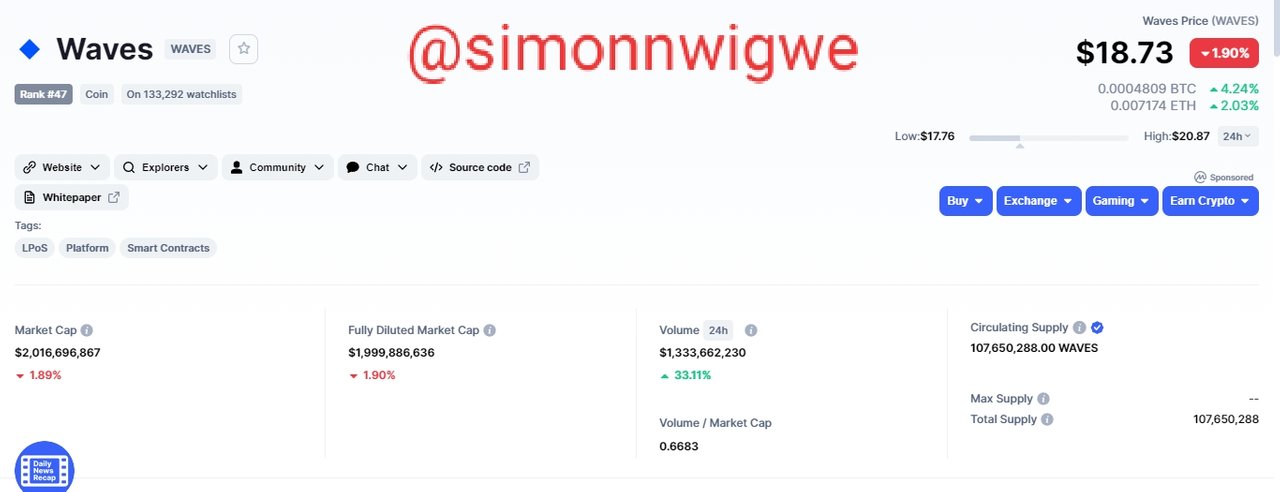

The WAVES token can be traded in any of the major exchanges such as Binance, OKX, FTX, Mandala Exchange KuCoin, FTX, Bybit, Bitfinex, Hotcoin Global etc. From coinmarketcap, information about the WAVES token as at the time of carrying this task are as follows.

| Parameter | Value |

|---|---|

| Rank | #47 |

| Price | $18.73 |

| Marketcap | $2,016,696,867 |

| Volume | $1,333,662,230 |

| Volume/Marketcap | 0.6683 |

| Circulating Supply | 107,650,288.00 WAVES |

Why am I optimistic on this token today

From the fundamental point of view, the waves platform support smart contract and also DAPP development and that has continuously made the asset to increase even till this day. Since it uses the ERC-20 standard, people tends to value the asset the more.

Technical analysis in the asset shoes that buyers have set into the market to purchase the asset at this point in time this is after a long bearish season. So the asset on this day is moving in bullish direction and that is why am optimistic about the token today.

Analysis of the Token

I will be analysing the token using the MA and RSI indicator. To remove noise, I used the Heikin Ashi chart instead of the traditional candlestick chart. I observe a cross over between the MA lines and also observe and notice RSI moving upward.

MA lines of length 5 and 20 which represent slow and fast movement are used. More also a confirmation is done using the RSI indicator. Lines above price chart signifies bearish trend and calls for sell entry, lines below price chart signifies bullish trend and calls for buy entry.

The chart below shows our MA lines below price chart and and also RSI moving upward and seen above the 50 threshold. This signifies bullish trend hence we look for an opening and then place our buy entry.

To enter the trade I looked for a suitable position where the slower MA is seen above the faster MA line and both are seen below price chart. More also, the RSI is seen above 50 threshold and also moving in an upward direction. My take profit is placed within my resistance point and the stop loss place within the support level.

The table below shows the entire details of my trade I.e entry price, stop loss and the take profit level.

| Data | Amount |

|---|---|

| Entry price | 18.7050 |

| Take Profit | 19.2000 |

| Stop Loss | 18.0000 |

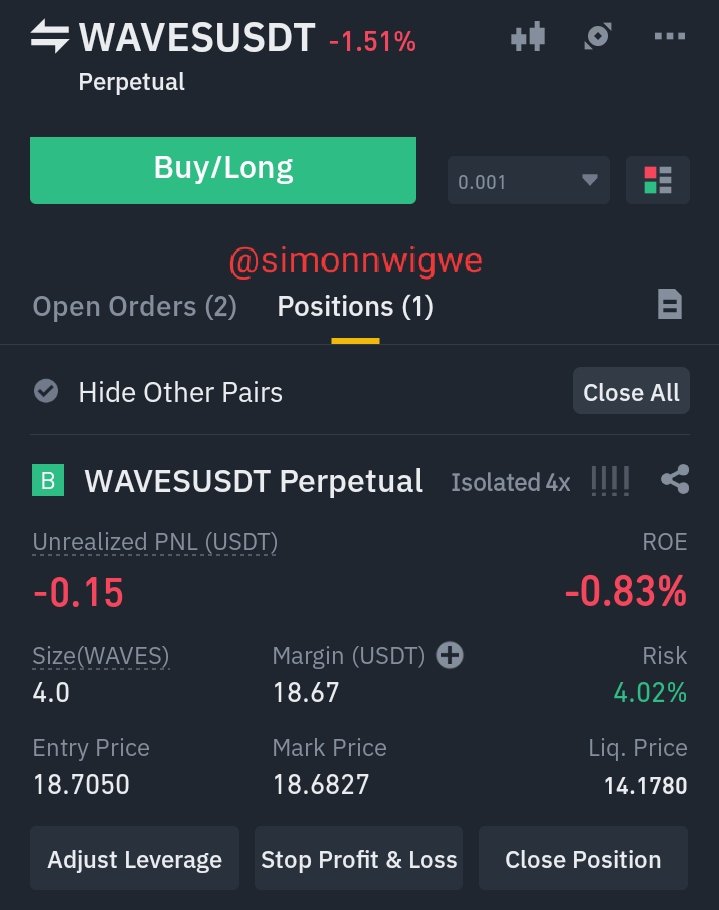

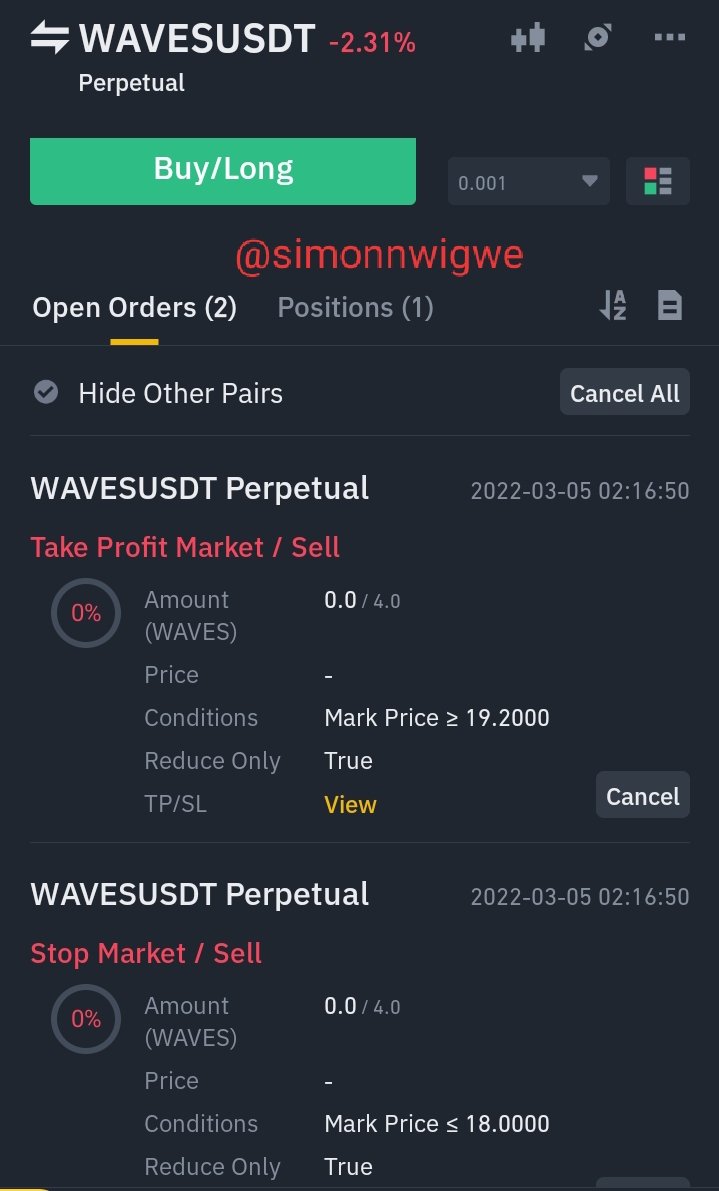

The analysis was done on tradingview.com platform but the execution was done using my binance exchange platform. All risk management system was taken into consideration. I used the future trading account to perform this trade, I use the Isolated margin mode and the 4x adjusted leverage. See the screenshot of the position and the open order below.

Source

My position

Source

Open Orders

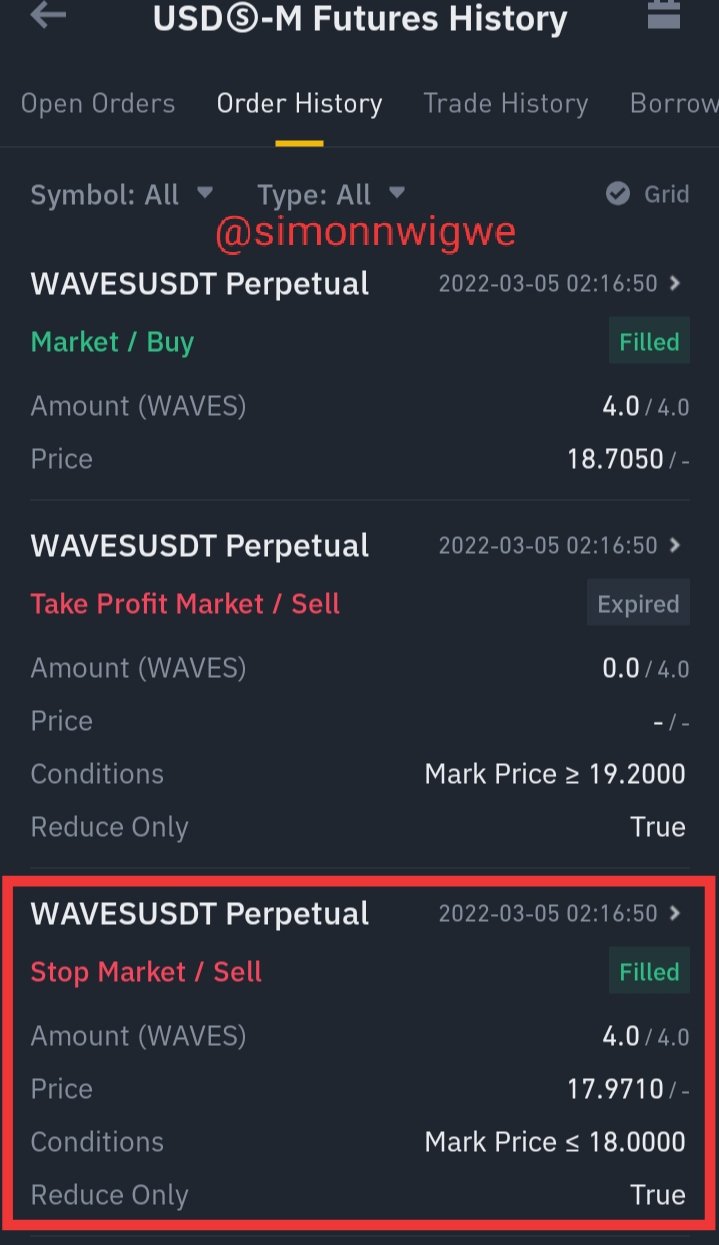

After about some hours, the trade executed. This time the trade went against my prediction. So it terminated exactly at the point I set to stop my loss. The takeprofit at this time expired and the stop loss was filled. The screenshot below shows the details of the trade I carried out.

Source

Order filled

My Plan to hold WAVES long or sell

I intend to hold the WAVES token for a longer time because I intend to make better profits from the token when the price of the token eventually raises. All token will rise again it's just a matter of time. For this reason I will want to hold the WAVES token for at least 1 year.

Would I recommend people to buy WAVES

I will recommend other people to buy the WAVES token most especially at this period where almost all coins are going bearish. The reason is that we can get this token at this point at a very lower price and sell it once the asset start going bullish again. The price of all token will definitely rise again and for those who are investors, this is the best time to make investment.

Trading requires one to be patient and ready to accept every form of loss that may surfaces. Trading is not one sideded and for that reason you prepare your mind for either profit or loss. The loss should not be too much that we can not bear and that is why we implore every risk management strategy to reduce the amount of loss. In my trade here, I have taken into consideration all risk management strategy and that has help me to minimize loss and maximise profit.

I want to say a very big thank you to professor @abdu.navi03 for his constant guidance and correction for this week trading. I have really learnt a lot through your correction and I believe my trading style has improved as well. Sir, I do hope you continue to correct me as I continue to to trade.

Written by @simonnwigwe