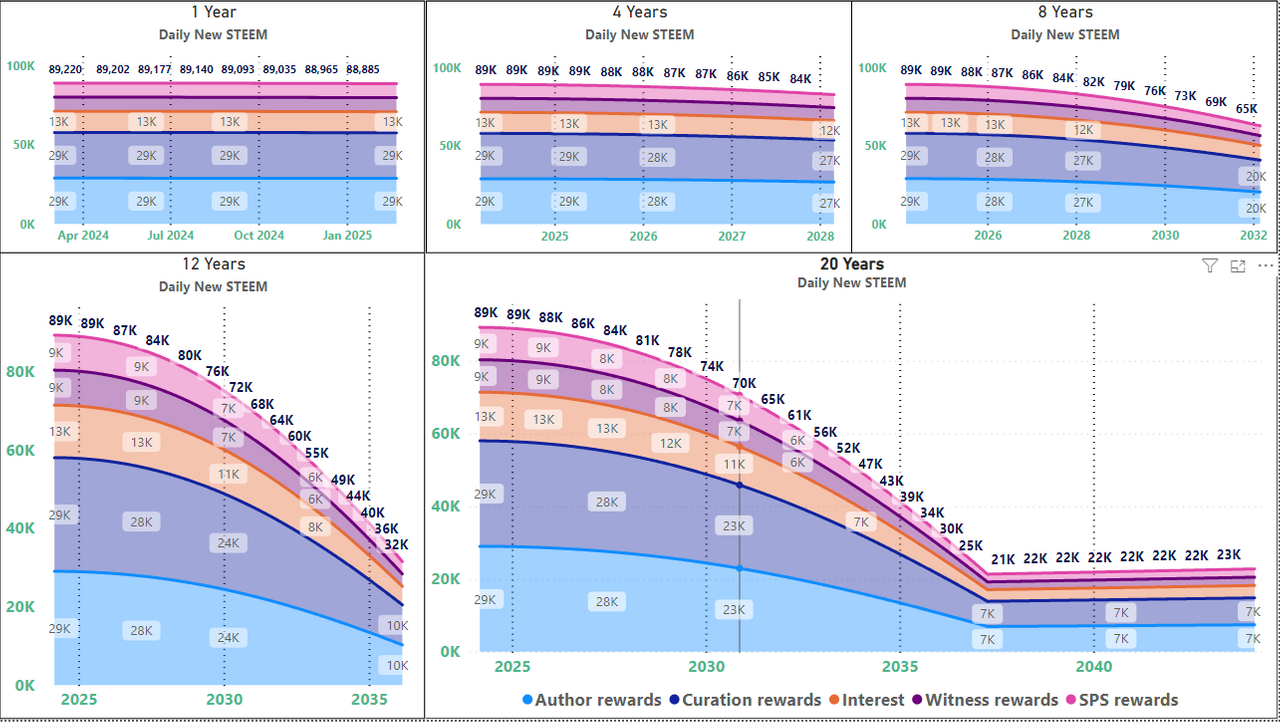

The other day I posted an update on Steem inflation. In that article, we saw that the expected daily STEEM production was 89,874 and that it was set to decline to ~22,000 over the course of the next 13 years.

In broad strokes, I'm fairly sure that the idea behind this inflation curve was to distribute STEEM widely for its first decade, and then to increase scarcity for another decade, and finally flatten off at a low, but steady and permanent rate.

However, something that worries me about this curve is that we see the rewards for witnesses declining from about 9,000 per day now to about 2,200 per day in 2037. This is (roughly) a 75% reduction. We depend on the witnesses to secure our blockchain, and if the price of STEEM doesn't go up, that's a pretty harsh decline. In order to maintain current income levels, the witnesses would need the price of STEEM to go up by a factor of four during that timeframe. Bitcoin has survived reductions like this, but every halving shakes out some portion of the miners. I'm not sure whether Steem has enough witnesses to support such a shakeout.

Further, let's look at what happens if the price of STEEM does go up. Here's the same graph as "Figure 1" in my previous post, 3 days later, after the price of STEEM crossed the haircut threshold.

Just $0.02 in price movement over two and a half days caused the daily rewards to drop by 654 STEEM, or 7/10 of a percent, and now the expected payout for witnesses in 2037 would be just 2,100 STEEM. Thus, even a 4x increase in the price of STEEM probably wouldn't get the witnesses up to today's income levels at the bottom of the curve. There's a lot of complicated math here, and we don't know what the future may bring as far as usage and investment, but I wonder if there's a point on the curve where the rewards will be so scarce that it won't be enough for even a top-20 witness to be profitable?

(If the STEEM price goes down again, the daily rewards will increase, but they'd never again reach the height of the original curve without some sort of intervention by witnesses.)

So, if a threat to witness profitability eventually arises from the blockchain economics, I'm wondering what the witnesses can do to remain profitable, and I have only come up with two answers:

- Implement a hardfork to give themselves a larger percentage of the rewards or increase the overall inflation rate.

- Increase the daily rewards without a hardfork by increasing the virtual supply by paying interest on SBDs.

All the way back in 2016, I made a Steem At A Glance graphic, where I noted that (at the time) SBDs were paying 15% interest, and we all know of a similar blockchain where their stable coins are currently paying 20%, so it certainly seems to be possible to implement option 2 with little difficulty. I believe that it's just based on a parameter that can be set by each witness.

So, assuming that the capability still exists, what would be the ramifications of such a decision?

Effect on delegation bot users

As we've discussed many times, most delegation bot users would probably prefer to have completely passive income. One solution to the problem of spam from this investor community was almost exactly this, as suggested by @michelangelo3, Wie wäre es mit einem Investorenaccount? (How about an investor account?).

So, with a high rate of interest for SBDs, many delegation bot users might be encouraged to stop SPAMing the blockchain and start earning passive interest, instead.

Effect on curators / curation bots

- Again, if the interest rate is high enough, many curators might decide to power-down their STEEM and convert to SBD for interest payments. In turn, this would increase the SP interest and curation rewards for the curators who remained.

- The total amount of daily curation rewards would be increased as a result of the increased virtual supply.

Effect on external SBD markets

I could imagine this going in one of two ways:

- SBDs are removed from the market and tucked away in savings, increasing scarcity, and therefore increasing the market price for SBDs on external markets; -OR-

- The increase in the SBD supply causes a surplus and reduces the price on external markets, until it eventually falls to a dollar, where it can be (imperfectly) regulated by the blockchain's internal conversion mechanism.

Effect on Steem authors

- The reduction in competition from delegation bot SPAM leaves more rewards for true content creators with a desire to cultivate audiences and communities;

- The SBDs that they earn on their posting (when the STEEM price is above the haircut level), might be more or less valuable. It's not clear to me which way that would go.

- The daily amount of rewards that are available to authors would increase as a result of the increase in virtual supply.

Effect on witnesses

- Without increasing their percentage of daily rewards, they would increase their block producer rewards.

- Anyone who powers down SP and shifts it to SBD would lose their voting influence, which could shake up the ranks of witness voting.

Effect on SP investors

- Selling by investors who switch holdings from SP to SBD could lead to downward pressure on the price of STEEM.

- Investments would be diluted by the amount of the increased interest, which could put downward pressure on the price of STEEM (which would increase the virtual supply even more whenever the price of STEEM is above the haircut level).

- Two interest-bearing avenues would be available. If the investor wants to evaluate content, they could invest in SP. If not, they could invest in SBDs.

- The reduction in SPAM levels from delegation bot users might offset some or all of the dilution and put upward pressure on the value of STEEM.

Technical effects

One of the things we have seen over the years is that STEEM's price can be influenced by BTC price movement. In recent weeks, I created this graph to compare the ratio of [new steem per day] / [new BTC per day], according to the two blockchains' inflation formulae.

As a result of BTC's halving cycle, there is a 4 year sudden doubling in new_STEEM/new_BTC that might produce some sort of a price shock. By paying a lower interest rate immediately after a halving and increasing it smoothly over the four year cycle, is it possible for the witnesses to use SBD interest to smooth out the impact of BTC's 4 year cycle in order to reduce the shock from BTC halvings? (and if so, is it desirable? I haven't thought this through at all.)

It's also worth noting that the SBD supply is currently around $13 million, and nearly 1/3 of that is locked up in the SPS, so the scope of these interest rate changes is currently limited to a total of about 9 million SBDs (which would - of course - increase with interest payments and author SBD rewards).

Conclusion

When should the witnesses start paying interest on SBDs? I'll be the first to say, "I don't know".

But, I think that the witnesses should start thinking about the possibility (if they're not already). At some point in the future, I think it might be a good decision - and potentially even necessary. In my opinion, it would be prudent for the witnesses to start deciding now what conditions would trigger it, instead of rushing it through during an unanticipated crisis.

If the witnesses decide to do this, there are possible benefits to authors, curators, investors, and the witnesses themselves. Of course, there are also tradeoffs, so the decision needs to be carefully considered.

What do you think? What are the conditions that should trigger the witnesses to reenable SBD interest payments (assuming that the parameter is still functional under HF23)?

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.