image credits; canva image credits; canva |

|---|

Greetings fellow steemians alike, it is I Ace, with a steem-database exclusive Fintech post which would be looking specifically at the various types of spot trading orders available to users on the Binance Exchange. It really is a complicated platform hence it has a beginner and pro mode and as time goes on they keep innovating leaving us newbies clueless and unable to use the features but today I would be explaining a section of it.

On the Binance Exchange, there are various trade options made available for users like margin trading, futures trading and spot trading. It really would be weird to start talking about the orders available on the platform without looking at what spot trading is.

Spot Trading as the name implies is trading that is carried out on the spot depending on the market price. In spot Trading, once payment is made the buyer gains full possession of the cryptocurrencies purchased. In the spot market, all we do is sell off one crypto currency for another like selling my USDT for TRX. Think of it as an exchange market simply. You buy or sell out a crypto currency in exchange for another crypto currency with equal worth.

This method is mostly used by newbies who don't have the experience or expertise to utilize other trading features. They enter the spot market to buy crypto assets which they then hold before looking for the right time to sell so as to ascertain profit.

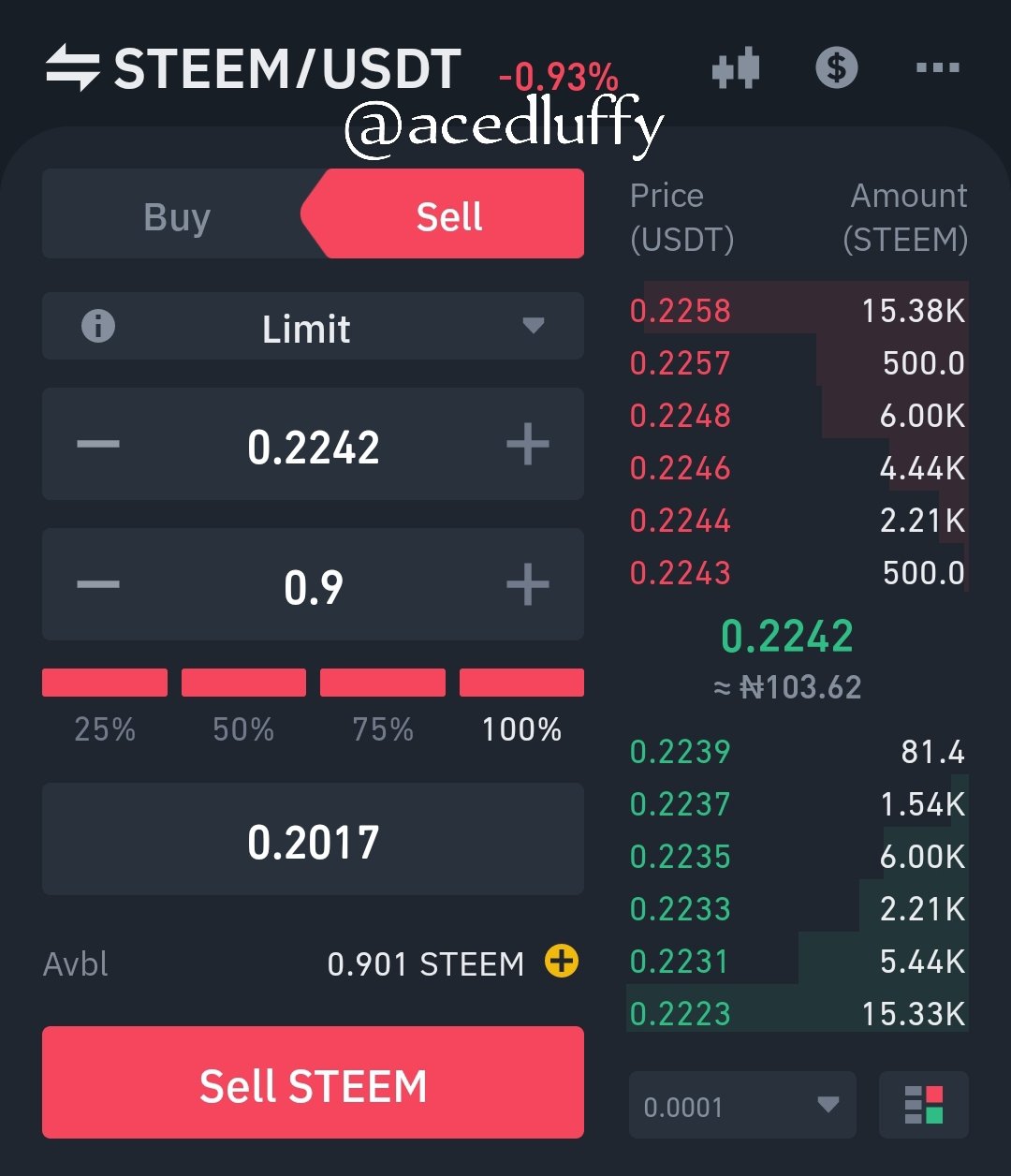

A Limit Order😃

This is the order I utilize the most and is very advantageous in minimizing losses and maximizing profit. Explaining individually, In a limit sell order, you determine an exact price where when reached the order would be executed immediately. In a buy limit order, you determine a lower price, set the lower price and whenever the price falls to that level or lower the order would be executed immediately. Here profit is maximized and the transaction fees are significantly lower.

A Market Order😀

This is another popular and commonly used order as it is done immediately and on the spot. Here once the market order is placed, it picks out the best possible price from the limit orders available in the market and executes it immediately. As I explained earlier, in a limit order you make your own price hence resulting in smaller transaction fees but in a market order, you utilize someone else's set price because they make use of existing limit orders to sell at the best possible price so the transaction fees here would be higher.

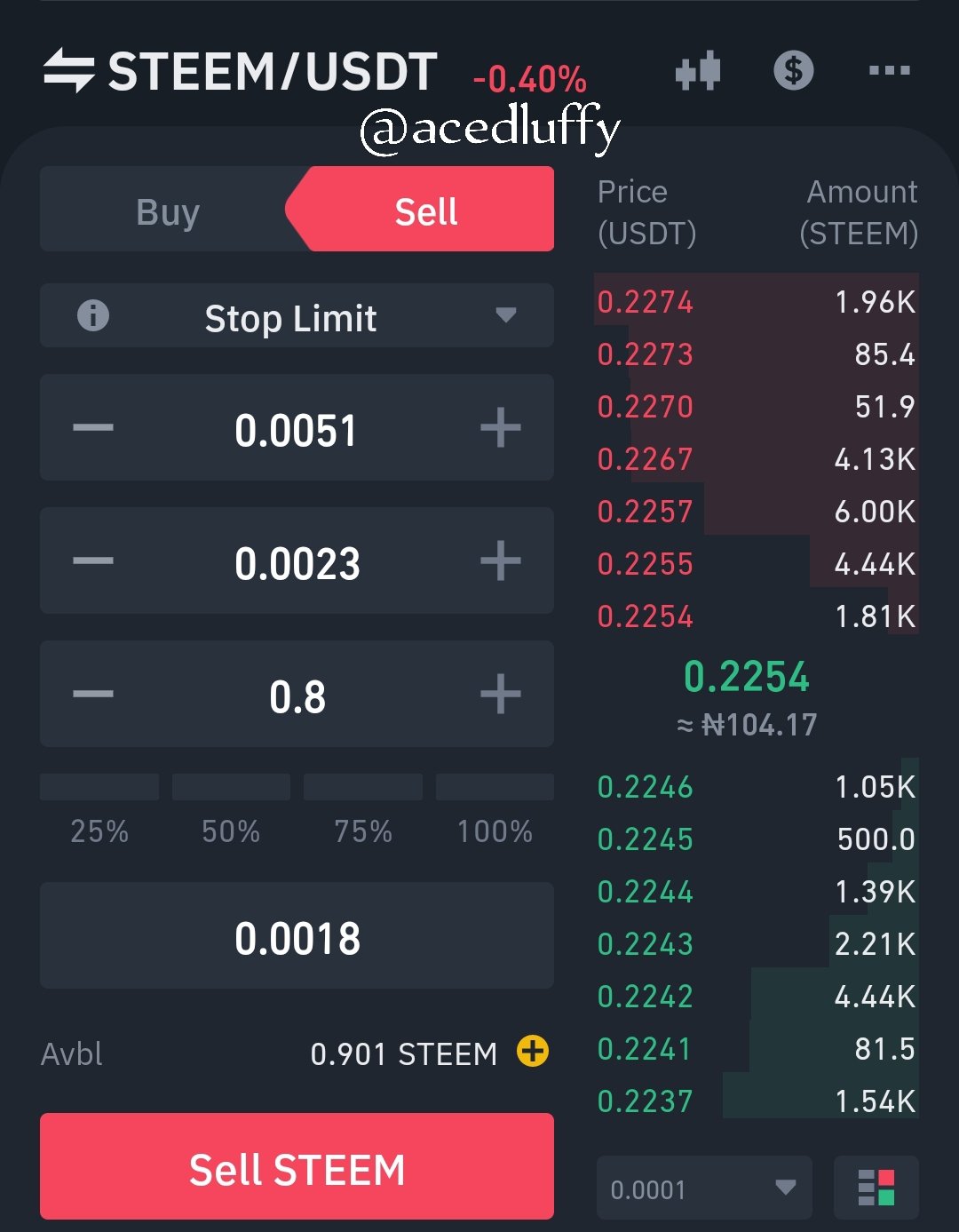

A Stop Limit Order🛑

This order gives you more control over your trade as it combines the attributes of a stop-loss order and a limit order. When this order is set for a sell order, you set a lower price for the limit order so that the stop order would be higher. Once the stop price has been reached, Binance would place a limit order for the crypto asset.

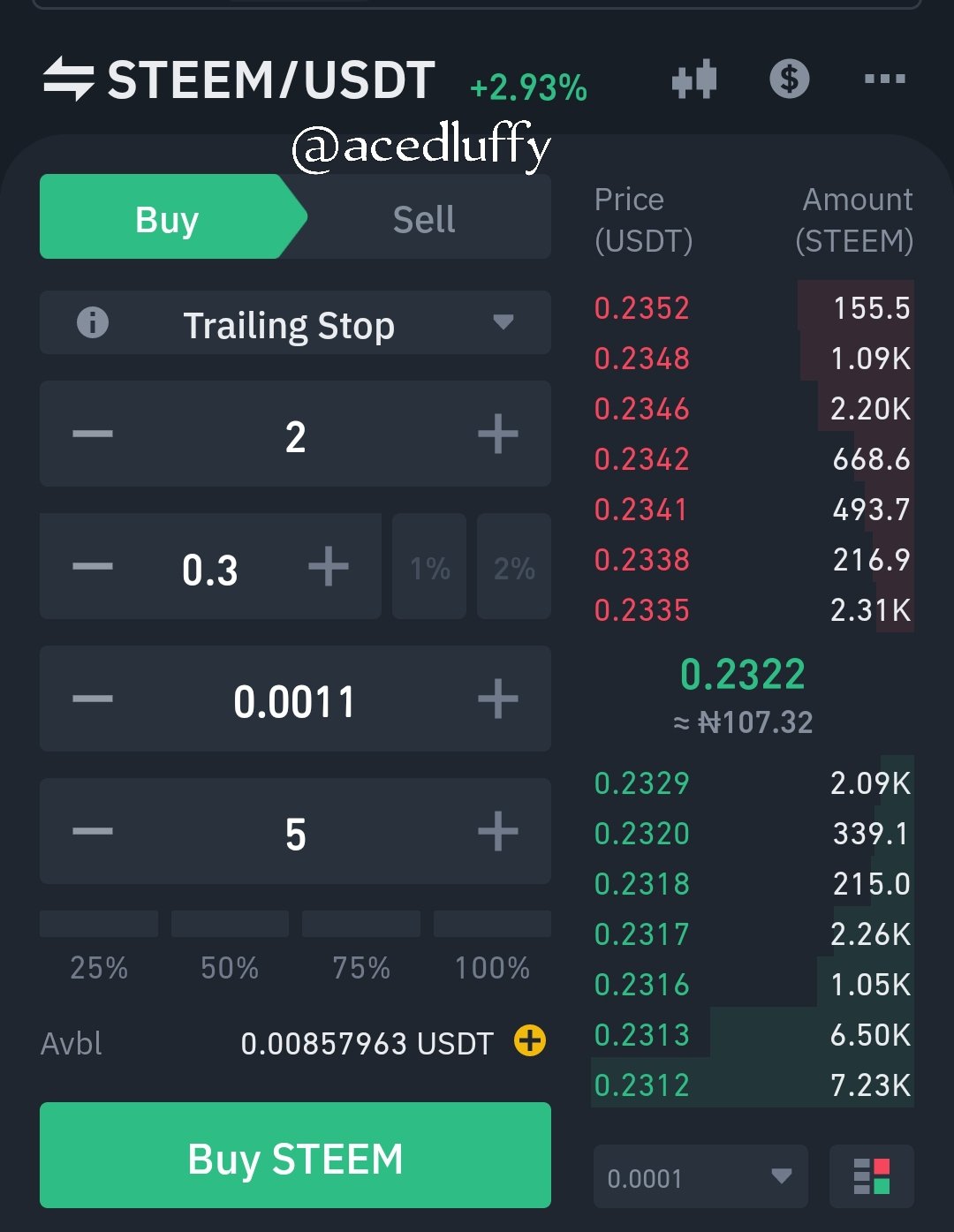

Trailing Stop Order🛼

This isn't really a common system as I'm just seeing it for the first time so it probably came during an application update. The trailing stop order makes use of percentage and locks up the profit when the criteria has been met but it keeps the market open for the possibility of gaining more profit. for example, I place a sell trailing stop order but the market keeps getting more favourable, it would keep accumulating the profits but if the market starts becoming unfavorable, it would immediately execute the order and close the market.

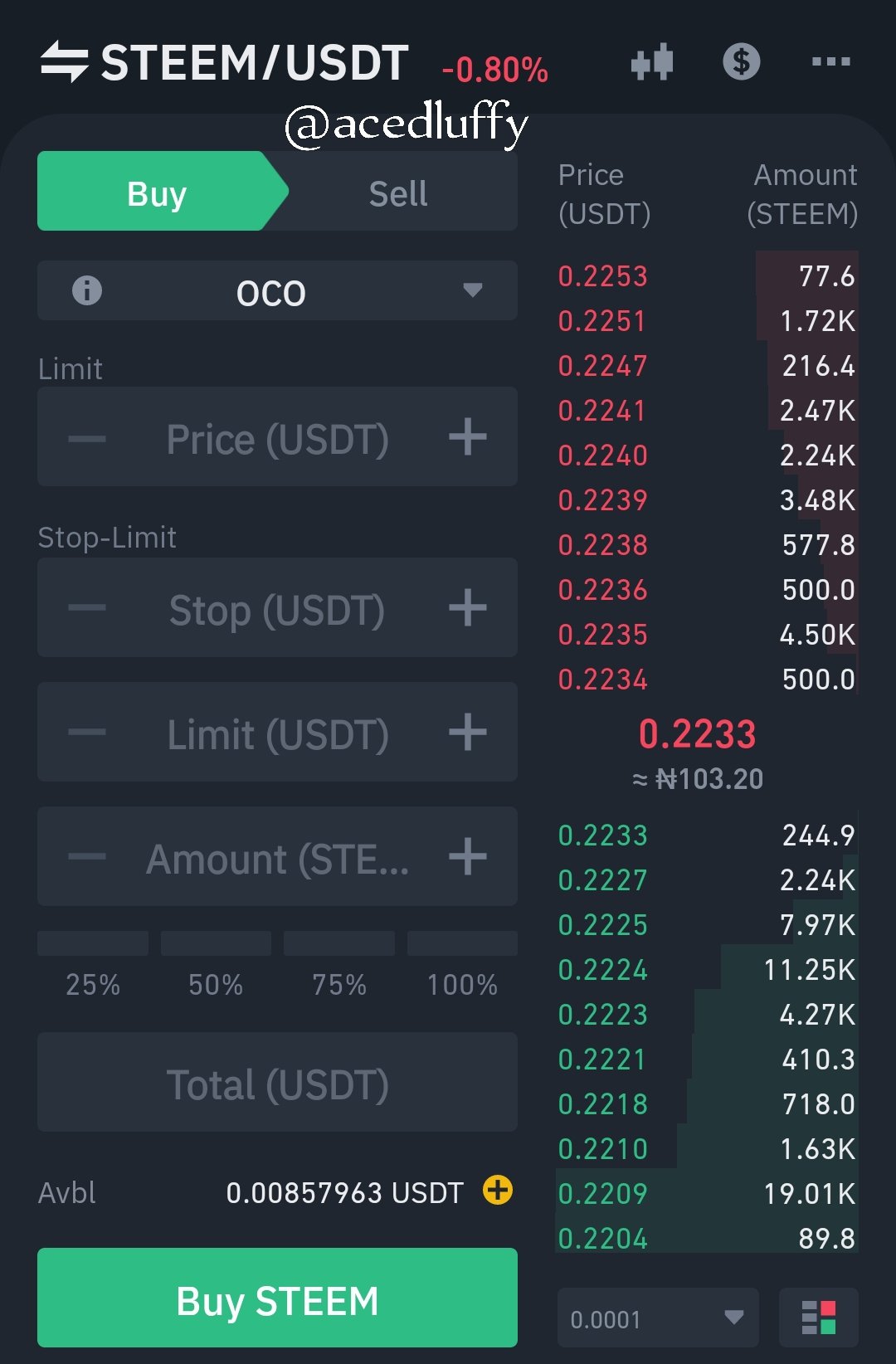

One Cancels the Other (OCO)

When it comes to an OCO, two orders are set (a stop limit and a limit order) of which only one needs to be fulfilled. So after placing the both orders, once either is atleast partially fulfilled, the other one cancels and vice versa. For example we can create an OCO order with a limit order at 270 USDC and a stop-limit order with a stop price of 300 USDC. You then go on to set the stop limit order’s price to 310 USDC so that the order can be executed.

The binance interface might be complicated but they warn us adequately before we venture into anything that could result in us losing our money. It also has alot of futures which would be very beneficial to traders and help them in both analysis and minimizing loses and maximizing profit. All we have to do is take our time to learn each and everyone of these features.

All screenshots used in this publication were taken from the Binance Exchange application

10% to @steem-database