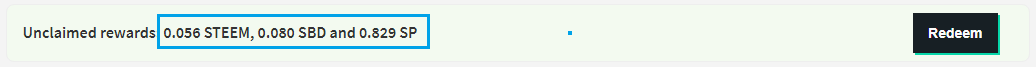

So now the recent Author payout in Steem Blockchain is STEEM, SBD & SP, instead of SBD & SP.

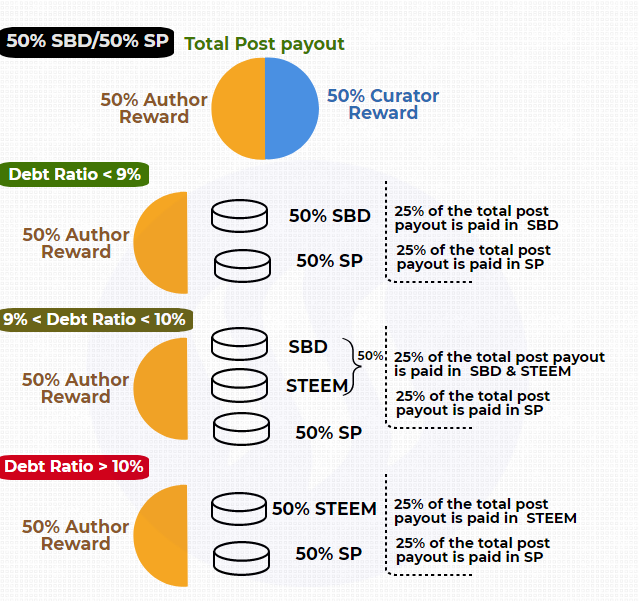

In general, the Author payout in Steem Blockchain is SBD and SP in the case of "50% SBD/50% SP" setting. But technically that is the case when the debt ratio is below 9%.

What is Debt ratio?

A rapid change in the value of STEEM can dramatically change the debt-to-ownership ratio. The blockchain prevents the debt-to-ownership ratio from getting too high, by reducing the amount of STEEM awarded through SBD conversions if the debt level were to exceed 10%. If the amount of SBD debt ever exceeds 10% of the total STEEM market cap, the blockchain will automatically reduce the amount of STEEM generated through conversions to a maximum of 10% of the market cap. This ensures that the blockchain will never have higher than a 10% debt-to-ownership ratio.

Page 10/32-- Steem White Paper

SBD is a debt instrument in Steem Blockchain and ideally designed to reward the content creators/authors. Each SBD is backed by an equivalent amount of STEEM as per the market rate.

All other actors except the Authors are rewarded in SP. Of course, Steem DAO is another pool, for a different purpose where proposals are also funded with SBD.

In a bull market, generally, the debt ratio is low because STEEM price is generally high, so the STEEM/SBD ratio is also higher, which means fewer STEEM tokens are required to back 1 SBD.

In contrast in a bear market, the STEEM price goes down and STEEM/SBD ratio goes lower, which means more STEEM tokens are required to back 1 SBD.

The Blockchain constantly prints SBD to reward the Authors/Content creators in Steem Blockchain. However, it is programmed to stop printing new SBD tokens if the Debt ratio exceeds 10%(upper cap), in that case, the Payout is in STEEM.

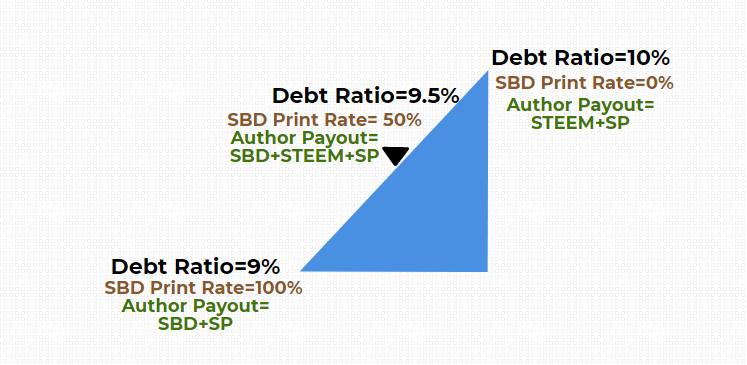

The Blockchain prints 100% SBD for Debt ratio up to 9%, from 9% to 10%, the print rate starts decreasing linearly and it completely stops at 10%.

For example,

If the Debt ratio is at 9%, the author payout will be in SBD & SP.

If the Debt ratio is more than 9% and below 10%, then the payout will be in SBD, STEEM & SP. SBD print rate, in this case, will be as per this formula: SBD print rate= 100% * (10-Debt ratio).

Say the debt ratio is 9.1%, then SBD print rate= 100%*(10-9.1)= 90%

So 90% of the liquid reward will be paid in SBD, the remaining 10% of the liquid reward will be paid in STEEM and the staked reward will be in SP as usual.

Say the Debt ratio is 9.5%, then SBD print rate= 100%*(10-9.5)= 50%

So 50% of the liquid reward will be paid in SBD, the remaining 50% of the liquid reward will be paid in STEEM, and the staked reward will be in SP as usual.

Once the Debt ratio reaches 10%, there will be no SBD reward.

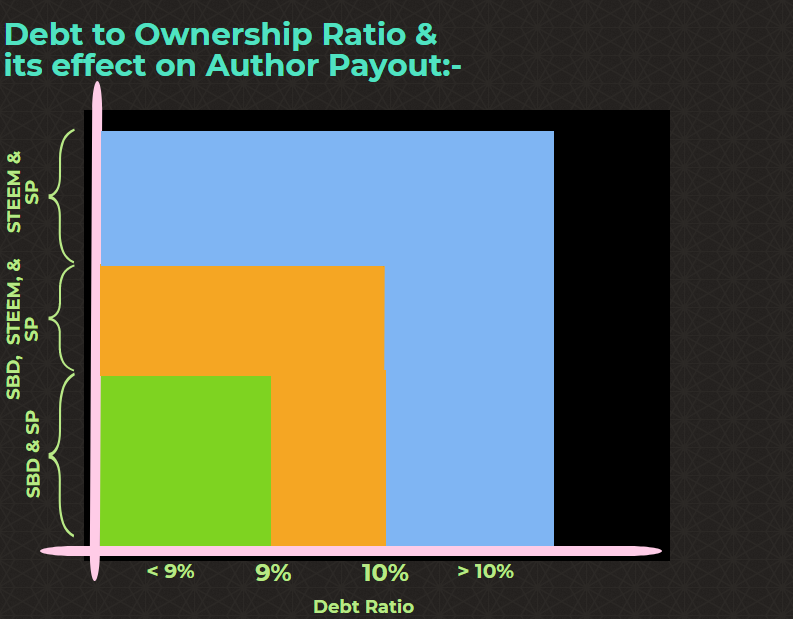

- Debt Ratio <9% Author Payout: SBD+SP

- Debt Ratio between 9% & 10% Author Payout: SBD+STEEM+SP

- Debt Ratio >10% Author Payout: STEEM+SP

How do I calculate Debt Ratio?

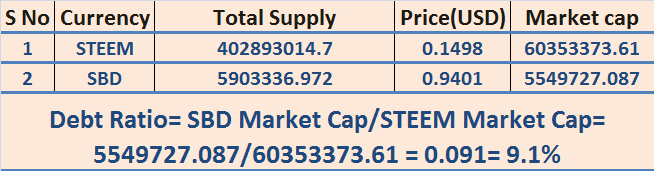

Debt Ratio is defined as the ratio of SBD Market cap to STEEM Market cap.

STEEM Market Cap considers the whole supply/virtual supply including those required to back SBD.

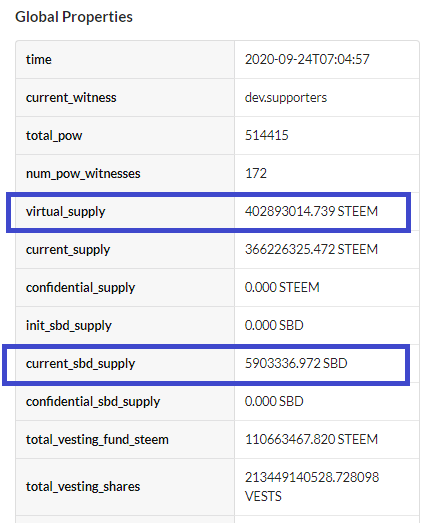

The virtual supply you can get from Steemdb.io, similarly, total SBD supply also.

SBD Market cap= Total SBD supply * SBD price

STEEM Market cap= Virtual STEEM supply * STEEM price

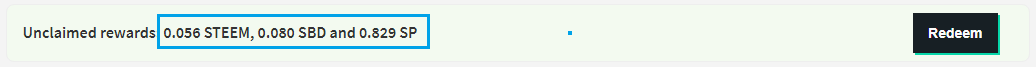

As calculated, the debt ratio now stands at 9.1%, that means the SBD print rate is 90%.

So 90% of the liquid reward is now being paid in SBD and the remaining 10% is being paid in STEEM. That is why now you can see your Author payout in a combination of SBD+STEEM+SP.

Analysis

If the STEEM Market Cap goes up, the debt ratio will go down and when it goes down below 9%, the Blockchain will start printing 100% SBD again and the Author payout will be in SBD+SP.

If the Authors in Steem Blockchain set the payout to "Power Up 100%", that will also help to some extent, as the daily liquid supply will remain in check, which will affect the supply/demand ratio in favor of STEEM and STEEM could perform better in the market. If STEEM price goes up, the Market Cap will also go up and the Debt Ratio will come down.

Conclusion

As the Debt ratio has gone above 9%, "Power Up 100%" should be encouraged more in PoB, at least until we have a Debt Ratio in the comfortable zone (preferably below 9%).

This Post Reward is set to "Power Up 100%".

Thank you.

(If you have any doubt related to the "Debt Ratio", feel free to ask in the comment section.)

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

@cryptokannon

@neerajkr03

@rishabh99946

Benefactor's reward: 10% of the Author reward will go to @bestofindia .