There has been a lot of confusion recently about steem, steem power, interest, dilution and other economic issues. I decided to write a post to help clear it up.

IMO, a big part of the problem is that frequently, the white paper can't describe things with their proper and useful names, because to do so would invite problems with the SEC.

There are Three Types of Assets in the Steem-iverse

And no, @lukestokes one of them isn't relationships.

For this post, i am going to call steem in general: the site steemit, the blockchain the company everything, The Steem-iverse. A big problem with coming to an understanding all the parts of Steem is that there are like 43 different things that are all called Steem, which frequently makes any explanation sound like a econ class taught by Pappa Smurf.

There are Equities

There are Cash Equivalents

There are Bonds

Steem (and only steem) is a cash equivalent

A cash equivalent means exactly what you probably think it means. Its a quasi currency that you can spend, invest, cash out, buy sell or transfer.

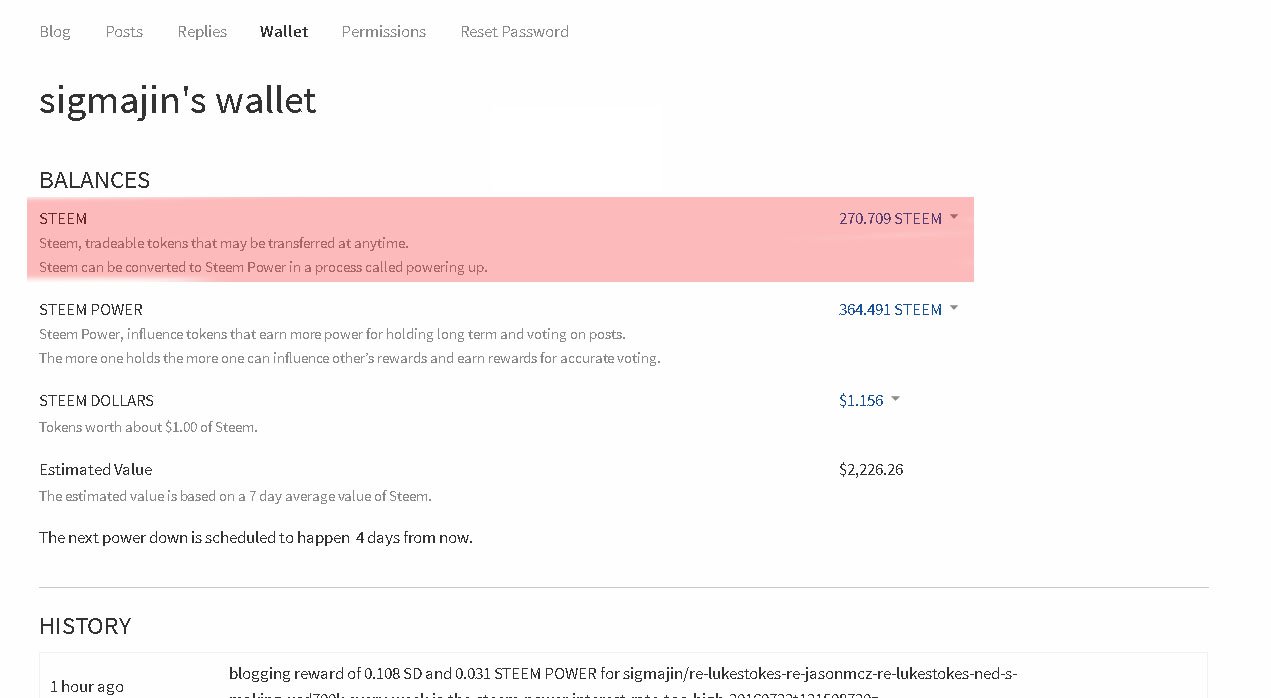

check this out:

See the part highlighted in red. Thats my steem. 270.709. I know im a total baller right.

Its very important to keep in mind here that, the part highlighted in red is the only steem in my account, even though the word appears like 4 other times on the page. When you're looking at a wallet, the only real steem is listed under steem balance. Nothing else is Steem. This is important.

Equities (see my vest, see my vest, made of real gorilla chest)

An equity is a stock in a company. In the Steem-iverse, equities are vests. Vests determine your steem power. Just like real world stocks, a vest represents a percentage ownership of the steem-iverse.

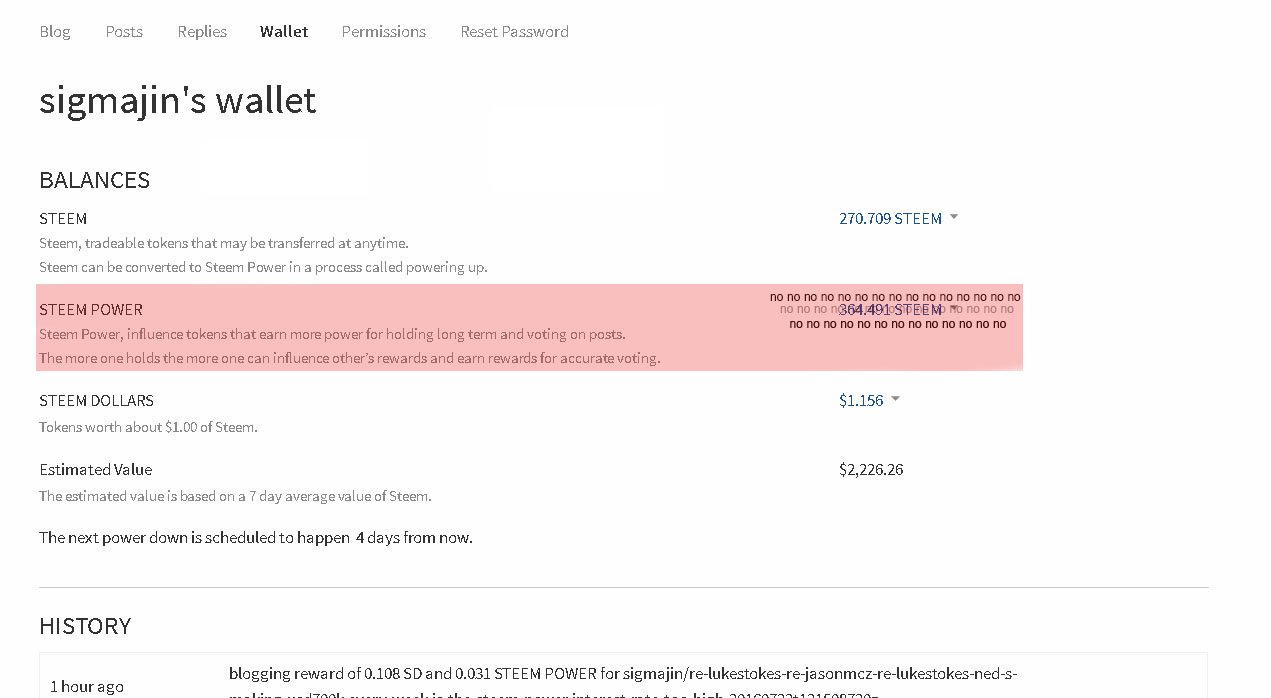

steem power is not smurfing steem

Unfortunately, rather than show you your vests the UI lists your steem power as Steem. But, its not real steem. In fact, the number shown there is nowhere on your account in the blockchain. Thats why i have mine covered in noes. What that number is really telling you is the amount of steem it would take to purchase the amount of vests you have right now.

This is very important, because until you understand this, youre going to be spinning your wheels. Steem power looks like steem in the UI, but its not.

So how do you get stock in the company? The same way you get stock in any other company, you buy it. With Steem. Thats what happens when you power up. You're buying vests in exchange for Steem.

Awesome. Ima buy me some vests. How many vests to i get for my steem.

This is complicated. For reasons I'm going to discuss shortly ,the conversion rate between steem and vests increases by about 100% every year. Right now 1 million vests is worth about 240 steem. Remember how i said that that number represents how many Steem it would take to purchase the number of vests you have right now? Well, if you watch it for a bit, that number keeps increasing. Thats because the price of a vest is increasing. The rate of increase is such that a vest will be twice as expensive a year from now as it is today.

The Dilution Solution and the 1.9% Markup

So why double the conversion rate between steem and vests every year, and make things complicated? Why not simply keep it steady?

This goes back to vests being like stocks. Imagine there is a company that issues 1000 shares of common stock. I buy 100 shares. Those shares represent a percentage ownership of this company... in this case, 10% ownership. Now, imagine that the company needs to raise money, and decided to issue an additional 200 shares. First of all, no. This will not cut the price of the shares -- it doesn't work that way. Maybe it should, but it doesnt.

However, i have a problem. My 100 shares, which used to represent 10% ownership (100/1000) now represent about 8.3% ownership (100/1200). This effect is called stock dilution. I've basically had 1.7 percent of the company taken away from me.

When this happens with a real company, what the company will do is offer a cash dividend as compensation for that dilution. and pay for that dividend with proceeds from the new stock issue.

So lets say my stock is valued at $5 when the new shares are issued. Rather than charge $5, the company might charge $5.04 for the new stock. with the extra .04 from 200 shares, they would have $80.

With that $80, they could give about $0.08 to each share holder for every share that got devalued. So in this case, I would get $8 back for my on my 100 shares. Since $8 is about 1.6% of my $500 investment, its fair compensation (well close i wasnt wiling to figure out the math for 1.7%) for the dilution of my percentage ownership.

The exact same thing happens with vests. Remember, vests are like stock. They represent a percentage ownership. When the steemi-verse awards stock to others (like blogging rewards), the percentage ownership represented by my vests is diluted. So the 1M vests i had that used to represnet a certain percentage ownership in the company, now represent less. In order to compensate me for that dilution, it charges new buyers more to purchase the stock. By doing so, the steemi-verse is able to pay me more if and when it buys back my stock.

Steem power "interest" -- Nothing is Created

So how does the "interest rate" work? Lets consider 2 users, @moe and @joe. For the purposes of this example, assume that @moe and @joe are the only two users in the steem-iverse

Moe and Joe both have 240 Steem. Moe powers up right now, buying 1 million vests. Joe does not power up.

So right now Moe has 1 million vests, and joe has 240 steem

now we wait a year.

Moe still has 1 million vests. Joe still has 240 steem. Nothing has changed. Now, joe decides he wants to power up too, because hes sick of moe being a douchey whale.

However, the conversion rate between vests and steem has doubled. Joe's powerup one year later will only purchase about 500,000 vests (half as much as moes powerup for the same amount of steem did).

Now, if the UI showed what was really going on, it would show that Moes steem power had stayed the same (1M vests) and joes purchase of steem power came at a rate twice as high, giving him half as many vests (500,000 vests)

So in real terms, their steem and steem power would look like this

today moe:0 steem, 1M vests joe 240 steem, 0 vests total today=240 steem, 1M vests

1 year from now moe:0 steem, 1M vests joe 0 steem 500, 000 vests total 1 year from now 0 steem, 1.5m vests

However, they decided to make it so that the UI represented the decrease in the vest purchasing power of Joe's Steem, as an increase in in the value of Moes power. thats what they mean in the white paper when they say

The increase in the supply of STEEM is mostly an accounting artifact created by the desire to

avoid charging negative interest rates on liquid STEEM. Negative interest rates would

complicate the lives of exchanges which would have to adjust user balances to account for

the negative rate of return of STEEM held on deposit. Mirroring the blockchain logic exactly

would be error prone and complicate integration and adoption. Therefore, STEEM has

chosen to never charge someone’s account, but instead to increase supply. This achieves a

similar economic result without forcing everyone accepting STEEM deposits to implement

negative interest rates on their internal ledger

So the Ui would display (somewhat incorrectly)

today moe:0 steem, 240SP joe 240 steem, 0SP total today=240 steem, 240SP

1 year from now moe:0 steem, 480SP joe 0 steem 240SP total 1 year from now 0 steem, 720SP

This makes it appear as though there was an increase in the total steem, because they both started with 240 for a total of 480, but 1 year later, the total SP was 720. But this is not real. What really happened is joes value halved. But rather than show it that way (because joe would be pissed) they represent it by saying that joes value stayed the same and moes value doubled.

To put it simply, they are showing moe 480 steem for his SP because thats how many steem it would take to purchase the number of vests he has right now.

What Happens When You Power Down

So moe has 1M vests one year from now, and the UI shows him that he his steem power is 480 steem. What does it mean when he powers down?

As i mentioned before, Vests are an equity. Like stocks. But more importantly, vests are like restricted stocks. Restricted stocks have to be held for a certain time period before you can cash them out. (When your restricted stock is eligible to be cashed out its called "vested", which is why they call them vests to begin with). Specifically, you can only sell 1% of your vests per week.

When you power down, the Steem-iverse agrees to buy your stock back witih steem at the current conversion rate, as it becomes eligible to sell. The money for this buyback comes from two places:

- Other people paying steem to buy vests (other people powering up)

- issuing bonds (more on that later)

The important thing to understand here is that your decision to power down does not transform your vests into steem. It does not create anything that wasn't there to begin with. Your decision to power down creates nothing at all. You are merely selling your vests for steem, the same way you bought them for steem. Nothing is created. The Steem used to buy your vests would exist wether you powered down or not.

of Moe and Joe. Lets say that after Joe buys 500,000 vests for 240 he goes, gets some bitcoin, buys 240 more steem, and uses that steem to power up another 500,000 vests.

Now, moe and joe both have 1 million vests. Moe paid 240 steem for his 1 million, and joe paid 480 steem for his 1 million.

Now moe decides to power down. For a moment, lets ignore the weekly payouts and assume he can power down immediately. He would get 480 steem for his 1M vests, because that is the current rate of exchange (remember were a year in the future), which is double the amount of steem that he paid. This extra steem that he gets is a cash dividend, paid to him as a compensation for the dilution of the percentage ownership.

But, we have a problem. What if joe also decides to power down? In our example, these were the only two users in the steemi-verse. Therefore, the steemi-verse only has 240 steem to pay him.

Steem Backed Dollars are Bonds

A bond is basially an IOU. A SBD is an agreemnt that you will allow steem to borrow $1 worth of steem now, in return for an IOU paypable on demand for $1 worth of steem in the future. So a Steem backed dollar is really an IOU for one dollar worth of steem.

Now in reality, Steem would not pay a power down with SBDs (it would use them to pay other debts, like blogging rewards), but the purpose remains the same, to provide a steem buffer in case a short fall arises between the amount of vests being sold and being bought.

Well thats a giant wall of text. Any questions?