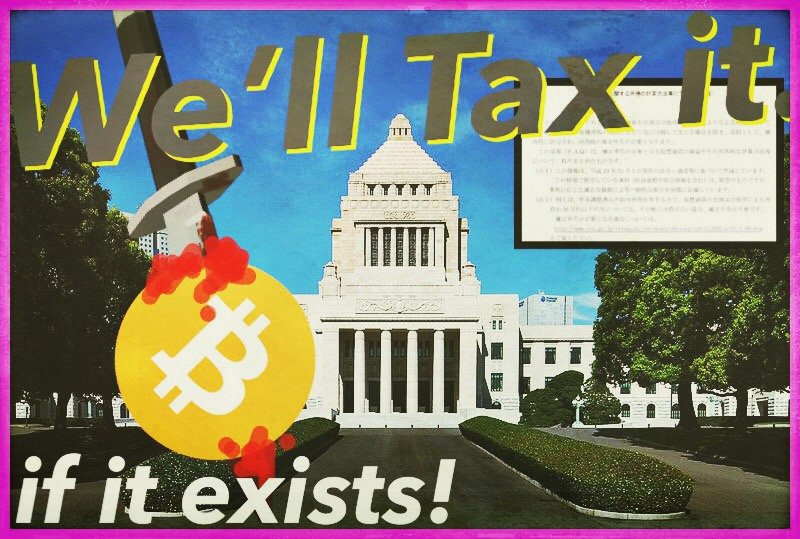

The National Diet Building, Tokyo, Japan.

In a not suprising, and yet still suddenly disturbing move, Japan has once again announced that all crypto gains will be taxed, including all transfers, trades, forks, and purchases. Mining profits will be taxed as well.

This information is not really new, per se, but the frequency of the reminders, as my friend Jon Southhurst at bitsonline has pointed out in his latest article, is telling. The state is not happy that money is being made without their hands in the pot. This comes as no surprise to those who know the score. It still sucks, though, to be reminded of this harsh reality at a time when crypto and the free market are gaining such massive acceptance and momentum.

The newest information released by the Kokuzeicho (National Tax Agency) makes it clear that all profits gained from the use of cryptocurrencies, whether by mining, exchange, acquisition of coins created by forks, or purchase of goods, will be taxed at the time of conversion to fiat.

Is your head spinning yet? It should be.

Imagine purchasing crypto token X today. It is worth 1 USD. Let’s say it goes up in value to five dollars and you then decide to purchase a bit of crypto token Y with your gains. Now crypto token Y must be thought of as a result and continuation of the now divided value of X, and any fluctuations in the value of this token Y will actually be fluctuations in the value of the now exchanged percentage of token X. Meanwhile, the rest of the original token X, not used to purchase some of token Y, must be accounted for separately. When it comes time to pool your X and Y coins together and purchase that sweet new sweater you’ve been eyeing, you now have to calculate your total profit by tracking the price fluctuations of both coins, and then report that to the tax man.

This is a very simple scenario and it is already a massive pain-in-the-ass clusterfuck fast approaching practical impossibility. Now think of all the transfers, exchanges, and trades you’ve made for a zillion different crypto coins on myriad exchanges, blockchains, and platforms (just like this one right here). Starting to sound a little nuts, isn’t it, all this tracking?

In other words, for users of crypto tokens to remain “legal”,

they will be forced to keep track of every single coin they purchase, its value at the time of purchase, and any and all price losses or gains resultant from exchange for other tokens, transfers, trades, blockchain forks, network fees, etc, along the way. Then at the time of conversion to Japanese yen for purchase, the original value of the coin must be measured against the profit and taxed.

Now if you’re not both laughing and crying here a little bit, I would encourage you to read the above paragraph one more time. I laugh because I am thinking about the fantastically impossible task this poses for the state, in that executing a successful tracking program for every crypto coin address used on every exchange, platform, and in every single trade, private or otherwise, AND linking said addresses to individual users (most wallets and exchanges use fresh addresses for each transaction), is akin to an attempt to keep every single raindrop from hitting the ground in a typhoon-scale, massive downpour.

I’m looking forward to see how individuals here in Japan approach this problem. Sometimes challenging times bring out brilliantly creative solutions.

Check out Jon’s great article HERE for more information.

If you read Japanese or don’t mind using a translator, you can read the legislation for yourself HERE.

Please let me know what you think, in the comments.

~KafkA

Graham Smith is a Voluntaryist activist, creator, and peaceful parent residing in Niigata City, Japan. Graham runs the "Voluntary Japan" online initiative with a presence here on Steem, as well as Facebook and Twitter. (Hit me up so I can stop talking about myself in the third person!)