I get absolutely no pleasure from writing this post, except to clarify my thoughts, reaffirm my own knowledge and experience, and help spread the wisdom and lessons that others can gain from F.S. Comeau's "adventures in trading". While this post may appeal most to those interested in investing, trading, and other forms of "professional gambling", the truth is that these lessons can be applied to many other areas of life as well.

For some background on this story, F.S. Comeau had an uncle who passed away and left him $2,500,000. His uncle had never really had a career or a profession of any kind. He stuck to the usual odd jobs, being a trucker here, working in security there, even teaching at some point, but he would usually never last long. When he died, everyone was shocked at the fortune he had managed to prudently amass over his lifetime. As if F.S. had just won the lottery, he found his life change as he became a wealthy man overnight, after drifting around from one place to another and in some dead-end telemarketing job.

I wanted to trade. I had always wanted to trade and the world of daytrading seemed like a utopia to me. At first, I had success. People might remember my big Apple bet a few years ago where I essentially made $30,000 in under a week. Looking back at it today, much later, I regret winning that trade. Perhaps if I had lost everything on that trade, it would have disgusted me from trading forever and I would still have much of that $2.5M today. But I won, and I won for a good while, and it kept me going.

So to make a short story, this brings us to today. From the original amount, I have $325,000 Canadian left. I have a $100,000 personal loan at 8% (yeah), a $51,000 credit card debt accruing at 19% per year and various debts ranging from 6 to 10%. Oh man I feel so dumb – I could have paid the car I am driving in cash, but somehow I ended up getting financing because… Because.

NO NO NO!!! Get the F out! Save your capital! $325K IS STILL NOT CHUMP CHANGE! It's still more money than most people amass in a lifetime, and certainly still plenty to rebuild from... PRUDENTLY!

If I liquidated all my positions and stopped trading today, yes, I could probably repay my debts. And then what? I would have almost nothing left, nothing at all. My $2.5M would be gone forever and perhaps most of my mental sanity along with it. What’s the point? Truth be told, at this point, I have really nothing to lose. Worst case scenario, this YOLO [You Only Live Once] fails and I go bankrupt. If I'm going out, well, I'm going out big. I'd rather take my chance to get my money back.

This is perhaps my last chance in life to “hit it big,” aka be someone. I won’t get another chance like this. Look, I’ll be blunt: I want my two point five million back. It’s mine and I want it back, period. Unless you’ve hit it big and lost it all, you don’t know how incredibly painful it is to look at $325,000 and think, “Yeah, this used to be 7 times higher.”

YOU STILL HAVE $325K, more than enough to PAY OFF YOUR DARN DEBTS and live FREE and CLEAR! How is this your last chance to "HIT IT BIG? Michael Dell started with $1000. The initial investment in FaceBook by Eduardo Saverin was $5000 (as described in "The Facebook Effect"). What can never work (certainly more than a lucky once or twice) is betting the farm on one single trade. In fact, that's probably how he came to lose so much in the first place. One really shouldn't be risking more than 1% per trade, and probably even less than that. For your best "sure thing" bets, okay, if you've got a cushion, maybe you can go up to 2%. Some would even stipulate that's foolishly high for a single trade. In F.S.'s case, even if he plays it to perfection, for him that would be like winning the lottery TWICE. And how many times have we seen stocks that had blow-out earnings and tank, or vice versa. In trading, it's not so much about the news, as it is the reaction to the news that counts.

Perhaps worst of all is that F.S. does seem to understand this, but his denial, desperation, FOMO (Fear of Missing Out), and YOLO (You Only Live Once) mentality has completely overtaken his better judgement:

Some of you might have noticed the (subtle) changes in my personality and demeanors. It is time for me to stop making a fool out of myself and stop suffering. I am tired of perpetually losing money. That Google trade was the last straw. Even though I called the earnings perfectly, I still somehow lost money. The stock market is rigged and I am done with it.

There may be plenty of examples of how the markets are rigged. However, this is not one of them. This is simply an example of how markets are anticipatory and forward-looking. If everyone expects the same thing, you'll probably get the opposite. If you're messing with options, especially going into earnings, you're fighting over-inflated option premiums as well. It's one of the toughest "games" of all.

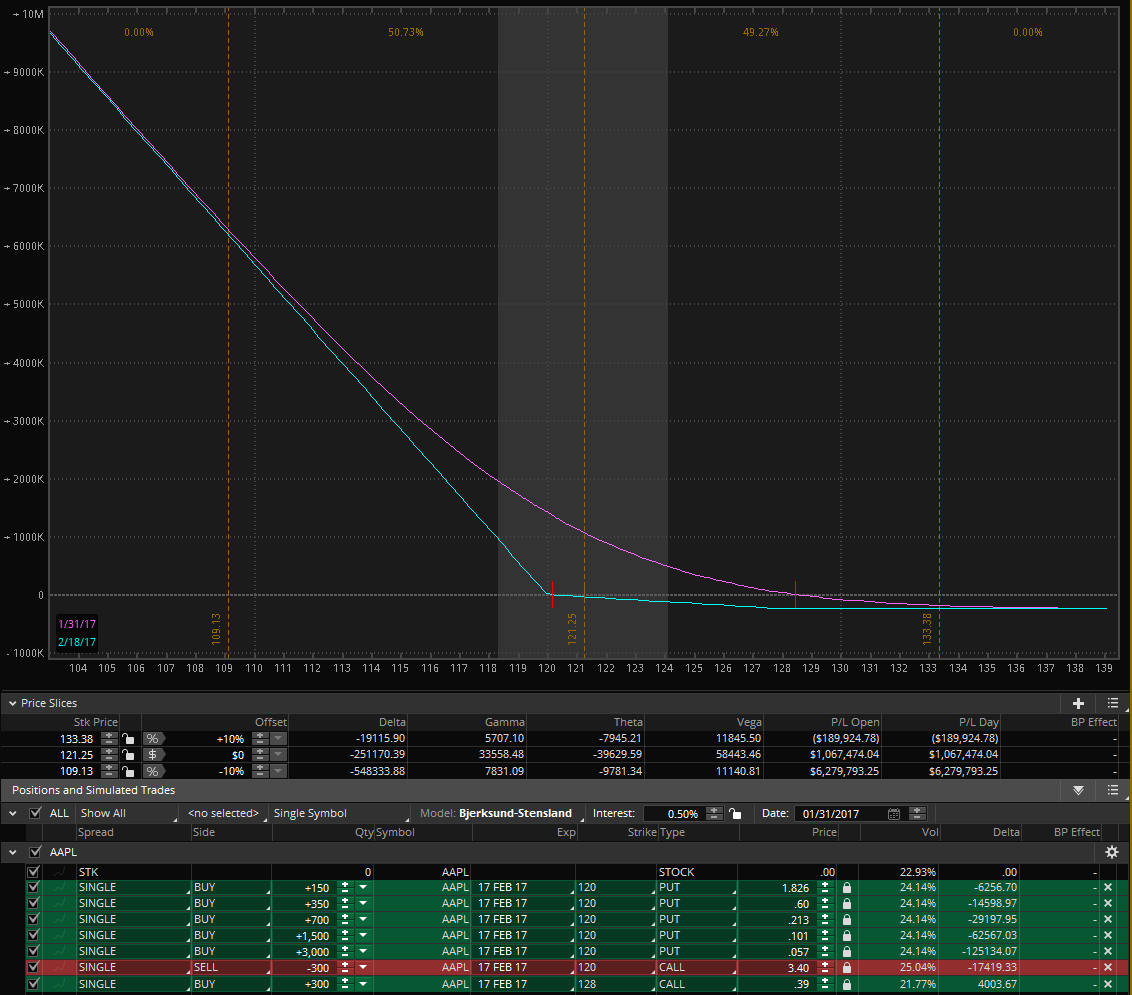

And F.S. doesn't once mention the option greeks in his analysis. Furthermore, the bulk of his options ($100 Feb 17 '17 PUTs) would require a 20% underlying move in AAPL by Feb 17th just to break even. Of course, with options that's often irrelevant as one must consider the complete picture. And while it's not the worst model I've seen (his breakeven point at expiration is around $128.50/share in Apple), his position size should be a 10th of what it is now to accommodate his current account size. This is what his trade looks like as an option model:

On Risk Management

Here's an interesting bit from Michael Platt's (BlueCrest Capital) interview in Jack Schwager's book "Hedge Fund Market Wizards":

Perhaps the most potent risk control Platt employs in BlueCrest’s discretionary strategy is maintaining an extremely tight rein on what a trader can lose before capital is withdrawn. A mere 3 percent loss is enough to trigger a 50 percent reduction in a trader’s allocation, and the same small additional percentage loss is all it takes to remove a trader’s entire allocation. These rigid rules seek to prevent any trader from losing more than 5 percent of his initial stake. (The combination of two successive 3 percent losses is less than a 5 percent loss because the second 3 percent loss is incurred on only 50 percent of the starting stake.) In his own trading book, Platt is subject to the same rules as his traders, but he has never approached the 3 percent loss point.

Every January 1, BlueCrest traders reset and start off with the same 3% stop point. However, if a trader's done really well the previous year, they can opt to roll some of those profits over as an additional "cushion" to the 3% going into the next year. For background on BlueCrest, over 11 years the fund achieved an average annual compounded net return of just under 14 percent while keeping equity drawdowns to under 5%.

While I could keep breaking down F.S.'s "justifications" and misconceptions, perhaps I can cover more ground by highlighting this one:

One final thing. I don’t know if God exists. I won’t pretend that I suddenly believe in Him (or Her), like so many do in their time of need, but if you do exist God: please, please, please, please, please help me. I have never been lucky in this life and you have thrown many obstacles in my way, but if you help me here, everything is forgiven. It’s not that hard to break that $100 floor and once that happens, it’s game over – I’m rich. I know the earnings are going to suck. Don’t let big banks screw me once again.

F.S. didn't have a dime to his name, and was bequeathed $2.5 MILLION from an uncle everyone thought was broke... Yet, he's NEVER BEEN LUCKY... Now's there's a twist of perception if I've ever heard one. Perhaps I shouldn't judge, because I'm sure we've all been guilty of such nonsense at one time or another. And blaming the banks? F.S. needs to spend some more time reflecting (as can we all) on some of the real injustices that go on in the world every single day. Here's just one of them... Flawed Justice After a Mob Killed an Afghan Woman.

THE STORY GETS BETTER...

ONCE again, RESPECT goes to Martin Shkreli, who reaches out to F.S. Comeau on a livestream this evening and tries humbly talking some sense to him by sharing some of his own knowledge and experiences. Taking in "the view" from the cheap seats, the more they speak, the more you realize how little F.S. really understands about trading, and how far in denial he's gone in his quest to "get his money back":

I expect to make close to a million from that trade, although there is a lot of possible variance. Obviously, I wouldn’t be happy with the $100,000 scenario as this is my chance, and probably my last chance, to get my money back. Note that even if apple doesn’t go below $100, my $100 strike puts will gain in value if Apple drops to $109 post-earnings, so I might make a bit more there.

And if this isn't the ultimate sign of an addicted gambler in denial and despair, I don't know what is:

In therapy, I was told that the most important thing was being honest with yourself. I’ll be honest with yourself and also myself: I’m not a good trader. I’m so tired of losing. I wasted two years of my life on this bullshit. No matter what happens, this is my last trade. After that, I am moving on and never, ever even thinking about finance or stock ever again. Two years of perpetually losing money are enough for me. But recently, I have been on a hot streak (100% success recently) and I just need the streak to last one. last. time.

Among many other great points, Shkreli schools F.S. in historical analysis and in never risking more than 1% of your bankroll / portfolio per trade. Shkreli also calls him out for being an addicted gambler. He chastises F.S. for even considering bankruptcy... it'll haunt him "forever", and tells F.S. to pay his debts off. $300,000 is NOT chump change. Some Billionaires have started with a fraction of that amount. And what's the rush that F.S. feels "compelled" to "make it all back" in a single "home run" trade?

I could keep going on about the conversation, but frankly, anyone interested in trading or investing would be well-served to take the time to watch the livestream themselves. Even seasoned traders and investors can benefit from this, as these lessons cannot be pounded in enough. Just ask Billionaire Bill Ackman and his "masters of the universe" ego about his $$Multi-Billion "can't lose" Position in Valeant...

F.S.'s Full Story on Reddit: Well, this is it: Going All-in. My last stand. My final Yolo. $2M-5M possible payoff.

Video Link: "Crazy $AAPL guy" FaceBook LiveStream with Martin Shkreli and F.S. (starts about 10 minutes in)

And remember, while you can't control what happens on any given trade after you "pull the trigger", the one thing you can always control is your risk and position size. It's not about how much you can make, but HOW MUCH you are risking that counts. Focus on managing your risk on a well planned strategy, and the rewards will come in their own due course.

UPDATE

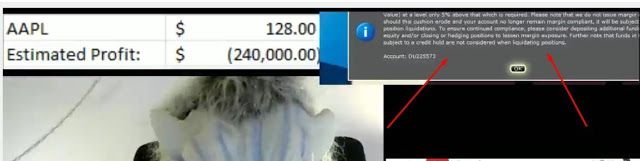

So... it turns out not only did the trade not work out (who would have thought!) with AAPL currently trading over $125/share (Apple beats Q4 expectations, boosted by strong iPhone sales), but apparently someone went through a bunch of F.S.'s YouTube videos and found a reference to his IB account number which starts with a "D" (indicating an IB Demo Account) and can be linked to the same account he claimed to use for his YOLO option trades:

Full Story: Traders Huge Bet on AAPL- Fake blow up video - Fail

So, just another self-aggrandizing douche bag. On the positive side, the "lessons" in humility and sound risk-management that can be gained from this "episode" still remain.