Steemers!

It's @jasonmcz again form Firstblood.io! If you missed my self-introductory blog last time, here is a

link to the post.

The Beginning

24 hours ago I was browsing the through some of posts about the Steem Internal Market posted by @blakemiles84, quickly learned that some whales / early players who are making the market are doing wash trades against themselves.

The fuck is Wash Trade?

For those of you who don't understand the concept of a wash trade, here is a link to the wiki page explaining the definition of a wash trade and why it is illegal.

In short [wash trade] is a form of market manipulation in which an investor simultaneously sells and buys the same financial instruments. Why? For 3+1 reasons:

1. inflate the volume

2. commission fees rebate

3. ping an instrument price onto the tape to cheat on derivative product settlements.

4. some jurisdiction allows loss resulted from wash trades to be deducted from tax.

yeah but..

In this case, the wash trade had a purpose, which is to game the liquidity reward.

A reward totals 1,200 STEEM /hr or a dollar equivalent about $3720.00 /hr.

Last 24 hours

After reviewing all the archives on the topic of liquidity reward and internal market, I've decided to make market myself and see if I could take down those whales who are consistently getting those fat rewards.

some of those might think being a market maker needs a set up like this to watch the book, chart and signals..

But in reality, in this electronic trading world...Market making looks like this

You have elegant robots with just few dozen lines of code or a complicated system that has tens of thousands code and has the ability to learn from other peoples trades and its own mistakes.

Finding The APIs

Due to lack of documentation from Steemit official site about the internal exchange part forced me to look around for other solutions. Thanks to @Xeroc Fabian's post, I was able to set up something running really quickly with his steemit-python interface:

from pprint import pprint

from steemexchange import SteemExchange

class Config():

witness_url = "wss://this.piston.rocks/"

account = "xeroc"

# Either provide a cli-wallet RPC

wallet_host = "localhost"

wallet_port = 8092

# or the (active) private key for your account

wif = ""

steem = SteemExchange(Config)

pprint(steem.buy(10, "SBD", 100))

pprint(steem.sell(10, "SBD", 100))

pprint(steem.cancel("24432422"))

pprint(steem.returnTicker())

pprint(steem.return24Volume())

pprint(steem.returnOrderBook(2))

pprint(steem.ws.get_order_book(10, api="market_history"))

pprint(steem.returnTradeHistory())

pprint(steem.returnMarketHistoryBuckets())

pprint(steem.returnMarketHistory(300))

pprint(steem.get_lowest_ask())

pprint(steem.get_higest_bid())

pprint(steem.transfer(10, "SBD", "fabian", "foobar"))

Setting something up isn't hard but winning that liquidity reward is insanely hard especially when you have few people who are already extremely well established with their book. I transferred some ETH via blocktrades to convert into my initial liquidity capital (STEEM).

I was pretty confident that I was going to score all the liquidity points by providing the tightest spread in the market.

Then I was WRONG.

Algo_Bid: 3.239 x Algo_Ask: 3.2410000000000003 Thanks to those well documented API. I was able to set up my robot and consistently provide a spread as low as $0.002, however providing the tightest spread doesn't mean anything and certainly doesn't earn me anything to the liquidity reward.

But why is that?

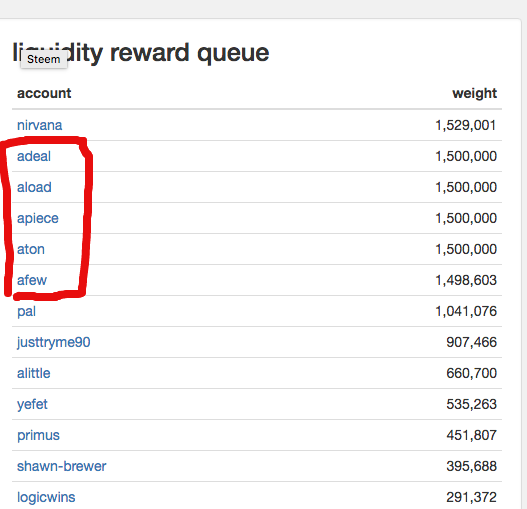

The 'A****' & Nirvana/Ledzeppelin/thebeatles/thewho Clan

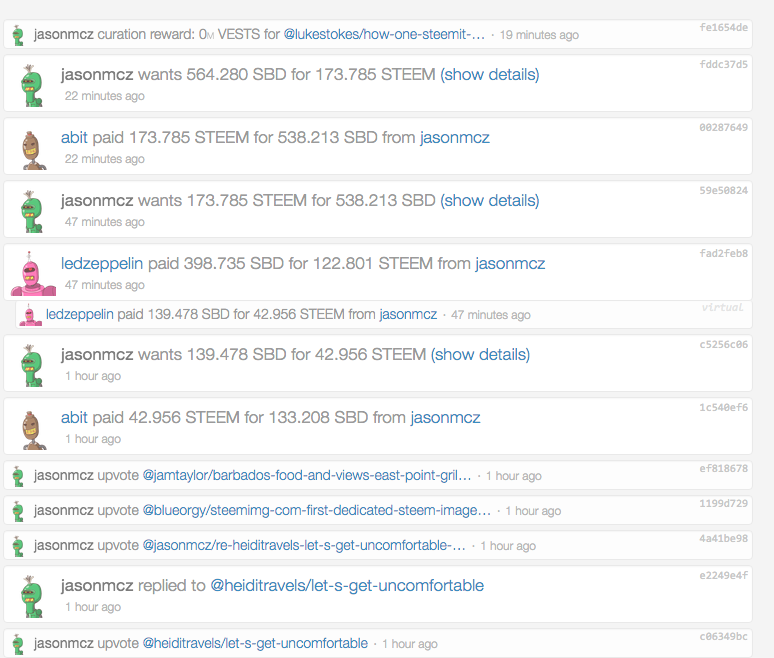

adeal, abit, alittle, aload, apiece, aton, afew -- the 'A' clan is controlled most likely (my speculation) by one person

Nirvana, theBeatles, the Ledzeppelin/thebeatles/thewho accounts are probably controlled by the same person as well

It's strange and interesting at the same time to witness how the 'A' clan and the Nirvana clan were adjusting their trading strategies after the change to liquidity reward calculation in the last implementation.

[Now Liquidity Points are only applied to those open orders remains on the book for more than 30 minutes]

Now instead of wash trading every couple minute, they will place big wide orders on the order book with a huge spread. We that know with that $0.15 - 0.20 cents -- it is quite discouraging to people who want just to trade and with the less trades happening at the spread they are providing.

They were able to utilize multiple accounts to wash trade every 30 minutes to take out the very liquidity they put on the book themselves.

AHHHHH... THAT'S WHY I HAVE NO LIQUIDITY POINTS.

Cuz my tight orders were eaten by them before they could hit the 30 minute mark, and it seems like the last thing they'd be concerned about is to provide orders with tight spread. Isn't this counter-intuitive in the way that encourages liquidity reward takers to place their bid/ask away from BBO?

The Change of My Strategy

Knowing I have no chance to compete with whales on that fat check given by the network even tho the liquidity that I provide is obviously tighter than theirs. I've decided to change my strategy entirely. Instead of providing tightest liquidly on the market, I wrote a Robot that detects A clan and Nivara's orders.

Robot will scan the orderbook and identify where the whales are and then place my orders one level above or below them so in order for them to wash trade they will have to eat the orderbook up from me first, but this time with bigger cost.

Now I am collecting few bucks on each trade they make! but HELLO??? Why are they collecting 1200.00 STEEM when I am real MM who's ACTUALLY providing order flow on top of the orderbook

The Conclusion

To be honest, as someone who has been prop trading for past 8 years on equities, derivatives and cryptos (on exchange) this strange structured liquidity reward thing is completely a new animal. I've never seen anything like this -- especially the part that all orders have to be on the book for ( 1minute before) 30 minutes. Perhaps @jl777 is right on his comments earlier or perhaps I just fail to see the bigger picture this time.

I am not saying this is not doing its job but rather it's counter productive from making a liquid market for STEEM community. There is a reason why some exchanges let market makers compete on the order flow and get rebate (solely) on liquidity takers fees. Just my two cents.