Critics are beginning to turn their eyes to Steemit, even people in the cryptocurrency space - Bitcoiners. The cries of "Ponzi scheme" seem strangely ironic, as it seems like months ago the critics of Bitcoin were parading the same rhetoric.

The thing is, if you want to examine a new idea, or an implementation of a new idea, and you examine it through the lens of old conceptual frameworks, you may be mislead. To examine a new idea, we must examine it at a more fundamental level - we must examine the principles.

A New Paradigm

In the Dotcom Bubble of 2001, many people became overcome with "irrational exuberance", purchasing any company which had ".com" in the name.

In 2013, many of us were again overcome with excitement - this time for Bitcoin. I remember buying a single bitcoin for as much as $900, believing that it might continue going up for a long time, maybe to $10,000. When it went back down to around $200, I was certainly puzzled.

Of course, during both of those years, many people were misguided about where to put their money, falsely believing that "it's different this time!" or "this is the new paradigm! It's going to go up forever!" Investing on emotion and putting the money in close to the top were mistakes, but we weren't entirely wrong when we proclaimed that it was different that time. On the other side, people were of course shouting "Greater fool theory!" and "Bubble!" and "Ponzi scheme!" Both sides were mistaken, in different ways.

The investment in the Internet eventually lead to many innovations. Before 2001, it was more convenient for me to use an encyclopaedia or go to the library to find reliable information. Now, information is so easily accessible and so cheap to access, that people will even label it as "free". The excitement around Bitcoin is leading us to a world where anybody can send money around the world cheaply, without concern for capital controls or large transfer fees.

We probably are going to see a bubble in Steem, if not several, if we're not seeing one already. However, the occurrence of a bubble does not preclude the possibility of a new paradigm.

Where does the money come from?

If we want to know where the money comes from, first we have to ask "What is money?"

What is money?

Of course, many people were left scratching their heads about this question when Bitcoin first started to gain notoriety, especially economists. Certain economists opined that there was no way that Bitcoin could ever be money, as it didn't originate from a good which was originally a commodity, others wondered if it fit their theory in a way which they didn't expect, some others said that perhaps it shattered their previous conceptions of money, and still others chose to simply ignore it.

Money, at its purest, is a representation of value. The better something represents value, in all its aspects - being readily and widely accepted, maintaining, or even increasing its purchasing power with time, durability, fungibility, scarcity and so on - the better suited it is to be used as money. The better a digital or physical commodity aligns with the abstract qualities of value, the more likely it is to be called "money".

Money or shares

It's curious that people think of Steem as "money", and say that Steemit is "giving away money for articles". According to the everyday definition of the word, it's not really "money". There aren't really any marketplaces in the world where you can walk in and spend your Steem - except of course, to buy other currencies. Steem is really only money if we use a particularly broad definition of the word "money" - one that must also include shares.

Oddly enough, when Peter Thiel purchased a 10.2% share of an unprofitable company in 2004 for $500,000, nobody asked "But where did the money come from?" - not the money that he spent, but the money that he purchased.

In the summer of 2004, Peter Thiel purchased 10.2% of Facebook for $500,000, putting his valuation at approximately $5 million. Source: Business insider However, it wasn't until September 2009 when Facebook stated that, for the first time, it was cashflow positive. Source: CBC.

So why did Thiel pay for a share in a company which was unprofitable? It wasn't because he was duped - though he may have been told many things which were not yet true.

Shares are a representation of value, a form of money - though again, you can't go to the store and pay for your groceries with Facebook shares. (However, you may well be able to buy another company with them.

So, Thiel traded in his dollars for a different kind of currency. Where did that money come from - the money that he bought? Or later, when people paid $38 per Facebook share at the IPO, where did that money come from? Where did the value of the shares come from?

Thiel paid because he had an expectation of the future value of Facebook. Of course, the expectation was that the company would one day make a profit, and that would be the driving factor in increasing the share price. However, that's merely a secondary datum - a detail which he used to estimate the future value. The more important point was that he estimated that it would indeed have more value.

The illusion of value, or: The perception of value

Pep

There's a classic episode of Ducktales in which Fenton Crackshell intends to prove to Scrooge McDuck that he has some entrepreneurial nous, and he starts filming a commercial for a product that doesn't exist. The commercial gets played by mistake, and suddenly the entire city is looking for where they can buy Fenton's imaginary product "Pep".

Demand can exist for a product that doesn't even exist. Something which doesn't even exist can have value. Fenton produced a commercial for a product that didn't exist, which people were willing to pay money for. Pep had a price, a dollar value, and people were willing to pay that price. Where did the value come from?

Stone Soup

Some soldiers arrive at a town, hungry and broke, and they realise that the townspeople are so scared of them that they don't want to share any of their food. One clever soldier tells the townspeople that he's going to make a special kind of delicious soup, using a magical stone which can give an amazing flavour to the soup, the likes of which they had never tasted before. A local chef was curious, and offered his pot and some water from the well. Each of the townspeople offered a little something, some vegetable scraps and a lambbone, in their excitement to try the stone soup. In the end, the soldiers and townspeople enjoyed the soup, and it was indeed the best soup they had ever tasted. The soldier discarded the worthless stone in the forest.

What did the soldiers trade to get the soup? Where did the value come from to buy the ingredients?

A trick

Many people will read the story about Crackshell and the story about the soldiers, and they will assume that the events in the stories were nothing more than con games, and that those who bought in were tricked. However, there is a greater principle to be demonstrated. As Napoleon Hill once wrote:

All master salesmen know that ideas can be sold where merchandise cannot.

The illusion of value can be, in certain cases, indistinguishable from value. Given that money is merely a representation of value, does that mean that the illusion of money can be, in certain cases, indistinguishable from money?

Attention has value

When Fenton told Scrooge about his "mistake" of playing the fake commercial on television, Scrooge was ecstatic, because he knew the fact that people looking at the ads for Pep, talking about Pep, getting excited about Pep, meant that Pep had value in their eyes, and so his eyes turned to dollar signs.

Likewise, when Thiel saw that people were using Facebook, talking about Facebook and getting excited about Facebook, he knew that Facebook had value in their eyes.

So, when we look at Steemit and Steem... well, you see where I'm going with this.

Are you buying?

In the Ducktales episode, Crackshell sold the idea of a product so exciting and sexy that everybody bought it. In Stone Soup, the soldier sold the idea of attempting to make the best soup anyone had ever tasted, and the people bought it. Mark Zuckerberg sold the idea of an easy-to-use social network which would change the face of the web, running parallel to search engines or even eclipsing them. When you buy bitcoins, you buy the idea of a currency which cannot be controlled by central banks, which is designed to evade politics.

Dan Larimer, Ned Scott and their team are selling the idea that there can be a social network in which all of the contributors and moderators are paid with the shares of the "company". Many people like the idea, and many people have bought it.

A stable currency

Of course, there are many technical details about the way the site and currency have been structured which give it a greater chance of success. These have been explored at length, but here are a few quick points:

- Steem dollars are pegged to the almighty dollar, making regular people much more comfortable with using them. After all, only the most hardcore gamblers really want to use a currency that may go up or down 10% between breakfast and dinner.

- Steem power is very illiquid. That means there is a constant demand for Steem, which again, stabilises the price, and makes it more comfortable for regular, non-crypto nerds.

- The use of the currency is linked to a social media site - a medium which more than a billion people in the world are already using and comfortable with.

- Zero transaction fees. This is a rather small thing in the grand scheme of things, but among cryptocurrency enthusiasts who have seen the amount of unconfirmed transactions rising to a 30,000 unit backlog, encouraging bitcoiners to pay larger and larger transaction fees, this may become an important selling point in the future.

Domination, baby

[Interviewer]

So what's like, I mean what's like your ultimate goal against in this industry?

[Method Man]

Domination baby, fuck that

Social networking is only the first stage

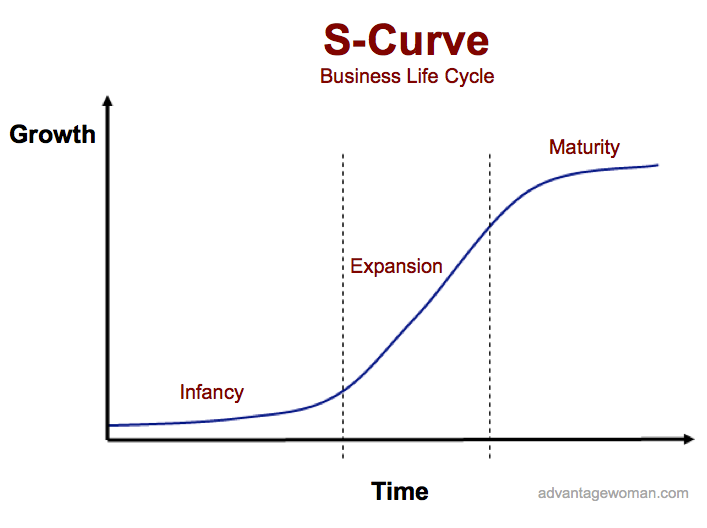

Once Steemit reaches a maturation point on the S curve, you might think that growth in the currency will slow, or even that it will collapse. But by that stage, when Steemit and Steem are as common as Facebook is today, people will be using crypto for all kinds of transactions. That means that Steem's growth as a currency is not limited to social media, and that means that it's posssible that the market cap can continue to grow as long as the Earthling economy continues to grow.

Conclusion

These are a few of the reasons that Steem and Steemit might very well transform the world, in one way or another.

The Internet set us up for a world where we can easily see that encyclopaedia are out of date by the time they're printed, where the vast majority of the information available to the human race is available to us, now, at such a low cost that we can call it "free".

Facebook put us in a world where we can share our ideas, and see our friend's ideas, a world of viral media where the thoughts of an everyday human being can be given a platform - and can have a dollar sign attached - when it comes to the shareholders.

Bitcoin changed the world to one where the power of money is in our own hands, and has the potential to be free from manipulation by powerful interests - giving the power to print money to many miners, rather than a handful of central bankers.

Steemit combines those three paradigms in a way that makes information not only free, not merely accessible, and not only monetarily valuable to shareholders, but monetarily valuable to all of us, making most of the benefits of the ability to print money available to all of us.

#steemit #beyondbitcoin #circle-jerk #blockchain #crypto #cryptocurrency #disruptive #steem #steemitsocool #bitcoin #blockchain #business #facebook #social-media #cryptonews #economics #market #money #ponzi #psychology #steem #steemit-adoption #steempower #thoughts #writing #steemenomics