Your boy @doggedfi is back. Let's cover Part III in the FI/RE series (Financial Independence / Retire Early). You ready?!

Just Take The Free Money Already!

I don't know about you, but I encounter VERY few opportunities to take advantage of free money. Why wouldn't you if you have the chance? Many do and never reach out to snag those free.99 dollars.

So some of you may be confused. When I say "free money", what do I mean? Well, for those of us that work for employers and have benefits from said employers, one such benefit may be a 401k/403b employer match.

This means that if you agree to fund your employee retirement account, your employer will also agree to match your contributions to a certain extent. HELLO FREE MONEY!

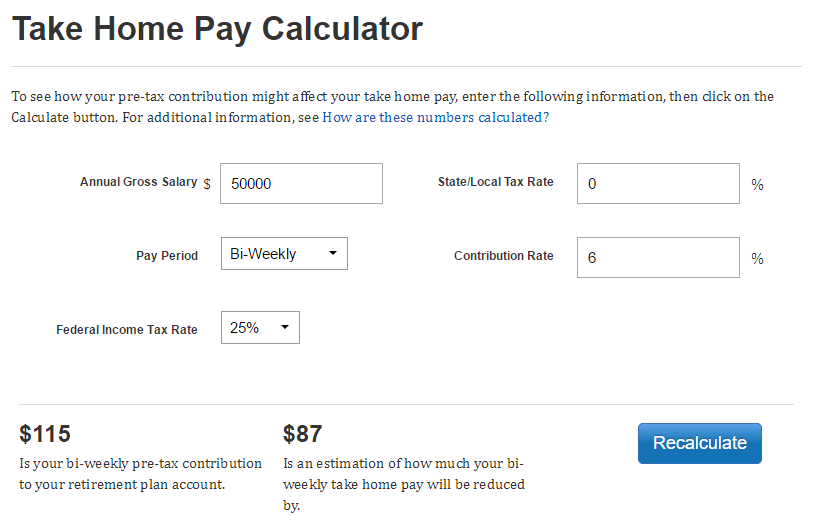

For example, if I elect to invest 6% of my yearly salary into my 403b account, my company will automatically invest 6% as well, dollar-for-dollar. If my salary is $50,000, that means I am sending $3,000 a year to my retirement account... and my employer is also sending $3,000 a year to my account.

But I Can't Afford To Contribute - No Wiggle Room!

It is important to note that when you contribute to your retirement account, it helps you in 2 ways:

- It is not a 1:1. If I elect to invest 100$ a paycheck, the amount of money I take home is not -$100, its a little less. This is because..

- Investing in your retirement account lowers your Adjusted Gross Income (AGI), meaning you are funding your retirement while simultaneously paying less overall income tax for the year.

Check out this nifty calculator that will tell you how much it "costs" you to invest any given percentage in your retirement account each pay period:

Closing Thoughts

If it is available to you, ALWAYS take advantage of the free employer retirement match. Also, the annual contribution limit for your 401k/403b retirement account is currently $18,000. Your employer's contributions to your account do not count toward this limit.

As we continue through this series, we'll hopefully get you to a point where you can max out annual contributions to your retirement account to get you to retirement quicker than normal!

Cheers!

Just in case you missed any other parts of this FI/RE series:

Part I: What is Financial Independence and why should I care?

Part II: Preparing For Emergencies

Recommended reading:

The Simple Path to Wealth

Mr. Money Mustache

The Mad Fientist

Personal Finance subreddit

Financial Independence / Retire Early subreddit

@doggedfi

for the Minnow Support Project,

brought to you by rockstars such as

@aggroed, @acidyo, @ausbitbank, @canadian-coconut,

@teamsteem, @theprophet0, @Someguy123, and more.

.png)