Veritaseum was founded by self proclaimed genius, Reggie Middleton. Veritas, the coin, makes me throw up in my mouth just thinking about it. But, if you bought the Veritaseum ICO, you would have made a ton of money. That's the case with a lot of ICOs these days. My vomit aside, let's dig in and try to understand what the coin is, who Reggie Middleton is, the fundamentals, and some technical analysis.

What is Veritaseum

"Imagine Having the Keys to the Internet in 1994". That is literally is all the info you will get by going to the main website. Did I already mention Reggie Middleton is a genius? What more do you need to know...just give him all your money now and skip reading the rest of this forensic evaluation.There is very limited useful info on the main Veritaseum page. 95% fluff, 5% content. There is one snippet that says "Veritaseum enables software-driven P2p capital markets without brokerages, banks or traditional exchanges". The rest is all about how you missed the internet in 1994, a "forensic valuation for ripple", pricing for Veritas, and blogs about the economy.

What is Software-driven P2p capital markets?

Reggie is playing off people's distrust of corporations and banks. In simple terms, this idea implies that Veritaseum will allow people to trade stocks and other investment vehicles without going through banks, brokerages, etc. The veritaseum token will be able to represent many different types of investments. The idea sounds similar to bitShares...essentially the token is a derivative or representation of something else.

Why is this horse shit?

- There is very little info available on the stock exchange idea on the Veritaseum page. Most of the info is about random economic news or predictions. By the way, if you missed investing in the internet in 1994, send me all the SBD in your Steemit account immediately. You won't regret it.

- The website is a hodge podge mix of random stuff. There is no flow, no clear info, and looks awful in general. It actually looks like it's a website from 1994.

- The one product that is being touted on the Veritaseum page has nothing to do with the P2P capital market trading. What is being sold is analysis on different coins. You have to pay Veritas tokens to see these magical evaluations. The only one available today is on Gnosis, this one is a free teaser.

- The Gnosis teaser evaluation is complete garbage. It's a cut and paste job off the Gnosis website essentially. @SteemCleaners (the friendly Steem plagerism bot) would have a field day with this report. The only thing that was not cut and pasted was revenue projections. The Gnosis website is pretty nice actually, I'd much rather get my info from there than read a 30 page PDF.

Stock Market isn't coming to decentralized blockchain anytime soon

Bitcoin and Ether are the 2 most accepted coins and even they are not widely accepted by mainstream yet. The Bitcoin ETF hasn't been approved yet in the US and there are only 2 funds that are available for investors to trade BTC like a stock (one small fund in the US and one small fund in Europe). Most big investors are weary of investing in the volatile crypto currency arena. Sure, there are some big name investors...but it's a tiny percentage.Stocks are centralized and highly regulated. Most crypto currency is not. I'm a pessimistic person, but is there really demand from crypto currency holders to trade stocks with it? All I see on Steemit are people upset about the possibility of the US asking about your crypto holdings on flights, and how we have to pay tax on every crypto transaction as if it's a stock. Those 2 are painful for me too....and whenever the time comes that we can trade stocks via crypto, there will also be 1,000 times more regulation. I really hope that isn't anytime soon!

Without that addition regulation, I have 0 trust in Reggie Middleton to make sure these trades are done appropriately. Crypto is exciting, volatile and can be very profitable. But, let's not be naive and think that people with a significant amount to invest are going to put it all in a crypto inorder to buy a stock. As a generality, people accumulate wealth as they get older. As they get older, they want less and less risk because they worked hard for that money for several years. Taking less risk means they want more regulation and safety nets. Buying a stock derivative from Reggie Middleton doesn't provide that. I buy crypto to buy crypto..not stocks or real estate or other traditional investments. Stocks are done through a regulated financial institution and fees are extremely low these days btw. $20 of fees to buy $100k of stocks...that's basically non existant.

Who is Reggie Middleton?

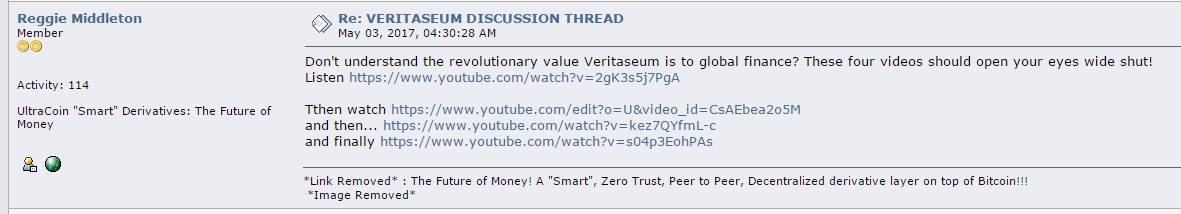

Reggie is an analyst and blogger. His website is called BoomBustBlog and it's actually a decent blog. He was also on CNBC as a guest a few times....CNBC has a LOT of guests on every day btw. Reggie uses the fact that he was a guest analyst to remind us in every one of his useless youtube videos. Please go watch some of his videos. I'd recommend the 4 videos Reggie recommended investors watch to better understand his ICO 2 months ago. Here is what Reggie posted on BitcoinTalk as part of the Veritaseum ICO announcement.

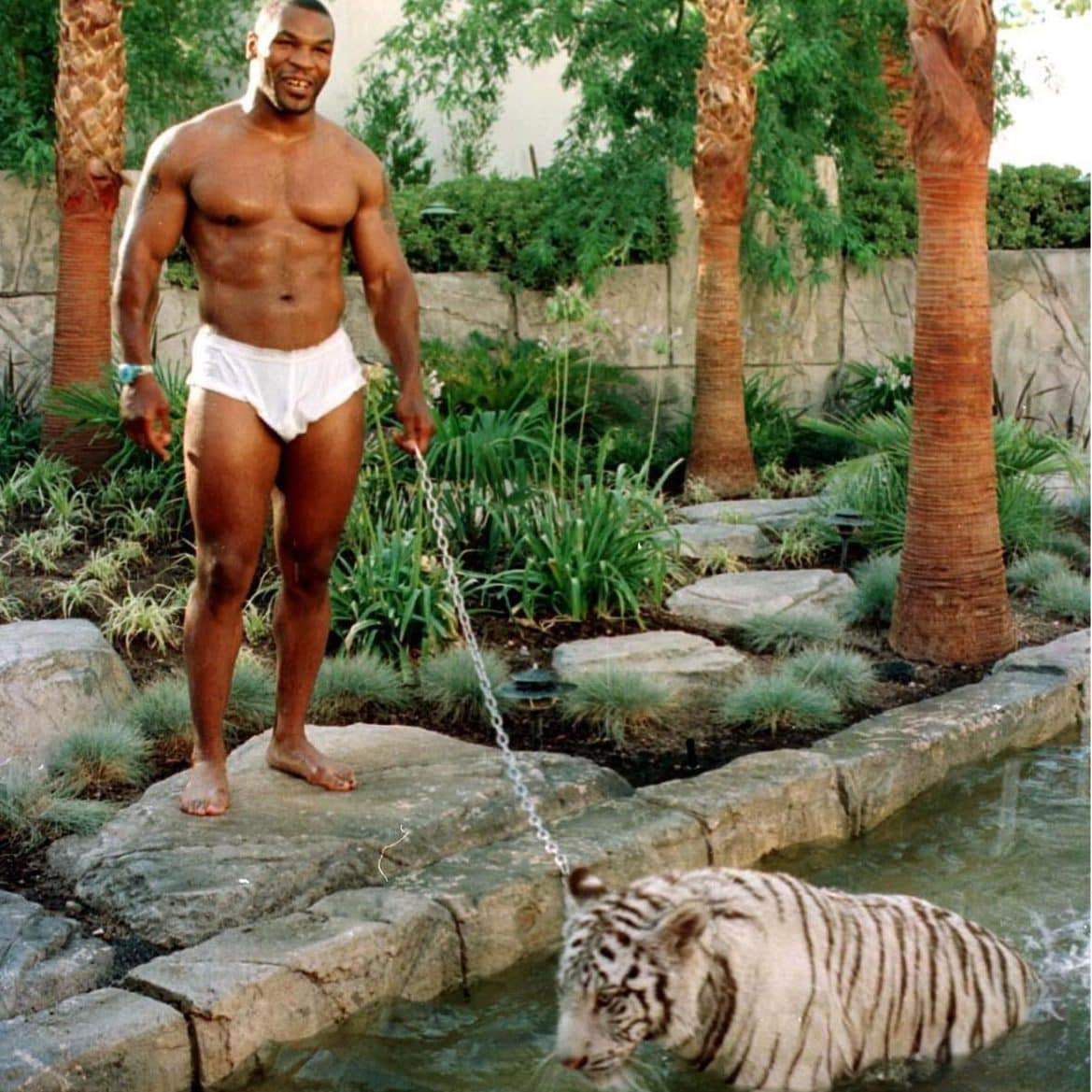

The first video is a random propaganda type of video about how you shouldn't trust corporations and banks. I don't...so what? The second video's link is broken. The 3rd and 4th videos are comedy gold...like many of Reggie's other videos. The intro to most of the videos is a chorus chanting "Reggie Middleton". There is a leopard (or maybe a cheetah) walking across the screen. And audio from Reggie's CNBC appearance that repeats "Contrarian Bad Ass Reggie Middleton". It's as catchy as it gets. Lots of fluff...marketing genius. I'm not sure if Reggie is selling a used car or a worthless token. I'd probably be more likely to buy a used car from him though.

Technical Evaluation

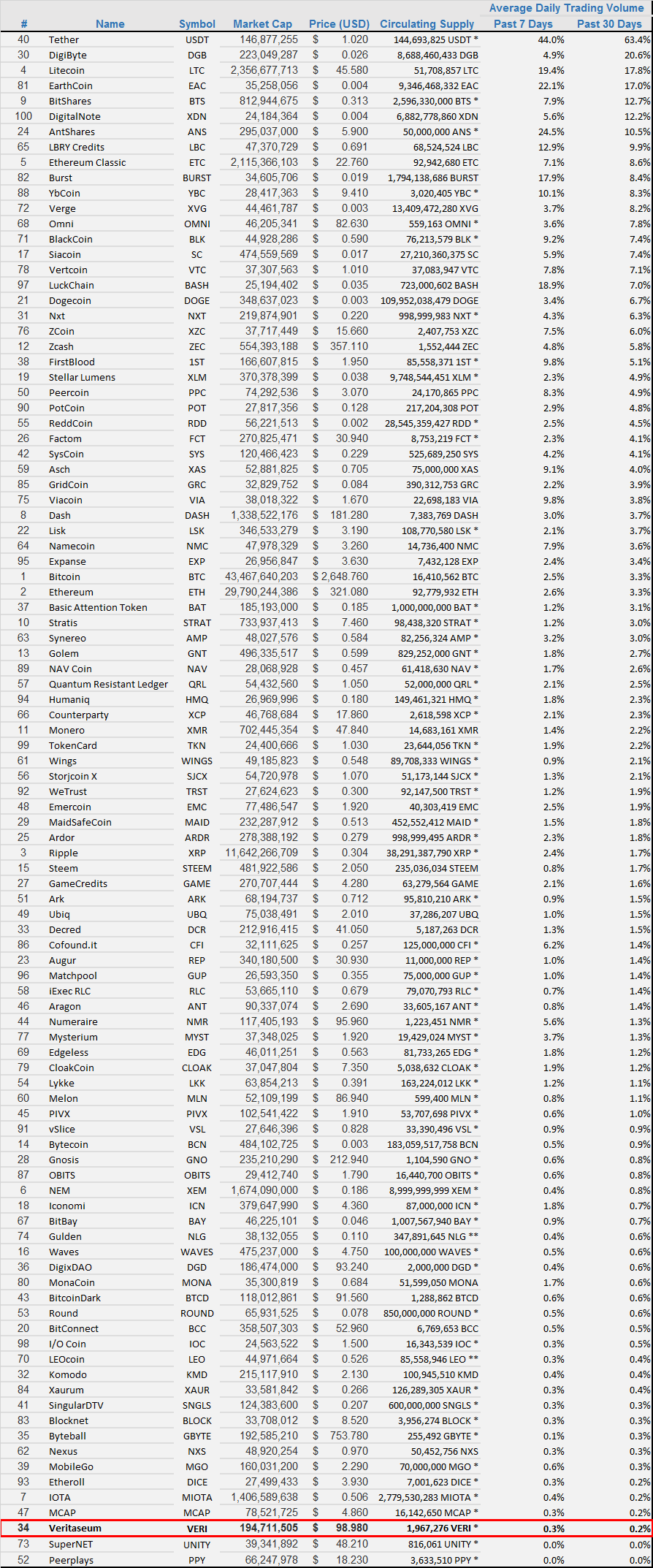

The Veritas token has a supply of 100 million with only 2 million in circulation today. Market cap is listed at $166 million. The only place to get the tokens is on EtherDelta. No offense to anyone affiliated with EtherDelta, but today that is a rinky dink exchange. There is practically no volume being traded....and Veritaseum is the largest volume coin on there.Let's look at the volume of the top 100 coins on Coinmarketcap and what kind of volume they trade on a daily basis. The average is 4% for the past 30 days. This means that on an average day, 4% of the total coin's marketcap will be traded. If we take out the top 10 high fliers, we end up with 2.4%. Where does Veritas rank in the top 100 coins? Spoiler alert, it's 98th out of 100!

This means that the valuation is bogus. When Veritas moves to Poloniex, Bittrex, or another exchange with high volume, then we will see the true value people are willing to trade it at.

Conclusion and Announcement

The problem Reggie Middleton is trying to solve is that financial and corporate institutions are not trustworthy. The only thing his "solution" solves is how to get money in his own pocket. He is part of the problem, not the solution. Regulation exists to keep investors safe from people like Reggie. I will 100% agree with Reggie's self assessment that he is a genius. And he is successfully ripping people off with his marketing genius.This is a free detailed analysis on Veritaseum aka scam coin. Future evaluations will cost you FinancialCritic Coins. Cue the music and the tiger. ICO coming soon...