You know what really grinds my gears? Paying interest. In any amount. To anyone.

Unfortunately, I don’t think many of us understand or even think about how the interest on our debt really affects our lives.

I found this statistic from credit.com that figured the typical American will pay $279,002 in interest over the course of their life. I imagine this statistic is similar in many other countries as well.

$279,002

Let that sink in for a moment.

Then figure out that they would have to earn more to pay the taxes on their income, at a tax rate of 25% that is an additional $69,750.

All this doesn’t even count the years you will have to work to pay off the principle borrowed.

It’s basically $350,000 and at an average income of 50K a year it would take seven years to pay off.

SEVEN YEARS of your life working to pay the banks. Seven years.

I took this definition of slavery straight from Wikipedia. ”While a person is enslaved, the owner is entitled to the productivity of the slave's labour, without any remuneration.” Remuneration is the compensation that one receives in exchange for the work or services performed

So the owner of a slave is entitled to its productivity (income), without compensating the slave.

Debt seems similar to slavery, but a closer comparison would be indentured servitude. An indentured servant signed a contract for the debt and could at least become free after paying it off, unlike a slave. (Coincidentally, the normal contract for an indentured servant was seven years as well)

That’s why I hate it. That's why I avoid it. I want to be free. If you want an easier road to financial freedom you should be aware of the dangers of paying interest. Currently, the only interest I pay for is on my home, but I want that gone too.

I am sure some of you will tell me that in the future you will be paying off that debt with inflated money thereby making it cost less. $1000 today is way more than what $1000 will be in 30 years.

True, but do you think banks are giving you the loan to their detriment? Additionally, in an installment loan most of the interest is at the beginning of the loan – when the money is still at full power.

Still, paying interest has the benefit of you being able to use the item right away. That’s why I have a mortgage, the benefit of purchasing my home was more than the cost of the interest. Of course I chose to have a 15 year loan instead of the more common 30 year.

Still, I hate seeing that interest accumulate.

Since interest is a powerful thing, what if you could get it to work FOR you?

You could have your own force of indentured servants going out there and working to pay you back for the privilege of using your money.

One way I have done that is by funding loans on Lending Club. You could also buy bonds, government or corporate, if you wanted.

You could even take loans out to buy productive assets, like rental properties, if you can make the numbers work. Thereby paying interest on the loan, but using the borrowed money to cash flow more into your pockets than you pay out.

By using the power of interest for your own good, you can drastically decreased the time it takes you to reach your own point of financial freedom.

Imagine a day when you earn enough from your investments that you don’t have to work if you don’t want to. You have enough coming in to support your lifestyle. You have all your needs covered, forever.

Buy assets that pay you. Anyone can do this because you don’t need a fortune, you can start with very small amounts.

Small things done consistently will become large things eventually. The Great Pyramids of Egypt were built block by block over time. You can do something more to your own scale. You just have to start.

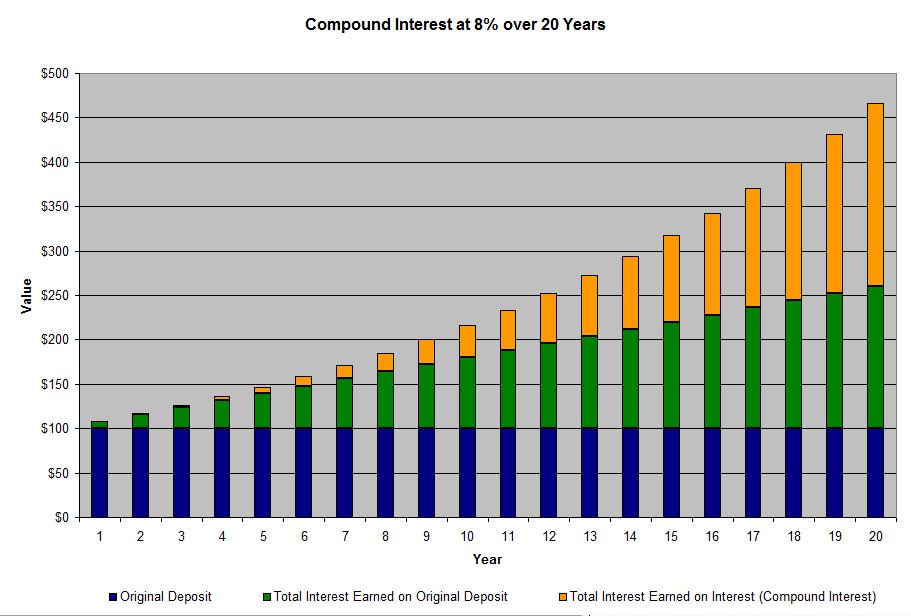

Soon you will see another magical thing happen – compound interest.

Your interest has little interest babies. The babies have babies. It starts to get out of control. People who have earned their first million after 20 years of working report getting their second million 7 years later, and their third million 3 years after that. It’s how the rich get richer.