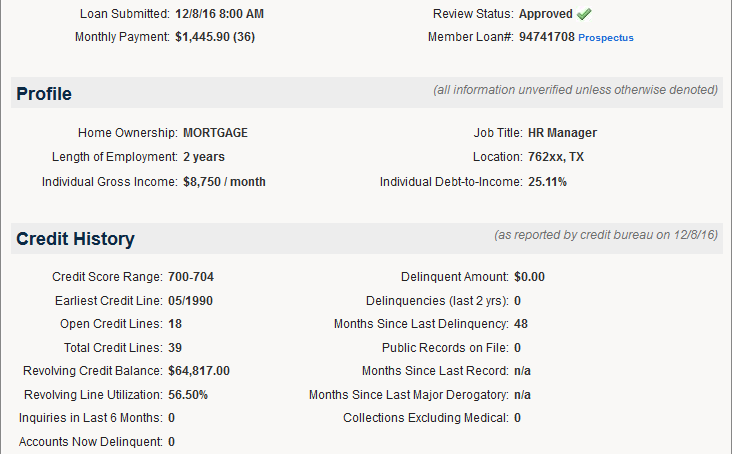

I remember one time I was searching LendingClub.com to find another loan to fund and I ran across this person who was making over $14,000 a month. If you don’t know Lending Club is a peer-to-peer lending service in which individual investors can buy pieces of a loan in chunks of $25. The investor is paid back as the payments are made.

Anyways, their financial details were so outrageous that I had to call my wife over to come see them.

Even though they were making $168,000 a year, they had $125,000 in revolving credit (credit card or HELOC) debt! I was just floored. They made nearly 3x what I do, yet still needed to bum some money off me. Needless to say I didn’t buy a part of their loan, I just couldn’t give some of my money to someone who owes that much on credit cards! I am pretty sure it was credit cards too, as HELOC rates are lower than the rates one gets from Lending Club.

I don't have a picture of their loan, but I checked out Lending Club to find one to talk about.

This person owes almost 7.5 months of salary, before taxes just to their revolving credit! If the rate is just 15% (lowish for credit cards) than the monthly interest is $810 (that's more than my mortgage)! That is nearly 10% of their income, more if you base it off what they get after taxes. To put it another way, they will have to work more than a month every year just to pay the INTEREST on the revolving credit.

Is the stuff they bought months or years ago still worth their labor today? Do they even remember what they spent most of that money on? Probably not.

Another thing to look at is their earliest credit line. In this case 1990. I take this information to guess their age, the earliest credit line being they were around 18-22, so 20 years old or so. This person is probably in their mid 40's and making a great income, $105,000 a year! You would think they would have ran out of things to buy long ago. They have had many years to become wealthy, but I imagine all they have are 'things'. Things they are paying interest on.

With hard work they can still dig themselves out of this hole and get something saved for retirement, but they are very far behind the curve.

Do you know anyone like that? They have well-paying jobs, yet are still living paycheck to paycheck? People that have dollar bills raining down upon them, but such little financial education to use it that the money just goes straight into the gutter?

Society wants your money. Billions of dollars are spent every year to create powerful forces of marketing to ensure that most of that money ends up back in their pockets. Also personal finance isn’t taught in schools, at least not in any that I have seen. You need to have someone in your life that will tell you the details, or have the motivation to learn it yourself.

My wonderful parents weren’t that great with money - not terrible, just not great. Financial education is something I had to go and learn about myself. Luckily anyone that wants to learn these skills today has to just get on the internet to read or watch videos about it.

But like anything else, actually following through is the hard part.

I must confess, in the past I knew what I should have been doing but never really did it as much as I should have. I am behind where I should have been, but as the saying goes “the best time to plant a tree was 50 years ago, the second best time is today.”

You don’t need to make hundreds of thousands of dollars a year to end up wealthy. There are tons of stories of old people who never made big bucks and then they die and it is discovered that they had millions of dollars of assets!

If those people did it, so can you.

You just have to commit to it, because a little money and a lot of time is all it takes. If you want to speed the process up, just add more money.

If you need a place to start your financial education, here is a list of material that I think is worthwhile.

- I Will Teach You to be Rich by Ramit Sethi – Good for the young crowd new to the game

- Your Money or Your Life by Joe Dominguez & Vicki Robin

- Rich Dad, Poor Dad by Robert Kiyosaki – A bit light on details but will get you excited

- Dave Ramsey's Youtube channel

- KhanAcademy.com – Financial & Capital Markets section – Short videos

- The Millionaire Next Door (currently free on kindle for Prime members) & The Millionaire Mind by Thomas Stanley

- Think and Grow Rich by Napoleon Hill

- The Richest Man in Babylon by George S Clason – Great audiobook version on Youtube

- The Automatic Millionaire by David Bach

It is not right to take money from those with the motivation to earn it and give it to those that didn't. It is right, however, for all people to educate themselves as to how to go about obtaining wealth. If you are reading this you have the ability to educate yourself, no excuses.

My moment of honesty:

- My interests vary but I strive for quality work, check my blog for proof.

- I will not fill up your feed with crap, I have only resteemed twice.

- I will also reply to all your comments if they warrant any reply.

- These things I promise to you. So follow me, or don't. I want you to do what you want to.

@getonthetrain