$45 Trillion Dollar Market Bubble and When it Pops it is Going to Stick on You Like an Ugly Tattoo!

As David Stockman former director of the Office of Management and Budget under President Reagan, says in his new 2016 book called Trumped; "there is a $45 trillion dollar bubble." When this pops who will you trust?

Both, email leaks and voter fraud can be prevented with blockchain technology.

This article is about trust so you should read my last two short articles; War Mongering and Important Information Ignored by Mainstream Media so I can build your trust as integrity is important to me and should be to you too. Those two short articles will help you understand why the new computational trust is going to be so important and will be demanded. They will also expand on my background of 35 years in business and finance. Ten years of that was with the worlds largest company. The last 4 years I spent hanging with my 22-year-old son who graduated as a Computer Engineer. During his 4 year degree I followed and debated blockchain technology intensely with him.

Bitcoin has more processing power validating its ledger than has ever been put together for any single purpose in the history of man!

Why do we care? Because we care about trust and trust is being compromised everywhere these days. Even our beloved big banks that we always trusted to hold our money and advise us about our future finances has been acting stupid playing with fraud and damaging our trust in them. And to quote the most powerful money person on the planet last week Fed Chairman Janet Yellen says. “The federal reserve may need to run a high pressure economy to reverse damage from the crisis that depressed output and risked becoming a permanent scar”. This is setting everyone up for the mother of all economic falls along with these 5 major warnings of others spewing the same recently:

- HSBC Issues “Red Alert” Over Imminent Sell-Off of Stocks

- I.M.F. Issues “Stability Warning” Over Deutsche Bank

- The Bank of America Warns That a Recession is Imminent, and Unavoidable

- Macquarie Group’s Investor Warns That the Private Sector Will Never Recover From QE3

- The Bank of International Settlements – the Central Bank of Central Banks – Warns of Chinese Economy Meltdown

49 chairman of the boards of financial holding companies set the tone and direction for all large corporations especially the media. I call this the 'group of 49'.

People are seeing mainstream media censoring or ignoring information for the benefit of the connected group of 49 all the time – it is becoming very clear. Here is release from last week with undercover camera proving recent voter election fraud planning.

What ever happened regarding the Panama Papers and that fraud that was exposed, which undermined trust?

Bitcoin still has not gone away; it's been around for 8 years and people keep putting it in your face. Again, bitcoin has more processing power than has ever been put together for any single purpose validating its ledger. Granted, the processing power is not for general purpose processing, but I don't care if the processing power is for finding out relevant information or validating a ledger. The processing power is; zeros and ones or electrical on and off, bits and bites - binary code. Bitcoin has 360,000 times more processing power, and I had the math done, than all the Google server farms put together.

I am fascinated by an algorithmic protocol that uses cryptographic hashes & public key cryptography. It rewards participants with another protocol that retains its value called bitcoin. All for validating a ledger called the blockchain on a peer to peer decentralized transparent public network, that you don't have to trust.

You see this new technology that uses 'computational trust' to validate a ledger is like putting your audit firms KPMG, Arthur Andersen (out of business because of the Enron fraud) or Deloitte Touche into a calculator. Only, this calculator is a peer to peer decentralized computer program or an algorithm that is currently validated every 10 minutes.

The real heart behind bitcoin is known as the blockchain and has digital tokens given as rewards to processors for validating its ledger and fractions of the tokens are known as satoshi's or milibits and full tokens are called bitcoins. It's just a simple ledger bringing transparent auditing to the world of finance like bookkeeping was intended to do. A true new GAAP (generally accepted accounting principle) has arrived through 'computational trust'. Welcome to this new technology you should learn about it because it is here to stay and is: The greatest advancement in business since the computer.

To validate a ledger on the transfer of ownership, like a notary would do, is an extremely powerful date stamp. This is the silver bullet into the vampires heart of intermediaries taking a fee to confirm something. This will eliminate a great deal of what I call waste in our economies. And when the big mother of all economic crashes comes all money will be forced into a frugal environment.

Bitcoin is not an investment - it is simply a token used to validate a ledger and it is part of the most secure blockchain there is. Since it is validating the ledger with more processing power than has ever been put together for one purpose it seems to becoming the strongest store of wealth available by default. Yes bad and good news will move the daily price but it continues to get more powerful every minute. Bitcoin blockchain protocol has had no down time, no errors and no hacks since conception. Bitcoin is not a belief, it pays for the validating of the most powerful blockchain created and is a new science technology. I compare bitcoin to the blockchain like a triangle is to geometry. Keep learning. It will all boil down to trust. I favor computational trust.

Beware of the big brother blockchain (examples: Ripple, Hyperledger and even Ethereum). These are much more centralized and more like intranets. Any blockchain where you can change its code with less then 51% of the processing power, and not fully decentralized peer to peer, is not in my definition a blockchain. Even if it validates every 10 minutes or radically faster. Granted, the want-to-be blockchain are powerful new databases with an intranet server or servers that are very useful for companies to use among themselves or to offer services with. Just not as trusted for a store of value in their tokens.

Big brother those 49 chairman of the boards or group of 49 mentioned above will try to serve you their blockchain. That blockchain will not be as decentralized or even may be very centralized so they can control the money. For me, I trust the one that has the most decentralization and the most processing power. After those two considerations I weight in on the opinions of the majority of computer engineering specializing in software development and programming. I like the current most processing power one (bitcoin) as it is the most democratic as well requiring 51% decentralized processing power to make a change to its transparent code. It's processing power blows all other attempts of blockchain out of the water by a huge magnitude. Blockchain access must be permission-less in order to be equitable to everyone.

My definition of a secure and trusted blockchain:

Must have 51% processing power to change code

Must grow in decentralization as evolves

Must be permission-less

Must not have any central authority

Must have open source code

Areas around the world will and are starting to use the blockchain for common things like; car registration, land registration and there is a move to use it for elections and identification will follow. All non profit agencies should be required to be audited with 100% of the transactions transparent on the blockchain. The blockchain could be used to audit military spending. Do you remember just after the Iraq War, a defence contractor lost $2 trillion dollars worth of bookkeeping receipts (invoices)? Recently, a report from the US Inspector General said that the army erroneously made $6.5 trillion in adjustments. Trust that?

Once we are using the blockchain for all types of things the processing power becomes so big and decentralized that the tokens (bitcoin) become an even more excellent store of wealth. I don't expect the bitcoin blockchain to be used as a currency by any large country anytime soon. These countries won't be able to inflate it away to pay for their military or deficits, or as they will say, to add currency to grow with their economies. The group of 49 largest financial holding companies will create a centralized version to use as currency such as the United Kingdom's RSCoin or even a side chain coin off of something like the semi-decentralized Ethereum blockchain centralized by a foundation.

People should decide to use bitcoin as their money. It would eliminate so many fees and middlemen and bring the power of the individual back to the community level. It will eliminate foreign exchange charges and keep your finances private. I understand it is complicated and it's like a new language; bitcoin, blockchain, encryption, processing power, hash rate, satoshi, milibit, hacking, validating a ledger, computational trust, dual authentication all very new. Just like when the Internet came around; WWW, email, HTTP://, browser, ad blocker etc.

Revelations in the new email releases from Wikileaks also undermine overall trust. They allege that the Clinton's and around 25 reporters are in a conflict of interest: One email thread starts with Jesse Ferguson, the campaign’s Deputy National Press Secretary and Senior Spokesman, describing a venue:

We wanted to make sure everyone on this email had the latest information on the two upcoming dinners with reporters. Both are off-the-record.

- Thursday night, April 9th at 7:00p.m. Dinner at the Home of John Podesta… This will be with about 20 reporters who will closely cover the campaign (aka the bus).

- Friday night, April 10th at 6:30p.m. Cocktails and Hors D’oeuvre at the Home of Joel Benenson… This is with a broader universe of New York reporters.

The “broader universe of New York reporters” includes several top news anchors for network and cable channels, many of whom are listed as a “yes” for the appearance:

From ABC: Cecilia Vega, David Muir, Diane Sawyer (who could only stay for 30 minutes), and George Stephanopoulos.

From CBS News: Norah O’Donnell.

From CNN: Brianna Keilar, Gloria Borger, John Berman, and Kate Bolduan.

From MSNBC: Alex Wagner and Rachel Maddow (“TRYING”).

From NBC: Savannah Guthrie.

Encryption is used with the blockchain to ensure trust of transferring ownership even if its just ownership of a message. In the future the National Security Agency (NSA), CIA and all governments will demand extremely powerful encryption and systems to prevent spying. The blockchain will be used in sending private information securely, using processing power to lock out potential hacks, securing banking, communications and privacy. Currently, governments are trying to control encryption and that is an extremely dangerous threat to liberty and privacy. Governments say it's in the name of money laundering, war on drugs or terrorism but just know it is about controlling the money, people and companies. Follow the money! Do not trust any government or corporation and move to a system you don't have to trust – computational trust.

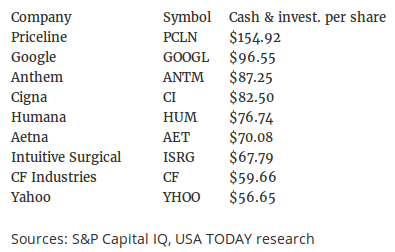

I think the 'group of 49' are ready to fleece the sheeple yet they just don't want to be blamed. I also think they are trying to poke the bear as much as possible so they can blame someone else for the market crash - war which seems to work as a great distraction for that purpose. Big players are sitting on tons of cash. Warren Buffett has $73 billion and the smart money has sold most European bank shares.

So it has never been riper for the shearing of pension plans as then the side line cash will be deployed making for what I call a super-boom in Asia. Leaving pensioners wondering what happened to their investments.

If my definition of the blockchain is allowed, as in the bitcoin blockchain, to flourish I believe it will help reduce waste and bring many of the un-banked or under served in banking into the 21st century. With micro-payments and no middle intermediaries like foreign exchange fees, the poor on the planet will finally get a break and leap frog into society and even international trade. Here is a very good explanation in the first half of this short You-tube clip from respected investor Reggie Middleton.

There is something you can do about it, the 'power of the individual' and yes one bit at a time: Please note I am not a financial advisor and suggest you seek one for all your needs but, in my opinion, they are paid for by corporations and live off of your fees so totally present a conflict of interest. The first thing you could do is shop local and or avoid all national companies. Next you could take your money out of the bank and put it in a lock box or buy physical silver coins. The banks are stealing your money with fees and fraud and it is at risk. Banks are allowed to leverage your money and put everyone at systemic risk by at least 10x so for every $1,000 dollars you take out you hit that bank by $10,000! Hit em hard folks and take these felons down.

My next article will name some of the top chairmans out of the 50 institutions controlling over $20 trillion in assets. This will begin to show who controls the 'group of 49' and how they have 10X the control on industries and business than the wealthiest 49 people in the world. The next research should be who do they answer to?

If I have helped you understand please read my introduction here, my other posts or my last article.

I am using Steemit as it is user friendly for this type of information sharing.