Will we know who to guillotine when this stock and bond market bubble bomb goes off? The following paragraphs in bold below are a recap from my recent post on an article by New Scientist about an intense in-depth study done by 3 PhD's; Dr. Stefania Vitali, Dr. James B. Glattfelder, and Dr. Stefano Battiston all from the Swiss Federal Institute of Technology in Zurich:

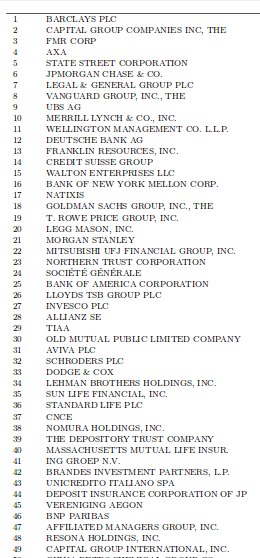

This 36 page intensely detailed study of the data set shows how 147 companies own 40% of the shares of 43,060 transnational companies.

“Relationships between 43,000 transnational corporations has identified a relatively small group of companies, mainly banks, with disproportionate power over the global economy.”

This information is not to be taken lightly. The 36 page study is the largest most comprehensive study of its kind in history.

That network of control also shows it is more unequally distributed than wealth. Top ranked companies hold 10 times more control than expected based on wealth.

The existence of an economic super-entity, as the study authors call it has never been documented before.

There are easy solutions to what seem to be very complicated issues. The top 49 financial holding companies have changed a little since the authoring of the study. Near zero interest rates for the last 8 years has facilitated the largest mergers and acquisitions in history. This has made the few have more control and, as you know, a lot richer. This needs to stop and I suggest the public must demand that any company industry leader that has more than 5% of market share needs to be dissolved. And not broken up like they did in 1911 with Rockefeller's Standard Oil as Mr. Rockefeller became twice as rich 12 months after his monopoly crumbled. For the next bail out or bail in, the dissolving of the institution and a rule requiring the smaller units to have 20% of shares held by the community and 20% shares held by employees is a must. A major one time redistribution of wealth is justified in an economic emergency brought on by those putting the public at systemic risk.

Example 1; A New York Times writer and food critic, Michael Pollan reported in an article dated October 9 2016 called Big Food Strikes Back: The $1.5 Trillion dollar food industry has four major groups: Big Agriculture, Big Meat, Processors and Retail. In the food industry, the top four companies hold market share of: beef 82%, chicken 53%, soy and corn 85%, pesticides 62% and seeds 58%.

Example 2; Health care is another industry that has abusers violating the Sherman Antitrust Act, Title 15 United States Code Chapter 1 -- a class of individuals and firms that; include virtually the entire health-care industry in the USA. They have taken health care as a percentage of the US economy from about 3% to 20% in 30 years. If we do not stop this now, the federal government, state governments, pensions, and the American way of life will collapse. This knowledge should make you sick to the stomach and furious with outrage.

Example 3; Banking is one of the worst abusers of their near monopoly and most large banks are listed as too big too fail and so are behaving badly. Bernie Sanders said in this year's campaign, “If they are too big to fail – they are too big to exist.” Last week, a story broke on a leaked email from Wikileaks from the head of Citi Group, Michael Froman to John Podesta one month before election on October 6, 2008, and two months before Citi Group got the largest bail out in history, discussing who should be in the next US cabinet. Michael Froman is an American lawyer who has served as the U.S. Trade Representative since 2013. He has been assistant to the President of the United States and Deputy National Security Advisor for International Economic Affairs, a position held jointly at the National Security Council and the National Economic Council. He is part of the group writing the trade deals of TPP and TTIP. Those deals need to be stopped in their tracks until a decentralization of corporate control occurs. Of course the elected officials can consult with whom they want, but when they are donors to the campaigns and run near monopolies there needs to be an overview and transparency and not one dime from tax payers in the form of bail outs or subsidies. Why is a business leader, who's company should have gone bankrupt and technically did, and (the company) has been fined multiple times and charged with a felony be selecting who should run the US government? Disgusting!

As evidenced in the above mentioned Wikileaks email, and before the election in 2008, Michael Froman suggested the following people be appointed to cabinet positions and most were appointed. This is called a “puppet” government and or banana republic: Eric Holder – Justice Department, Janet Napolitano – Homeland Security, Robert Gates – Defense, Rahm Emanuel – Chief of Staff, Peter Orszag – Office of Management and Budget, Arne Duncan – Education, and three choices for Secretary of Treasury: Robert Rubin, Larry Summers and Timothy Geithner.

The richest 49 people are reported on by mainstream media all the time and here are top two and a link to the wealthiest 49 people in the world.

Why doesn't the mainstream media report on the top 49 most powerful people, as disclosed by the Swiss Institute of Technology study mentioned above? The companies these people run, as the study says “hold 10 times more control than expected based on wealth”. Obviously, it is because these holding companies own the controlling shares of the media companies. This needs to be changed immediately. Those holding companies should not be allowed to own media shares or have any say in their management as it is a conflict of interest. If you look into Reuter's (founded 1851) history you will see it was purchased by the Rothschilds, a banking family and consolidated media control as early as the beginning of the 20th century. Reuters operates in more than 200 cities in 94 countries in about 20 languages and has way too much consolidated control over the media industry which may still include the Associated Press.

From the Swiss professor's study, the largest transnational holding companies are listed below:

The following are the top few most powerful holding company chairmen. I think it is time we sit down with these people and ensure they do not have any conflict of interests. We should also, immediately demand they don't hold positions on each other's boards to reduce their power and influence. This is extremely important as these people are putting the world under a systemic risk and therefore we are hostage to taxpayer bailouts or bail-ins that give derivatives priority over deposits.

BARCLAYS PLC - John McFarlane, Chairman

He spent eighteen years with Citibank, as head of Citibank in Ireland and the United Kingdom. Then he became the Group Executive Director of Standard Chartered Plc. based in London and Hong Kong. He was Chief Executive of the Australia and New Zealand Banking Group Ltd. (ANZ). Then joined the board of the Royal Bank of Scotland then the board of Aviva PLC. and became Chairman. He was president of the International Monetary Conference (the annual meeting of the heads of the world’s major banks and central banks) and was chairman of the Australian Bankers' Association.

CAPITAL GROUP COMPANIES INC, THE - Timothy D. Armour, Equity Portfolio Manager, Chairman

Connected to 3 Board Members in 3 different organizations across 7 different industries.

FMR CORP (Fidelity Investments) - Edward Johnson III, Chairman

Named by Forbes as the 43rd richest person in America.

AXA - Thomas Buberl, Chairman

AXA was the second most powerful transnational corporation in terms of ownership and thus has corporate control over global financial stability and market competition with Barclays and State Street Corporation taking the 1st and 3rd position, respectively.

STATE STREET CORPORATION - Joseph Hooley, Chairman

The Global Services business is a custodian bank with $28 trillion (USD) of assets under custody and administration. The Global Advisors business provides investment management services and has $2.45 trillion (USD) of assets under management.

JPMORGAN CHASE & CO. - Jamie Dimon, Chairman

The world's sixth largest bank by total assets, with total assets of US$2.35 trillion,

The worlds largest 49 holding companies are financial companies and their small number of leaders control markets. So you may see different logos such as Shell, Esso, BP or Coke verses Pepsi but really these leaders set the company's tone and direction. To me this is a near monopoly with different logos floating around. The study clearly concludes that, "globally, top holders are at least in the position to exert considerable control, either formally (e.g., voting in shareholder and board meetings) or via informal negotiations".

To quote from another study done by Oxfam in February 2016: “CORPORATE DOMINATION; a lack of competition presents opportunities for companies to set prices that enable them to extract returns over and above real value and productivity.”

It is all about following the money. Going deeper in this type of analysis would help form better decisions and rules in making global economics more stable and therefore less likely to cause volatile swings. This definitely would go a long way to prevent the connected few front running you in wealth transfer through their investment companies. The data set used by the Swiss Federal Institute of Technology is called Orbis and we now need to drill down on that data set and see who owns the shares to know who these powerful men actually bow down to. These leaders need to be asked if they understand the Sherman Antitrust Act. They also need to be asked if they have any conflict of interest and have them sign off yearly under oath stating they do not. Donald Trump could add this to his new ethics governance policy he set forth last week when he wins the presidency, because of this abuse of monopolistic power.

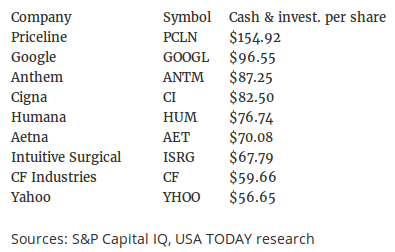

I think the 'group of 49' are ready to fleece the sheeple yet they just don't want to be blamed. I also think they are trying to poke the bear as much as possible so they can blame someone else for the market crash – war – which seems to work as a great distraction for that purpose. Big players are sitting on tons of cash. Warren Buffett has $73 billion and the smart money has sold most European bank shares.

So it has never been riper for this fleecing as then the side line cash will be deployed making for what I call a super-boom in Asia but leaving pensioners wondering what happened to their investments.

Lets fleece them before they fleece us as there is something you can do about it, the 'power of the individual' and yes one bit at a time: Please note I am not a financial advisor and suggest you seek one for all your needs but remember, they are paid for by corporations and live off your fees so totally present a conflict of interest. The first thing you could do is shop local and or avoid all national companies. Next you could take your money out of the bank and put it in a lock box or buy physical silver coins. The banks are stealing your money with fees and fraud and it is at risk. Banks are allowed to leverage your money and put everyone at systemic risk by at least 10x, so for every $1,000 dollars you take out you hit that bank by $10,000! Hit em hard folks and take these felons down. You should also learn about how computational trust can ensure transparency in auditing company shares or finances.

I am using Steemit as it is user friendly for this type of information sharing.