Hello Everyone,

I am not here to promote any company or tell you which future crypto index to invest into (there will be a few to pick from). I am here to talk about Crypto Currency and Global Digital Assets coming rise as whole. I am talking about Blockchain based Assets. Its very hard to spot exactly which will be the ones but its safe to say Crypto as a whole will do very well over the coming years.

I believe the same rules in investing will apply to the new decentralized economy.

The best way for a steady return in the old economy is dollar cost averaging into an index fund. On of the most popular in the US is the Vanguard S&P 500 ETF. Stock ticker VOO. Its proven that over time this produces the best rate of return for investors, even over many Hedge Funds by the time you pay them the performance fees. Only about 20% of the Hedge Funds will outperform the S&P Index.

More about dollar cost averaging

What does Crypto mean for your retirement and Investment Strategy?

Its means a lot. One of the very key reasons investing into a Crypto Index Fund is beneficial for you is that it has Zero Correlation to the traditional stock markets. What this means in very simple terms is that when investing into Crypto Assets you don't have the same track as traditional assets . Gold for example, is inversely correlated to the stock markets. If the dollar is weakening Gold tends to go up. If the economy is doing good and interest rates low investors tend to chase rates of return in the stock market and stocks go up.

Now here's the key you must understand.

The Decentralized Blockchain Based Economy is its own Digital Economy. Its not tied to any World Government organization. That's why people are calling it Global Digital Assets, not just stocks or bonds. This is a new asset class all of its own.

On the other hand, the traditional markets are tied to World Government policy. If the Feds raise interest rates is usually a bad thing for the stock market. If the banks are insolvent like in 2008 then you can bet your 401K it tanking with the banks.

Insiders control the outcomes in the old economy.

In the old world before blockchain we were held hostage to Governments and their Banks. Remember what happened in 2008? In the new world, since blockchain is peer to peer, computer to computer, nodes all through out the world verify transactions. There's really no need for traditional banks anymore. The blockchain can do what the bank does and much more. Blockchain based "Crypto Banks" are the hybrids that well evolve from the traditional banking system.

When the stock markets fall Crypto generally goes up.

Allocating 5-20% of your portfolio into a Crypto Index is the best thing you can do to hedge against market volatility. If you take a basket of the top Crypto Asset the volatility is much less than an individual asset. Unless you do an incredible amount of due diligence on each individual Crypto Asset you are taking a much bigger risk than following the index. The transaction cost are much higher trading in and out of individual securities.

For the average investor you are much better off in an Index Fund than individual securities.

Just like many things in life hardly anything is an absolute. As I mentioned above only about 20% of the hedge funds beat the S&P 500. In this new decentralized economy the markets have not been developed yet. This means stock pickers can have outsized returns for the risk/reward ratio. As the Crypto space evolves with more and more money flowing in the markets will become more efficient but longterm a good Crypto Index fund would still produce great returns. I estimate at least an average annual rate of return of 100% over the next few years. Some months are already close to 100% growth. That number is probably far to conservative for how rapid this very young space is developing.

BTW I am not here to try and sell you any particular Index Fund but Steem is currently the top holding of the world's first Crypto Index fund.

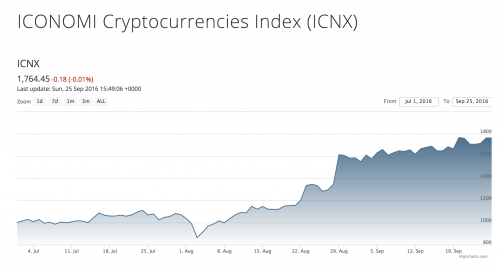

ICNX structure

CRYPTOCURRENCYPERCENTAGE

STEEM16.13%

BTC14.73%

ETH12.79%

XMR12.07%

DASH11.5%

MAID7.4%

FCT5.18%

LSK4.75%

DGD4.71%

The market cap in all of Crypto was just 1 Billion USD three years ago. Now we are into a $12 Billion market with Crypto Assets having explosive growth. Bitcoin is still the largest by far but the "alt coins" as some Bitcoin maximalist love to deny have reached astounding growth. Including Steem with just a 6 million market cap in March all the way to 400 million and now to a correlation of currently 100 million. All stats continue to point to Cryptos rapid growth. I like calling them Global Digital Assets each with their own economy. Some like Steem have their own blockchain, most will run and already running on Ethereum since its DAPP (decentralized applications) friendly and that seems to be there main focus. Bitcoin will also have its turning complete blockchain.

Later on I will talk more about my back ground as a successful Entrepreneur and Financial Analyst but for now I hope this helps make sense of a very complex investing world.