Nathaniel Freire, 16 Sep 2016 - Analysis, Bitcoin Price, Cryptocurrency

The technical setups posted below use simple trend detection, support and resistance, channels, pattern and candlestick analysis. We aim for high-probability trade setups on BTCUSD and use very few indicators. All charts use BNC’s Bitcoin Liquid Index for maximum accuracy. The timeframe for trades is 1 to 7 days, so we’ll use 4h candlesticks. Bitcoin is best traded as a purely speculative commodity on 4h+ timeframes.

Market Sentiment And Macro Key Points

- Circle Pay announces iOS iMessage Bitcoin integration plans. Adding payments to iMessages reduces “the friction,” for consumers, says CEO Jeremy Allaire. Customers can send dollars, euro, pound sterling and bitcoin to anyone directly inside of iMessage, and can fund payments and cash out using almost any bank in the US, UK and, soon, Europe.

- The race to capture the lion’s share of the ETF market is heating up. The Winklevoss ETF, once to be listed on NASDAQ, then later to on BATS, has just had a regulatory setback. SolidX is stepping up their game to provide a competitive foothold.

- Ripple raises $55m in Series B Funding. Ripple also added new partners to the Ripple network; Standard Chartered, Westpac, National Australia Bank, Mizuho Financial Group , BMO Financial Group, Siam Commercial Bank and Shanghai Huarui Bank. This shows that the digital currency industry started by Bitcoin is still growing.

Long Term Technical Analysis

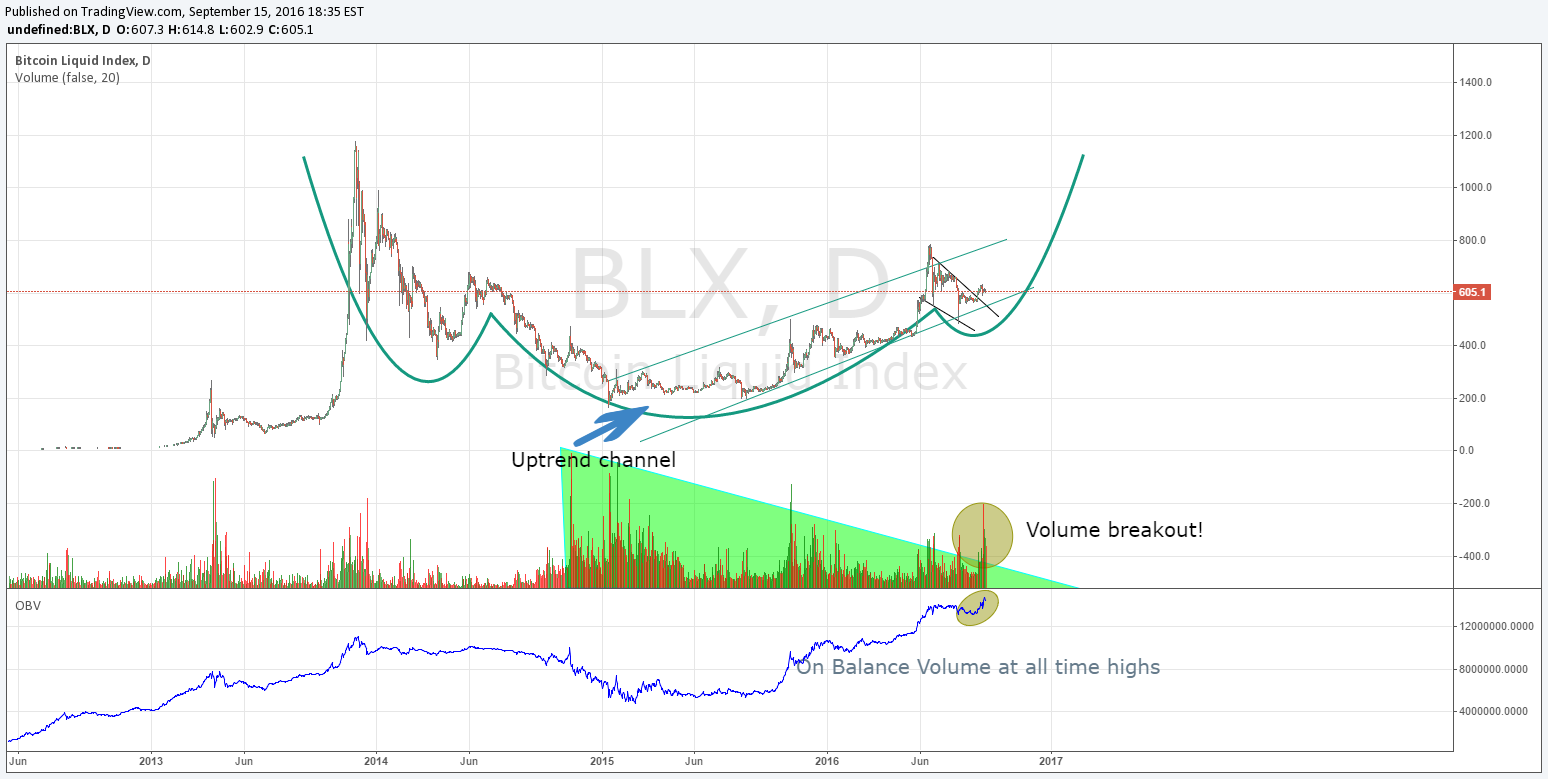

Its great to see the long term uptrend channel is still intact, It’s safe to say that we are still in an uptrend. The very bullish inverse head and shoulders consolidation pattern is still forming. Should this pattern complete, we should see new highs this year. Something great has happened over the past week, BTC’s volume broke out of consolidation! We see this as a big deal as heavy volume is needed in order to take BTC’s price higher.

Although the price retraced a bit, this should be a healthy retrace that’s needed if price is to continue higher. On Balance Volume is at all time highs, this indicates that buying pressure is still strong and is usually a good indicator of future price continuation to the upside.

Long Term Trade Idea

We see a very strong probability of BTC retracing further in the coming week(s). We view this as a potential long term buying opportunity.

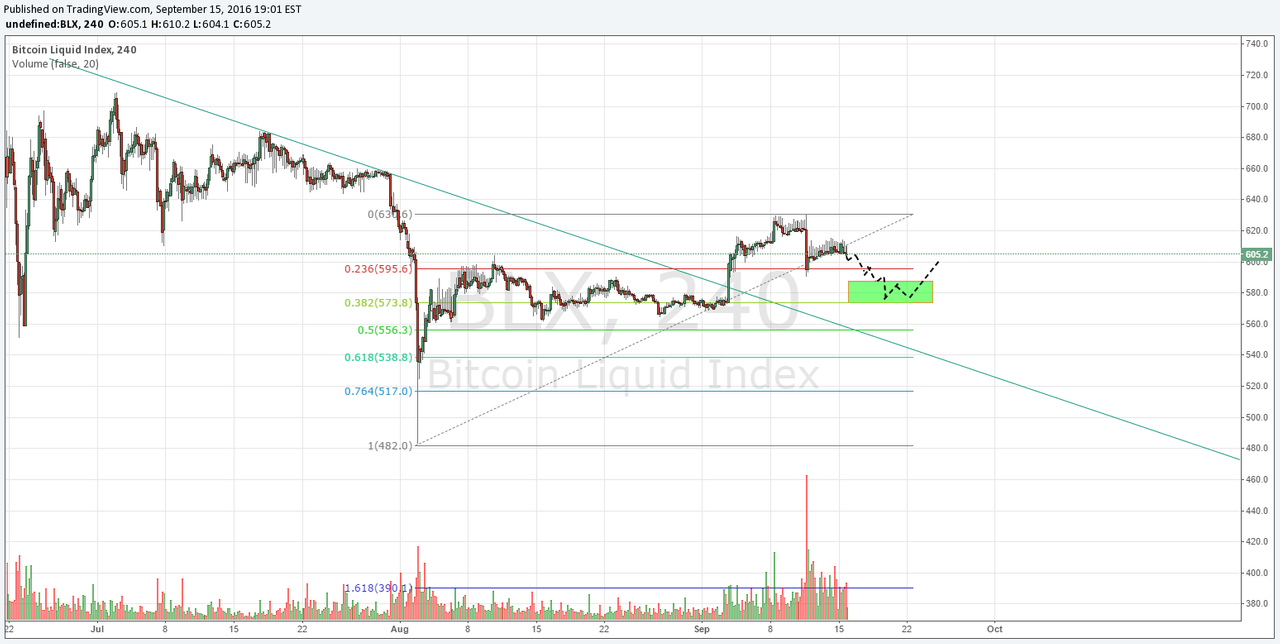

There is a high probability of further retracement in the near term as BTC found strong support at the $615.00 level, which is 50% Fibonacci support. The next support level is at $575.00, should be a good buying opportunity. Setting a tight stop loss in case the market does panic may be beneficial. It may be best to look for a pattern of higher lows and higher highs if the price does reach the $575.00 level before confirming an entry.

Short Term Trade Idea

Short term we see a decent sell opportunity. The retrace this week, on Sep 9, accompanied heavy volume, Historically retraces of that magnitude tend to have further continuation. The spot price is currently $605.00. Shorting now, with a take profit at $575 and stop loss at $615, gives a good risk/reward ratio of 2:1.

GBTC Bitcoin Investment Trust Analysis

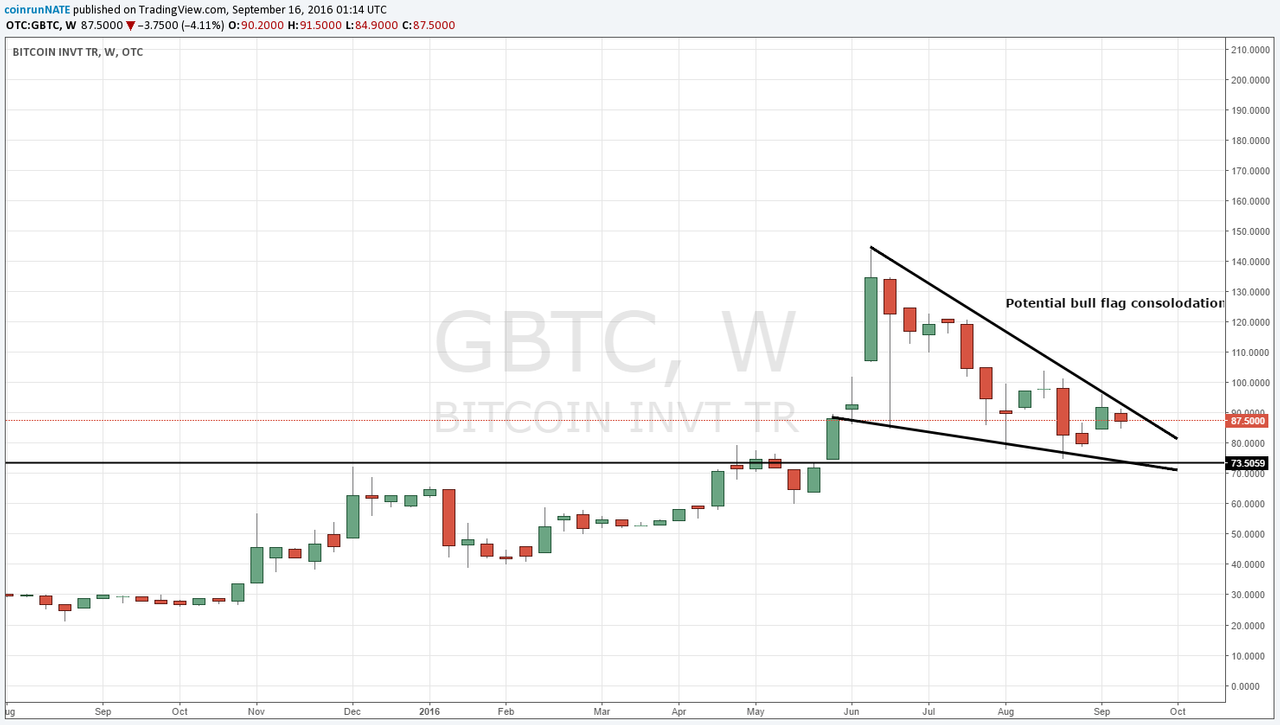

We can see that the Over The Counter (OTC) market is in bullish consolidation and printing a bull pattern above support of $75.00. We like to keep an eye on the OTC market for a general idea of how money is flowing in all BTC markets. This is a strong sign of OTC demand, should the price hold the $75.00 level.

Conclusion

With the potential Winklevoss ETF approval date of October 12th, we see a great opportunity to buy and accumulate BTC should the price drop in the $550.00-$575.00 range. This should give us a great speculative play. The ETF is expected to double the price of Bitcoin if it is approved by the SEC. Short term, we do see a decent short opportunity as we are expecting the price to retrace a bit going into October. If shorting, keep a tight risk level because we are in a long term uptrend.

Disclaimer: The information presented in this article is general information only. Information provided on, and available from, this website does not constitute any investment recommendation.