This past Wednesday we heard from the Federal Reserve with regard to monetary policy, and as I predicted they did raise the federal funds rate 25 basis points however, instead of yields rising, they are dropping.

More than a year and a half ago I had said publicly that the Federal Reserve's attempt at trying to normalize bond yields would backfire-and this is exactly what is happening.

It is clear to me that the Federal Reserve has absolutely lost control of what is occurring in the bond market. Remember, this is uncharted territory, we have never been here before in the history of the financial world-so the Federal Reserve actually has no idea of how the market will react in the current environment with regard to their attempt at normalizing interest rates.

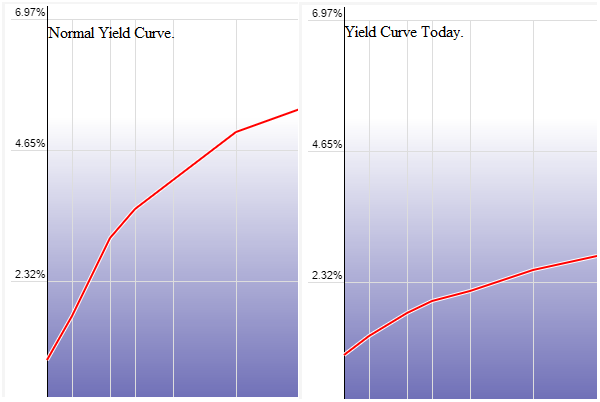

The yield curve as seen in the picture above continues to flatten out, and this trend will continue until the curve inverts.

The last time the yield curve inverted, the 2008 economic meltdown occurred, and the time before that we suffered the.com bubble meltdown.

The fact is we are existing in a multiple bubble economy at this time, worse, and unlike anything which has ever been seen before.

The reason why these bubbles exist is simple: the Federal Reserve has not allowed the market to do its one and only job, and that is to determine fair value.

The Federal Reserve's interest rate suppression cycle has not only allowed, but has been the driving force behind mass malinvestments across the entire spectrum of asset classes and as such, bubbles have been created.

The Federal Reserve has created distortions across the spectrum of asset classes which is frankly beyond belief, worse than has ever been witnessed in the history of finance. What this means is when the yield curve inverts this time, we will experience a meltdown magnitudes greater then the 2008 crash.

The irony is just like last time, the general public has no idea of what is coming and they are just as complacent as well.

In summary.

The federal reserves attempt at raising interest rates is having a paradoxical effect on the market as the yield curve continues to flatten.

I fully expect the yield curve to invert in the not so distant future. What this means is we can expect a market meltdown orders of magnitude worse than the last two times we had a yield curve inversion.

Gregory Mannarino