From FDR & Nixon to Goldmoney

From Franklin Delano Roosevelt in 1933 to Richard Nixon in 1971, gold has been steadily degraded or outright eliminated from being money. The measure of value shifted from gold to gold backed currency to government mandated fiat money.

Be it paper money or fiat money, an individual's purchasing power is steadily depreciated because paper "money" is progressively failing. The rapid decline in the value of paper currency makes it inherently dishonest money. Fiat or paper works to the disadvantage of the poor and to the advantage of the rich.

The intellectual foundation for this chicanery is "in the long run are all dead" Keynesian economics. Monetarist Milton Friedman, rebuking Republican Richard Nixon, confessed, "we are all Keynesians now".

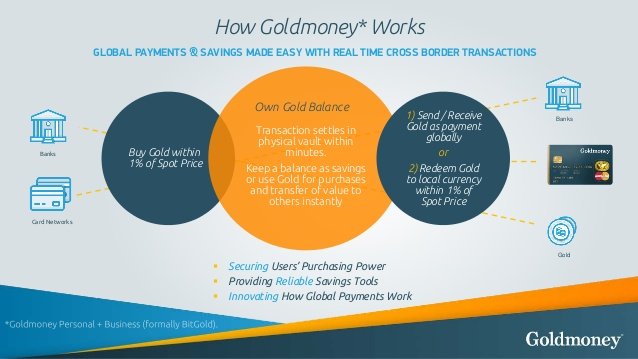

To bring back sanity to money, Alan Greenspan advocated a return to the gold standard. The gold standard’s problem was a problem of technology; a problem of payment-in-transit delays. Goldmoney has shortened the settlement cycle to settle gold title to within seconds. This is not the classical gold standard.

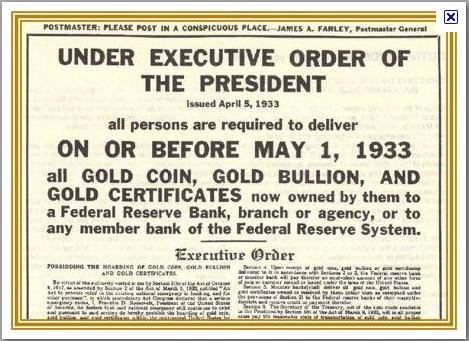

FDR confiscates gold, 1933

In 1933, the United States confiscated its citizens' gold, effectively taking America off the gold standard. Americans were coerced into surrendering their private gold holdings, ending individuals being able to protect themselves from government fiat or paper currency.

Image from "The Philosopher's Stone (Gold)"

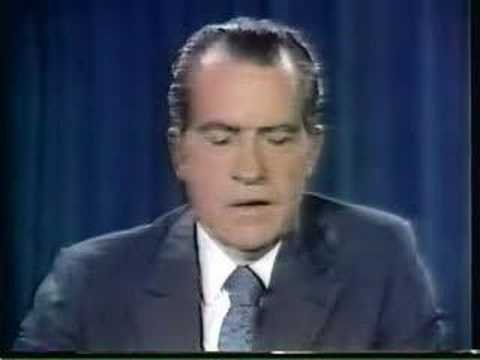

Nixon "temporarily" ends dollar to gold convertibility, 1971

Valery Giscard d'Estaing, France's Finance Minister, chafed under the exorbitant privilege or the benefit that the United States had due to the dollar being the world's reserve currency.

US imports, priced in dollars, insulated the United States from a balance of payments crisis. As the French began losing confidence in the dollar, President Charles de Gaulle pressed the United States for some French gold. Nixon defended the dollar by "temporarily" suspending the convertibility of the dollar to gold.

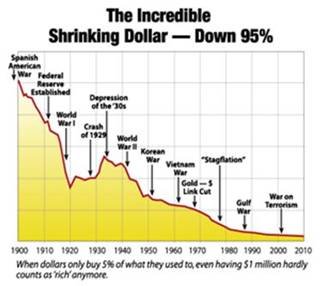

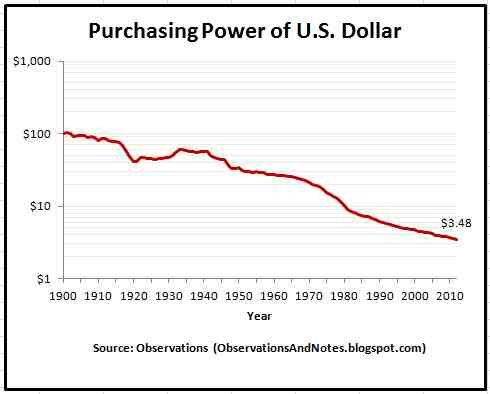

The value of the dollar

FDR, Nixon, & the Federal Reserve have systemically eroded the value of the dollar through inflation: printing more dollars. Inflation is an insidious tax on that negatively impacts the earnings & savings of the poor more than that of the more wealthy.

The poorer you are, the bigger the inflation's bite.

Image from aheadoftheheard.com

Image from "The Decreasing Purcashing Power of US Currency"

Gold has always retained value over time

Image from "Is gold the anti-dollar?"

If saved in gold, savings are class agnostic.

Gold levels the playing field for all classes of people: serfs, lower, middle, upper & chattering.

The savings of the poor, middle class & gold equally retain their value over time.

Patents (one to Josh Crumb & Roy Sebag & the other to Alessandro Premoli, Sebag & Crumb) awarded for the underlying BitGold Aurum tech, 2015

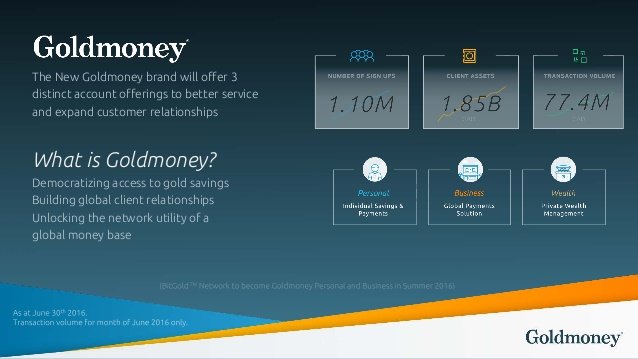

Josh Crumb, Goldmoney's Chief Strategy Officer & Roy Sebag, Goldmoney's CEO co-founded BitGold. Alessandro Premoli is Goldmoney's CTO. BitGold is now rebranded as Goldmoney Personal & Goldmoney Business. The patents enable liquefying gold for savings & payments in gold.

Goldmoney gives you the option to bring back gold as your money.

Everyone, everywhere, at any time can make gold their money.

You can create your own gold standard today.

Gold as your money means that you can choose sound, honest money as your money.

Freedom from the tyranny of government mandated fiat currency.

What are you waiting for?

Create your own gold standard today.