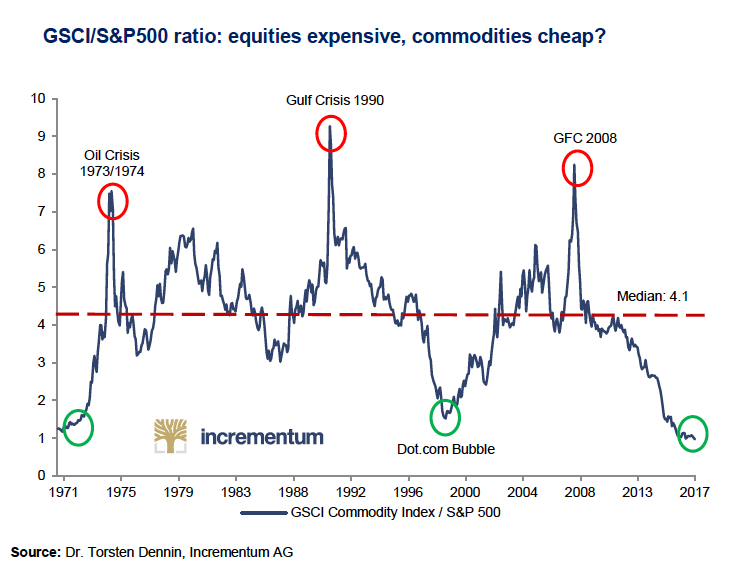

The prices of commodities (oil, gas, gold and silver, among others) have never been so low compared to US stocks since 1971. Due to the monetary policy of central banks, stocks and bonds began to rise, but due to weak economic growth, prices of important commodities like oil have been under pressure over the last couple of years. Meanwhile gold and silver are also struggling to break the downward trend of recent years.

In relation to the S&P500, the GSCI commodity index is currently trading at the lowest level in 50 years.

The chart above outlines the valuation of the GSCI commodity index relative to the S&P500 stock index. The GSCI commodity index comprises 24 commodities from all commodity sectors and serves as a benchmark for investment in the commodity markets and as a measure of commodity performance over time. If the ratio is low (green circles), it means that commodities are cheap relative to shares. If the ratio is at a high level (red circles), like during the Gulf Crisis in 1990, the prices of raw materials are relatively expensive.

The current ratio is 0.87 while the median is at 4.1. A return to the median gives 371% potential, but in most cases a rally doesn't stop at the median. Markets usually evolve from one extreme to another. From cheap commodities to expensive commodities. Just look at the rally from 1999 to 2008.

As an investor you do not often get an opportunity to buy assets at the lowest price of the past 5 decades.

Stocks vs Commodities

Based on this comparison, we can conclude commodities are currently relatively inexpensive, or US stocks are currently overvalued. Or both. Either way, history teaches us that extreme valuation like this never last forever. While it's not a good timing indicator it does show that this ratio will need to regress back to the mean. The last time stocks were relatively expensive compared to commodities was during the dotcom bubble of the late nineties. We know that didn't end very well for the stock markets...

Are stocks overvalued?

Today, US stock markets are at record levels again, while the economy is still recovering from the previous crisis. Shares are valued as if companies are going to make even more profits in the future, while meanwhile US jobs growth is slowing down and the expansion of the world's largest economy remains stuck around the 1% level.

So the big question is what justifies the high stock prices of today?