It is not unusual for a company to face a large number of ethical issues when doing business in other countries (CTU International, 2016).

No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form or by any means (electronically, mechanical, photocopying, recording or otherwise), without the prior written permission from me.

All rights reserved.

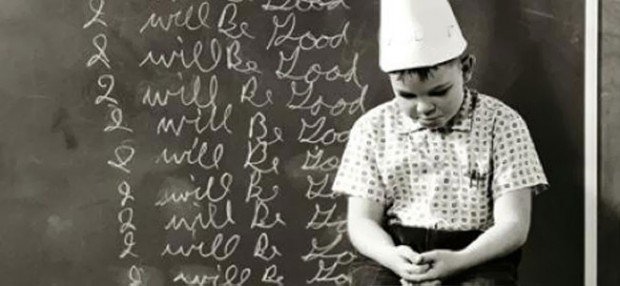

Image Source

To help uss better understand how to handle those issues, today we are going to take a look at the U.S. Foreign Corrupt Practices Act and its control objectives.

Companies based out of in the United States need to be aware of the U.S. Foreign Corrupt Practices Act and how it will direct their business actions in the foreign markets overseas.

As part of the effort to address these issues, companies that are based in the United States are required to comply with the U.S. Foreign Corrupt Practices Act (FCPA).

This act was created in 1977 and “generally prohibits the payment of bribes to foreign officials to assist in obtaining or retaining business” (Spotlight, n.d.).

The FCPA also requires the keeping of accurate books and records and maintaining a system of internal controls sufficient to “provide reasonable assurances that transactions are executed and assets are accessed and accounted for in accordance with management's authorization” (Spotlight, n.d.).

I think this is an area or arena that blockchain with public ledgers could provide a way to openly and fairly carry out compliance.

Image Source

The U.S. Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) are jointly responsible for enforcing the FCPA (Spotlight, n.d.).

Additionally, the FCPA makes it “unlawful for certain classes of persons and entities to make payments to foreign government officials to assist in obtaining or retaining business” (Foreign, n.d.).

For U.S. companies, this commitment to “fair play” may seem to put tgem at a disadvantage.

As a response to this situation, “U.S firms have complained that the Foreign Corrupt Policies Act puts them at a competitive disadvantage to other firms whose governments have less strict laws” (CTU Business, 2016).

However, I think that it is important that U.S. firms hold themselves in being leaders on dealing with the issue of corruption.

There have been several attempts at the international level to address corruption, including the United Nations’ Declaration Against Corruption & Bribery in International Transactions (CTU FAQ: Business, 2016).

This is a broad international effort by the United Nations (UN) to “address the problem of corruption and bribery in international commercial transactions” because there is a need for “transparent environment for international commercial transactions in all countries” (United Nations, 1996).

Furthermore, the FCPA outlines control objectives related to transactions and accounts to make it clear what is and is not in compliance.

When it comes to regulating these transactions the term “reasonable detail” is defined as the level of detail that would “satisfy prudent officials in the conduct of their own affairs” and is set as the standard for record keeping (A Resource, n.d.).

Also, it is important to note that “it is never appropriate to mischaracterize transactions in a company’s books and records” in an attempt to work around the law (A Resource, n.d.).

In June of 2015, the he US Department of Justice (DOJ) and Securities and Exchange Commission (SEC) made recent changes to the FCPA manual, A Resource Guide to the U.S. Foreign Corrupt Practices Act (the Resource Guide) (Department, 2015).

Some particular changes of note were “to make clear that issuers should use “good faith efforts” to cause their minority-owned subsidiaries or affiliates to implement adequate accounting systems. The prior version required issuers to use “best efforts”” (Department, 2015).

Other changes include amendments in 1998 to the anti-bribery provisions of the FCPA which “now also apply to foreign firms and persons who cause, directly or through agents, an act in furtherance of such a corrupt payment to take place within the territory of the United States” (Department, 2015).

Image Source

Now that we better understand the U.S. Foreign Corrupt Practices Act, we will explain the penalties of Noncompliance.

The BHP Billiton settlement is only one example of a penalty related to noncompliance.

The 1988 amendments to the FCPA outline other “penalties, sanctions, and remedies” (Our Top, 2016).

These changes include that “individuals are subject to a maximum fine of $250,000, an increase from the maximum of $100,000 under the Alternative Fines Act, 18 U.S.C.” (Our Top, 2016).

Also “under the Alternative Fines Act, a fine of up to twice “the benefit that the defendant obtained” may be imposed” which is different from the prior version that “stated that the maximum penalty under the Alternative Fines Act was twice the benefit “the defendant sought to obtain”” (Our Top, 2016).

The FCPA specifically provides different criminal and civil penalties for companies and individuals that include fines, civil actions, and “collateral consequences, including suspension or debarment from contracting with the federal government, cross-debarment by multilateral development banks, and the suspension or revocation of certain export privileges” (A Resource, n.d.).

Still have questions?

Please speak to a legal advisor to insure compliance.

Stay interesting. Stay Strange.

See the latest adventures and creations from my wife Sarah on steemit!

Also Check Out Some of My Previous Post:

Do you want to take out a loan to consolidate debt?

If you use my Credible Referral link, you can get a cash bonus if you take out a loan.

A Resource Guide to the U.S. Foreign Corrupt Practices Act. (n.d.). Retrieved February 17, 2016, from https://www.sec.gov/spotlight/fcpa/fcpa-resource-guide.pdf

Colorado Technical University. (2016). Business Ethics and the World Economy [MUSE]. Retrieved from Colorado Technical University Virtual Campus, FINC610 -1601B-01: https://class.ctuonline.edu/CbFileShareCommon/coursebuilder/30000/22985.pdf

Colorado Technical University. (2016). FAQ: Business Ethics and the World Economy [MUSE]. Retrieved from Colorado Technical University Virtual Campus, FINC610 -1601B-01: https://class.ctuonline.edu/CbFileShareCommon/coursebuilder/20000/13547.pdf

Colorado Technical University. (2016). International Business Issues [MUSE]. Retrieved from Colorado Technical University Virtual Campus, FINC610 -1601B-01: https://class.ctuonline.edu/CbFileShareCommon/ctu/FINC610/P1/Hub2/13305.pdf

Department of Justice Quietly Revises Foreign Corrupt Practices Act Resource Guide. (2015). Retrieved February 17, 2016, from http://www.natlawreview.com/article/department-justice-quietly-revises-foreign-corrupt-practices-act-resource-guide

Foreign Corrupt Practices Act. (n.d.). Retrieved February 17, 2016, from http://www.justice.gov/criminal-fraud/foreign-corrupt-practices-act

Our Top Ten List didn't change in 2015 (but here's when it did change) - The FCPA Blog - The FCPA Blog. (2016). Retrieved February 17, 2016, from http://www.fcpablog.com/blog/2016/1/5/our-top-ten-list-didnt-change-in-2015-but-heres-when-it-did.html

Spotlight on Foreign Corrupt Practices Act. (n.d.). Retrieved February 17, 2016, from https://www.sec.gov/spotlight/fcpa.shtml

United Nations Declaration against Corruption and Bribery in International Commercial Transactions. (1996). Retrieved February 17, 2016, from http://www.un.org/documents/ga/res/51/a51r191.htm