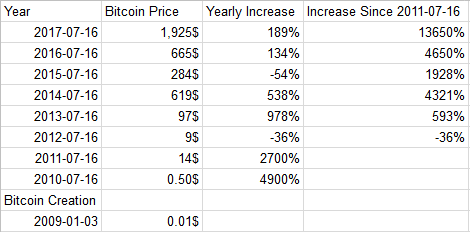

The price of Bitcoin has gone up 567% in the last 365 days. 10,000$ of Bitcoin exatly 1 year ago is now worth 66,700$.

My Latest Series

The current post is part of a series of post listed below but can also be read on it's own.

- #1 "What Truly Matters!"

- #2 "How National Currencies Are Created And Who They Profit"

- #3 "Cryptocurrencies: The Best Investments Of All Time"

- #4 "Understanding Bitcoin"

- #5 "Understanding Bitcoin Cash"

- #6 "How To Buy And Secure Your First Bitcoin"

- #7 "Empower Everyone, Decentralize Everything!"

- #8 "Doing Away With Governments: How And Why"

The Opportunity Of A Life-Time

In many of my previous posts I've talked about cryptocurrencies, why they are a better form of money than national currencies, why they pose a challenge to the existence of countries as we know them today and I've also shown the fact Bitcoin is the best financial investment of all time.

In this post, I will treat of altcoins which are cryptocurrencies derived from Bitcoin. Many altcoins have out-perfomed Bitcoin in the last years. This post will show some of those stats and some strategies for investing in those altcoins. It will be much more about the fundamentals than any prediction as this make a lot more sense when investing.

I first learn about Bitcoin in June 2011 possibly even sooner and I began to read about cryptocurrencies daily in February 2013.

Governments Are Masters Of Deception

They can't exist without war and war is based on deception. Those who engage in wars are always looking to gather more power to themselves at the expense of everyone else and that's exactly what we are observing from governments.

Countries run the show and create money out of nothing, until this changes, it's their will that will be realized and the suffering of the masses will go on increasing.

Everything that redirect power away from governments and give this power back to people is a good thing.

This is the first book I ever bought. I was still a teenager. It's a French version of "The Art Of War". It turn it to be my favorite book ever yet I don't necessarily recommend it.

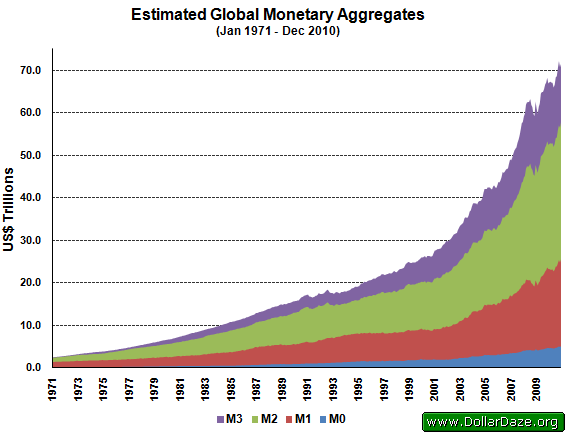

National Currencies Are Inflationary And Losing Value

One of the greatest example of this is Zimbabwe where inflation reach 231,150,888% in less than a year. [Wikipedia]

All countries create or issue new currencies every year. They are issuing a lot. When they do so they are debasing the value of their currencies. The people receiving the newly created money couldn't care less about it losing some value but for everyone else this lost in value has very real consequences.

I live in Canada. Here, prices in 2017 are 63.2% higher than prices in 1990. This is because the Canadian Dollar lost 63% of it's purchasing power during that time. [Source]

This purchasing power have been taken away from those who hold Canadian Dollars and given away to those who created it out of nothing through multiple schemes like fractional reserve banking and other scheme, all of which comes down to creating money of or nothing, benefiting some unknown people at the expense of everyone else.

Many countries don't have a national currency and use the national currency of another country or use a multi-national currency. Here's a very interesting article on the subject.

I've talked a lot about how money is created and who it profit in my post: "How National Currencies Are Created And Who They Profit". I've also given a lot of sources for anyone interested about investigating the subject further. It's a subject of capital importance, pun intended.

@jockey also wrote a very good post on money creation here.

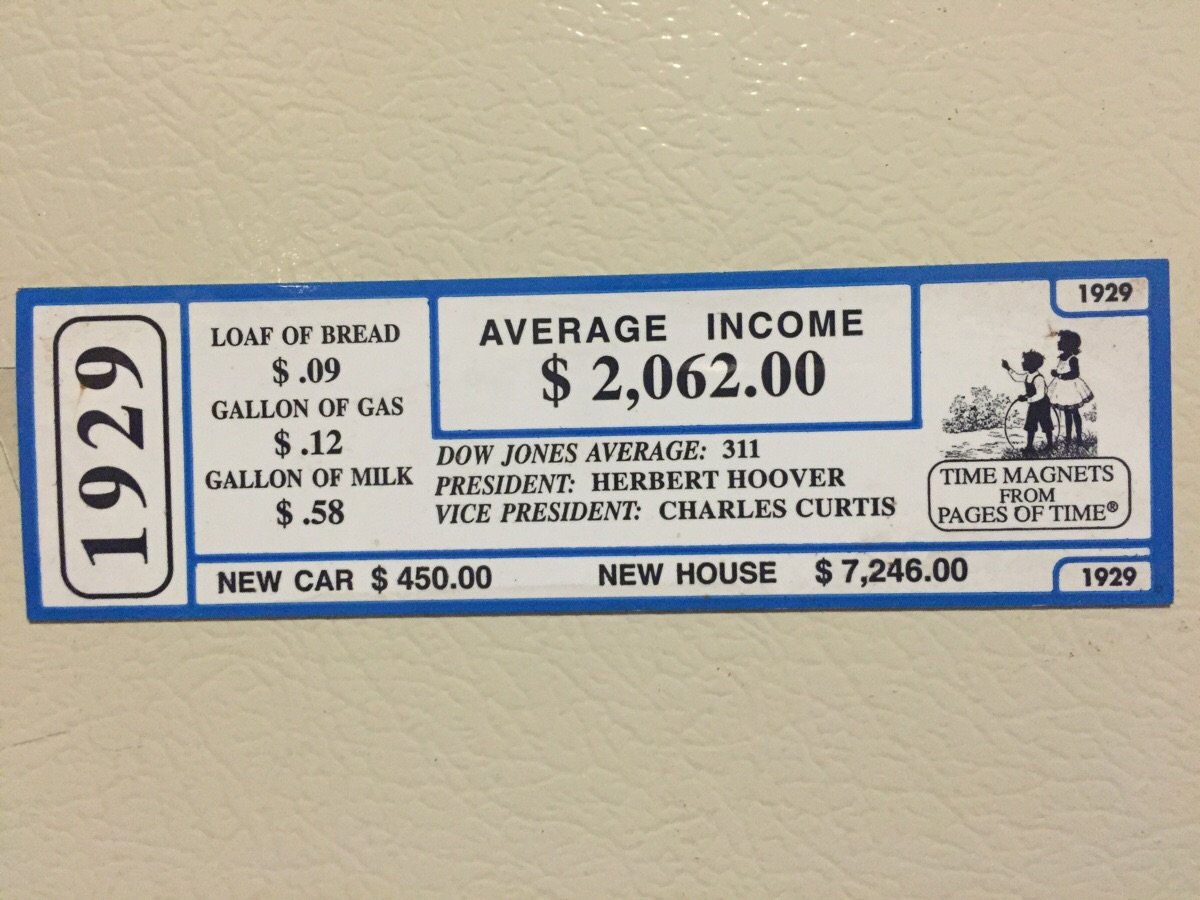

National Currencies Are Inevitably Losing Value

This is the case for all national currencies. I hear a lot of people saying they are buying houses because the prices of houses go up over time. Though it's true that the price of some houses go up in value, in those case most of the time it's the land on which those house are built that is going up in value, the rest of the time it's simply that the money with which the house are bought that is going down.

In other word most of the time it's not that houses are going up in value but it's the value of the currencies they are bought with that is going down.

National currencies are created out of nothing at the expense of everyone who hold them. This is in great need to be exposed. This is in great need to be repeated.

Holding national currencies when someone somewhere create them out of nothing is very foolish.

I've talked about this in more details and why cryptocurrencies are a much better form a money in the post I just mentioned.

There's more US debt than there exist US money.

Cryptocurrencies Recap

Cryptocurrencies have given a lot of financial freedom to many people but even more importantly they are taking away from governments by making national currencies, less desirable.

Obviously the poorest of the poorest can't invest in Bitcoin but because cryptocurrencies are taking power away from governments and redistributing those power to the individuals, this is a good thing for everyone. In the long run even the poorest will benefit greatly.

Countries can still issue more of their national currencies but if there's an ever diminishing demand for them, their value will inevitably go down and the power behind countries will also go on decreasing.

I've talked about cryptocurrnencies in much more details in my previous post of this series. They have been the best way to make money for the last couple of years. Make the smart choice by learning about cryptocurrencies.

Cryptocurrencies Are A Huge Market And Growing Fast

Cryptocurrencies' market cap or the total value of all cryptocurrencies is $127B and currently rank them as the 53th largest company (by market cap) in the world and the 52th biggest economy (M3) in the world right between Algeria and Pakistan. At the current rate, cryptocurrencies will become the company with the biggest market cap in less than a year and the biggest economy in less than 3 years.

The company with the biggest market cap is APPLE with $827B and the biggest M3 is China with $22T has of December 31 2016. [source: 1, 2]

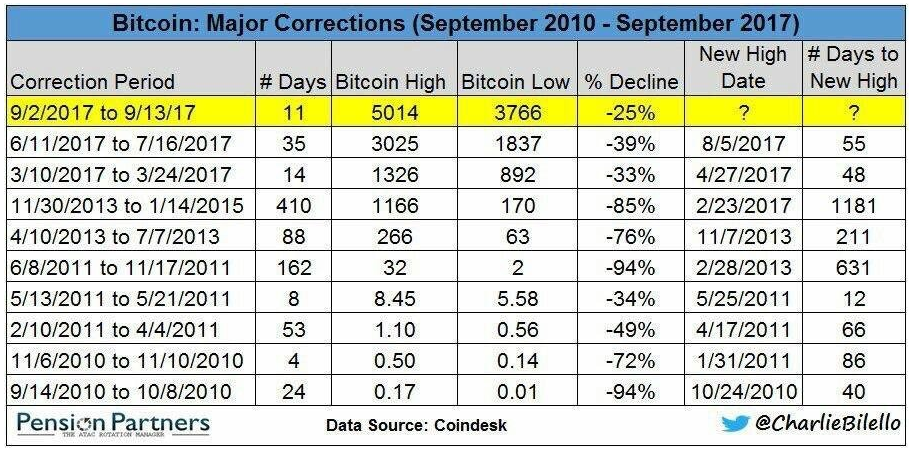

Bitcoin Lastest Price Correction Put Into Perspective

A Primer On Altcoins

Altcoins comes from the contraction of the words alternative and coin. Altcoins are cryptocurrencies like Bitcoin but an alternative to it.

There exist now more than 1,000 altcoins. [Source]

Hundreds of those coins come directly from the source code of Bitcoin. We can see what are those coins here and when did they split as well as what other altcoins those splits generated.

Some other altcoins have a totally new source code. Some of those altcoins which don't share the Bitcoin source code can be seen here from the very same website I just mentioned.

Cryptocurrrency Market Overview

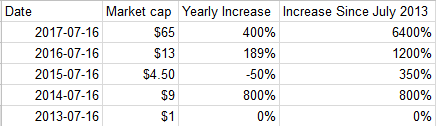

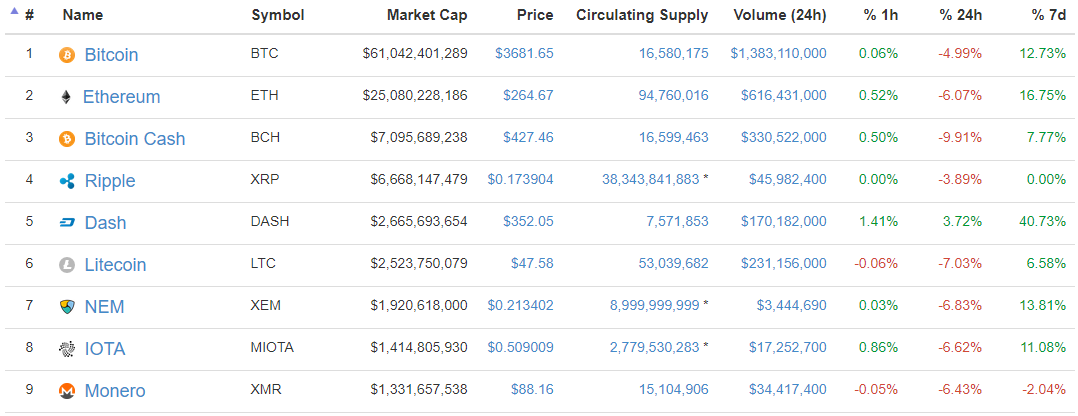

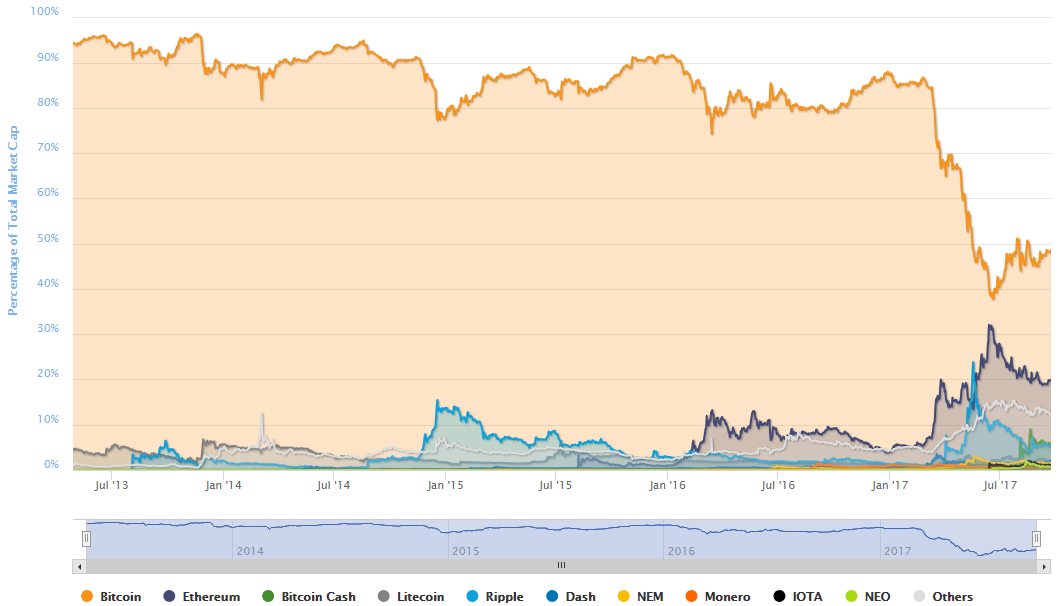

Comparing the market cap of cryptocurrencies separately to the total market cap of all cryptocurrencies give a good overview of the cryptocurrency space. The stats above aren't quite up-to-date. They are a bit less than a month old and comes from this website. It used to be up-to-date.

Up-to-date graph of the top 10 crypcurrencies market cap dominance can be found here.

Much of the value of cryptocurrencies are highly concentrated at the top.

The Initial Investment Hold The Most Potential

There's no amount of re-investment that can make up for the lost of potential gain from the initial investment. Let's take Bitcoin for example, it's price has gone up 567% in the last 365 days. If someone invested 1,000$ back then, they now have 6,670$. No amount of re-investment can make up in potential gain that initial investment hold. I've talked about this in some previous post and why I max out my credit card 2 years ago to buy Bitcoin.

I can't blindly recommend people to do the same. The future is not 100% predictable. At that time, this move made sense to me and it turned out to be a very good one. Losing all my investments would have been pretty bad but not catastrophic.

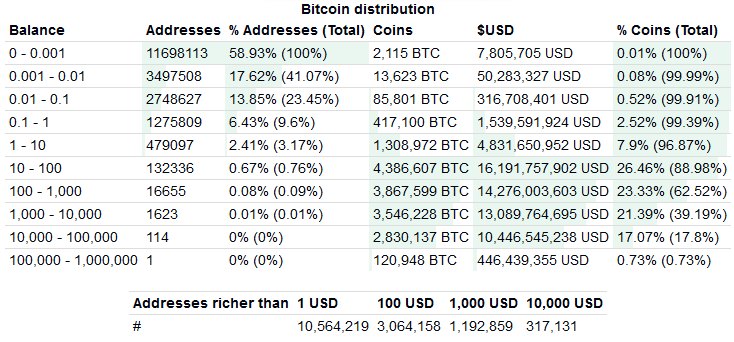

The Importance Of Coin Distribution

If one person held all the Bitcoin that currently exist, then it would be more sense for miners (owners of hardware) to start a new Bitcoin blockchain from scratch. The value of the Bitcoin blockchain which would entirely held by one person would be close to 0$.

For this reason, the incentive for someone to diversify from holding a cryptocurrency increase proportionally with how much % of this cryptocurrencies they own compare to the total market cap. If someone owns 1% of all Ethereum for example they wouldn't have as much incentive to diversify away from Ethereum than someone who owned 99% of all Ethereum.

Stats on the distribution of most cryptocurrency can be found here and more detailed one here.

The Logic Behind Diversifying Your Crypto Investment

If someone only hold one type of cryptocurrency and there's a bug found in this cryptocurrency causing its price to crash then this person would lose most of their crypto investment. This is in a sense the most risky, least diversified portfolio but if this one cryptocurrency goes up more than any other then it's the most profitable option. This is now what I'm looking for and thus not how I invested.

The opposite strategy would be to have a portfolio investment reflecting more perfectly the market cap of all cryptocurrencies and how much of the total market cap they represent. So for example, above Bitcoin represent 46% of all the cryptocurrency then their cryptocurrency portfolio would hold 46%. Ethereum represent 20% then someone would hold 20% of their cryptocurrency as Ethereum, etc.

Note: The image is about an app which keep track of someone's crypto investments called blockfolio.

A Portfolio Representative Of The Crypto Space

This is in part the strategy I use but I mostly concentrate on the top 10 cryptocurrencies. This doesn't mean I hold every top 10 cryptocurrencies and in direct proportion to the market and this doesn't mean I don't hold any of cryptocurrencies which smaller market cap. Steem is one good example.

Cryptocurrencies with bigger market cap are usually more scrutinize by a greater number of coders and hackers. There is more to gain or to lose from finding bugs and from the success or failure of the coin. I'm not talking about bugs in the protocol itself but sometimes the wallet accessing the cryptocurrencies and other related application can have bugs. The price of cryptocurrencies with larger market cap are also most of the time more stable.

Cryptocurrencies with larger market cap are traded on more exchanges and are paired with more cryptocurrencies. More pairing mean they influence the price of a greater number of cryptocurrencies. For example, when the price of Bitcoin goes up compare to the USD the price of all cryptocurrencies will go up compare to the USD if there's no order book filled between Bitcoin and those altcoins.

There's many dynamics at play here and trying to keep track of them all is pretty much impossible.

Proof-Of-Work Vs Proof-Of-Stake

There's 2 mains ways cryptocurrencies are created and thus distributed. There's proof-of-work (POW) often reffered to as mining and which I explained here in detail with a full explanation of Bitcoin and there's proof-of-stake (POS). There are other type of distribution and there are also hybrid like POW/POS. Steem is DPOS or delegated proof-of-stake.

POS have been criticized and could possibly be insecure. Because of those criticisms and also because POS have a tentency to concentrate the distribution of newly created coin, I avoid investing in POS coin. DPOS coin aren't at risk to the attack described below.

"Some authors argue that proof-of-stake is not an ideal option for a distributed consensus protocol. One problem is usually called the "nothing at stake" problem, where (in the case of a consensus failure) block-generators have nothing to lose by voting for multiple blockchain-histories, which prevents the consensus from ever resolving. Because there is little cost in working on several chains (unlike in proof-of-work systems), anyone can abuse this problem to attempt to double-spend (in case of blockchain reorganization) "for free"."

Statistical simulations have shown that simultaneous forging on several chains is possible, even profitable. But Proof of Stake advocates believe most described attack scenarios are impossible or so unpredictable that they are only theoretical." [Wikipedia]

Initial Coin Offering (ICO)

"Initial coin offering (ICO) is an unregulated means of crowdfunding via use of cryptocurrency, which can be a source of capital for startup companies. In an ICO a percentage of the newly issued cryptocurrency is sold to investors in exchange for legal tender or other cryptocurrencies such as Bitcoin. The term may be analogous with 'token sale' or crowdsale, which refers to a method of selling participation in an economy, giving investors access to the features of a particular project starting at a later date. ICOs may sell a right of ownership or royalties to a project.` [Wikipedia]

I advice to be cautious with ICOs. They can easily be scams created solely to enrich their creators. I use caution and I've rarely invest in them. Still some of them have turned out to be really good investments yet the vast majority haven't done as good as Bitcoin.

Proof-Of-Work Mining Algorithm

There are many proof-of-work mining algorithms. Some mining hardware like those mining Bitcoin can only mine coin which use the SHA-256 algorithm. These hardware are based on chips called ASICS. A list of many cryptocurrencies with many different algorithm mined by ASICS as well as their mining profitability can be found here.

"An application-specific integrated circuit (ASIC), is an integrated circuit (IC) customized for a particular use, rather than intended for general-purpose use." [Wikipedia]

There are some coin which have mining algorithm that can't be mined with ASICS these coin can only be mined with GPU and CPU. A list of many cryptocurrencies with many different algorithm mined by GPU and CPU as well as their mining profitability can be found here.

Mining Profitability And Cryptocurreny Prices

I tend to think there's a certain correlation between the price of cryptocurrencies and their mining profitability. Miners won't sell the coin they mine at a lost or else the miner with the smallest mining profitability will stop mining, driving up the profitability margins of remaining miners. There are somewhat opposite incentives when mining profitability margins are too high.

The Cost Of Mining 1 Bitcoin

The cost of mining 1 Bitcoin at the relative price of 3619$ with the most efficient hardware miner, the Antminer S9 and the price of electricity at 0.10$/kWH is roughly 1030$. This doesn't take into account the cost of the miner itself. Cryptocurrencies can also be mine with a pencil and a paper.

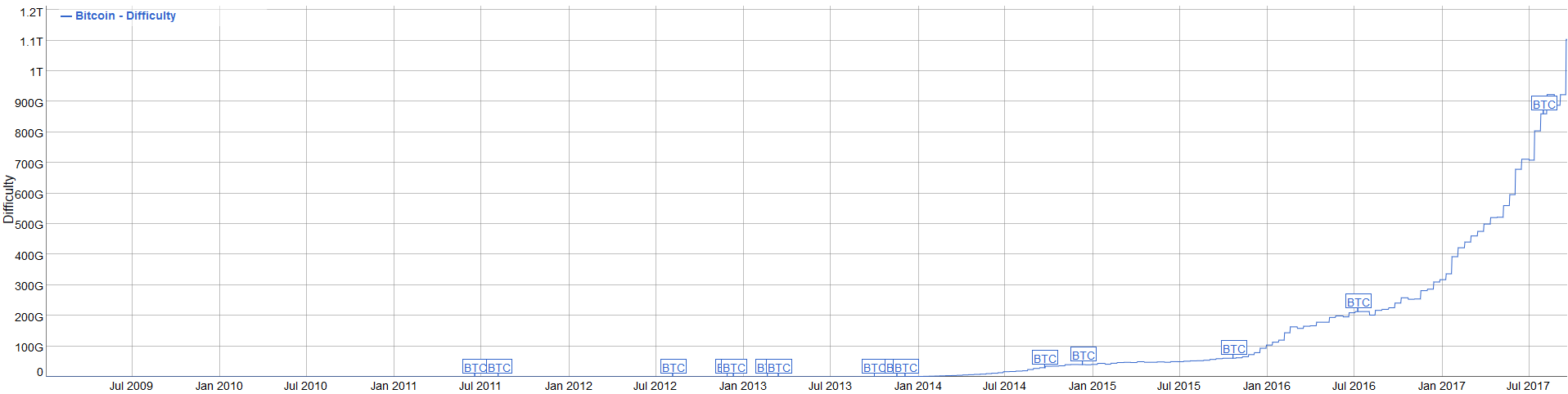

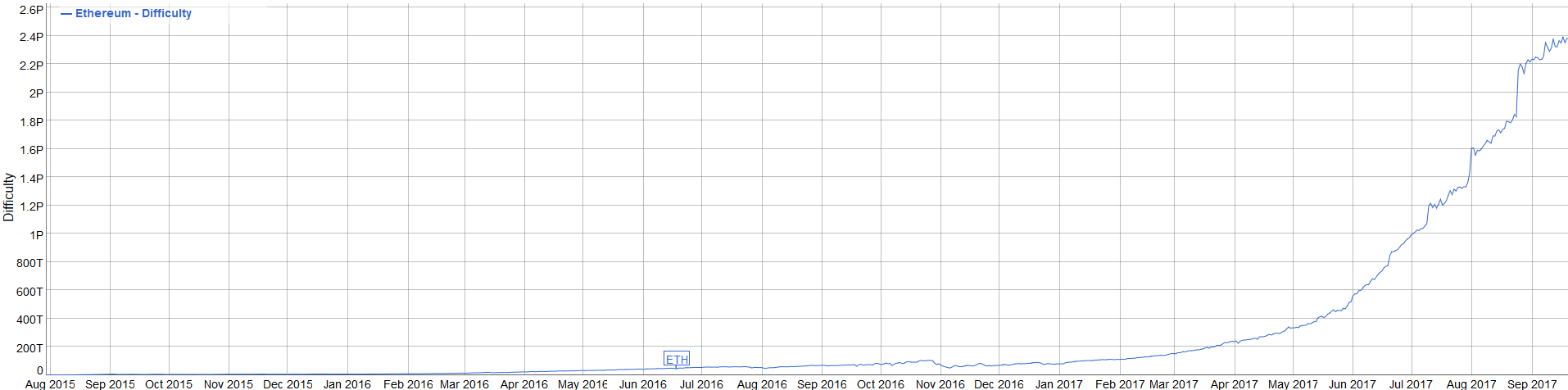

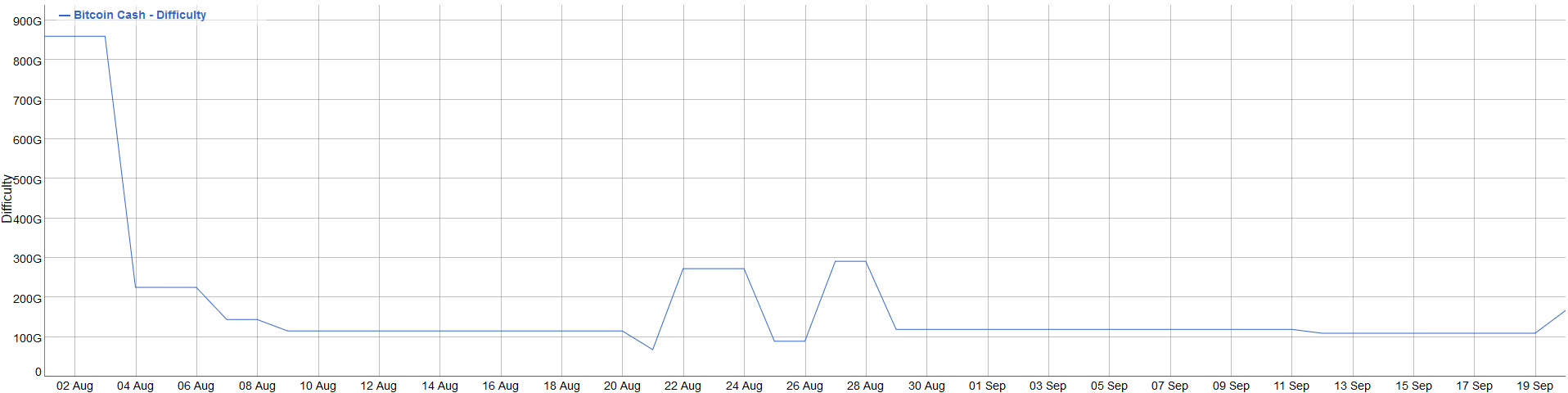

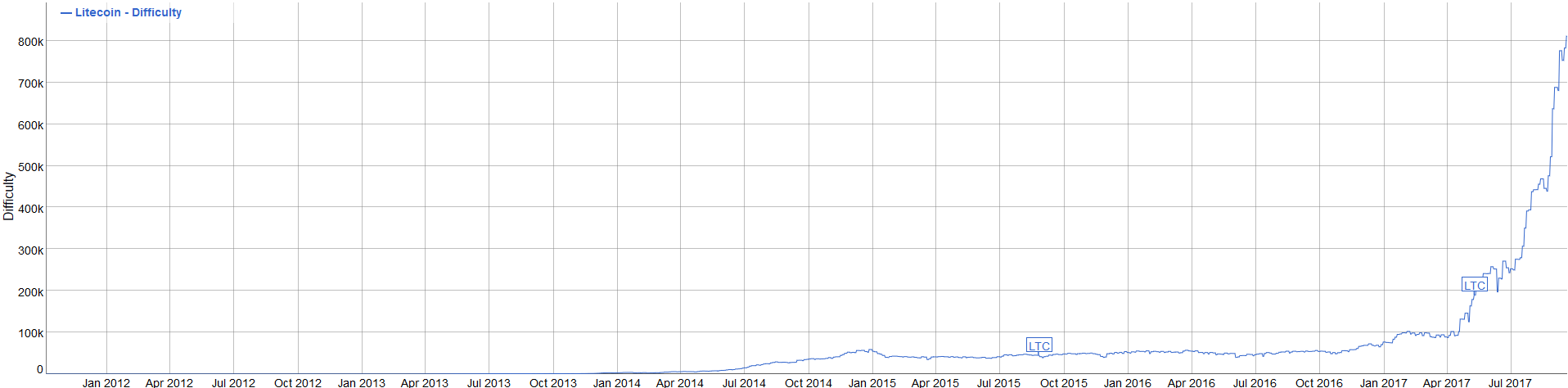

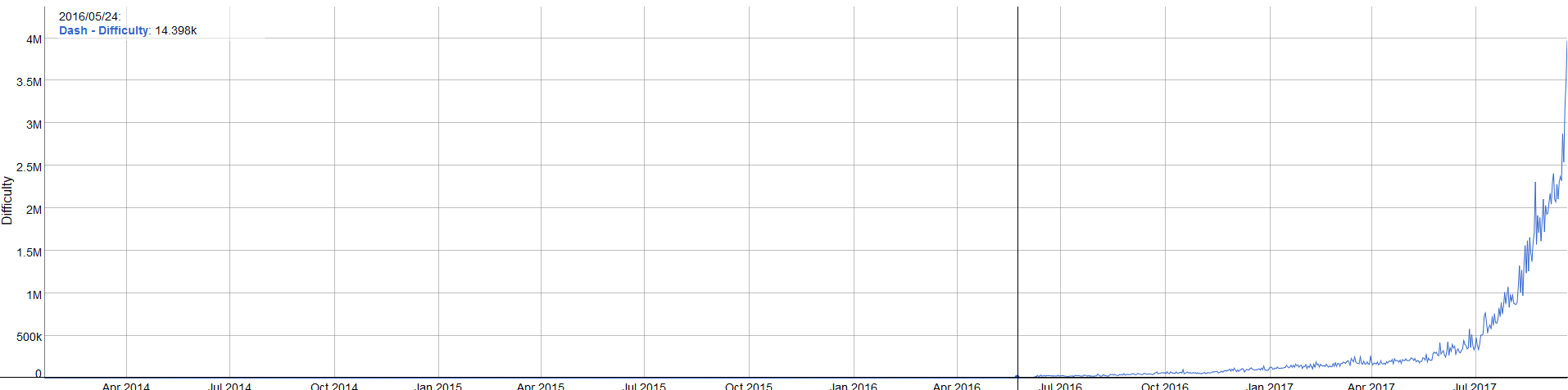

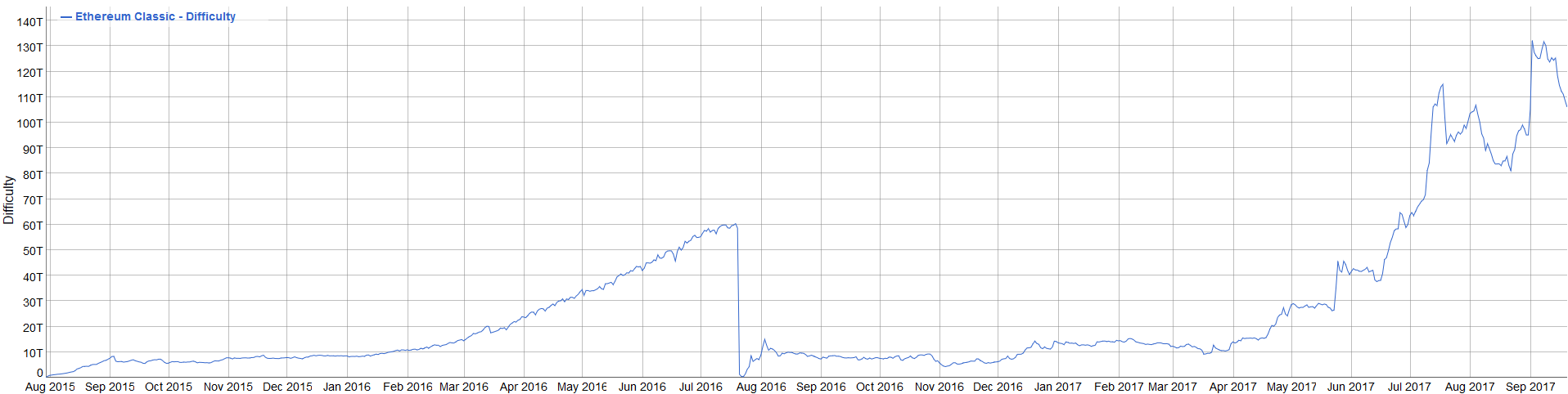

Mining Difficulty

Difficulty is a measure of how difficult it is to find a hash below a given target which translate into the difficulty to find or mine a given cryptocurrency. The cost of mining a given cryptocurrency goes up proportionally with the increase in difficulty.

Below the difficulty chart of the 7 POW cryptocurrencies with the biggest market cap.

Bitcoin

- More precise number here with prediction for future difficulty increament.

Ethereum

Bitcoin Cash

Litecoin

- More precise number here with prediction for future difficulty increament.

Dash

Monero

Ethereum Classic

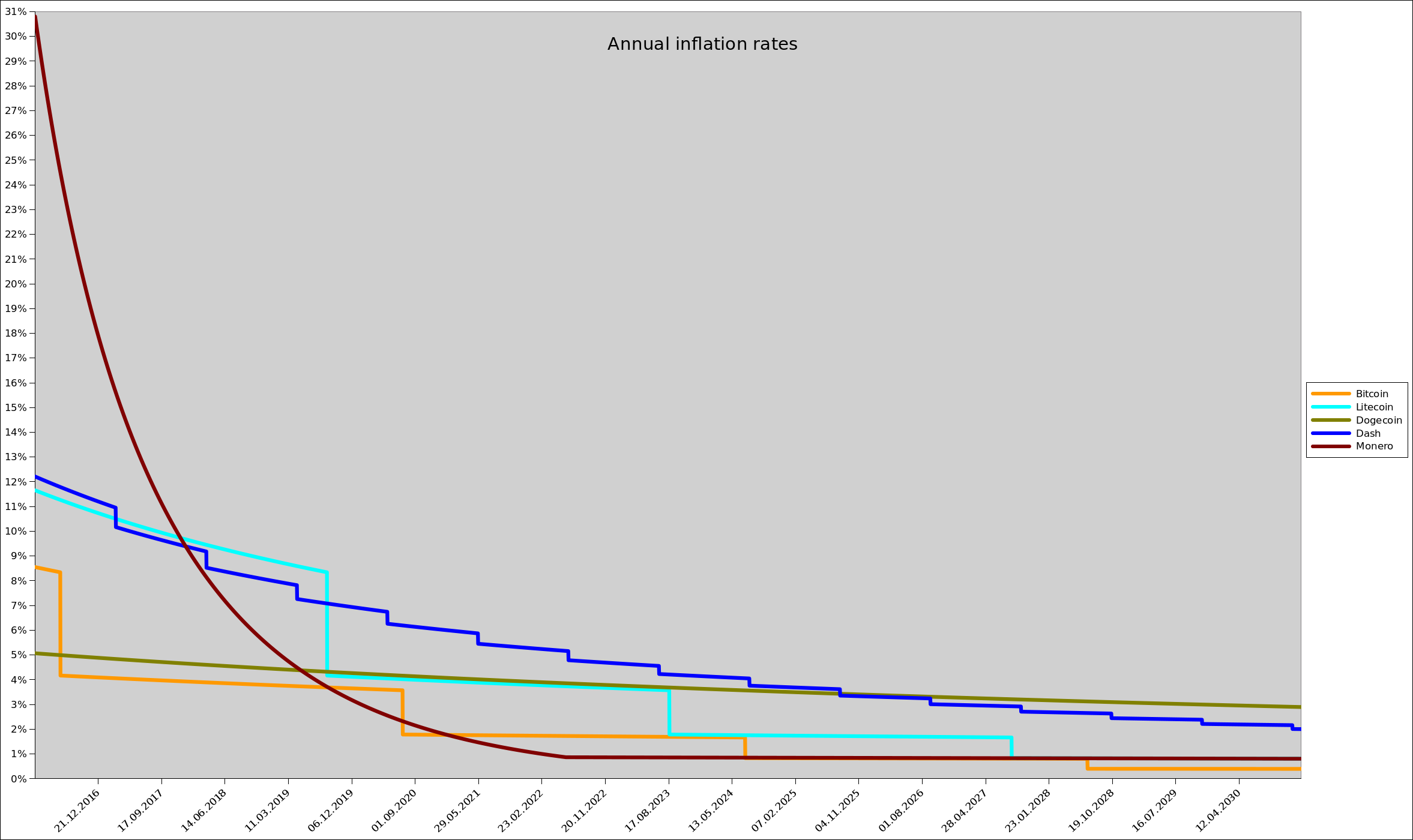

Inflation Rate Of Major Cryptocurrencies

The inflation rate of the different coin also influence the mining profitability. Some inflation rate decrease slowly with every blocks while some happen abruptly at some precise block.

Bitcoin, Litecoin, Dash & Monero

- Click on the chart above for more information.

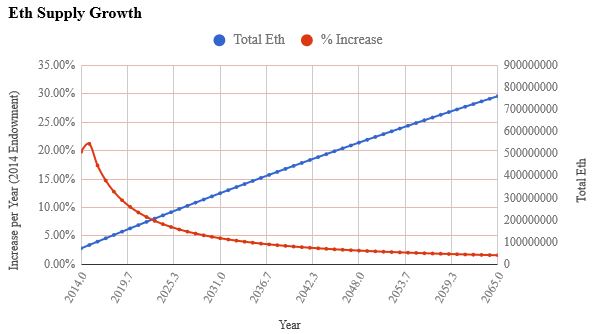

Ethereum

- Click on the chart above for more information. Ethereum is suppose to switch to a new type of POS at some point.

Best Performing Financial Assets Of 2017

Cryptocurrencies have out-performed pretty much all other financial assets for the first half of 2017.

"Cryptocurrencies have become so prominent that major semiconductor stocks have started to move based on how readily their chips are used by “miners,” who use high-powered computers in a race to solve complex puzzles. Those who solve these problems are rewarded with the digital gold of bitcoin and other digital currencies." [Marketwatch]

Best Performing Altcoin Of 2017

These are the best performing cryptocurrencies from December 31 to May 31 2017.

"While Monero took the crown in 2016 with growth of 2,760%, 2017 has seen even more explosive – crazy? insane? bubbly? – growth of the cryptocurrency market. I’ll leave word choice and analysis up to others for now." [Source]

More information can be found at the source.

A much more better place to find information on the best performing altcoins of the last past months can be found here.

Cryptocurrencies From Top 10 Which I Don't Know Much About

Ripple, NEM, IOTA are 3 coins from the top 10 which I've investigated for less than 5 hours and thus I don't consider knowing much about them. Here's one enlightening discussion I had with Ripple CTO @joelkatz here on Steemit.

Best Investment Advice

"I am up almost 50% from two weeks ago because I always have pre set orders ranging from -10% market value all the way down to -%75. These recent dips have been incredible to my ROI."

"If you analyze an order book of a given coin, you will see that I am not alone. There is a reason you see a ton of orders for ridiculously low prices, these are the smart investors, waiting for the price to come to them, we are not chasing the prices ourselves. That would be stupid yet i'd argue MOST of you do just that." [Reddit]

With Every Price Movements

"When this happens, that bitcoin (money) is travelling from hands of people with very large holdings in bitcoin, and weaker hands than those buying it up usually. Therefore, these large movers are divesting. In divesting, the money is put into more peoples' hands. When it is put into more peoples' hands, liquidity increases, and volatility necessarily must decrease."

"Think of it this way: maybe Roger Ver sells 25-50% of his bitcoin, and sometimes idiotically, people will do that in one fell-swoop. When that happens, the price drops significantly, but then others (undoubtedly multiple people) buy it up. Thus, next time, those price variations must be consigned by multiple people, all who have independent will."

"See every single swing in bitcoin's price as a hardening in it, ups and downs alike." [Reddit]

In Conclusion

Bitcoin and other top 10 cryptocurrencies have had price increases that are very satisfying to me. Because cryptocurrencies are fundamentally better than national currencies, I think the current trends observed over the last years will continue pretty much as they have for most of them with their usual roadblocks and hiccups.

When I invest in coin with much smaller market cap than the top 10, I avoid investing more than 2% of my portfolio. There are some exception to this. Steem is one. EOS is another one. @eosio There are others. If I invest in a coin that I think as some potential, I try to invest as soon as I can.

There are many good opportunies out of the top 10 market cap but they aren't so obvious to spot. I've read on at least 50% of the top 100 cryptocurrencies and on so many others, of which quite a fair amount are now dead coins, with no dev anymore or they aren't traded on any exchanges anymore.

Money is just a tool and I have enough to achieve my current life objectives and thus I keep my trading at a minimum. As with everything there's a trade-off. The more someone spend time trading and looking at the charts the more opportunities they will be able to size.

Do what you love in life. Trying to accumulate as much money for the sake of owning as much as possible is foolish.

Music Time

One of my very best song from one of my very best album (2015).

Approving My Witness!

Witness #53

Would you consider voting for my witness to help us Steeming the world we all long for? https://steemit.com/~witnesses

Thank you for reading and for commenting! I read all comments!

Steem's Growth Is Unmatched!

Its Popularity Is Rocketing!

Share the fun by inviting your friends!

Good To Know

I used @jerrybanfield's strategy for this post title. See Jerry explain all about it here. We'll see how it does.

I use Markdown Pad (free version) to create my posts and I recommend it to everyone.

How to align pictures.

Get On The Chats!

Not the private messages but in the chat rooms. These are some of the best places to makes some Steem friends.

- Official Steemit.chat

- SteemSpeak.com @fyrstikken @fyrst-witness (24h/7 Voice chat)

- Peace, Abundance, Liberty @aggroed @ausbitbank @teamsteem & More (Minnow Support Project)

Find Out More!

Useful Links

- https://steemd.com/@teamsteem

- https://steemdb.com/@teamsteem

- https://steemit.chat/

- http://www.steemreports.com/

- http://steemvp.com/

- https://steemvoter.com/

- https://coinmarketcap.com/currencies/steem/#charts

- https://coinmarketcap.com/currencies/steem/#markets

- https://steemdata.com/charts

- https://www.steemnow.com/

- http://steem.supply/@teamsteem

My Most Useful Posts

- "Stand for What Feels Best!" (Money in the world today is created out of thin air by a small elite group at the expense of everyone else.)

- "Creating The World We Long For!" (My last post from my previous series, listing my 16 previous posts.)

- "Thank you Dan Larimer! You are a great mentor!" (Dan is the Ex-CTO of Steemit)

- "Steemit.com Set To Become The World's Most Popular Website" (Part of The Ultimate Steembook)

- "The 911 False Flag Tragedy"

- "Geoengineering: Its Documented History"

- "The most beautiful thing I’ve ever heard" (My best paid post at 8,000$)

Steem 101

- "Steem: An In-Depth Overview!" (The most in-depth and clearest guide to understand what Steem is and what it can do for you!) (Reached top #1)

- "The Ultimate Steem Guide!" (How to Use Steem: The revamped edition.) (Reached top #1)

- "What Are Steem Witnesses And Why You Should Support Them!" (Your 30 most important Steem vote.)

- "Some Steem Stats!" (Empowering Cryptocurrencies Stats, Steem In Particular.)

- "Some Steem Tips For Some Steem Success!" (Who to follow and many more Steem fundamentals every serious Steemians should know!)

- "Hello Steemit! - Coinmarketcap.com Introduced Me!" (Template people can follow for their own introduction post. It list my most favorite short video and documentaries.)

Shared On

- Facebook Profile: (760)

- Facebook Page: (236 followers)

- Twitter: (1,425)