In the world of finance, institutions and individuals use various instruments/tools to minimise risk, curb volatility amongst other things. These tools haven't been available in the crypto world, leaving investors to only buy, sell and HODL tokens. This is also the main reason we don't see a lot of BIG MONEY INVESTORS coming into the crypto space as the tools they are familiar with are not here........ until now, thanks to a project called Firmo.

What is Firmo?

Firmo in a nutshell, is a project that creates and enables advanced financial contracts to be executed on blockchain technology easily, without the use of complex codes and hard to find blockchain experts.

Firmo uses a domain specific language called FirmoLang that has the specific purpose of writing/coding advanced financial contracts such as but not limited to derivatives, loans, options and swaps. It transmutes these instruments smartly to any blockchain platform with the highest degree of accuracy, safety and security, brining the advantages of the existing financial markets to the blockchain.

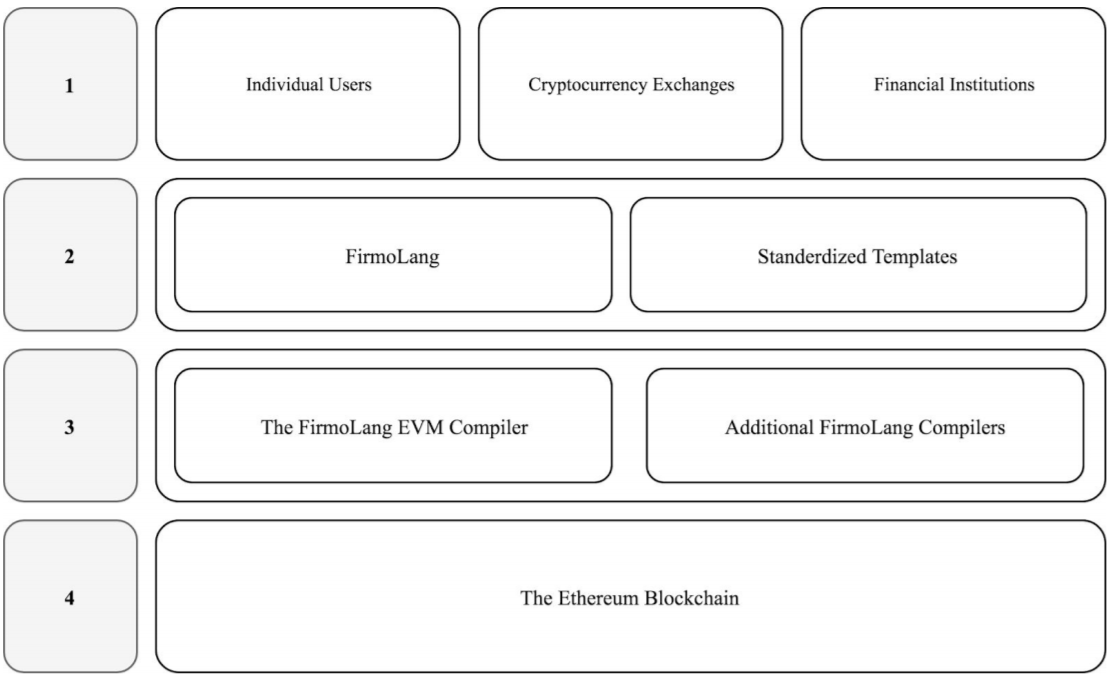

How the protocol ( FirmoLang) works

Step 1: Target User/Group

User groups that the financial contract is being written for are assigned.

Step 2: Custom/Pre-Set

Either a standard snippet of code is chosen from the library or a custom code can be implemented.

Step 3: Compilation/Execuition

The code is launched onto the Ethereum blockchain, allowing any existing tokenized project to utilize the newly developed tools.

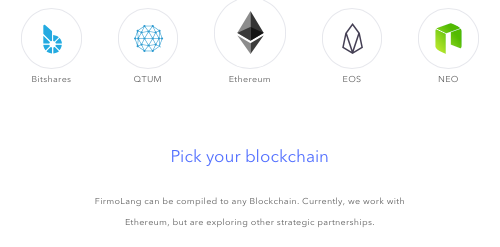

If crypto is to go mainstream like we hope it will, the financial structures have to be in place to safeguard investors by curbing volatility and offering instruments that financially educated individuals are used to. This is what Firmo seeks to accomplish. Firmo is already partnered with Ethereum and is in talks with other blockchains such as Bitshares, Neo, Eos and Qtum to name a few.

Firmo 30 second explanation video

Who will use Firmo and for what?

- Individuals can enter into smart derivative contracts, safeguarding themselves from risk and also having the option to trade their positions to third parties.

- Cryptocurrency Exchanges will use Firmo to conveniently create and securely offer smart derivatives and financial instruments to its clients. They can also play the role of clearing institution or counter-party in a contract. Basically it will be an open hand welcome to big money to hop into crypto currency feeling more secure.

- Financial Institutions can use the Firmo protocol to reduce costs associated with clearing and settling financial instruments by eliminating middle parties and automating the process on blockchain technology. They can also offer a wider variety of more advanced financial tools more cost effectively.

What Firmo will bring to the crypto space

Added Security

With major attacks/hacks taking place in the crypto space, security is of a major concern to Firmo. That is why they employed security features from airplane, train and sattelite applications that are domain specific. The CEO has had first hand experience with these applications and sees it as a must in the crypto space. This gives the Firmo protocol an advantage over Solidity which has been pray to numerous attacks such as the Parity and the DAO attacks..

With Firmo using the highest levels of security standards with its smart contracts, it will bring more trust into the crypto space and set new standards for other smart contract providers to follow. Once this happens, adopters of crypto will feel more at ease in the space. ( Hopefully).

source

sourceEvolution of the crypto-space.

Many financially educated investors have stayed away from the crypto-space because of the lack of the financial tools available. Some have opted to enter through centralised futures markets so they can participate indirectly. With Firmo's smart financial contracts, these individuals will be more likely to enter the space bringing streams of wealth into crypto because they can now curb their risk through derivatives and other tokenised assets on the blockchain without third party involvement. The individuals in the space who are not financially educated will have an incentive to learn these tools as they know these big money investors are not coming into crypto to lose. This will intern create a new generation of financially educated individuals in a high-tech blockhain based world. The younger generations are not interested in the current financial world, but they are interested in crypto and blockchain technology.

Firmo also has extremely smart derivatives contracts that can be triggered by external data feeds such as the price change in the US dollar, gold or even a verifiable event such as the cancellation of a flight. The possibilities are endless.

Investors can use derivatives provided by Firmo to lock in prices of cryptos if they feel the price will fall or rise and lock in a price accordingly with a derivatives smart contract. They can also use tokenized tools to set rates for suppliers they pay in crypto, so if the price of a currency falls or rises it doesn't affect the parities as they have locked in their rates while locking in the price of their goods in the supply chain so business runs smoothly on the blockchain even with volitilty at play.

Zero Coverage for collateral management

Firmo will offer a zero coverage option for collateral accounts and margins which means users can execute smart derivatives without putting up their assets. This is used when:

"The smart derivatives are executed on permissioned infrastructure, or when sufficient trust exists between the counterparties. This feature will be built by the Firmo Community."

Zero coverage collateral will allow investors to do more with less and do so in a less risky manner enabling them to conduct finances in such a way that benefits them. They can be more liquid and open to many opportunities. If their assets are already tied up, zero coverage collateral will be an option they can use now with assists they have later.

Firmo will also offer Variable Collateral Coverage ( an amount of the asset or an asset equivalent is put up as collateral) and Full Coverage ( a kind of escrow of assets until contract completion)

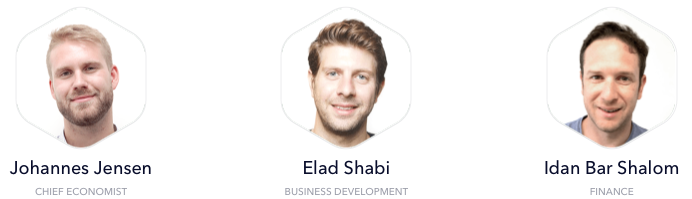

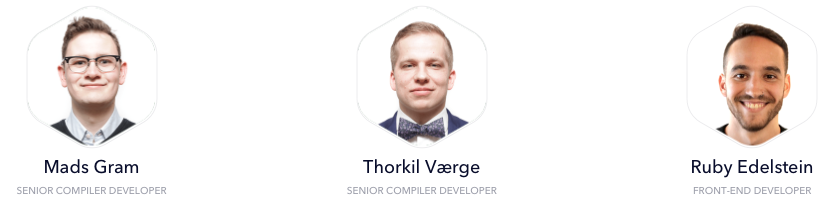

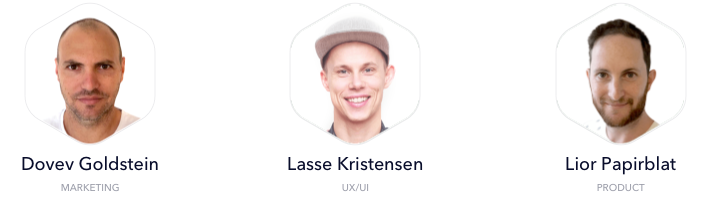

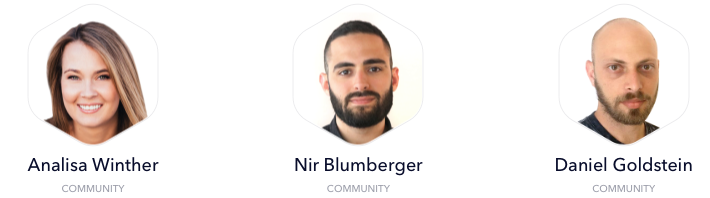

The extremely large Core Team

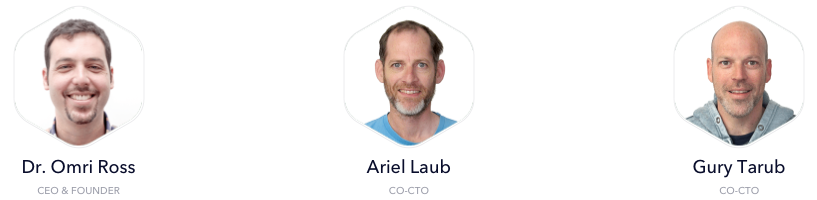

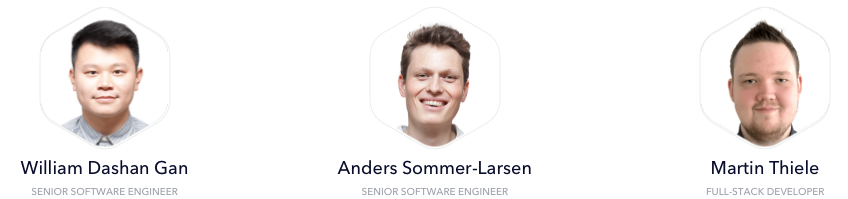

The extensive team is highly capable of executing and maintaining this ambitious project. Led by CEO Dr Omri Ross who is highly educated in blockchain technology and also has over 20 years experience in the financial sector with his own venture, Ross Holdings IVS and also through working at Wintergreen Global Holdings. So the leader of this huge team knows how to bring these two worlds together. The developers on the team have years of experience and have deployed numerous well built projects on a variety of platforms.The team seems well structured and observant of the cryptospace, the current financial arena and even have an economist on the team which I think is very vital because a project like this has to be on top of the micro and macro economics to spot future trends and make necessary pivots. They also take community very seriously as they have 4 individuals working on that aspect. This is the most extensive team I've seen in a new blockchain project.

Conclusion

Firmo will bring advanced financial tools to the crypto-space which is a natural evolution that must take place. It will help investors to be more secure in a volatile market and enable exotic smart contracts with endless capabilities to enhance the infrastructure of business and finance worldwide. It also has the possibility to be the catalysts for the wide adoption of crypto currency and the spearheading of financially literacy to the masses who where not taught so in school.

Many may argue that these financial instruments have no business on the blockchain and will only bring the current financial problems of corruption into the space. However, if blockchain is to become the backbone of the global financial structure, it is a natural evolution that must take place and being on the blockchain will make these advanced financial tools transparent trustworthy.

For more information on this highly technical project, please see the links at the end of this post so you can dive deeper. Their Telegram is also very responsive and Analisa as well as other members will be there to answer any of your questions. Thank you for reading

PS: There was much more to this conversation I had with team members in the Telegram group. Another team member came along and discussed other ideas on the matter. He also said an updated technical paper would be out soon and that he will send a copy.

Firmo Ceo Omri Ross @ Tel Aviv FinTech Week

For more information and resources, see the links below.

Firmo YouTube Channel

Firmo Website

Firmo TechnicalPaper

Firmo Telegram

Firmo Reddit

Firmo Twitter

Firmo Facebook

This is a submission for @originalworks contest

firmo2018