In this four-part essay I consider the nature of centralization by asking the following questions:

- (1) What is centralization and decentralization?

- (2) Why do governments, businesses and organizations centralize?

- (3) Why is centralization of power and authority bad?

- (4) How can we make centralized organizations more decentralized?

Each part should stand on its own and you can skip to the parts you are most interested in, or you can read the whole thing, and with some minor repetition, you will gain a holistic perspective on the nature and meaning of centralization in today's world.

The essays are based on blogposts I wrote for my BitSpace blog, updated for Steem and the changing times. Throughout I've tried to keep it as simple as possible, but not simpler. I hope you will enjoy it!

1. What is Centralization?

In this first part I will cover the meaning of centralization and decentralization, as well as give three examples to illustrate the difference. Along the way we will better understand the pros and cons of centralization and decentralization.

Centralization means to draw into or toward a center, generally a central source of authority or power such as the head of an organization. Decentralization in contrast means to distribute the sources of authority or power over a less concentrated area. Centralization and decentralization are a gradual phenomena, with degrees of centralization and decentralization. Something can be either more or less centralized, more or less decentralized.

To make this definition more concrete, let us look at three examples of the kinds of entities that can be more or less centralized/decentralized: 1) a system 2) a company and 3) an organization.

1.1 System/Structure

Lets look at a nuclear power plant considered as a system and consider the pros and cons of centralization.

By drawing together workers, facilities, and energy processing, the nuclear power plant becomes more efficient; it is quicker to build, easier to maintain and more powerful than it otherwise would have been. Centralizing its operations, the power plant becomes a more efficient system that can create and handle more energy at a lower cost.

The problem of drawing everything together is that it creates a central point of failure, meaning that if something goes wrong at that central point it will hurt all the workers, buildings, and processing capacity that has been drawn together as well.

1.2 Company

Let us now look at a business company like Facebook. Facebook can be more or less centralized, and again this will be associated with advantages and disadvantages.

By drawing together (centralizing) all the processing and account information in private servers, Facebook has full control over all accounts and all processing on the site. It also creates extreme resourcefulness on the part of the owners as all the revenue flows through one centralized point.

This centralization means that they are a central point of failure in terms of theft and corruption. And they can censor and subjugate individual accounts at their own discretion. Because of their control and resourcefulness it also means that they can maintain a monopoly on their market by forcing out competitors.

1.3 Government

Let us now look at an organization, like government. One aspect of government is that it gets money through taxation and spends it on government programs.

By drawing together the money of all citizens into a centralized pool, it is possible to re-distribute the wealth from the rich to the poor.

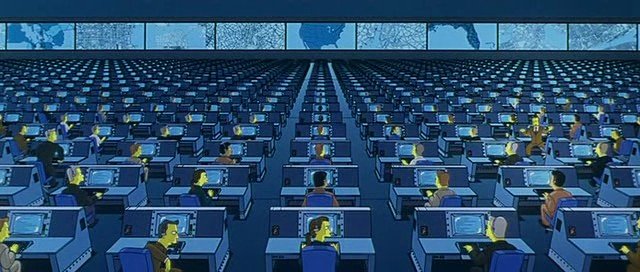

However, because all the wealth is concentrated into a centralized pool, there is potential for corruption and fraud. And again, the special authority government has, to take from the rich and give to the poor, is a monopoly on force that can obviously be abused, for instance by excessive surveillance.

2. Why do governments, businesses and organizations centralize?

In the previous section I explained what centralization and decentralization means and gave some examples to illustrate the advantages and disadvantages of being centralized. In this section I will give three examples to help explain why centralization happens, and some of the downsides that it brings.

The first thing to note is that entities like government and business and organizations in general just want to survive, and centralization is a consequence from this drive to survive. The underlying reason centralization helps these entities survive can be examined by looking at three things; 1) decisions, 2) efficiency and 3) redundancy.

2.1 Decisions

Government, organizations and companies need to make decisions, and in this respect they can be more or less centralized, with either one person deciding on everything, or many people collaborating on reaching agreement.

For instance, in the military, there is a strong chain of command, with one person sitting on the top of a hierarchy with the most authority, who can issue orders that can override all other orders.

The advantage of centralization of decision-making is that it is in one place, and can be executed at that time. This makes it both more focused and faster than decision-making that is more decentralized.

However, by drawing together all decision-making in one person, it becomes a bottleneck due to the limited capacity of that person. In addition, the person can make mistakes or become corrupt causing failure.

2.2 Efficiency

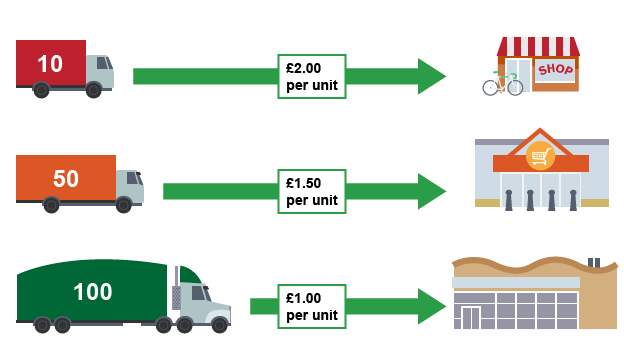

In general, government, organizations and companies need to be efficient in delivering their products or services, but to be efficient it is usually better to do things together, in bulk.

For example, when we go to the store, we notice that it is less expensive to buy a pack of something than an a single item. The same is true for the store; they get a discount when they buy large orders from the factory.

The pros of centralizing production is that the service or product becomes cheaper, and often better, than if it had been made in a decentralized way.

The cons of centralizing production is that it tends towards monopoly and stagnation. All the products and services become identical, and they can stop innovating and instead force out the competition by pricing or regulatory force.

2.3 Redundancy

Government, organizations and companies can protect against centralization by adding redundancy, for instance redundancy in decision-making or facilities.

Redundancy adds resilience to protect against failures. By simply having an extra person or backing up all the files it is possible to protect against bad apples (corruption) and servers crashing (failure).

On the negative side redundancy is expensive, and may be inefficient. For instance by having multiple authorities instead of one, and multiple servers instead of one, it multiplies the complexity and costs of doing the same thing. In addition, everything will be more exposed, making it harder to keep secrets and protect private information.

3. Why is centralization of power and authority bad?

Both the left and the right on the political spectrum have in common a disdain for centralized powers. The left focuses on a dystopic future where big companies are free to create monopolies. The right focuses on a dystopic future where a big government is free to create tyranny.

In each case the underlying problem is the same, centralization of powers. In this section I will recap what centralization is, why it happens, and talk a bit more about why it is bad, and how we might help improve the situation.

Causes and Problems of Centralization

First, recall that centralization means to draw into or toward a center, generally a central source of authority, such as the head of an organization. Second, recall that when we look at the causes of centralization we find at least the following contributing factors that serve the instincts of entities to survive and prosper: 1) increasing efficiency, 2) minimizing decision-bottlenecks, and 3) lowering redundancy costs.

To make this more concrete and get a feel for some of the problems, let us again look at our example of centralization in both the political left and right's version of a dystopic society.

- First, notice that they each express truths about a possible bad societal outcome. However, also notice that they could both be true simultaneously; in the worst of all possible worlds big companies create monopolies and big government creates tyranny. In the dystopia of crony capitalism, the government inherits the worst of companies, and companies inherit the worst of government.

- Second, notice that the heart of each dystopia is the centralization of big institutions that become too powerful. This is because centralization, despite its efficiencies, also have a set of troubling features that can be deeply corrosive to the overall health of society.

To parse the problem of centralization, let us look at 5 of the most obvious and problematic features of centralization; 1) trust, 2) security, 3) transparency, 4) identity, and 5) control.

3.1 Trust

The first issue I want to highlight is trust. As we increasingly rely on central institutions and authorities, we can easily be exposed to corruption and fraud. Trust can always be abused by those who are trusted. And even if a trusted party does not intentionally abuse your trust, coercion by threats and violence can corrupt and ultimately leave you just as exposed.

3.2 Security

When we bundle our security into a single system or solution, there will always be a limited number of people who have the keys, a limited amount of servers that hold your data. And when centralization occurs, these centralized sources, be they safes, people or servers, become a target for theft, coercion, and hacking, and can even become the target of acts of violence and destruction.

3.3 Transparency

Centralized organizations often have a tendency to become less transparent as they close in on themselves. They keep their cards close to their chest, and try to avoid accountability at all costs. After a while, levels of classification ensure that many documents never see the light of day, and insider information bottles up into a bureaucratic mess that inevitably creates even less insight into what is happening and who is accountable for what.

3.4 Identity

When we have centralized institutions that keep track of our identity, the very nature of our social existence is in danger. The problems to do with trust, security and transparency all hit home when we consider our “online” identity (Google, Facebook), or our “off-line” identity (Passport, Bank-ID). Whether in the hands of big corporations or big governments, we still just have to trust them, as we lack insight into the information that is being kept on our profile, and have no chance to ensure that the right measures are taken to secure that information.

3.5 Control

When control is centralized in the hands of a few, they are more likely to control a huge number of people. As we saw in the identity example, we do not have full control of our own identity. We also lack control over fundamental aspects of our lives like the money we use. If we spend money online, we often depend on big companies like Mastercard/Visa, who can block us out at any time, and when save cash we trust the central banks not to print and devalue our savings.

In sum, because we have to trust centralize institutions and organizations, we compromise our security and expose our private information, we lose insight into fundamental aspects that govern our lives and lose our autonomy as free beings.

4. How can we make centralized organizations more decentralized?

In the previous 3 sections i’ve covered the basics of centralization and decentralization, why it happens, and why too much centralization can be a bad thing. In this section I will cover how we can make centralized organizations, like companies and governments, more decentralized.

There are many places where centralization occurs, but one of the more obvious places occurs in the realm of money and financial institutions. In this section I will focus on this realm for three reasons:

- First, both companies and government is involved in the centralization of money and financial institutions – the problem is orthogonal to left and right on the political spectrum.

- Second, the problem is identifiable: It is relatively simple to understand why centralization occurs with money and financial institutions, and unless that problem is solved it is impractical to adhere to an ideology of decentralization.

- Third, the problem is currently, tentatively, on its way to being solved, and we might be in the midst of a highly instructive financial revolution.

4.1 The Revolution Will Not Be Centralized

At the forefront of this financial revolution is the decentralized cryptocurrency Bitcoin. And while previous calls to revolution have had the slogan “The Revolution will not be Televised,” the current slogan from the Bitcoin adherents reads “The Revolution will not be Centralized.” Adherents thus see Bitcoin as a way to “stick it to the man,” bypassing centralized payment solutions like PayPal, Visa, Mastercard, and even rejecting centralized fiat currencies like USD or CNY that can be printed at will by the powers that be.

4.2 But what is Bitcoin?

Bitcoin is both a payment network (“Bitcoin” capitalized) and a digital currency (“bitcoins”). Unlike ordinary payment networks and currencies, there is no one in charge of the Bitcoin payment network, and nobody controls or owns the supply of bitcoins. Despite being decentralized with nobody in charge, Bitcoin allows fast, easy and secure transfers of value to anyone in the world, threatening to disrupt major financial institutions.

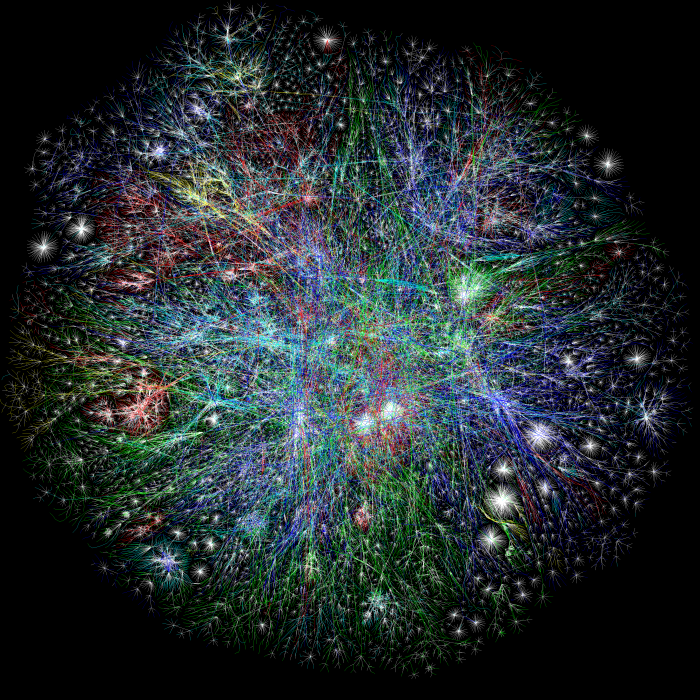

4.3 Decentralized Internet of Value

Despite the seemingly “decentralized” nature of the internet, we have only had real decentralization of regular information, like sharing a file. When it comes to decentralization of valuable information, there has been no way to avoid that it won’t be copied multiple times. Only after the invention of Bitcoin, and its fundamental blockchain technology, is it now possible to transfer things of value in a peer-to-peer fashion, without having to worry that people will copy it.

Because of this the technology behind Bitcoin can be used for things that go way beyond just currency. It can be used to start exchanges, new types of banks, and even be used in non-financial sectors like internet voting, intellectual property registration and identity management.

4.4 Beyond Currency

Without going into too much detail I want to mention just two examples here to give a flavor of what can evolve from this invention.

The first is an example of a Decentralized Autonomous Company (DAC), a new kind of entity made possible by the technology underlying Bitcoin. To understand this example, let us first consider an Autonomous Company (AC), for instance, a slot machine. A slot machine is autonomous because it operates automatically, and it is a company because it provides a service (gambling) and it generates a profit (more money in than out).

To decentralize it, think of a virtual slot machine running on several computers all over the world, with no one computer being in charge of what happens when people play, and no one computer owning the slot machine. In other words, just like Bitcoin, it would be distributed all over the world, with nobody in charge or owning it, and it would be impossible to hack or game the system.

Second, consider a trading platform where it is possible to trade anything for anything – i.e. gold for dollar for stocks for bitcoin and so on. To some extent such platforms are already available in centralized form, exposed to theft and extreme regulations that prevent fluid and fast global transfers. After the invention of Bitcoin, there was a lot of centralized exchanges popping up around the ecosystem trying to help people convert their fiat currencies into cryptocurrencies, but many of them struggled with corruption, hacks and compliance issues, surviving on average only some 144 days each before going bankrupt or closing shop out of fear for the repercussions.

During this time several projects in the cryptocurrency ecosystem set their aim to develop a decentralized exchange platform that would facilitate global transfers among all kinds of values with all the benefits of Bitcoin.

Among these pioneers was Daniel Larimer, the founder of BitShares, who set out in 2013 to create an unhackable exchange that would belong to everyone and no one equally. Fast forward to October 2015 and BitShares’ Decentralized Exchange Trading Platform is going live. This means that BitShares, and other decentralized exchanges that are emerging, are directly challenging the major financial institutions of the world with their own solutions that are decentralized, without borders, and fair and free for everyone who wants to participate.

4.5 Conclusion

The lesson from Bitcoin and BitShares is that indeed, the revolution need not be centralized, we don’t need to replace one authority (big corp) with another (big brother) or the other way around. If we stay innovative we can use our interconnectedness through technology and the internet to create our own decentralized revolution, non-violently and legally while competing with the traditional systems, companies and governments to the point where people will voluntarily migrate to the free, fair and open solutions. If this is possible even in the case of the monetary system and financial institutions, perhaps the most powerful institutions in the world, it means that centralization is not a necessity, and that in the coming years we’ll see more industries becoming decentralized, benefiting us all.