The other day I was watching for the 6th time the film of "The Big Short" one of the best films of the whole 21st century in my personal opinion, if you haven't seen it, I recommend you to go and see it right now. This film is about the financial crisis of 2008, and the great role that banks played in it. The truth is that at the time of the crisis the government was at a crossroads whether to save the banks and those that created the problem because of their ambition and greediness or to save the people. We already know who the government ended up saving. So, what happened? That all the people turned their heads and looked at the government and began to discredit capitalism.

Source

The culprits in the 2008 crisis were undoubtedly the banks and WallStreet, that speculated on real estate prices by granting unsecured bonds to people who were unable to pay them without government consent. The unfortunate part of this bankers' crisis was when the U.S. government made the decision to refinance the banks that had lost all their money in the crisis, thus losing all the savers' money, the terrible part of this was that the government made the decision to save the banks instead of their own people, using taxpayers' money.

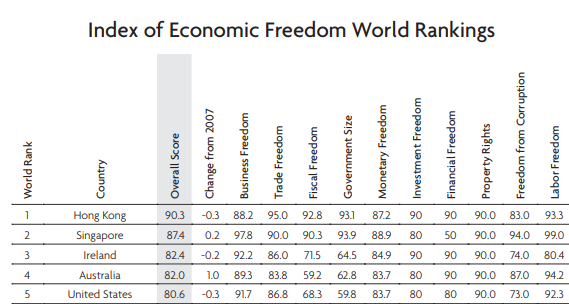

After the crisis, governments and politicians, mainly of the left, did not lose the opportunity to attack and blame capitalism, given that the United States is famous for being the father of capitalism, the curious thing is that by then the United States was not even the freest country in the world, it was fifth below countries like Australia, Singapore, and Ireland.

But what does capitalism really have to do with the crisis? As we said earlier, the banks were to blame for the crisis, so how do they associate banks with capitalism? Central banks and capitalism have no relation whatsoever, central banks are in charge of the regulations and controls of the state's monetary policies, they are the ones who centralize power over interest rates. On the other hand, Capitalism is based on the doctrines of laissez-faire, laissez-passer, this doctrine is characterized by abstention or interference with the individual freedom of citizens; a doctrine that opposes government interference in economic affairs and if there are regulations it is to guarantee the individual rights of individuals and property rights. The purpose of this is to create a totally free, pure, uncontrolled and unregulated free market economy. The socialists are the ones who really advocate interventionism in the market with regulations and controls, so the banks are institutions of a more socialist and communist nature than really capitalist ones.

Source

In addition, we must add that central banks are artificial monopolies created by the government to regulate and control the financial sector of a country, controlling everything from the monetary settlement to the interests of a country.

Central banks such as England's or the Federal Reserve itself are national banking systems that have an exclusive monopoly on the issuance of debt securities in their countries' currencies in paper and electronic form.

One of the most frequent criticisms against the free market or capitalism is that they encourage the creation of monopolies, and therefore state interference is necessary to prevent them from being created. This is completely untrue. The capitalist system disapprove, de facto, monopolies because it is inherent in capitalism to promote free competition, you cannot have capitalism without competition.

Monopolies are artificial creations that obtain legal privileges and hinder free competition; a single institution or corporation is the only one capable of providing a certain good or service, in other words, the monopolization of the market by a single competitor.

Any serious economist recognizes that in an environment of free competition, with few state regulations, no special concessions and a well-defined and reasonably low tax rate for entrepreneurs, it is almost impossible to establish monopolies.

The results and the economy have demonstrated through empirical results that it is not the free market that produces monopolies but the absence of this (through taxes and state regulations) that generates them and makes their eventual disappearance more difficult.

As an instance, we have the break-up of the State-taxist monopoly represented by the UBER company around the world.

UBER is obviously such a good thing, said entrepreneur Paul Graham, "that you can measure how corrupt cities are by the extent to which they try to suppress it".

Now back to the central banks, let's focus specifically on the Federal Reserve, the main agent.

After the American Revolution, the first United States Secretary of the Treasury did not have enough money to pay back the war debts. So he implemented a strategy called fractional reserve banking, to keep a fraction of the deposits made by customers in cash so that the rest can be used for loans to other agencies. In 1791, Hamilton established the First Bank of the United States of America, a private bank that would print gold-backed on notes for lending to the government gys However, it was only the beginning of a system financed by the debt of private bankers, who contributed only nominally "backed" notes in gold.

Source

In the next 20 years, the big private banks would be in charge of doing their own thing to benefit economically, how did they do it? During the period of monetary expansion, all people were in debt, and when they could not pay themselves, much of the capital was used to pay usurious interest, banks expropriated the profits of the real economy for nothing.

It wasn't until Andrew Jackson, who in 1835, canceled all U.S. debt by that time. Even so, it was not enough, because the fractional reserve banking would continue to work at full capacity. Therefore, the issuance and creation of money would continue to be controlled by the banks, leading to economic depressions that would end up being triggers in the secession war.

During the Civil War, 1861-1865, President Lincoln would, in order to avoid an overwhelming war debt, return to the monetary system of money issued by the government. It issued U.S. Treasury bills called Greenbacks in order to avoid borrowing money with usurious interest rates. However, after winning the war, Lincoln was killed, and the Greenbacks broadcast stopped.

The second American president who wanted to follow in Lincoln's footsteps and issue his own monetary system without resorting to private banking was James A. Garfield, who was also assassinated. Do you know who was the third in the line of murders? Of course, John F. Kennedy, from here you could get a very solid answer to the famous question, Who killed Kennedy? In 1961 JFK would pass a law that would allow the US government to print its own money outside the control of the FED and other private banks. Once JFK was dead, the law was repealed. Coincidence? I don't think so.

Since 1913, economic crises and collapses have occurred deliberately caused by the banking system with the aim of creating a central bank, and so the private FED was created, which was authorized to issue its own banknotes deliberately as a national currency. The Federal Reserve was created with the purpose of preventing these bank failures, but it ended up being just the opposite, economic cycles were created manipulated by it. Twenty years after the creation of the largest monopoly in the United States, the Fed would see the biggest banking failure in human history, "The Great Depression". And two more crises in the future.

So, in fact, the answer to the question in the article is:

No, capitalism and central banks have nothing to do with it at all.

We need to reform the global monetary system, otherwise, society will collapse, because we depend on limited resources that will not last forever.

The complexity of our financial system is hidden under a mask that hides how deceived our society is, a society that has been cognitively manipulated through its educational system. Don't you believe me? Here are three simple questions.

✅ Why don't education systems teach us how to think, but rather, what to think about?

✅ Why are we not taught finances and subjects related to economics and politics in our education system?

✅ Why do they want to regulate information on the Internet so much?

A totally manipulated society where massive control is exercised to perpetuate the interests of a few who want to dominate the world.

To begin with, we need to give back to the state the power to imitate money without debt and to create an interest rate that is related to public spending. With this, taxes that unjustly damage work and consumption will be eliminated, and thus the real economy of work will be financed.

In particular, the principle of fractional banking must be banned and the reserves of public and private banks must be increased to maximum capacity. This is in order to avoid fraudulent loans based on promissory notes in exchange for fictitious credit granted for money you do not have. These loans based on promissory notes are one of the factors of inflation, a hidden tax on the population, which ends up diminishing the purchasing power of society when price rises occur, manipulated, of course, by the banks.

Public banking could also be used to displace and replace the current private financial system, but the main thing would be to ensure the flow of credit and prevent the creation of oligopolies and monopolies.

One could follow the example of public banking systems such as those in Australia, New Zealand, Germany, and Switzerland.

These would be the prudent measures to escape the debt we have been dragging down by the world's bankers for centuries.

The predominant economic system of the world is Capitalism and it has proved itself and our whole society is witnessing that it is, but it still carries with it evils such as the Bank-Cryptocracy, which expropriates all the nation's wealth. By introducing some better changes the economy will no longer depend on a system of cyclical growth based on debt that prevents us from moving forward and progressing as a society.

It is no coincidence that the century of total war coincided with the century of central banking- Ron Paul |

|---|

|

|

|---|---|

| Century of Enslavement: The History of The Federal Reserve | |

| Challenges of Modern Capitalism | |

| El falso capitalismo de Hamilton | |

| End the Fed - Ron Paul | |

| "Historical Beginning ... The Federal Reserve" | |

| How to Think About the Federal Reserve - Peter Schiff | |

| Index of Economic Freedom World Rankings 2008 | |

| La Solución de la Banca Pública | |

| Reserva Fraccionaria | |

| Secrets of the Temple: How the Federal Reserve Runs the Country - William Greider | |

| Uber Is Not (And Will Never Be) A Monopoly |