I know I am an idealist in my hopes that we can make the world better. Most people believe the super rich are too big to take down. That could very well be true because it has been that way for the last few hundred years but I am still hopeful that awareness can do something.

The economic game has turned into who can steal more and get away with it. Trust is being challenged and I see a move to computational trust.

The general public chooses to stick its head in the sand. Is it because it's complicated, boring or they are dumbed down with media, medication, sugar, caffeine and or alcohol? Probably some of that though maybe they have given up because they think their point of view does not matter or won't make a difference, as again maybe the system is too big to change and will do what it damn well pleases.

How the Corporation Act has allowed corporations (fascism) to conquer.

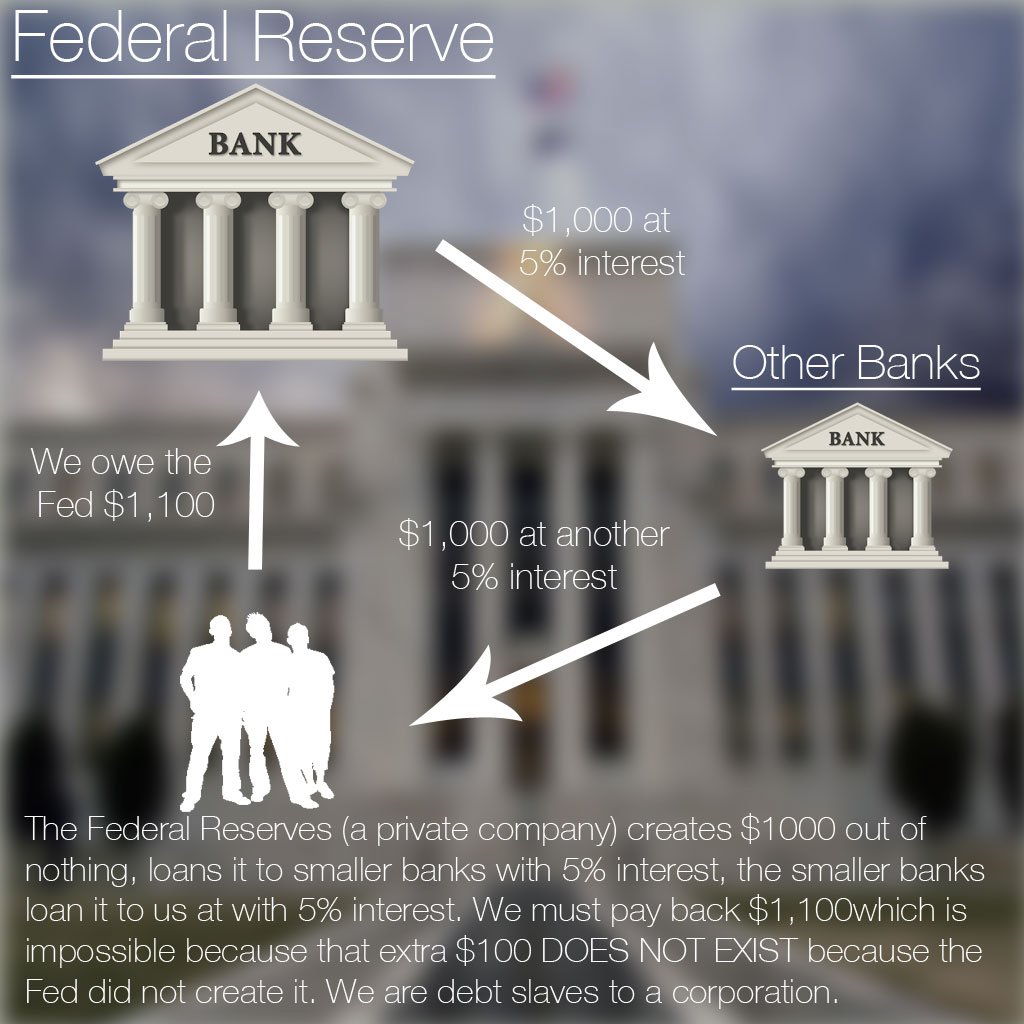

Your money is being inflated away to keep the Industrial Military Complex (IMC) funded. The IMC dictates the controlling shares of the major companies in the world and has taken over control through the Corporation Act. 147 companies own 40% of the shares of 43,060 transnational companies. Those 147 chairman of the boards advise the Federal Reserve (which is private and has a controlling interest of shares) through organizations such as the Council on Foreign Relations on how their top few shareholders want things. If there is a war in the next 30 days it is purely political as the IMC is worried they will lose their grip if their choice (Hillary) loses the election.

Pointless wars are keeping the rich richer and poor poorer. Yes over the last hundred years the fractional reserve banking system has taken hundreds of millions out of poverty, brought about productivity gains and technology that has been incredible, but over time, greed has crept in deep and eroded the already shaky rigged system to its core i.e., the Industrial Military Complex (IMC) now has the Patriot Act and the National Security Agency (NSA) to do “whatever it takes” in the name of national defence including breaking the law thus sending 100 million people back into poverty. As George Bush put it during the 2008 meltdown in this short 1 minute clip “I have abandoned free market principles to save the free market”.

I know the rabbit hole gets deep but please stay with me. Those who know me can trust the information as they know I have studied this my whole life so I do not need to plunge into the deepness of the linked evidences.

The Industrial Military Complex's (IMC) biggest revenue source is the US Government to the tune of $700 billion being spent on defence each year. That is so large that it has become the budget that controls the world through proxies of controlling the shares of holding companies via the top 49 companies in the world (they are all financial holding companies). While the shareholders are few, their biggest holdings are with the IMC. GE and Westinghouse are two large defence contractors that own much of the mainstream media.

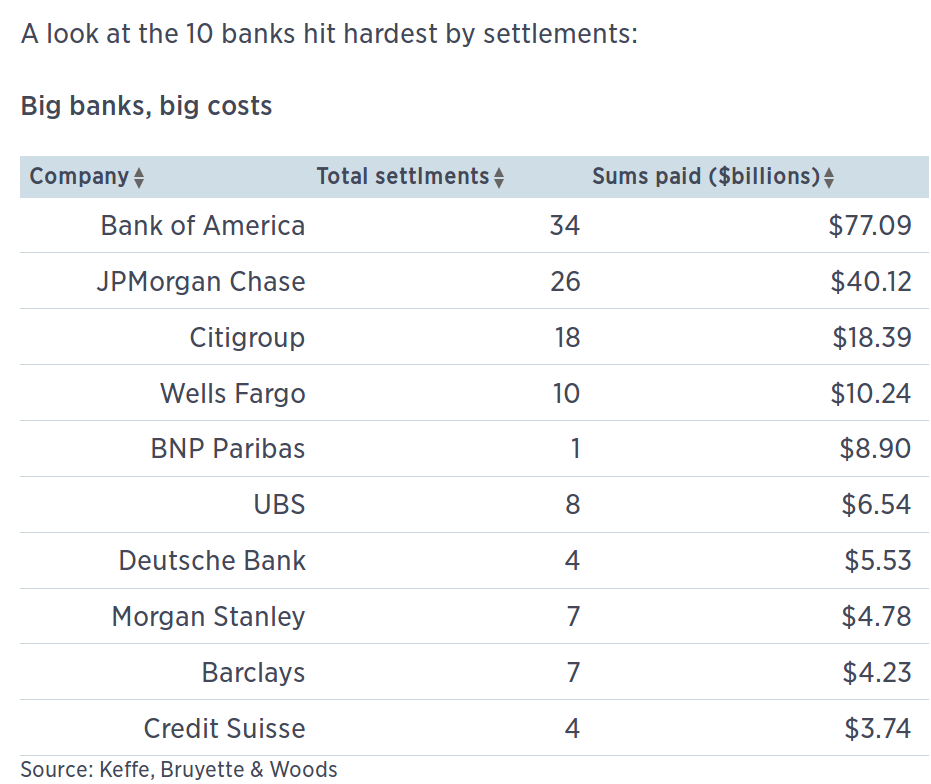

To make things worse the Plunge Protection Team and Exchange Stabilization Fund both should not exist in a true free market. We do not have a free market so start protecting yourself from the unsustainable economic system you are in. You can even do something about it. Firstly, by reading this you are educating yourself – congrats! Please note I am not a financial advisor and suggest you seek one for all your needs but in my opinion, they are paid for by corporations and live off your fees, so there is totally a conflict of interest issue. You should shop local and or try to avoid all national companies. Next you could take your money out of the bank and put it in a lock box or buy physical silver coins as the banks are stealing your money with fees and leveraging it with fraud meaning it is at risk. This article outlines $204 billion dollars in recent bank fines for crimes:

http://www.cnbc.com/2015/10/30/misbehaving-banks-have-now-paid-204b-in-fines.html

New bail-in rules have made the money you think is yours (in your bank) not yours anymore. You have lent that money to the bank and you may think it's insured but the system is so systemic that when one fails all will fail and should tie up your funds way longer then you could imagine and then all tax payers would be called in to fix it.

With this type of system trust or confidence is eroded and with current currency and trade wars between countries (China, USA, Russia and Iran to name a few) that don't trust each other all this continues to undermine the system. The 2008 Bear Stearns and Lehman Brothers collapse was all down to banks not trusting each others balance sheets as some were actually insolvent (broke), bank overnight lending stopped for 30 days. We were hours away from all ATM's being closed until further notice.

The shareholders of the 147 largest holding companies in the world have put most people, companies and countries in debt to them (i.e.; enslaved). The top 49 companies are financial companies holding the voting control of the Industrial Military Complex which includes the media.

Global growth has crashed to levels not seen since 1955. Home ownership rates are at 50 year lows in the USA and the job participation rate is also at 38 year lows. So don't listen to the head lined unemployment rate as that may look good but mainly because of new part-time jobs. The Dry Bulk Index been at a low for multiple years and a recent report from the WTO said they are lowing their forecast by about a third to its lowest rate since 2009. The smart money has already left holding shares of the European banks as most of their share price have dropped 40-50% over the last year. The stock market is at a record 25:1 P/E (price to earning ratio) corporate profits have been down for 6 quarters in a row. This represents the longest and broadest slide in earnings since the financial crisis. During good times and before this near zero interest rate policy the average P/E was something closer to 15:1.

Corporate Capture is alive and well in the G20 countries.

This all while the US has printed over $5-10 Trillion dollars in the last decade and European Central Bank's (ECB) Mario Draghi saying we will do “whatever it takes”. The ECB has been printing monthly for the last year and a half along with Japan printing full blast monthly for the last three years. The real fraud here is bailing out banks, if true free markets were around those companies would have been closed or sold off to more trustworthy competitors or nationalized.

I think there is some anxiety and this may blow up (on purpose) around election time, never mentioning that they caused this or most were too incompetent to see it while the decisions makers behind the curtains have big smirks on their faces while front running the swings in the markets.

One of the biggest problems and the most misunderstood is that governments don't have to borrow money; they can print any deficits and therefore avoid interest payments. Those interest payments are transferring your wealth to the rich. For those wanting more on this here is Bill Still explaining in his documentary The Money Masters. Canada alone pays over $18 billion per year on interest to the banks shareholders and the US is at $223 billion.

Over the last four years the Plunge Protection Team and Exchange Stabilization Fund or Open Markets Committee has represented 40% of the upside move in the S&P index. This is clear state planning or a banana republic that has abandoned free markets. Can they hold the markets up and should they? Everyone should be aware of this and place their investments strategies accordingly. I would suggest this is playing the system for the benefit of the few and I expect the greatest transfer of wealth in recent history to be followed shortly. The global debt is unsustainable and the largest pensions will be looted to pay for it via hyperinflation.

The Japanese Government is currently buying 60% of the Exchange Traded Funds (ETF) on their stock exchange. These are not free market moves, these are moves of desperation.

The risk of errors or poor judgment such as interest rate increases, or withdrawing liquidity is increasing. Intended or accidental breakdowns within the Euro Zone potentially restructuring the single currency (Euro) is no longer unlikely. The global currency war is complete with trade wars, as Trump discusses, and capital movements are likely as countries act independently consistent with their national interests. This is to be expected and could push us into a phase shift - the signs of failure are everywhere pushing central banks into more extreme actions.

My writings are never intended to be hyperbole (exaggerated) or sarcasm I am for the most part deadly serious on this topic. I am trying to make my point through a cogent argument but have included links for those who don't trust me. The links in themselves don't represent my full beliefs as there are many more sources to back up those links and what I am trying to say.

This information is out and the rigging is now exposed hence the rise of extreme changes in voting directions all over the world.

My blogging style should say nothing of my integrity I am here viewing my opinions with sincere intent based on my experiences giving me a confidence in the validity of my beliefs.

The good news is the establishment is scrambling to take more control (mergers & acquisitions, Patriot Act, moving Internet control to the United Nations etc.) so they don't lose it but it is so vast and complicated that I believe they won't be able to and are losing more and more control daily. I even fear sometimes that my writings will be stopped but I seem to be very under the radar currently so still have lots of time to write.

You can only keep this current economic fantasy going for so long – you can only defy fundamental accounting for so long. Kicking the can down the road or sweeping it under the carpet does not fix a system that is broke.

Why Trump the Disrupter is better than Clinton the Establishment.

Is Trump going to solve it all? No. Is he going to bring new ideas or clean the stables? Maybe. He has not been a career politician drinking the cool-aid that makes all of this is viable or sustainable. Immediate improvement? I don't think so as it will be painful to transition out of the debt. Crisis is more likely than the early 1980's but if the choice is between Clinton's continuation of the status quo and a disrupter I vote for the disrupter.

Fundamental house cleaning at the Federal Reserve and Trump is way more likely to see results than Clinton. Massive intrusions in the financial markets manipulation of interest rates and efforts to prop up the market all has to stop! Abolish the Open Markets Committee abolish discretionary intervention day in day out let interest rates be discovered by the market, let price discovery come back into Wall Street, that is the heart of capitalism. Shut down the Federal Reserve as as it exists today.

I believe that the economy is the single most important and ignored topic to bringing people globally out of poverty. My writings have no motives behind them besides helping people understand that there is a better way. The world now has $152 Trillion in debt and median household income has fallen by 20% since 2000. That kind of drop has not been seen in many decades.

If I have helped you understand or you have learned something please follow me and you can read my introduction here, my other posts or my favorite on trust.

I am using Steemit as it is user friendly for this type of information sharing, it is not intended as a revenue source.

donations via bitcoin to pay for an editor: 13x2aiXXMwuKAPi1ph9WPWhoTq6AvHTcde