Hello my cordial greetings to the Steemian family

How are you doing, i am good and feeling honored while taking part in another contest the topic is Steemit Crypto Academy Contest / S13W2 - Triangular arbitrage. Let's explore the topic.

Explain in your own words, What triangular arbitration?

The method adopted by traders to gain profit with the price differences in different underlying markets is called arbitrage. It takes place mostly at forex and also in foreign currency markets.

Triangular arbitrage refers to a process that involves the conversion of one currency into another, again converting to the next currency, and finally converting back to the first or original currency this process occurs in a period of a few seconds.

The process is carried out to take profit from the market when there are bit differences or mismatch in the exchange rate of the currency. Although it's not commonly take place there are rare chances in the market.

The most common form of trading in the market is observed between two currencies as one is buying and the other is selling the currency depending on the market situation when it is favorable to the traders.

In triangular arbitraging the trader has to carry out three simultaneous trades; in which he is buying one currency while selling another, and at the same time he is using a third currency for the the base currency.

How does it may happen?

Obviously in the case of arbitrage opportunity may arise only when there is a mismatch or difference between the exchange rate and the quoted cross-exchange rate. Moreover, This can be observed only when a certain currency is seen as overvalued against one currency while at the same time, there is an undervalue for the other currency.

The most commonly triangular arbitraging combinations are seen as EUR/USD or USD/GBP, and EUR/GBP in any combination form.

How to do triangular arbitrage trading?

Aa i have mentioned above the triangle arbitrage try to get advantage of price mismatch between three different assets such as cryptocurrencies in the market.

It can be simplified as for example a trader has exchanged one cryptocurrency for few seconds, the seconds for a third currency, and then third currency for the first one. The whole process is repeated till the price differences is in currencies.

Although the execution is done carefully in triangular arbitrage as traders must identify the price differences and the trading different asset pairs quickly, as the volatile prices in market so the proper risk management must keep in notice.

Since the crypto market highly volatility in term of prices the executetion in triangular arbitrage trades done rapidly.

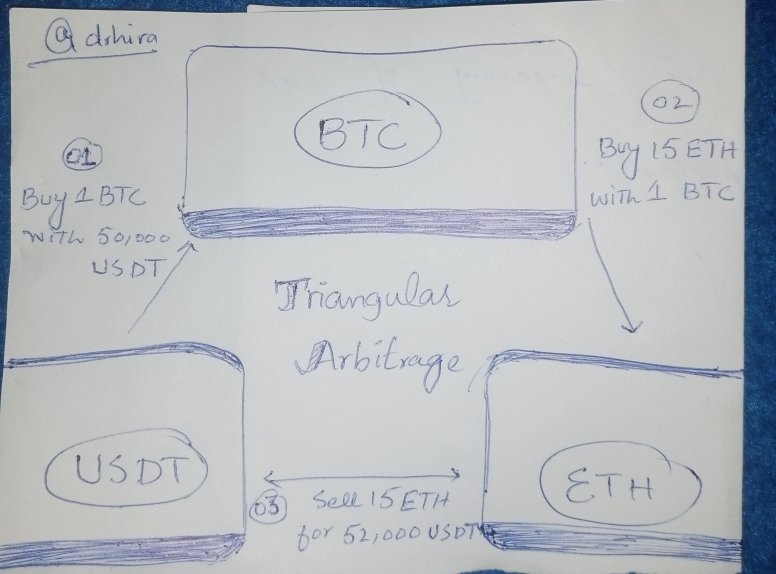

For example when a trader observed that mismatch in prices among three different assets such as Bitcoin (BTC), Ether (ETH), and Tether (USDT).

Now how can we tell if there’s an arbitrage opportunity is there in trading?

The trader will buy $50,000 worth of BTC with the help of USDT. Now he will use BTC to buy ETH. Next he will use the ETH to buy USDT again. This will happened only when the relative value of the USDT remained at the end is significant mismatch from the start capital $50,000, so it can be noticed there is an arbitrage opportunity takes place successfully.

What is the difference between arbitration and triangular arbitration?

The arbitrage is executed is takes place between any two currency while triangular arbitration is takes place in three different currencies.

The arbitrage can be executed by the consecutive exchange of one currency into another as there is discrepancy in the quoted price for the given currencies.

While in case of triangular arbitrage takes place only when the exchange rate of a currency doesn't have match the cross-exchange rate.

The process of arbitrage is the simultaneous purchasing and selling of the same asset in different markets. This process is used to gain profit from a differences in price.

While in case of triangular arbitrage occured when the exchange of a currency takes place in three currency pairs in short time span for gain profit.

Do an example of triangular arbitration, having 10,000 Steem as the first cryptocurrency. You can choose the remaining 2 cryptocurrencies.

The first step is the choice of the crypto coins and I have selected two more coins ETH and USDT for this Triangular Arbitrage. Consider the following trades are possible

- 1 STEEM = 0.35 USDT

- 1 USDT = 0.0005 ETH

- 1 ETH = 9000 STEEM

So, we will start the exchanging of these crypto coins in the way that we will make USDT from STEEM and then convert those USDT to ETH and finally we will convert the ETH back to STEEM. This will happen in the following steps.

10,000 STEEM => 3500 USDT

3500 USDT => 1.75 ETH

1.75 ETH => 15,750 STEEM

Consider that, all transactions cost us 3 percent as per the total initial amount. So,

Total Profit = Total Amount of STEEM obtained - (Initial Amount of STEEM + Fees Deducted )

Total Profit = 15,750 - (10,000 + 472.5)

Total Profit = 15,750 - 10,475.5

Total Profit = 5274.5 STEEM

Conclusion

The Triangular Arbitrage can be used for profit gain but only expert can trade very well as the process of trade on triangular arbitrage is of shoet time span.

Thank you for reading my post.

I would like to invite my dear friends @ashkhan, @m-fdo and @suboohi to take part in the challenge.