Market watchers love to toss around the word "bubble". This is a curious creature since they are easy to spot in hindsight but difficult when we are in them. The definition of the term is rather simple yet the applicatoin of it is an individually slanted. There never is consensus of a bubble until after the fact.

Often, money flow pushes one particular asset class up. In the late 1990s, it was the equities markets, specifically the tech/internet related stocks. A little less than a decade later, it was real estate that was bubbling. Each of these ended with the proverbial crash.

This is the danger of boom/bust cycles, you cannot have one without the other.

So where does this put us today?

Over the last decade, central banks around the world got very aggressive with their easing. Tens of trillions of dollars was issued in all different kinds of currencies around the world. Whatever form the easing took, this meant that a ton of liquidity entered the markets.

Globally, we saw different markets appreciate over time. In the United States, both equities and real estate experienced sustained runs. Both are still in long-term bull markets that are providing a huge "wealth effect" among the participants.

But are we in a bubble? And where are these located?

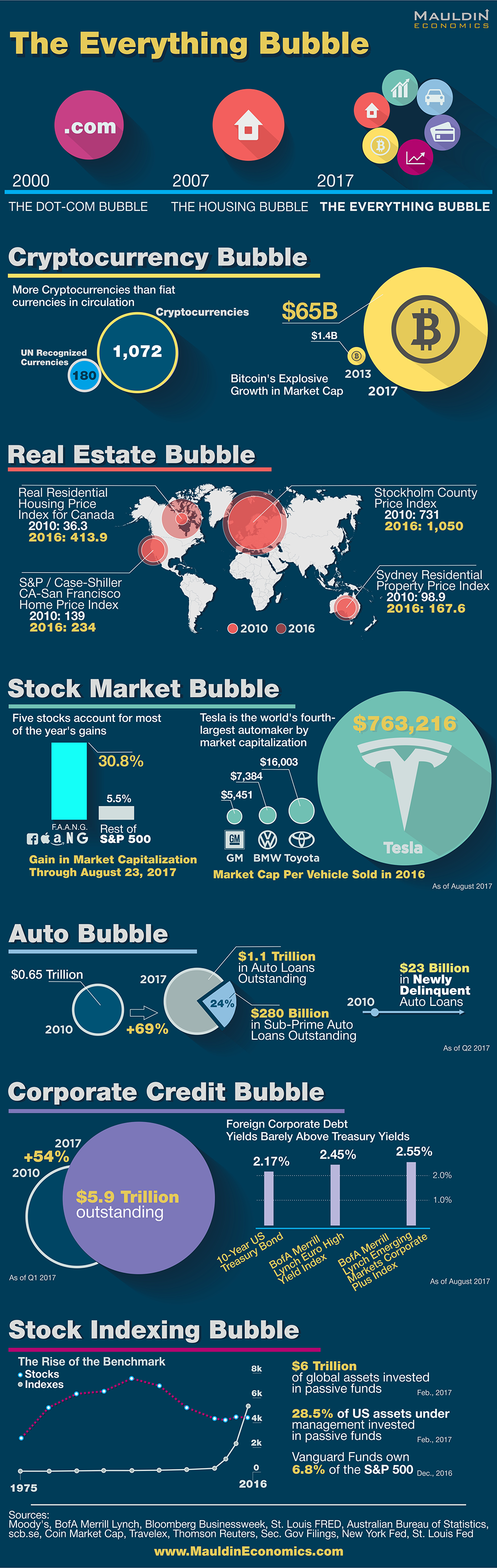

According to an infograph put together by Mauldin Economics, it seems that everything is bubbling. So, according to them, we are in multiple bubbles and they are located everywhere.

Infograph from here

This chart is about a year old. What is interesting is, for the most part, each market mention has only appreciated more.

Bitcoin, for example, was only worth $65 billion when the data was taken. Today, it is $110 billion. Couple that with the fact that there are closer to 2,000 cryptocurrencies as opposed to the 1,000 listed and you can see, in spite of the enormous pullback, cryptocurrency is still much higher today than it was when this infograph was created.

The only market that appears to have a pullback is the auto sector. 2018 was a rough year for that industry. Car sales are down again while defaults are rising. The bull run for autos stopped a while back.

What will happen if everything starts plummeting? We never witnessed this much money being doled out through the easing program. Markets could well be addicted to the cheap and easy money. The U.S. Fed started tightening a year ago yet rates are still at the lower end of the spectrum compared to historical norms. Money is still cheap.

The equities markets used this inexpensive cash to do a record number of stock buybacks. This was only aided by the Trump tax cut which provided more liqudity for companies to repurchase their stock. What will these companies do to sustain these valuations? Will they be able to product enough to keep the train rolling?

Housing is already starting to show some signs of cracking. It might be a temporary situation but it bears watching. We might well see a number of markets turn over in rapid succession.

Bubbles always end up popping. If we are in a "Bubble of Everything", the pop will be felt across multiple markets at the same time.

We could be in for something never seen before.