People throw out all kinds of numbers for the price of bitcoin by the end of 2018, but what are those based on?

Over the past couple years it has become very popular to make price predictions on bitcoin for the end of the year.

Surprisingly, in recent years people have undershot what actually happened.

Last year, people were saying bitcoin would end the year at $2k, $5k, or even $10k and that seemed pretty optimistic considering prices were hovering around $300-$600 at the time.

Low and behold, prices hit $20k, and the rest is pretty much history.

What can we expect this year?

We have seen predictions of $15k, $25k, $50k, etc... but how do they come up with these numbers?

A few of them are pulling numbers out of thin air, but some of them base those predictions off of past trends as well as the cost of mining.

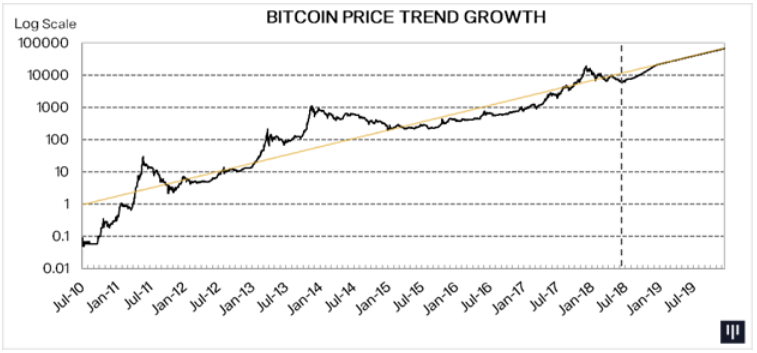

If we look a logarithmic chart of bitcoin dating back to its genesis, we can see that there has been a fairly defined trend that prices have followed.

Basically, it started from the left and has slanted fairly significantly up and to the right:

Based on this trend, one would expect to see the price of bitcoin around $21,000 by the end of 2018.

Looking out one more year, one would expect prices to be around $67,500 at the end of 2019 based on the same trend.

Those are some pretty impressive numbers, but those are exactly the numbers that Pantera Capital is predicting for the end of 2018 and 2019, based primarily off of the trend line I just showed you.

(Source: @bizon18/head-of-pantera-capital-now-is-the-right-time-to-buy-bitcoin)

What about a price prediction not solely based on trends?

Tom Lee of Fundstrat Global Advisors says that they like to make price predictions based on trends as well as the cost of mining.

Prices in other commodities are often determined by their cost of mining, why shouldn't bitcoin be any different?!

According to Tom, the fully loaded average cost of mining will be around $9,000 by the end of 2018.

Bitcoin has historically traded for around 2.5x the cost of mining, which would give us a price target of around $22,500 by the end of the year.

Tom rounds up and gets us to his $25k year end call.

Using that same model he also came up with a price target of $90,000 by the end of 2020 due to the increasing cost in mining.

Something interesting to take note of is that the price of bitcoin often trades much higher than 2.5x the cost of mining during bullish periods, which means Tom was making his predictions off of a base case...

In other words, he thinks it hits those prices at a minimum.

(Image Source: https://vi.bitday.com/post/tom-lee-cua-fundstrat-global-advisors-de-xuat-mua-bitcoin-ngay/)

Conclusions:

Using both historical trends and the cost of mining as a price predictor we get wildly higher prices for bitcoin within the next 6 months as well as the next few years.

Historical trends indicate prices likely hit $21k by the end of this year while the cost of mining indicates we likely hit around $25k by the end of this year.

Whichever method you subscribe to, we get roughly a triple from current levels in about 5 months.

Not sure about you, but I sure like those returns.

Stay informed my friends.

Image Source:

Follow me: @jrcornel