What is meant by inflation?

When talking and delving into the details of the relationship between inflation and digital currencies, we will first talk about the definition of inflation, which means an increase in the prices of goods and services during a specific period of time with a decline in the purchasing power of a currency.

Inflation is also considered as a phenomenon that lasts for a long period of time, in which prices continue to rise for a period of time, as most countries measure inflation rates on an annual basis, and inflation results in a rise in the prices of goods and services in general, in which prices continue to rise without reaching the stage of stability. And fortitude.

Causes of inflation:

After talking about inflation and digital currencies, it is necessary to talk about the causes of this phenomenon as well, as there is undoubtedly some who inquire about the causes of inflation and the motives that lead to the occurrence and spread of this phenomenon, so economists answered this question that the causes of inflation lie in two reasons, which are as follows: the next:

Increasing the amount of actual currency rapidly during currency circulation. For example, when the Europeans invaded the Western Hemisphere in the fifteenth century, they flooded gold and silver alloys, which led to the phenomenon of economic inflation.

The reason for the occurrence of inflation is the existence of a shortage in the supplies of certain commodities, especially in the event that there is a large demand for them, and this in turn leads to an increase in the prices of commodities in the markets in general, and ultimately a rise in the prices of commodities and services in general.

Steem Inflation

At the beginning, it must be noted that Steem Blockchain is based on the DPoS (Delegated Proof of Stake) governance protocol, in addition to (20 + 1) witnesses whose main role is to supervise the creation and signing of transactions and secure the network. It takes 3 seconds to produce each block in rounds of 63 seconds each.

Compared to Proof-of-Work chains, in which the block reward is distributed to a miner randomly, DPoS, is specific rather than random as the highest (20) witnesses plus 1 backup witness receive block rewards, 10% of the total reward pool which forms an inflationary model.

Steemit's social platform philosophy is based primarily on motivating users with the goal of achieving inclusive growth and sustainability of its ecosystem. Therefore, this inflationary mint model put a certain fixed number of tokens into each block according to the inflation rate.

The inflation rate decreases by 0.01% every 250,000 blocks until it reaches 0.95%. The initial rate of inflation was set at 9.5% in December 2016. Since then it has been declining continuously at the set rate.

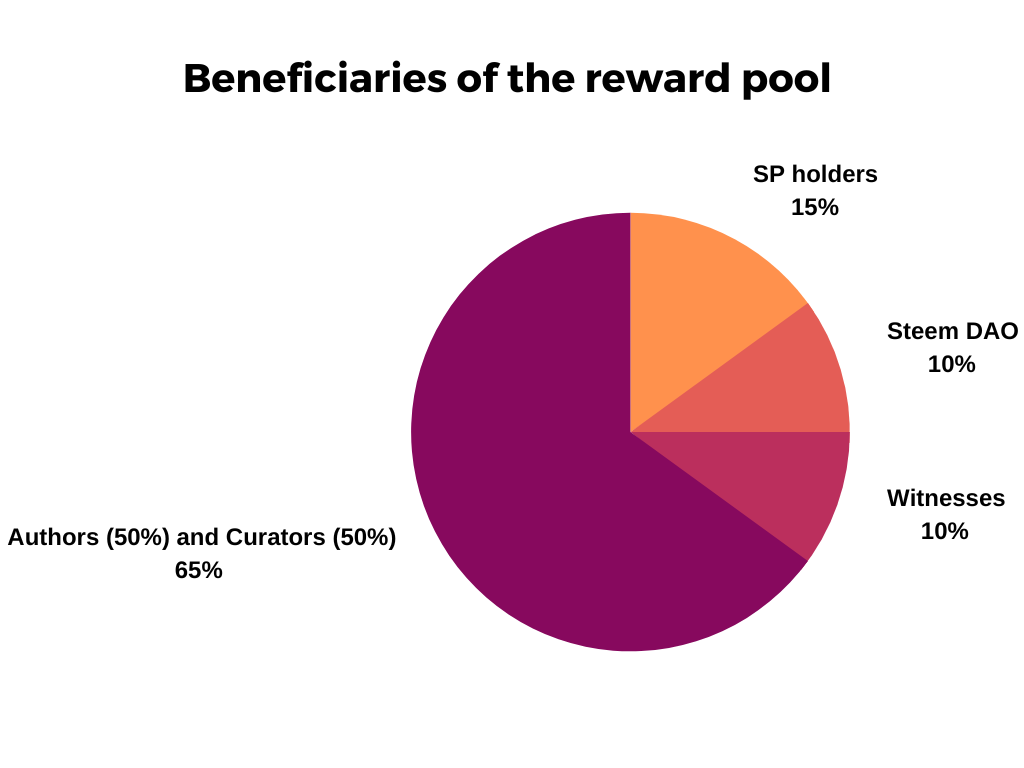

What we can see from this distribution of creation rewards for newly minted STEEM, 35% of the distribution is capped, but the remaining 65% is task-based (PoB), with consensus witnesses getting 10%, and holders of earned tokens (SP holders) getting 15%, and Steem DAO receives 10% to generate SBD for the SPS.

Example- If you have stake an amount of SP, you will definitely get your share (in proportion to the size of your SP) of 15% of the new total supply (inflation). You don't need to perform any task to get your share.

For the remaining 65% of the newly generated Steem Tokens, they are added to the reward pool, known as the PoB reward pool. It is then distributed to content creators and curators based on the specific tasks they perform and distribution is subject to PoB.

Therefore, the user must create content to become a beneficiary as the author of the PoB reward pool, and the reward is determined in an organized manner, which we will talk about in another lesson.

How to calculate the current inflation rate?

To calculate an inflation rate for a given time t we can follow the following formula:

Inflation rate at time t = (978 - (head_block_number / 250000)) / 100

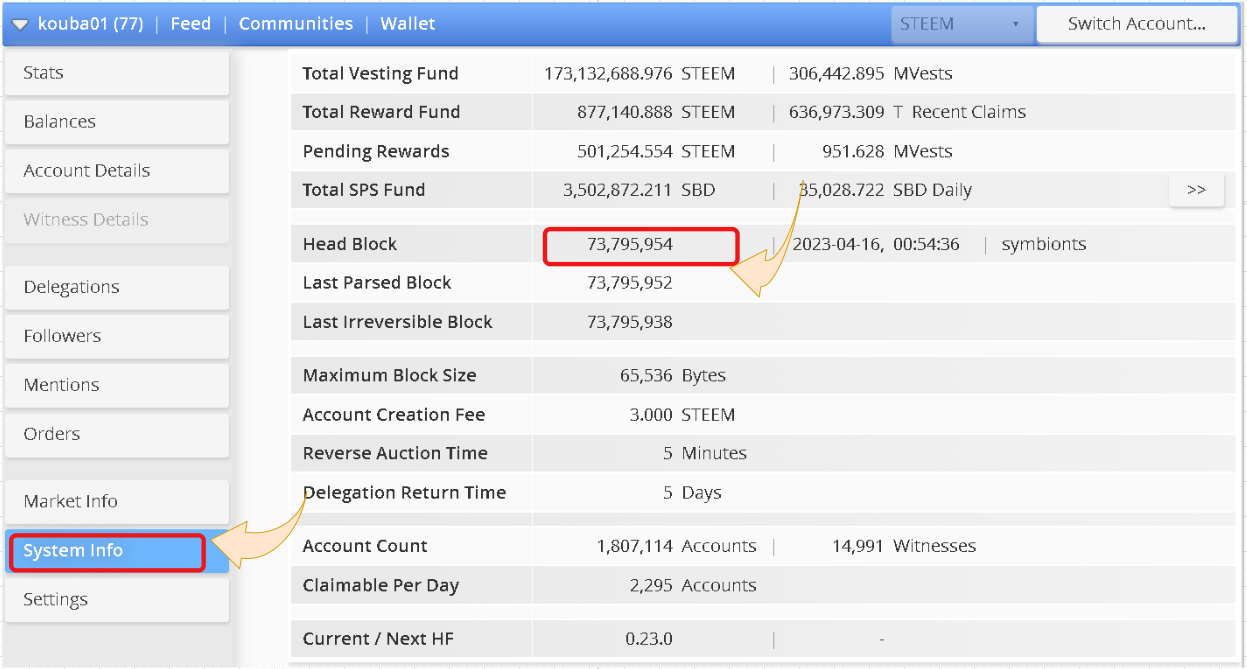

And to find the header block number, we go to Steemworld.org and click on System Information, then you can see the header block number 73,795,954. (You can also use Seemdb.io to get this data )

Inflation Rate= (978- (73,795,954/250,000))/100= (978-295.183)/100= 6,828%

How to calculate Total Virtual Supply?

You can follow the following formula:

Total Virtual supply= Total STEEM supply in circulation+ Total SBD supply in circulation(in STEEM equivalent)

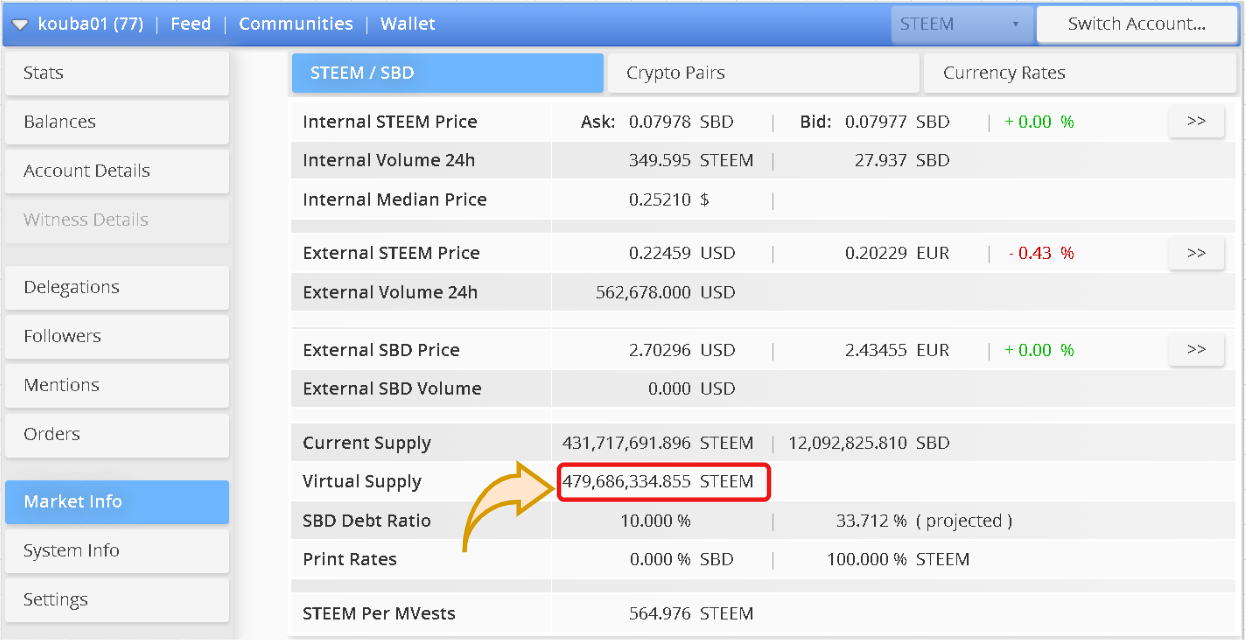

To find the Total Virtual supply, you can also access the Steemworld.org tool --> Market info.

Total virtual supply= 479,686,459.559 STEEM

How do you determine the number of blocks per year?

As mentioned before, it takes 3 seconds to produce a block unit in Steem Blockchain. So the number of blocks produced annually is (365 * 24 * 60 * 60) / 3 = 10,512,000 blocks.

Since there is a strategy to reduce the inflation rate by 0.01% per 250,000 blocks (The inflation rate drops by 0.01%, or approximately every 8.68 days.)

So, in a year, the inflation rate decreases = 10512000 / 250,000 = 0.42%

How many new Steem do you get per block?

To find this one can use the following formula:

new_steem = ( ( virtual_supply * inflation_rate ) / (Number of blocks per year ) )

We have ,

Virtual_supply = 479,686,459.559 STEEM

Inflation rate = 6.828%

Number of blocks per year = 10,512,000 blocks (The number of blocks per year is fixed.)

So, New STEEM being created per block = ((479,686,459.559 * 6.828%)/(10,512,000)) = 3.115 STEEM

Notes and analysis:

In December 2016, the inflation rate was set at 9.5%, after a continuous decrease of 0.01% every 8.68 days (0.42% decrease every year until reaching 0, 95%), the current inflation of Steem Blockchain has reached 6.828%

New STEEM tokens are produced in blocks due to inflation, just block the reward. Currently, the block reward is 3,115 STEEM.

We conclude by looking at the hypothetical estimated supply and block reward projection, it is pertinent to note that those who build their strengths over the next 10 years are the real winners (orcas, whales) and will impact this ecosystem significantly since STEEM tokens will be scarce And it is very difficult to earn it easily in the coming years.

In the crypto ecosystem, we have noticed that reducing the block reward also paves the way for an increase in the demand for coins. So this could be a strong underlying driver for STEEM in the long run.

I hope that this second post in this series helped many users to understandabout steem inflation in the hope that the series will continue in future episodes.

Best Regards,

@kouba01

Cc- @steemcurator01