700여종이 넘는 가상화폐가 발행되어 있는 현시점에서 살림살이를 나아지게 할수 있는 가상화폐를 고르는 첫번째 요령이 해당 화폐 개발자들이 자신들의 계획대로 개발이 되었을때 그 화폐가 어디에 사용될 것인가를 살펴보는 것이라고 나는 생각합니다.

나는 비트코인이 화폐가 될꺼라는 생각에서 비트코인 투자를 시작했고 스마트컨트렉트라는 기능을 이용하면 못하는 것이 없다는 이야기에 이더리움의 강력한 지지자이기도 했습니다.

오늘은 찬밥신세를 면치 못하고 있는 비트쉐어라는(BTS) 코인이 가진 강력한 기능에 대해 생각해보려고 합니다. 비트쉐어가 가진 기능중에 내가 혹 했던 부분은 사용가 쉽게 자신만의 가상화폐를 발행할 수 있다는 점이었습니다.

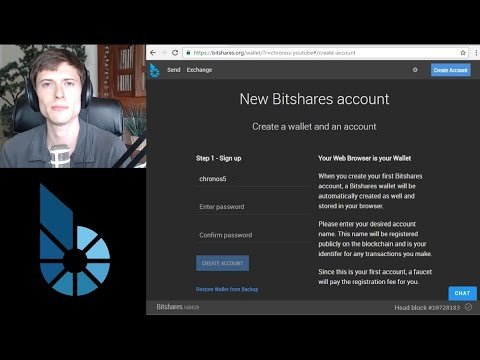

비트쉐어를 통해 사용자 자산을 발행해 보려고 한다면 다음과 같이 하면 됩니다.

- https://bitshares.openledger.info/#/ 이곳을 클릭합니다.

- 위 사이트에서 아래동영상을 참고하시어 계정을 만듭니다.

- 계정을 만들면 백업받는파일이 하나 있습니다. 그 백업파일만 잘 가지고 계시면 지갑복구도 무지 쉽습니다.

4.아래 동영상을 클릭하시고 크로노가 설명하는대로 따라 하시면 3만원으로 가상화폐를 발행하실수 있답니다.

*주의할점

1.비트쉐어에서 발행할수 있는 가상화폐는 3종류가 있습니다. http://cryptofresh.com/assets 에 가시면 TYPE 에 (1)SmartCoin (2)UIA (3)Prediction Market (4)Core token 이렇게 4종류가 있는데 저것들 중 Core token 코인을 제외한 나머지를 사용자가 발행할 수 있습니다. 그중 UIA 를 발행하는것이 방법입니다.

2.UIA를 발행하려면 발행화면에서 스마트코인 라디오버튼을 활성화하지 않으면 자동으로 UIA로 발행됩니다.

3.(1)SmartCoin (2)UIA (3)Prediction Market 코인은 각각 몇가지 기능이 다릅니다.

4.발행 비용은 약 8천 BTS 가 소요됩니다. 8천BTS가 자신의 계정에 있어야 발행이 됩니다. 사용자발행 자산이 많이 발행되고 이것들의 사용이 증가한다면(이체수수료가 있음) 비트쉐어의 수요는 증가할 것이고 가격은 수요에 비례해서 오르게 될 것입니다.

*어디에 사용할 것인가?

비트쉐어 2.0 백서에는 사용처를 다음과 같이 명기하고 있습니다.

3.2 Use-Cases

Having discussed the administrative possibilities of UIAs, we

will now list and briefly describe a few use cases. These serve

as examples and only represent a subset of the possibilities.

3.2.1 Rewards Points

A use-case that can be easily implemented and with only minor

regulatory hurdles are reward points, which Merchants already

today offer to their loyal customers. These points are accumulated

to earn discounts on future purchases.

Rewards systems are a prime opportunity to add value by

making them available to BitShares smart contracts. With an

UIA, a merchant no longer needs to maintain a database of

customers and their rewards. Instead, he simply transfers a crypto

token to the customer (e.g. via a mobile phone application) and

the public ledger of BitShares takes over the maintenance leaving

all administrative power to the merchant (i.e. the issuer of the

UIA).

Furthermore, because the issuer may set a trading fee for their

UIA, merchants can have an additional revenue stream from

people trading or transferring their rewards points.

3.2.2 Event Tickets

Event tickets are a largely unregulated use case for UIAs. Tickets

to an event could be issued as digital tokens that are auctioned off

to the highest bidder, who would then resell them. This ensures

that the ticket issuer raises as much money as possible up front,

while transferring the risk of ticket sales on to speculators. On

the day of the event, the issuer can freeze all trading of the asset

and then allow users to cryptographically check in (e.g. with their

smart phones).

Furthermore, the blockchain maintains the database of tickets

which drastically reduces the organizational overhead.

3.2.3 Digital Property

Software and music licenses can be made transferable by issuing

them as a digital asset. Every copy of a program can check to

make sure that the user has control of a token before running.

Software implementing such a licensing scheme can remain

functional even if the company that produced the license goes

out of business.

Trading cards can be simulated by creating many limited issue

assets. Online games can use these assets to represent game

items.

Further related possibilities include, but are not limited to:

ownership tracking, authorization, membership identifications,

etc.

3.2.4 Crowdfunding

With BitShares, decentralized crowdfunding becomes an easy

task. Technically the process breaks down to as few as two steps:

(a) Create and issue a new token that should represent your

project, and (b) sell your shares on an exchange. The issuer is

now free to choose to sell them for bitUSD, bitEUR, or any other

token and is free to define the price for each share. Not only can

these shares be traded on traditional (centralized) exchanges but

they can also be traded in the decentralized exchange that will be

discussed in section 4.

Whether the UIAs are used as a transferable coupon for a presale,

or for holding an initial public offering (IPO) for a small

company, issuing an asset is one of the most effective means of

raising money for a cause.

3.2.5 Information/Prediction Markets

With BitShares and the decentralized exchange described in

section 4, prediction markets [6] can be quickly implemented.

A binary prediction market has a “price” between 0 and 1

representing the two possible outcomes of an event. All that is

needed is a proper prediction criteria in the description of a newly

created asset that anybody can issue by putting up collateral.

Hence, a prediction market is a specialization of SmartCoins

where there is no need for margin calls or forced settlement

because all positions are fully collateralized at any price.

While the event has not occurred, the price of this asset reflects

the probability of an event to occur. After the event has occurred

the issuer can settle all positions at final “price” depending on

the actual outcome. Participants that have voted correctly will be

able to settle their shares back to the network at a higher price

and make a profit.

These prediction markets can be very secure if the issuer is a

multi-signature account with many independent and trustworthy

parties involved.

This feature, in combination with the bitUSD, allows anyone

to implement most binary prediction and information markets

currently established in a decentralized and trustless manner.

3.2.6 Company Shares

In most countries Corporate shares are heavily regulated by their

corresponding exchange authority, such as the Securities and

Exchange Commission (SEC) in the U.S. However, most of those

regulations do not prevent them from being issued or traded

on an alternative trading system [7]. The regulations in many

jurisdictions require all shares to be registered (a.k.a. held by

known identities).

Since the BitShares network offers whitelisting for customers

of UIA according to section 3.1, corporate shares can certainly

be issued and traded in the BitShares ecosystem (see section 4).

When issuing a corporate share in BitShares, the company

can decide who is able to hold, share, or transfer its shares and

can restrict trading markets freely (e.g. only allow the market

STOCK:bitUSD but not STOCK:bitGOLD)

위와 같은 사용처중 어디에 사용할 것인가는 발행자의 상상력에 달려있는거 아닌가 싶습니다. 물론 발행자는 사용처를 잘 개발하여 자신이 발행한 코인이 가치를 인정받으며 사용된다면 >........ 이후는 상상에 맡겨야하지 싶습니다.