Come and listen to my story about a man named Jed

Bitcoin dominance in the crypto markets fell below 50% for the first time ever recently, driven almost entirely by the steep rise in the price of XRP. Even while the bitcoin price dropped, the price for Ripple and Stellar tokens kept rising. The market has since seen a reversal, with bitcoin and many altcoins getting a huge boost while Ripple keeps dropping.

Why now?

What's going on with bitcoin to provoke this shift? What about with Ripple? How does Stellar fit in? What do all of these things have in common?

Looking at the available data, I’ve come up with a theory (not proven, just conjecture, but I’ll show you how I got there):

Ripple’s recent incredible price increase was caused by one of its founders, Jed McCaleb, finally cashing out his XRP through what can only be described as a legendary pump to over 40x the starting price. XRP's bull run was led by a steep increase in trading of the FCK/YOU token pair on the Ripple network, by an address beginning “rJed”.

Fundamentals

Before we get into it, let's acknowledge there are some real fundamental issues happening with bitcoin and Ripple that could have an effect on prices.

Bitcoin transactions are slower and more expensive than ever before. That’s partly caused by an increase in transactions due to increased adoption, and partly caused by disagreements among developers and miners over how to solve the problem. When will it end? Who knows, but even with occasional drops, BTC is trading at or near the all-time high right now.

Ripple, on the other hand, has very fast transactions. That’s due to its trust-based validation method. Centralized, trust-based networks are always faster than decentralized trustless ones. While participants don’t need to use Ripple’s list of trusted nodes, their only option is to make their own list of trusted nodes, putting Ripple somewhere in between centralized and decentralized. Ripple is also signing up more and more partners in the banking world to use their network, and more off-network exchanges have started to offer XRP trading.

This is no doubt good news for Ripple the company, and its stock price. It’s less clear what that should mean for the price of Ripple’s network token, XRP. After all, using the Ripple network does not require using XRP.

In fact, through a partnership with Earthport, Bank of America Merrill Lynch has been using the Ripple network to conduct certain transactions since 2013 without using XRP in any way. The InterLedger Protocol allows network fees to be denominated in other currencies, meaning no Ripple user ever needs to own XRP.

But if we look at the charts, the price went up; that must mean more banks signing up led to more demand for XRP, right? Well, maybe. But what else is happening with Ripple?

I said this was going to be a story about Jed, so let’s get to that part:

Uncle Jed

There is perhaps no more controversial figure in cryptocurrency today than Jed McCaleb.

In 2010, Jed founded Mt. Gox. Initially conceived as a way for fans to trade “Magic: The Gathering” game cards, the site became popular for trading bitcoin. In 2011, Jed decided to jump ship and sold majority interest in Mt. Gox to Mark Karpeles, retaining 12% ownership of the company for himself. It quickly became the world’s biggest bitcoin exchange.

Mt. Gox later infamously collapsed into bankruptcy, amid claims of hacking theft and “transaction malleability.” Jed says he lost $50,000 on the Mt. Gox exchange and never received any payments from Karpeles beyond the initial sale, and that the exchange was entirely recoded after the sale. Whether that account is true or not, the stink of Mt. Gox seems to follow Jed around. Rumors abound suggesting he may have been behind its problems, or even its theft and subsequent collapse. But these are rumors.

In 2012, Jed cofounded Ripple with his partner Chris Larsen. Together the two of them created the OpenCoin corporation, rebranded in 2013 as Ripple Labs, and again in 2015 as Ripple. The Ripple network was built on technology developed by Ryan Fugger in 2004. (The first iteration of the system, built by Fugger prior to Jed's involvement, was ripplepay.com)

Jed left Ripple (less than amicably) in July 2013. Later that same year, Jed founded his own crypto project, Stellar (a Ripple clone). Where Ripple focused on banks, Stellar was supposed to focus on individuals using its platform for payments. More recently, Jed started a company called Lightyear to help attract banks to the Stellar platform.

Still, Jed's separation from Ripple seems to have helped attract more traditional financial players to the Ripple platform. Since such partnerships only increased with Jed's absence, so it's hard not to think Jed was holding Ripple back. But the drama didn't end there.

"XRP Dump Incoming"

Here's where the story starts to get spicy.

Because Ripple has no mining, all 100 billion XRP tokens were created immediately when the network started. In one of the most controversial decisions in crypto history, the founders of Ripple granted themselves 20 billion XRP, with the remainder held by the company to be slowly distributed using various giveaways and strategic partnerships. Both the company and the founders have also made charitable donations with portions of their XRP holdings.

After leaving Ripple in 2013, Jed still held most of his founder XRP tokens.

According to Ripple, 61 billion+ XRP are now held by the company, with 38 billion+ XRP out in the wild (including the founder coins). How many are really circulating is less clear. Many XRP that have been distributed by Ripple are bound by contractual obligations with partners to be released only on a predetermined schedule, to avoid flooding the market.

Ripple has previously announced its intent to release 50 billion XRP (half the supply) by 2021. The fate of the remaining 50 billion is less clear. Some are used to pay liquidity providers as a way of compensating for thinner margins. Others have been promised to early investors in agreements that are not public. With the recent run-up, concerns from the community led to most of the remaining XRP tokens being locked in escrow contracts. These escrow obligations are key to understanding XRP's recent rise (one in particular).

On May 22, 2014, Jed announced his intention to sell off his remaining 9 billion XRP (representing roughly one-fourth of the circulating supply) two weeks from the date of the announcement. Naturally, the market took a nosedive; XRP's price dropped 40% that day.

The announcement led to more chaos, with Ripple board member (and Kraken CEO) Jesse Powell resigning in disgust. Announcing his resignation, Powell wrote:

"I’m no longer confident in the management nor the company’s ability to recover from the founders’ perplexing allocation to themselves of 20% of the XRP... Unfortunately, unlike the founders, I don’t have swathes of XRP to dump if I don't think it's working out."

The drama continued as 2 days later, Chris Larsen announced he would donate 7 billion of his XRP to a charity, sparking a price recovery. It was not clear if this was all of Larsen's XRP, or what restrictions were placed on the donated XRP, though there must have been some.

Ripple wanted to prevent the sell-off from actually happening, so they entered into negotiations with Jed. In August 2014, they announced they had reached a deal. The terms of the deal restricted the amount of XRP Jed could sell, rising as time went on:

- $10,000 per week during the first year

- $20,000 per week during the second, third and fourth years

- 750m XRP per year for the fifth and sixth years

- 1bn XRP per year for the seventh year

- 2bn XRP per year after the seventh year.

In April 2015, Jed attempted to sell a large quantity of XRP on Bitstamp. (Why Bitstamp? It was a Ripple gateway, and Jed was invested in it.) Ripple saw this sale as a violation of their agreement, so they froze the funds.

The XRP had been sold, so Ripple froze the $1 million USD from the sale. This did not require intervention by the courts; Ripple simply used their power to freeze any transactions on the network (!) and since it happened through Bitstamp's Ripple gateway, the funds were on-network. Jed objected to the funds being held (of course), arguing that the XRP being sold were not his.

Here Come the Lawyers

A lengthy legal battle ensued (no pun intended), with Jed suing for return of the funds, among other issues. Almost 2 years later, Ripple and Jed reached an agreement.

In settling the lawsuit, Ripple returned the million dollars to Jed, found a buyer for Jed's Ripple stock at a favorable price, and agreed to a less restrictive schedule (based on daily on-network trade volume) for Jed to sell off his XRP. Jed was also required to donate 2 billion of his XRP (subject to his same restrictions) to a donor-advised charity, something he said he had been wanting to do. Jed viewed the settlement terms as a victory.

So what was the new timetable?

"for the first year of the agreement Jed and the DAF will be able to collectively sell 0.5 percent of the Average Daily Volume of XRP for each day of the week, including weekends and holidays.*

for the second and third years of this agreement, Jed and the DAF will be able to collectively sell for each day of the week 0.75 percent of the Average Daily Volume.

for the fourth year of the agreement, Jed and the DAF will be able to collectively sell for each day of the week 1.0 percent of the Average Daily Volume.

for any time after the fourth year of the agreement, for each day of the week Jed and the DAF will be able to sell 1.5 percent of the Average Daily Volume."

How do they figure out average daily volume?

"*Under the settlement agreement, Average Daily Trading Volume is calculated by dividing the Weekly XRP Trade Volume for the week that commenced two weeks prior to the week at issue by seven (7). Weekly XRP Trade Volume is defined as the total amount of XRP traded on the Ripple consensus ledger during a given week between Sunday midnight Pacific Time through the following Sunday midnight Pacific Time. Significantly, this definition excludes XRP traded on third party exchanges, unless in Ripple's reasonable judgment, the XRP market has changed so that the majority of legitimate XRP transactions have occurred off the Ripple consensus ledger during the prior 365 days.

Looking at the Ripple forum post on the agreement, we see that there was immediate concern over the terms:

"Basing the selling cap on a percentage of something that can be as cheaply and easily manipulated as the daily volume is tantamount to removing all transaction limits Jed was subjected to in the scope of the lockup agreement."

Along the way, co-founder Chris Larsen resigned from Ripple in November 2016, with Brad Garlinghouse taking over as CEO. But market-wise, things stayed pretty much normal until March 30, 2017.

Achievement Unlocked

On March 30, XRP started to see a run-up in price. XRP prices had been around 500 satoshis just 2 weeks earlier; starting March 30 and continuing over that weekend, the price went up to about 7000 sats. More than 10x! But the surprises weren't over yet.

Trading cooled off for a few weeks. The price settled around 2500 sats. Volume dried up; then, round 2. On Friday, April 28, the price started on another big climb, this time led almost entirely by trade on off-network exchanges. What could explain it?

Remember what I mentioned earlier – escrowed XRP, sell limits, and escrow conditions are important to understanding this bull run. Let's look at some charts to see what that means:

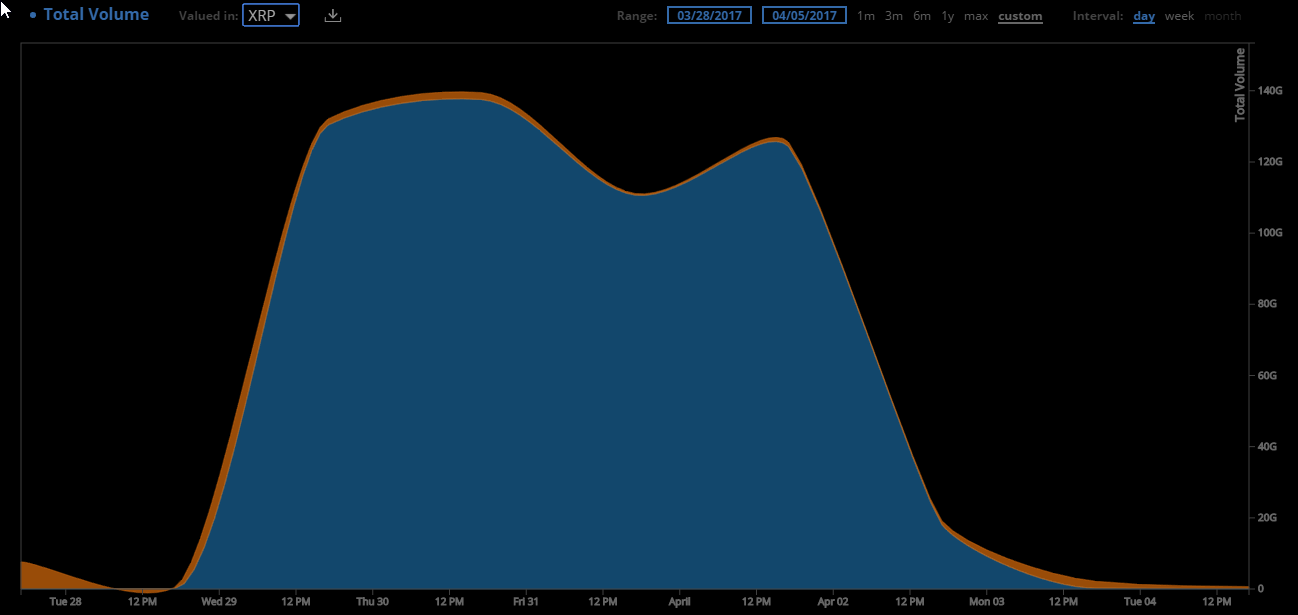

Ripple's on-network trade volume had a HUGE anomalous spike the weekend of March 30. That spike in network trade volume coincided with the initial 1000% price climb for XRP. Ripple's on-network payment volume was flat by comparison. To be clear, this spike represented a 1000x increase in Ripple network trade volume, which lasted only for those few days and corresponded with a 10x increase in price.

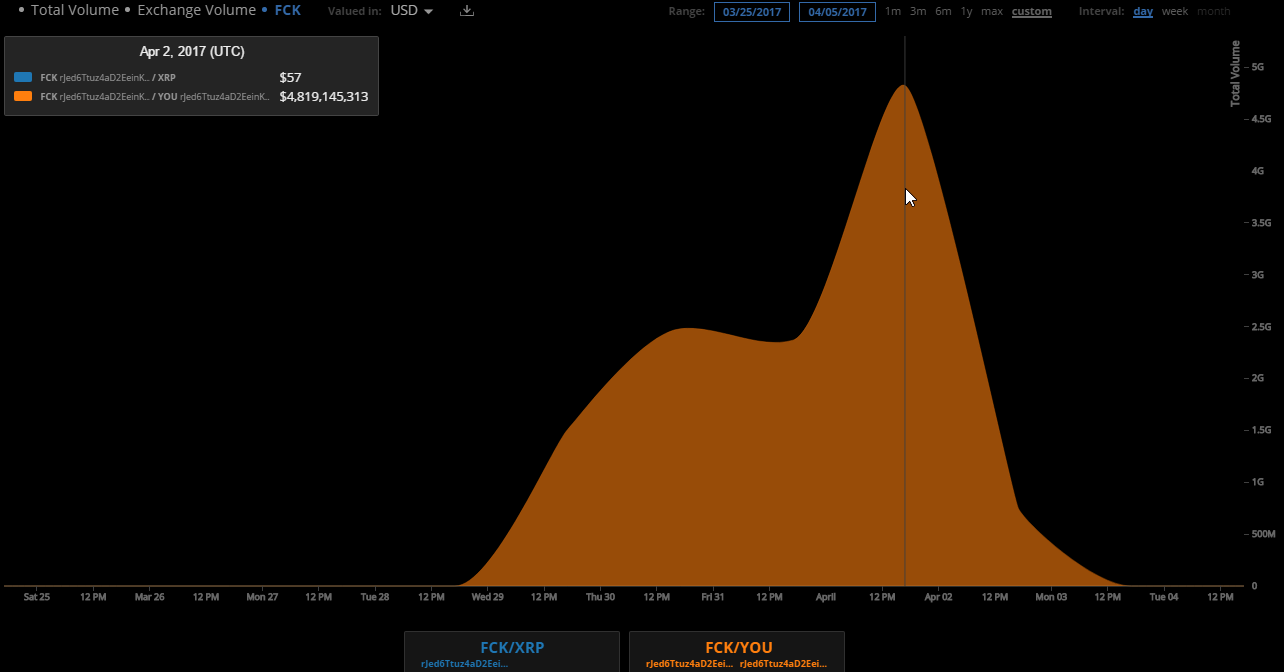

But what accounts for this massive explosion in trade volume? Looking more closely, we see that the volume consisted primarily of one trading pair – FCK/YOU. Is there perhaps a message behind this? The same account traded a smaller amount of FCK/XRP.

The address of the account responsible starts with "rJed" – coincidence?

The rJed account traded trillions of dollars "worth" of the asset it created. Over the course of that weekend, this amounted to an on-network trade volume valuation of over 500 billion XRP. For those keeping track of the escrow conditions, Jed gets to trade 0.5% of on-network volume: 0.5% of 500 billion = 2.5 billion XRP freed up for Jed, and 2.5 billion more for the 'donor-advised' charity subject to the same restrictions.

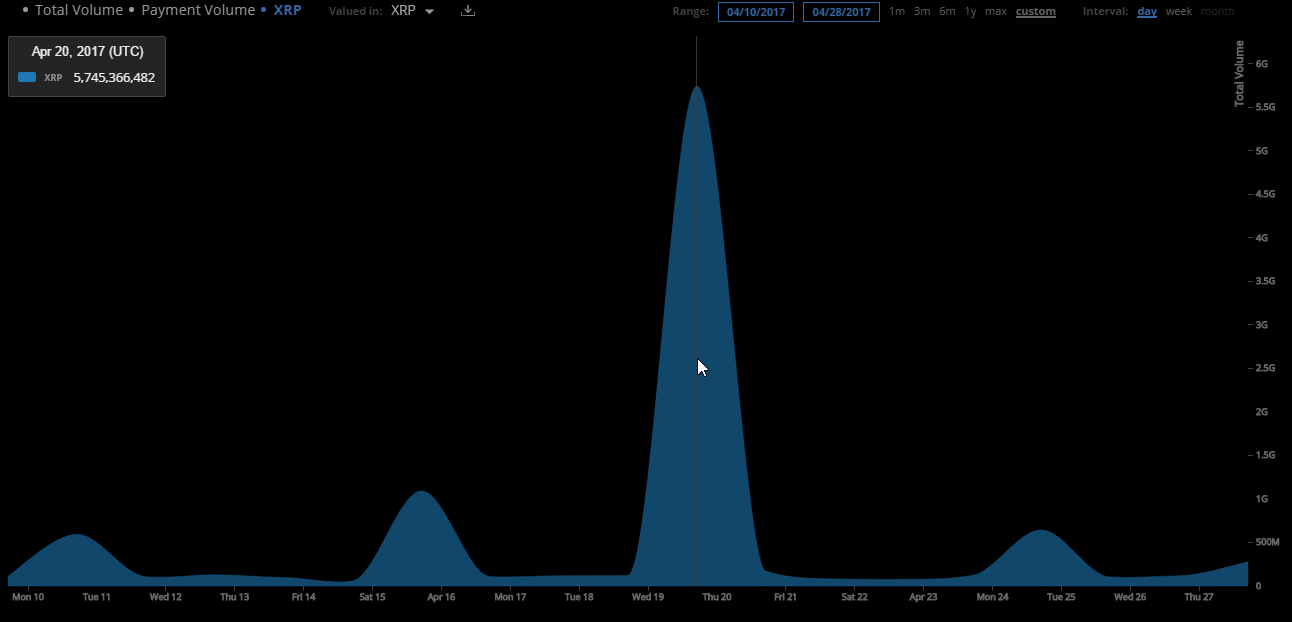

And sure enough, just over 2 weeks later on April 20, we see over 5 billion XRP in one day of on-network payments:

(Typical daily Ripple network payment volume is around 200 million XRP, sometimes spiking to 1 billion. This is a big jump.)

Jed said that (after sales under the previous agreement and making the donation required under the current agreement) his XRP holdings at the time of the new settlement were down to 5.3 billion, meaning that even after the huge FCK/YOU volume spike, he had withdrawn less than half his XRP holdings. He had 2.8 billion acknowledged XRP remaining.

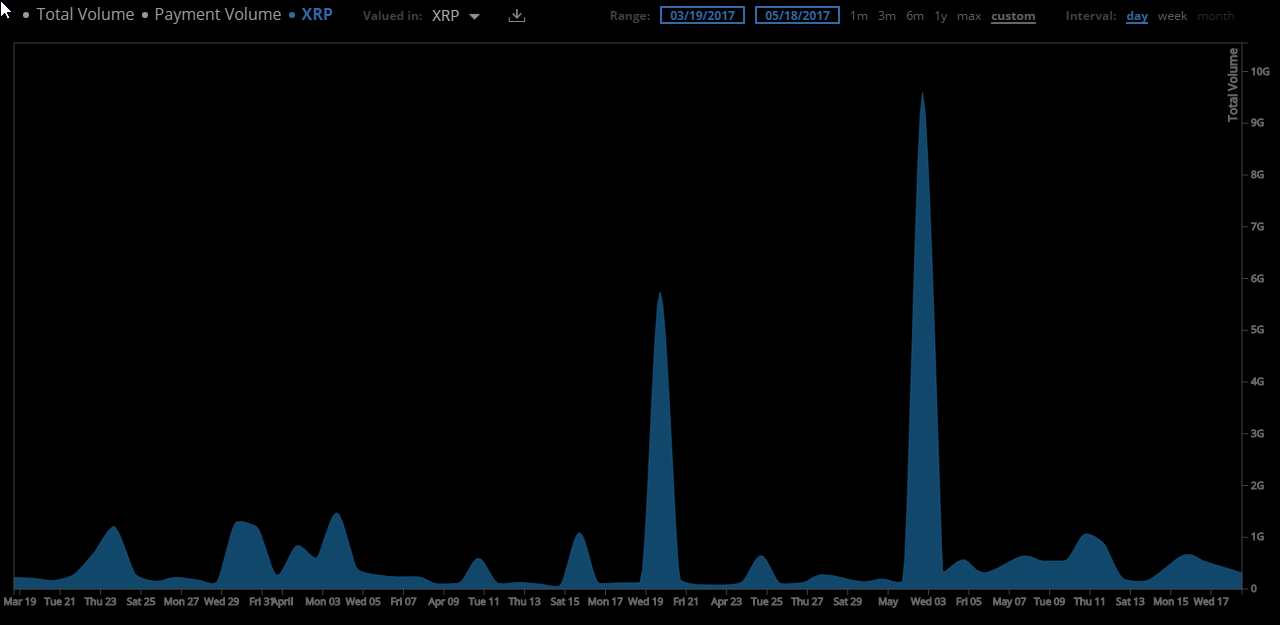

Two more weeks go by, and we see another spike with 9 billion more XRP moved over the network May 3:

What accounts for this? Hard to say whose it is, but it's also hard not to notice where the volume went. The second 10x price run-up (which had exploded beyond the price beyond all-time highs the weekend before) started on off-network exchanges (while Ripple network trade volume sank).

No doubt many long-time holders were removing their XRP to off-network exchanges. Maybe they wanted to find a more active market than the Ripple network itself; maybe they wanted to ensure their funds weren't frozen on a Ripple gateway. In any case, whoever made this huge transfer of XRP seems to have been one or more very large holders cashing in on the spike.

Another curious bit of timing is that, under the agreement, off-network trade volume was excluded from the amount considered for Jed's escrow conditions unless the majority of volume over the preceding 365 days occurred off-network. Not all of those numbers are readily available, but it's easy enough to look at total volume.

For the week of the off-network trading explosion, volume was over 100x the typical Ripple network trade volume, so it's entirely possible that off-network trade for that week was double the volume of the previous year. (I don't have time to make the charts, check it for yourself.) That would mean that off-network volume now counts toward the escrow conditions, which would mean Jed would now qualify to withdraw the rest of his founder XRP.

It seems we can safely guess that some of the 9 billion that moved that day was the rest of Jed's XRP, now out in the wild for real. It had always been part of the circulating count, but now it was unbound by legal agreements. What would Jed do with all his newfound crypto-wealth?

Stellar Moves

Two days later on May 5, Stellar tokens (Lumens, XLM) started to climb. Over that weekend, they climbed 10x from half a cent to 5 cents. Someone must have had some serious money to pour into those markets that day, right? Hmmm :rocket:

Finally, we see another curious movement on the Ripple network 2 weeks after that, as someone withdraws 700 million XLM on May 15. I'm guessing that the list of people storing hundreds of millions of Lumens on the Ripple network is not long.

The price of XRP has been slowly descending ever since the end of the month, and the only question is how much further it will fall without a crypto billionaire propping up the price for his own benefit. Personally, I think it will drop back below 1000 sats, but Do Your Own Research.

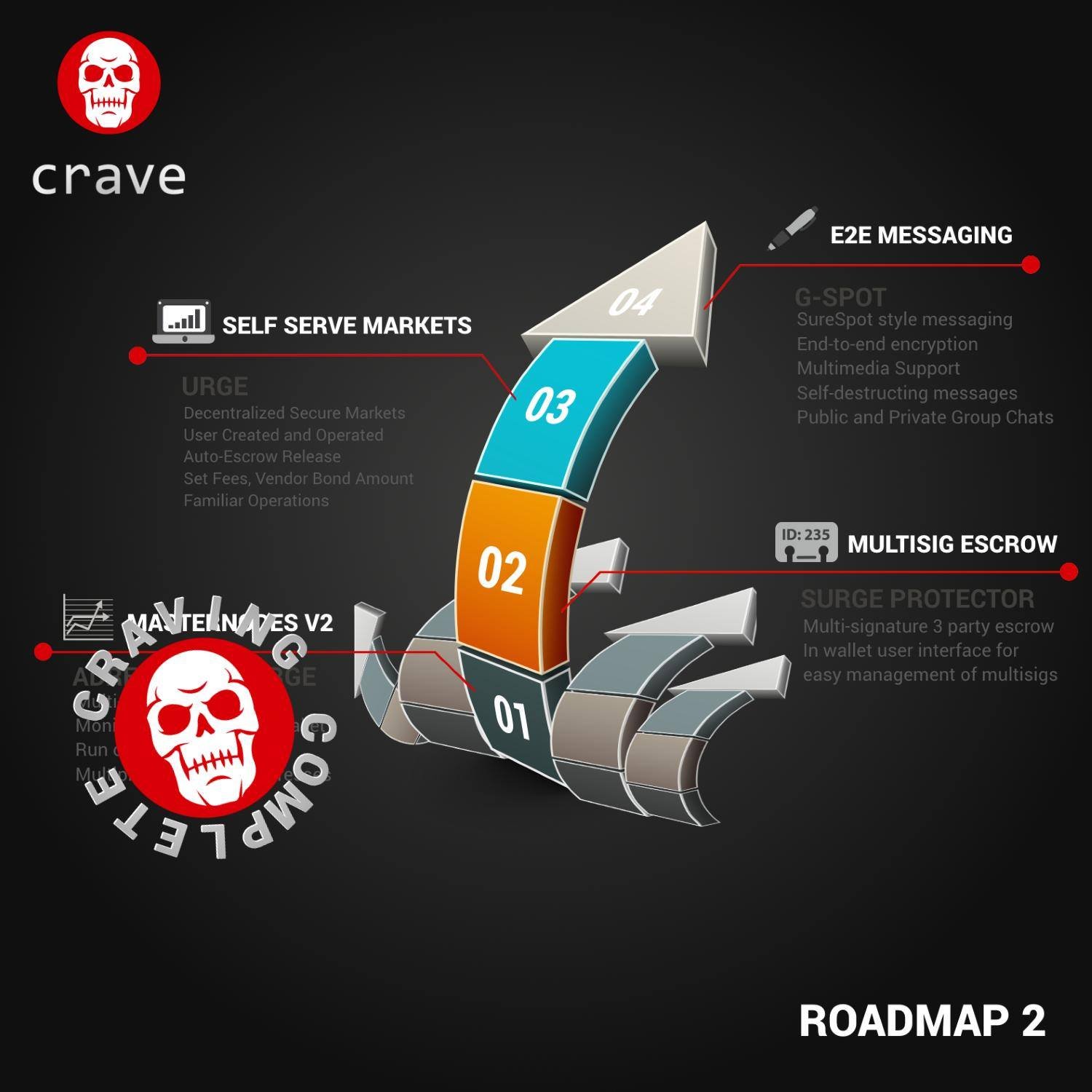

What's more amazing is that despite the public availability of this trade information, I have seen it mentioned nowhere else. This is the biggest movement in the crypto markets in a long time, and it seems to be driven solely by Jed trading FCK/YOU tokens. As trolling goes, this may be my new favorite for sheer ballsiness. My previous favorite was the anonymous developer of Crave, who dumped all his coins after releasing a development road map (driving up the price because people loved it) that no one noticed until later looks an awful lot like somebody giving you the middle finger:

Ripple is good tech for banks, but that is not very likely to drive up the price of XRP. The crowd of off-network exchanges could fuel more speculation, but don't kid yourself that this price jump is about fundamentals. It was all about FCK/YOU money.