I have @cryptogee to thank for the subject matter of this post, although it remains to be seen whether I understood his request correctly;

From this comment, I've decided to talk about the Steem / Steem Dollar Arbitrage. There is a trade off between Time, Risk and Reward at play here, which is really interesting to analyse.

Steem Dollars

Holders of Steem Dollars can request them to be converted to $1 worth of Steem, at the Daily Medium Price, Averaged out over the following 7 days after request.

At the moment, Steem Dollars are trading $0.90.

Why are Steem Dollars Trading below $1?

There are 2 distinct reasons why Steem Dollars are (and have spent most of the time since the 4th July) trading below $1;

- The sellers are stronger than the Investors: Obvious I know, however more to the point, there are not enough users playing the arbitrage game, compared to users cashing in there Steem Dollar Rewards to Bitcoin.

- The Price of Steem has been falling. Because the conversion of Steem Dollars to Steem takes 1 week, and is based on the Average Price over that week, there is executional risk involved. Namely, if the price of Steem falls enough over the week, you could lose of this arbitrage.

How much would the price need to Fall, for a user to lose when buying Steem Dollars at $0.90?

10% right?

Well, this isn't as simple as it first appears. Let me give you a scenarios;

Daily Medium Price

Day1: $1.00

Day2: $0.60

Day3: $0.60

Day4: $0.60

Day5: $0.60

Day6: $0.60

Day7: $0.60

Average Daily Medium Price: $0.6571

As you can see here, (assuming the user could sell the Steem at $0.60) a fall of 40% has resulted in a small profit...

1SBD coverts to 1.5218 Steem

Steem can be sold @$0.60

1.5218 x 0.6 = $0.9131

SBD brought for $0.90 sold for 0.9131

However, let's reverse this scenario;

Daily Medium Price

Day1: $1.00

Day2: $1.00

Day3: $1.00

Day4: $1.00

Day5: $1.00

Day6: $1.00

Day7: $0.60

Average Daily Medium Price: $0.9428

As you can see here, (assuming the user could sell the Steem at $0.60) a fall of 40% has resulted in a large loss..

1SBD coverts to 1.0606 Steem

Steem can be sold @$0.60

1.0606 x 0.6 = $0.6364

SBD brought for $0.90 sold for 0.6364

As you can see, the executional risk is for heavy losses (in Steem Prices) to be incurred in the final days leading up to conversion. If the market fell in a linear fashion, the market would need to fall close to 20% over the week (Because the average would be 10%) before losses are realised on the arbitrage trade.

How can you make money from $0.90 Steem Dollars?

If the price of Steem remains Static, or Rose over the following 7 days post conversion request, you would benefit. A static price would result in Steem Dollars converting to $1.00 worth of Steem (Purchased at $0.90, Profit $0.10), and a price rise would extenuated these gains even further.

Day1: $1.00

Day2: $1.05

Day3: $1.10

Day4: $1.15

Day5: $1.20

Day6: $1.25

Day7: $1.30

Average Daily Medium Price: $1.15

1SBD coverts to 0.8695 Steem

Steem can be sold @$1.30

0.8695 x 1.30 = $1.1304

SBD brought for $0.90 sold for 1.1304

The Best Arbitrage Strategy

If you are interested in exploiting this arbitrage opportunity, then I believe the best strategy to be the following

Bear in mind that, by exploiting any opportunity in a market place, you are contributing towards making that economic system more efficient. I'm of the opinion that, the more currency that flows through Steem, the better. So I would be an advocate of this type of behaviour.

Let's say you have $70 Steem Dollars, or you can buy $70 SBD at $0.90. I believe the best strategy at playing this arbitrage game would be to Convert $10 per day, for the next 7days.

Why?

This will spread the execution risk and give you the best chance of hitting an average $1 return. You could go one step further and convert $5 per day for 14 days. The more your spread your execution risk the better.

When a conversion takes place a week later, if the Steem Dollar price is still well below a Dollar, Convert your Steem for SBD and start the cycle again..

Is this behaviour putting pressure on the Price of Steem?

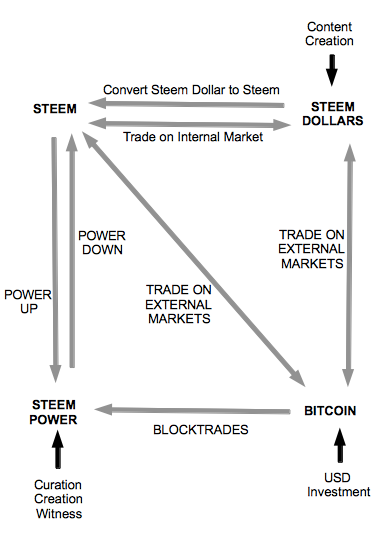

The Economics of the Steem Dollar Conversion

The quantity of Liquid Steem is ballooning, but this increase is mostly down to Powering Down activity, rather than this arbitrage..

Using data I have collected here, I can see that;

There is 2,217,145 SBD in Circulation (and growing...)

There is 5,548,086 Liquid Steem in Circulation (Up from 5,333,461 a week ago)

Internal SBD/Steem 24hr Volume of $18,443

External SBD 24hr Volume: $67,912

External Steem Volume: $327,628

These numbers suggest to me that, this arbitrage trade is not rife, and I would thus suggest that this is not impacting the Price of Steem currently. The increasing level of Liquid Steem (+60% Month on Month) is down to large accounts powering down.

Summary

There is a reason the Steem economic system is set up the way it is... The creators of this system designed it in a way to promote circulation. With circulation comes stability. The more active users we have closing arbitrage opportunities, the more we can move to a stable currency.

Happy to hear your thoughts...

Upcoming post on Steemit Promo at the RedBull 400 in Austria. Race Starts Tomorrow, here are some photo's from today..