In May 2010, a Bitcoin miner named Laszlo Hanyecz posted an offer on a forum to buy two pizzas.

He offered 10,000 Bitcoin (which, at the time, was worth very little). His offer stayed on the forum for four days. Then it was accepted by Jeremy Sturdivant, known on the Bitcointalk forum by his username Jercos. Jercos took the 10,000 Bitcoin and ordered the pizzas for Laszlo.

A few years later, this $41 transaction had a street value of over $10 million, thanks to the rising price of Bitcoin. Laszlo has been asked many times if he regrets spending millions on a pizza (publicly, he doesn’t regret it). More importantly, history will remember Laszlo for launching the first real world transaction involving cryptocurrency.

The pizza deal was probably a fun stunt at the time. I doubt Jercos was trying to make money on it. The participants may have known their transaction was a ‘first’, whether or not they understood its historic importance. But the pizza deal also serves as a simple model for the type of cryptocurrency-to-real world economy we need here in the Steem community.

Though Steemit gets all the attention, it is just the beginning of a much larger community based upon Steem and Steem Dollars. We all need to be Laszlos for these next few months, encouraging others to accept Steem and Steem Dollars for real world transactions. But our economy needs Jercos figures also, entrepreneurs who are willing to take a risk and become bridges, gateways, and merchants using Steem and Steem Dollars.

That’s the biggest area of opportunity right now in this emerging economy.

Who Profited From the Gold Rush?

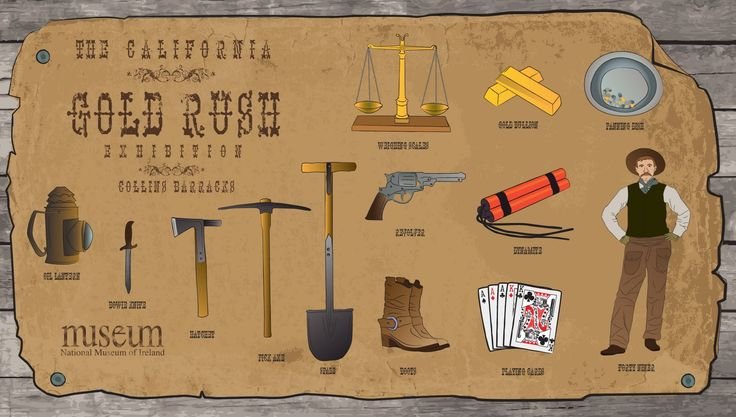

If history is any guide, “blogging is the new mining” will be just the beginning. Steemit’s miners can strike gold today by creating and voting on popular posts (not to mention actual currency mining). But during the Gold Rush, it wasn’t the miners who made the most. In California beginning in 1849 and in the Klondike region beginning in 1896, there was a big rush to mine gold. The miners were called 49ers, but they were not the biggest winners.

If you are looking for a real opportunity, consider that the merchants, banks, and railroads made more during the Gold Rush than miners did. After the Gold Rush, these entrepreneurs were the ones left standing. They built the American West.

Levi Strauss made canvas pants, opening a store in San Francisco that sold them to miners. His famous jeans, known as Levis, are still popular today. Phillip Armour started a meatpacking business and made today’s equivalent of several hundred thousand dollars, taking it back to the Midwest to form Armour Meats, which became the largest company in Chicago in the late Nineteenth Century.

In 1852, Henry Wells and William Fargo founded a bank and express delivery service, soon coming to dominate both Western banking and the stagecoach business. Last year (2015), more than a century and a half after its founding, Wells Fargo had the largest market capitalization of any bank in the United States.

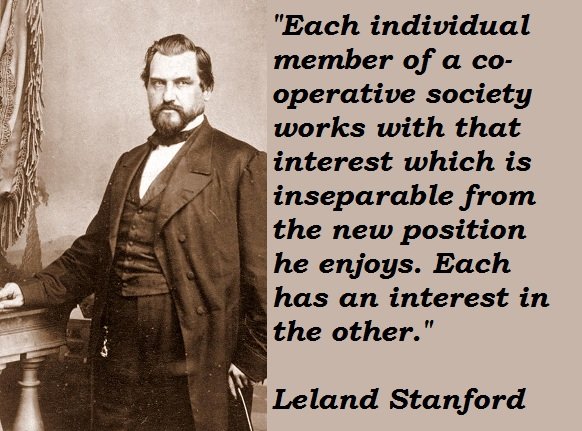

Leland Stanford was a merchant who got rich off of gold miners, investing his money in the Central Pacific Railroad and becoming one of the so-called “robber baron” railroad tycoons. He went on to become governor of California and to found Stanford University.

As soon as the word got out about gold in California, a real pumper named Sam Brannan bought up all the picks and shovels and buckets he could get, outfitting his dry good store. Then Brannan took a vial of gold dust and went through the streets of San Francisco, proclaiming the great opportunity that lay a few miles inland. Having bought tools and equipment for a few cents’ apiece, Brannan sold them for a few dollars each instead. He put his profits into buying large tracts of real estate.

In less than a year, Sam Brannan became the richest person in California. He was the state’s first millionaire.

Three-quarters of San Francisco’s male population headed for the hills, along with those who could get there by ship or rail. Initially, most of these came from neighboring regions (Oregon, Utah, Nevada, Mexico). The transcontinental railroad was not yet completed (though people could get partway by train), so most miners from the U.S. East Coast had to sail by ship around the tip of South America or through Panama. There was no canal yet, but the railroad that moved people across Panama’s narrow isthmus got rich from the traffic.

More than 1% of the U.S. population went looking for gold. Within two years, California’s non-native population increased from 1,000 people to over 100,000. A decade later, it was 380,000. A few decades later, 100,000 people headed for Alaska, the Yukon, and the Klondike gold fields.

Some of the miners found gold. In California, billions of dollars’ worth was discovered in the hills and streams. Later, more was discovered in the Klondike and in Alaska. But the money that miners made was a fraction of what the merchants around them made. Supplies, food, lodging, laundry, gambling, banking: these were just some of the products and services that catered to gold miners.

Other Examples of Indirect Economic Benefits

You may say that the Gold Rush was an anomaly. Even though cryptocurrency uses the “mining” term, it’s not really the same, is it? Maybe not, but it doesn’t have to be. Look at any large government office or company and you’ll see that a whole economy grows up to support it.

For example, let’s look at the United States military. One of the U.S. states with the largest military presence is North Carolina. There are 110,000 active duty military personnel in North Carolina and more than 700,000 retirees. The military supports 540,000 jobs in North Carolina, 340,000 of those in the private sector. Bottom line: The military accounts for about 10% of North Carolina’s gross domestic product (GDP).

You can just take any large entity, look at how much money it spends, and imagine what effect it has on the surrounding economy. Apple is based in Cupertino, California, where in a recent year it paid $4.6 billion to about 700 local businesses. And that is just the direct effect in three surrounding cities. It has a much greater indirect impact on spending and job creation in the region.

Steemit has a growing payroll. Its members are paid in Steem Dollars. They can have a huge impact on spending, creating a lot of direct and indirect financial opportunities.

I’d Buy a Pizza Right Now

If you’ve ever been sorry that you’re not a good writer or that you don’t have enough money to invest in Steem Power, then do not despair. Steemit’s opportunity is only the beginning.

As Steemit takes hold, much of the growth will take place in other parts of the Steem ecosystem. In the coming months and years, you will see a marketplace where people can spend Steem Dollars to buy real-world items. You may see the virtual-world equivalent of banks, stock exchanges, insurance cooperatives, and much more.

There will be lots of people with Steem and Steem Dollars to spend. So if you aren’t much of a writer and you don’t see yourself heading for the hills with a pick and shovel, think about what else you could do in this new economy.

When people come flocking to the blogging mine, what will they need? When they come to the marketplace, what will they need? Escrow, financing, exchange, insurance, shipping, and what else? What products or services can you provide or connect to this ecosystem? What other businesses will Steem itself need? How can you best capitalize on this huge shift to a new content platform and a blockchain-based economy?

I have some Steem and Steem Dollars to spend. I would love to buy a freaking pizza. Times have changed since 1849 and even since 2010. Technology has improved a lot. One doesn’t need an ice axe to hack at frozen pizza anymore; there is better stuff to hack. How about a 3D pizza printer (just debit my account for that extra cheese I printed), a pizza ATM machine (they’re in the news lately), or drones delivering pizzas?

The great thing about technology is that there’s some teenage kid writing a program right now to replace Google or Amazon. The great thing about the peer-to-peer (P2P) economy is that the cost of business is cut down to the essentials, unlocking money and creating more opportunities. And the great thing about Steem is that the blockchain puts us all on a level playing field. Everyone has the same opportunity to succeed.

While Steemit provides an amazing opportunity, the opportunity around may be even better. When up to 50,000 people (and more by the day) are being paid in a currency token that is not yet accepted anywhere, there’s a pretty strong opportunity to find and connect people with places to spend that money.

So I hope some of you will step up and help create a whole ring of new businesses and services to really rock this economy. We could even call it a circle of Jerkos entrepreneurs. Then I’ll Power Down so I can buy a pizza.

Sources:

Pizza Deal: https://en.bitcoin.it/wiki/Laszlo_Hanyecz

Gold Rush History: http://www.history.com/topics/gold-rush-of-1849

Wikipedia Gold Rush: https://en.wikipedia.org/wiki/California_Gold_Rush#Profits

Wikipedia Leland Stanford: https://en.wikipedia.org/wiki/Leland_Stanford#Stanford_University

More on the Gold Rush: https://cpacowboy.wordpress.com/2009/10/27/17/

Wikipedia Wells Fargo: https://en.wikipedia.org/wiki/Wells_Fargo

Military spending in North Carolina: http://www.nccommerce.com/Portals/47/Publications/Industry%20Reports/The%20Economic%20Impact%20of%20the%20Military%20on%20North%20Carolina.pdf

Apple Spending: https://www.apple.com/pr/pdf/apple_economic_impact_on_cupertino.pdf