Steemit is built for the long game. You should build your plan that way, too.

The great physicist Albert Einstein is often credited with quotes he probably never said. Whether it happened or not, there are a number of references to Einstein answering a reporter’s question at the Institute of Advanced Study at Princeton University in the 1950s. When that reporter asked him what the greatest invention of all time was, Einstein apparently thought for a moment and then replied, “compound interest.”

Compound interest is easier to understand than the Steemit financial system. But once you appreciate what makes compound interest great, it will help you realize the full power of Steemit Power Ups. Once you do, I hope you will agree with me that each of us, like Steemit, needs a long term growth plan of our own.

Treat Steemit as a long term investment now. It can be your ATM machine later.

I am not offering investment advice. Putting time and money into cryptocurrency always comes with risks, namely the potential loss of said time and money. But Steemit pays people in a stable currency and it has a mechanism to fund growth, so it comes with fewer risks and greater opportunity than anything else in the crypto space. That opportunity is most rewarding when you take a long term view, not a short term one.

Sure, I fully understand that you probably need money, have bills to pay, or have things you want to buy. But if at all possible, WAIT a while to cash anything out from Steemit. If you wait to cash out for a few months, invest most of your blog and voting rewards into Power Ups, and continue to post and curate on the site during that time, then you may soon have a lot more money to spend on these things.

Instead of withdrawing all your earnings at the July 4 payout (let’s say it’s $500), exercise some patience and you might be able to turn that “Power Up Principal” into an income of $500 every month or every week.

Compound Interest vs. Simple Interest

Compound interest is not a perfect analogy for Steemit, but it's a useful one, understanding that there are some differences.

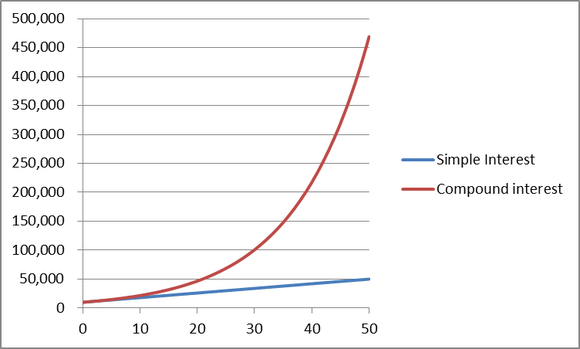

Simple interest pays you a percentage based on how much money you have deposited. The money you have deposited is called your principal. And so the interest is calculated only on your principal. The appreciation of your money is called simple growth.

Compound interest gives you a percentage based on your principal AND on any interest you have accumulated from past periods. Over time, as you earn more interest, the pot of money grows. So does the amount of interest you are drawing, since it is being calculated on a bigger and bigger pot of money. This growth rate is exponential.

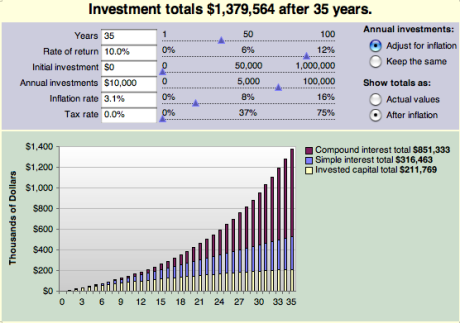

Here’s another chart which shows you a screenshot from a compound interest calculator. As you can see, the amounts can change based upon different inputs of information. You could begin with one investment and later add more money. You can fiddle with the period of time or the interest rate to make it more accurate. If you’re paying taxes, you can include that, too. I just want you to see that any of those can affect how much money you make over time.

Some people see that chart and think, “$1.37 million looks pretty good.” Others see it and think “35 years is WAY too long!” Fortunately, with Steemit, the growth should happen a lot more quickly (for a number of reasons, which we will cover below).

The Power Up Principle: Leveraging Your Power Up Principal

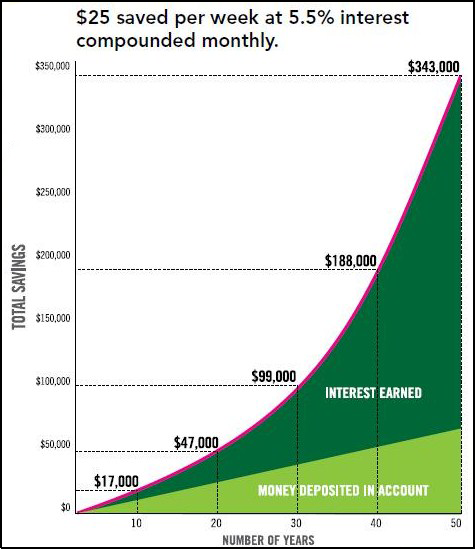

Here’s another chart (below). Even though this shows a growing bank account balance, we can imagine (with a few caveats) that it could more or less apply to growth of earnings on Steemit.

The growth here looks sharper because it’s not based upon just one initial deposit. This shows what happens when you contribute a small amount (say, $25 in value) every week for a period of time. See how much more you can make? Again, we would want a much shorter time frame than this, which is quite likely, given Steemit’s additional features.

But there’s one more thing I want you to consider from the above chart. See how small the principal was at first? Imagine that the initial principle is the value you put into your Steemit Power Ups on July 4. If you had taken half of your earnings on July 4 as a payout, then you would have started with half as much. How much longer would this growth have taken? Alternatively, if you started with $100 or $1000 instead of $25, how much faster could that growth have accelerated?

Nine Times More with Power Ups? You’re Kidding!

I am not kidding. Steemit creates new money every day on a fixed schedule; that’s how this project pays for so many things. Unlike government central banks, Steemit is not borrowing that money from a mega-bank who had borrowed it from the government central bank in the first place through some shady program, creating more zeros we don’t really have plus more debt on computer screens.

Instead, Steemit is very honest about how it is paying for growth and development. Inflation is built in and there is a growing community of users who are adding more value to Steemit and its currency in every moment of every day. Reddit has almost 40 million users. Don’t you think that Steemit, a site that pays people to post and vote while Reddit doesn’t, is going to keep growing rapidly as it adds users for at least a few years? Theoretically, it can always be growing, as developers and merchants add new features and related applications that encourage people to spend more time on the site and continue adding to it.

Did I mention that Twitter has over 300,000 users? Facebook has one billion users around the world. People on all of these sites are complaining how corporate and how controlled the content has become. With Steemit, users provide the content, and the only content control comes through users voting on the posts. Facebook, Twitter, and Reddit need advertising to survive; Steemit doesn't. If we decide to allow ads, then that's a community decision, but the real advertising comes from the upvoting of posts. “I’d switch if they paid me.” Oh yeah, Steemit does that, too. Quite the incentive, isn’t it?

We’ve established that Steemit creates more money every day. Do you know where most of each day’s money is going? Sure, Steemit’s posters and voters are being paid well. But out of every 10 dollars created, nine of them (9!) go to those who have powered up.

Let me re-phrase and re-state that. In fact, let me draw your attention to this quote from the Steemit Whitepaper:

“Power Rewards:

Steem Power rewards: For each STEEM created by the above (posting and curation) rewards, 9 STEEM are divided among all Steem Power holders.”

In summary:

1 = How much of every 10 Steem created go to voting and curation rewards.

9 = How much of every 10 Steem created go to vesting Steem Power holders

That means that when you Power Up, you are putting yourself in line to gain big-time interest. Yes, it exists to offset the inflation rate, keeping your money protected. But as Steemit continues to grow, your Power Up value is essentially granting you a bigger and bigger “ownership stake” in Steemit.

Powering Up is like trading in earnings for stock options on a stock you think will go upwards, through the roof and to the moon.

Minting Money. Like Having Your Own Government Printing Office

When you Power Up, your voting power grows, proportionately to how much Power Up vesting stake you have. Use it how you want. You can vote for newbies posts, the most popular posts of the day, or whatever you feel is the best content to reward. When you do vote, you will be using your growing voting power to print more and more money for anyone getting your votes.

You could even vote for your own posts. Imagine the day when there is a Steemit # tag for whale posts. As a whale, you’ll be able to pay yourself a salary if you want just be upvoting your own post. And if getting a whale like you to upvote a post is the only way to ensure it rises higher (kind of like advertising), can you imagine how much future posters will want your votes?

Power Up. Get Your Share

Do you see now why, if you believe in Steemit’s future, you MUST invest in Power Ups?

Long Term Plan

Your long term plan with Steemit should take into account how much money you need to cash out from here in order to pay for your needs. If all goes well, this thing should take off very, very quickly, very very soon, when the first payout comes. So much currency will suddenly be created and needed that the market cap of STEEM should rise much higher. The Steemit plan seems to anticipate that around 90% of this payout will be returned back into Power Ups, because enough people understand what I just explained above.

You don’t want to get left behind; you want a stake in this, too. You must Power Up. But also remember that when you Power Up, that vesting stake is locked up for two years, and you can only get it out in 104 equal payments made each week during this time. So be sure you really can spare and can invest this money before you do so.

Also, this is not a “passive investment”, unless you want it to be one. At least it will grow much more rapidly and grow much bigger if you also invest your time and energy to posting good content and upvoting other peoples’ good content on Steemit. Be a time and energy investor, a worker, too, and you will continue to build your rewards much more quickly.

Steemit is built for the long game. You need a long term plan, too. I’m pretty sure if Albert Einstein were here and he didn’t completely dismiss these cryptocurrencies or bootstrapped social media sites, he’d probably tell you the same thing: Power Up, as much as you can afford to do, if you want to share in Steemit’s exponential growth opportunity.